Share of Million-Dollar Homes Rising — Here Are the Metros Where They’re Most Prevalent

Though home prices have remained steep after rapid growth during the height of the coronavirus pandemic, paying $1 million or more for a house may seem excessive to most Americans. But just because most people aren’t spending seven figures on a place to live doesn’t mean million-dollar homes aren’t prevalent in parts of the U.S.

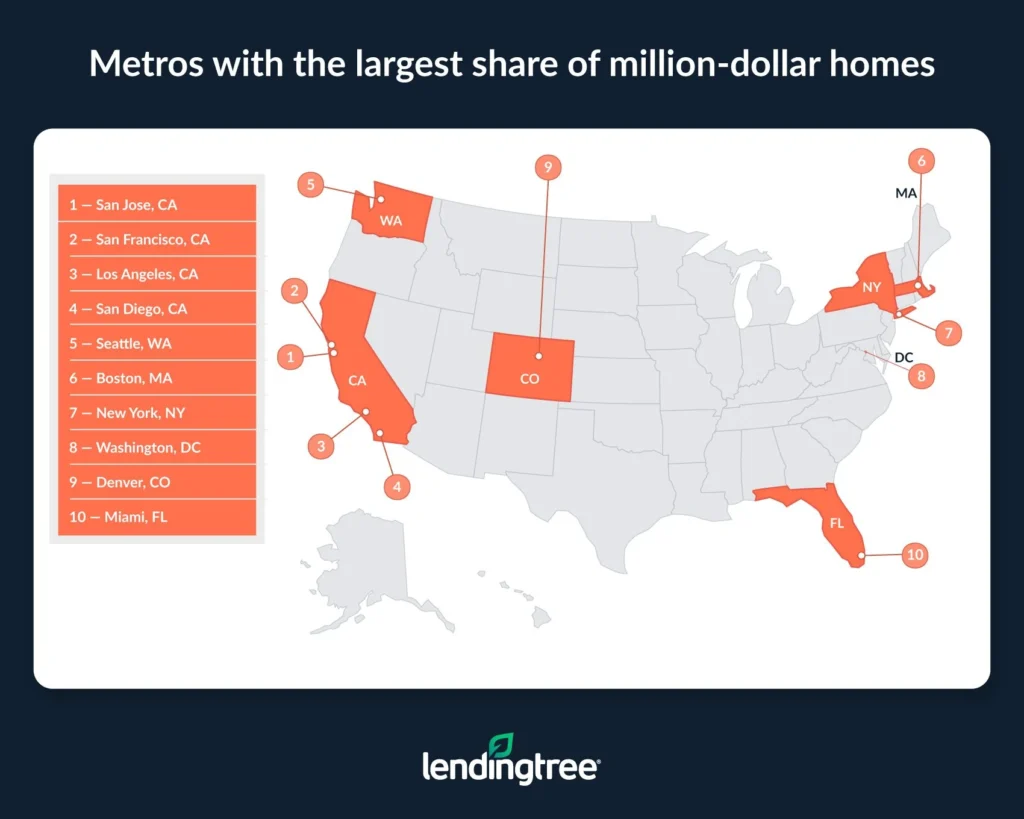

To see where million-dollar houses are most common, LendingTree analyzed U.S. Census Bureau American Community Survey data to find their share in each of the nation’s 50 largest metropolitan areas.

While million-dollar houses aren’t common in most of the nation’s largest metros, they crop up in many, accounting for a majority share of homes in two notoriously high-cost California metros, San Jose and San Francisco.

Key findings

- Million-dollar homes aren’t everywhere, even if they’re becoming more common. 10.57% of owner-occupied homes across the nation’s 50 largest metros were valued at $1 million or more in 2023. Though this means there’ll likely be plenty of sub-million-dollar homes from which buyers can choose in most areas, the share of million-dollar homes is growing. In 2022, the share across the same metros was 7.71%. Put another way, the share of million-dollar homes in the nation’s largest metros grew year over year by 2.86 percentage points, or 1.32 million housing units.

- San Jose and San Francisco, Calif., have the largest share of million-dollar homes. Respectively, 71.57% and 56.57% of owner-occupied homes in these metros are worth $1 million or more — making them the only two in our study where a majority of homes are worth at least $1 million. These figures are up from 66.28% and 52.91% in last year’s study.

- Including San Jose and San Francisco, the four metros with the highest percentage of million-dollar homes are in California. Driven by factors including limited housing supplies and the significant wealth generated by the tech and entertainment industries, 44.02% of owner-occupied homes across San Jose, San Francisco, Los Angeles and San Diego are valued at at least $1 million.

- Cleveland, Buffalo, N.Y., and Louisville, Ky., are the metros where million-dollar homes are least common. In Cleveland, 1.09% of owner-occupied homes are valued at $1 million or more. That figure is 1.16% in Buffalo and 1.44% in Louisville. Though million-dollar houses aren’t common in these three metros, their numbers are growing with a year-over-year increase of nearly 5,800 housing units valued at $1 million or more.

Metros with highest share of million-dollar homes

1. San Jose, Calif.

- Number of owner-occupied housing units: 374,116

- Number of owner-occupied units valued at $1 million or more: 267,751

- Percentage of owner-occupied units valued at $1 million or more: 71.57%

- Median value of owner-occupied housing units: $1,393,400

2. San Francisco

- Number of owner-occupied housing units: 975,016

- Number of owner-occupied units valued at $1 million or more: 551,606

- Percentage of owner-occupied units valued at $1 million or more: 56.57%

- Median value of owner-occupied housing units: $1,105,100

3. Los Angeles

- Number of owner-occupied housing units: 2,189,902

- Number of owner-occupied units valued at $1 million or more: 797,553

- Percentage of owner-occupied units valued at $1 million or more: 36.42%

- Median value of owner-occupied housing units: $867,200

Metros with lowest share of million-dollar homes

1. Cleveland

- Number of owner-occupied housing units: 633,722

- Number of owner-occupied units valued at $1 million or more: 6,925

- Percentage of owner-occupied units valued at $1 million or more: 1.09%

- Median value of owner-occupied housing units: $217,300

2. Buffalo, N.Y.

- Number of owner-occupied housing units: 332,076

- Number of owner-occupied units valued at $1 million or more: 3,856

- Percentage of owner-occupied units valued at $1 million or more: 1.16%

- Median value of owner-occupied housing units: $233,300

3. Louisville, Ky.

- Number of owner-occupied housing units: 392,931

- Number of owner-occupied units valued at $1 million or more: 5,654

- Percentage of owner-occupied units valued at $1 million or more: 1.44%

- Median value of owner-occupied housing units: $253,600

Why are million-dollar homes becoming more common?

While homes worth $1 million or more aren’t universal (and remain relatively rare in most metros), there’s no getting around the fact that home prices are generally moving upward.

The biggest reason is a lack of housing supply. Though estimates vary, experts generally agree the U.S. is short millions of housing units. This puts significant upward pressure on housing costs, as prices tend to rise when supply is low and demand is high. Steep prices are often felt the most in large metros, where roadblocks such as overly strict zoning laws can make new construction difficult and exacerbate supply issues. If left unaddressed (as it often is), a lack of supply can make prices once reserved for only the most luxurious homes more common.

In other words, million-dollar homes are becoming more common not just because wealthier buyers are more interested in making purchases, but because dwindling supply has pushed the price point of “middle-class” housing higher and higher. There are places (such as San Jose or San Francisco) where $1 million may not buy you much more than a relatively basic home.

Even if the housing supply were to increase dramatically and prices were to decline, there would be plenty of expensive properties nationwide. Wealthy buyers willing to spend a fortune on the nicest possible living arrangements aren’t going to go away, and developers who focus on high-end properties will continue to exist as long as there are buyers for their product.

Until we see more housing supply hit the market, housing costs will only continue to rise and the dream of buying will only become more difficult to achieve.

Tips for buying a home in a high-cost area

Just because you don’t plan to spend $1 million or more on a home doesn’t mean you won’t find yourself in a high-cost metro where you’ve got no choice but to spend extra to get a house. Here are three tips that can help buyers — including those not necessarily wealthy — make buying in an expensive area a bit less challenging.

- Look into different mortgage programs. Some kinds of mortgages, like those insured by the Federal Housing Administration (FHA), can be easier to qualify for than others. As a result, they can be good options for those who don’t have stellar credit or cash for a down payment. This is true even in high-cost areas, where FHA loan limits can be as high as $1,149,825.

- Boost your credit score. Though options exist for lower-credit borrowers, qualifying for a mortgage is typically easier when you have a higher credit score. In a high-cost area, good credit is especially important, as it can help you get a lower rate on your mortgage that makes housing more affordable. You should try to boost your score before you decide to buy by paying down other debts and limiting how often you apply for new credit.

- Shop around and compare mortgage lenders before buying. The first mortgage lender you go to may not be the lender that’ll offer you the lowest possible rate on your loan. Shopping around for a lender before you buy can help you find a lower rate on your loan, lowering your monthly payment and saving you money over the lifetime of your loan.

Methodology

LendingTree ranked the nation’s 50 largest metropolitan statistical areas (MSAs) by the share of owner-occupied homes (with or without a mortgage) valued at $1 million or more.

The data comes from the U.S. Census Bureau 2023 American Community Survey with one-year estimates (the latest available at this study’s writing).

To determine the share of million-dollar homes in a metro, LendingTree divided the number of owner-occupied housing units priced at $1 million or more by the overall number of owner-occupied housing units in the area.

Read more

77% of Americans Say the Housing Market Is ‘Prohibitively Expensive,’ Though 21% Still Consider Buying This Summer Updated July 29, 2024 While 77% of Americans believe the housing market is prohibitively expensive in their area, 21%…Read more

Staggering Sum: Value of Owner-Occupied Homes in Nation’s Largest Metros Tops $23 Trillion Updated January 8, 2024 Based on the total value of owner-occupied homes within them, New York, Los Angeles and…Read more