What’s a Full House? As 36% of Nonhomeowners Fear They’ll Never Be Able to Buy on Their Own, 29% of Americans Say They’d Consider Co-Buying With Friends or Family

Homeownership may seem increasingly out of reach for many Americans, but a solution may be gaining traction: co-buying.

In fact, 29% of Americans say they’d be open to co-buying a home with someone other than their spouse or significant other, according to the latest LendingTree survey of nearly 2,000 U.S. consumers.

Here’s what else we found.

On this page

Key findings

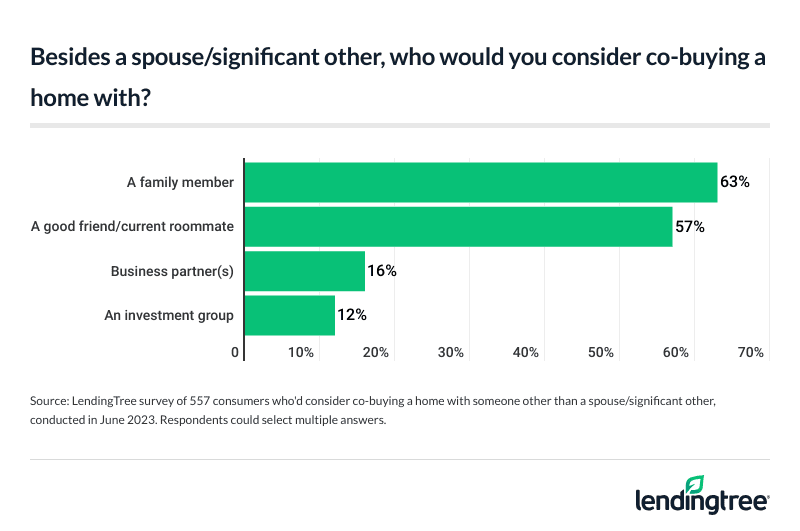

- As housing costs remain steep, co-buying a home with someone other than a spouse or significant other may be the key to making dreams a reality. Of the 29% of Americans who say they’d be open to co-buying a home with someone, 63% say they’d consider doing so with a family member who wasn’t their spouse and 57% say they’d consider buying with a good friend or current roommate. However, legal and financial protections (47%) and the desire for financial independence (33%) are the top worries for those who wouldn’t consider it.

- Fortunately for some children, their parents would consider signing on the dotted line to get their kids’ homebuying deals done. Nearly two-thirds of parents say they’d consider co-buying a home with their children. Millennial parents are the most receptive to the idea at 76%, compared with 53% of baby boomers.

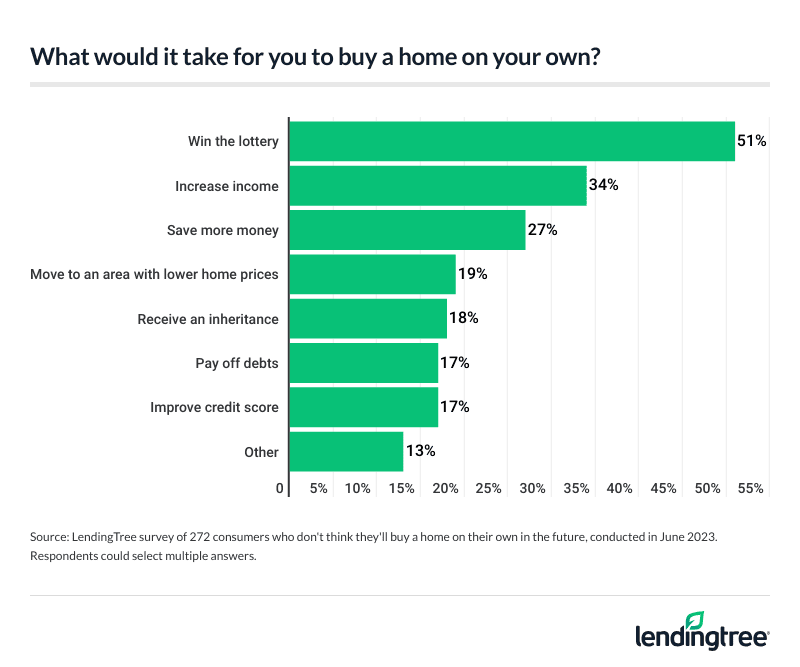

- With home affordability declining, a winning lottery ticket might be the only ticket to homeownership for some. Among nonhomeowners, 29% say they don’t think they’ll ever own a home. When asked what would have to happen for them to buy, 51% cite winning the lottery, followed by earning a higher income (34%) and saving more money (27%).

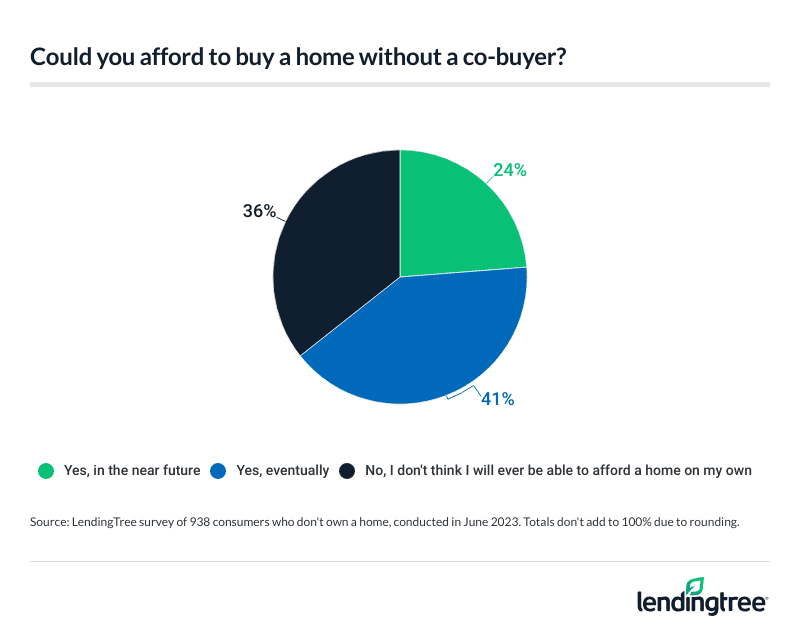

- Younger generations are the most optimistic about owning a home in the future. 64% of nonhomeowners say they think they’ll be able to afford a home without a co-buyer one day. Gen Zers are the most optimistic generation at 76%, while baby boomers have the bleakest outlook at 43%.

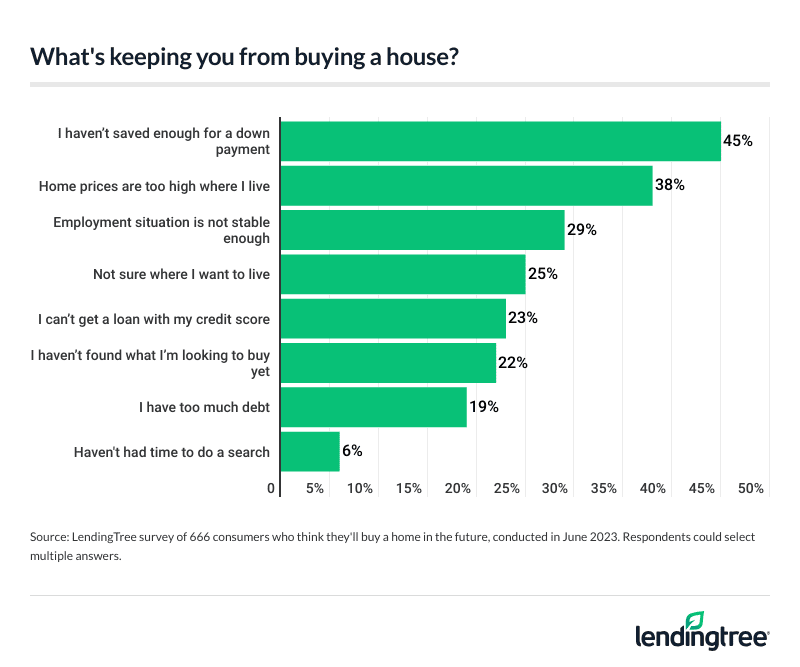

- High home prices and down payment requirements are keeping potential buyers locked into rental agreements. Of those who think they’ll be able to buy in the future, 45% say down payment requirements are currently holding them back, while 38% say home prices are too high in their respective areas. Still, hope is on the horizon for some, as 35% of future buyers say they plan to make the leap into homeownership within the next two years.

29% of Americans open to co-buying a home

Many Americans may dream of white picket fences, but those may come with a new stipulation: another name on the dotted line. As the hurdles to homeownership grow, 29% of Americans say they’d be open to co-buying a home with someone other than their spouses or significant others to make homeownership possible.

With younger consumers perhaps the furthest away from homeownership, it may not be surprising that they’re far more likely to consider co-buying a home than older generations. Gen Zers ages 18 to 26 are most likely to consider it, at 45%. That’s followed by:

- 36% of millennials ages 27 to 42

- 25% of Gen Xers ages 43 to 58

- 13% of baby boomers ages 59 to 77

Six-figure earners are the most likely income group to consider co-buying at 38%. On the other end of the spectrum, those making between $35,000 and $49,999 (24%) are the least likely to do so. In addition, men (34%) are more likely to consider co-buying than women (23%).

Who would these Americans ask to co-own with them? Of those open to co-buying, 63% say they’d consider doing so with a family member who wasn’t their spouse — making it the most popular option. Following that, 57% would consider buying with a good friend or current roommate.

According to LendingTree senior economist Jacob Channel, co-buying is a reasonable consideration — particularly for those without partners.

“While married couples have the advantage of being able to pool their incomes and resources together to afford a home in today’s expensive housing market, not everyone is so lucky,” he says. “Owing to this, buying a home may be out of reach for many unless they’re willing to co-buy with a friend or family member.”

Still, there’s good reason for hesitation. Of those who wouldn’t consider co-buying a home, legal and financial protections (47%) are the top concerns — particularly for baby boomers (57%) and those with adult children (56%). Following that, the desire for financial independence (33%) is another popular concern, though Gen Zers (42%) and millennials (40%) are the most likely to worry about this.

Parents are particularly receptive to co-buying with their children

Kids may be in luck — their parents may be willing to help them become homeowners. In fact, two-thirds (66%) of parents say they’d consider co-buying a home with their children — a sentiment particularly felt among millennial parents (76%). Once again, baby boomers are the least likely to do so at 53% (but that may be because their children are homeowners already).

In that same vein, parents of younger children (75%) are significantly more likely to consider co-buying than parents with adult children (55%). Meanwhile, parents earning six figures (74%) are the most likely income group to consider co-buying. That compares with 61% of parents earning less than $35,000 annually.

Channel says it’s not necessarily bad that many parents wouldn’t co-buy with their kids.

“While it’s certainly noble for a parent to agree to co-buy a home with their child, there are some drawbacks that both parties should consider before they pull the trigger,” he says. “For example, everyone involved should be willing to give up some control over what they can do with their property — be that remodeling or selling — to the parent or child who bought the home with them.”

Even if they don’t want to, however, buying with their kids might be necessary for some. Among parents whose kids are all 18 or older, 46% say they won’t be able to afford a home on their own (more on that below).

Nonhomeowners say it would take winning a lottery ticket to afford a home

Regardless of whether they’d consider co-buying, 29% of nonhomeowners say they don’t think they’ll ever buy a home. That ship may have sailed for older consumers, as nonhomeowning baby boomers (57%) are the most likely to believe they won’t ever buy a home. That’s followed by consumers with children 18 or older (48%) and Gen Xers (36%).

For these Americans, dreams of homeownership may be akin to dreams of winning Powerball. When asked what would have to happen for them to buy on their own, 51% cite winning the lottery — the most common response. That’s followed by earning a higher income (34%) and saving more money (27%).

Homeownership is widely considered a major milestone, but Channel says it’s OK to never own.

“While not being able to buy a house can be disappointing, it’s not the end of the world,” he says. “At the end of the day, if you don’t own a home but you’re still financially secure and able to plan and save for future events like retirement, you’ll likely end up being OK in the long run.”

Younger generations most optimistic about future homeownership

While many Americans may be open to co-buying, many more are optimistic that they’ll never need to do so. Although 36% of nonhomeowners think they’ll never buy a home on their own, 64% say they think they’ll be able to afford a home without a co-buyer. By generation, that percentage is highest among Gen Zers (76%) and lowest among baby boomers (43%).

Unsurprisingly, six-figure earners (87%) are the most confident they’ll be homeowners across all demographics. Meanwhile, Americans with children younger than 18 (72%) are more optimistic than those without kids (64%) and those with adult kids (54%).

“Optimism isn’t bad, but it won’t buy you a house all on its own,” Channel says. “With that in mind, those who want to buy a home someday should plan carefully and start doing things like saving, paying down other debts and working on boosting their credit scores as soon as possible. The more time you give yourself to prepare your finances for buying a home, the better off you’ll likely be.”

High home prices, down payment requirements are hurdles to homeownership

Many Americans are optimistic about their chances of owning a home — so what’s holding them back? Among those who expect to own a home in the future, 45% say down payment requirements are currently keeping them from buying a house. Women (52%) are particularly likely to say they haven’t saved enough for a down payment. In comparison, just 35% of men say similarly.

Meanwhile, 38% of people who expect to own a home in the future say house prices are too high in their areas and 29% say their employment situation isn’t stable enough yet.

Those dreams may soon be a reality for some, though — 35% of future buyers say they plan to make the leap into homeownership within the next two years. Those making between $75,000 and $99,999 (50%), six-figure earners (45%) and baby boomers (45%) are the most likely to say they plan to purchase a home in this time frame.

But even if they’d rather buy, Channel believes consumers should keep in mind that there’s nothing wrong with being a renter.

“It’s better to be a renter who can keep their head above water financially than be a homeowner who’s drowning in debt,” he says. “Similarly, being a renter is likely going to be better than being a homeowner with a co-buyer who is less than dependable and who might force you to pay their share of the bills.”

Considering co-buying? Here’s what to know

Co-buying is a recently popularized phenomenon, and many may be unaware of the risks since it’s new to the mainstream. Before making the leap with a co-buyer, Channel offers the following advice:

- Carefully consider your co-buyer. Anyone considering co-buying a home with a parent or friend (or even a spouse) should be sure that their buying partner is reliable.

- Understand that the risks are higher if you plan to take out a loan. “Buyers considering co-buying a home with a mortgage loan should know that as long as their name is on the mortgage, they’ll be responsible for making payments on time — even if their co-buyer leaves them hanging,” Channel says. In other words, if you and your friend buy a house together and you’re both listed on the mortgage, you’ll need to make payments even if your friend refuses to pay their share. If you don’t, your credit score could be severely damaged and you could lose the house.

- You probably won’t have total control over what’s done with a home. For example, both parties would need to agree if one person wanted to sell the house sometime in the future. While there could be circumstances where one owner could force another to sell, taking the legal route could be time-consuming and costly. “This is why it’s so important for co-buyers to be sure they’re 100% on the same page before they buy,” Channel says. “It might not be the most fun conversation in the world, but co-buyers should have an open dialogue about what they’ll do if one of them wants to move and the other doesn’t. They should also have open discussions about more mundane things like what they’ll do if they don’t agree on paint colors or kitchen cabinets.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,952 U.S. consumers ages 18 to 77 from June 5-6, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77