Nearly 1 Million Americans Fear They’ll Need to Leave Their Home Due to Foreclosure in the Near Future

With home prices still high and inflation hot, it can be difficult for households to afford necessary expenses. Because of this, some people are falling behind on their mortgage payments and — even worse — facing foreclosure.

To determine how many Americans 18 and older are at immediate risk of losing their homes to foreclosure, LendingTree analyzed the latest data from the U.S. Census Bureau Household Pulse Survey, fielded from July 27 to Aug. 8, 2022.

By and large, most American adults are neither living in households behind on their mortgage payments nor are they facing the threat of foreclosure in the near future. However, nearly 1 million Americans nationwide fear losing their home to foreclosure in the next two months.

Key findings

- Across the U.S., only 3.71% of adults living in owner-occupied housing units aren’t caught up on their mortgage payments. The share of people in owner-occupied households caught up on their payments is 60.43%, while an additional 35.47% don’t need to make payments because they own their homes free and clear.

- Of those not caught up on their mortgages, 19.62% across the U.S. report being either somewhat or very likely to leave their home due to foreclosure in the next two months. Though a noteworthy portion of adults who live in households behind on mortgage payments fear being foreclosed on in the near future, it’s important to reiterate that only 3.71% of households nationwide aren’t current on their housing payments.

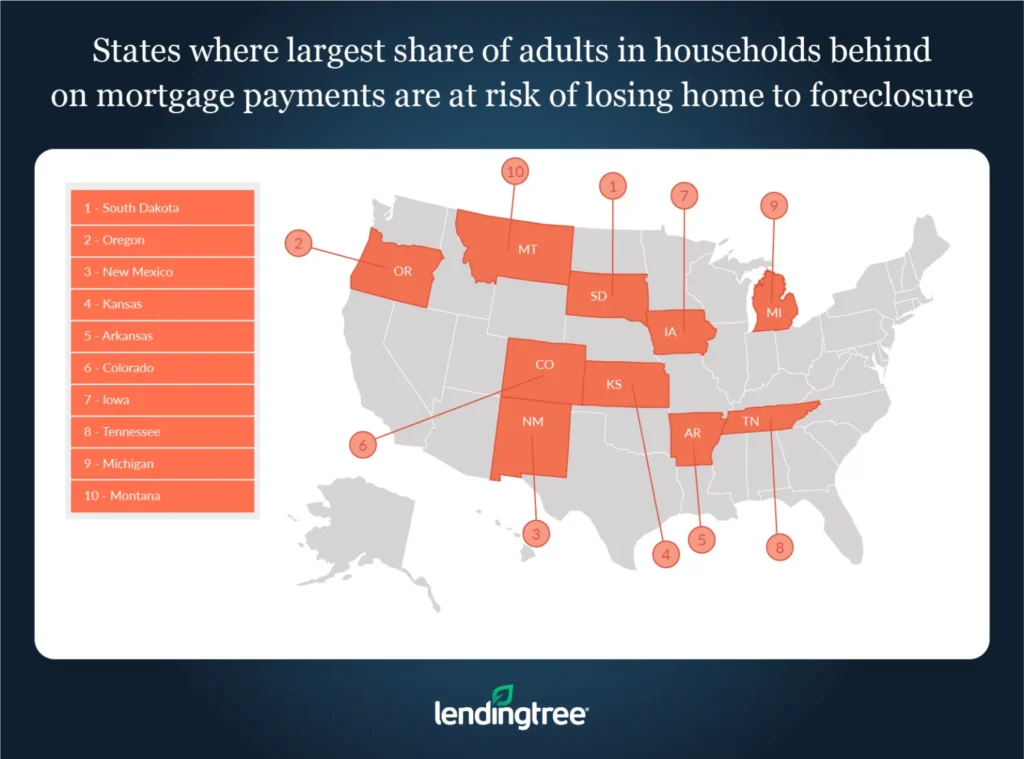

- South Dakota, Oregon and New Mexico have the largest share of adults behind on their mortgages who report they’re likely to lose their home to foreclosure in the near future. Across these states, an average of 55.45% of those not caught up on their housing payments say they’re somewhat or very likely to leave their home due to foreclosure in the next two months. However, of all the adults living in owner-occupied households in these states, an average of only 3.42% report living in households behind on their mortgage payments.

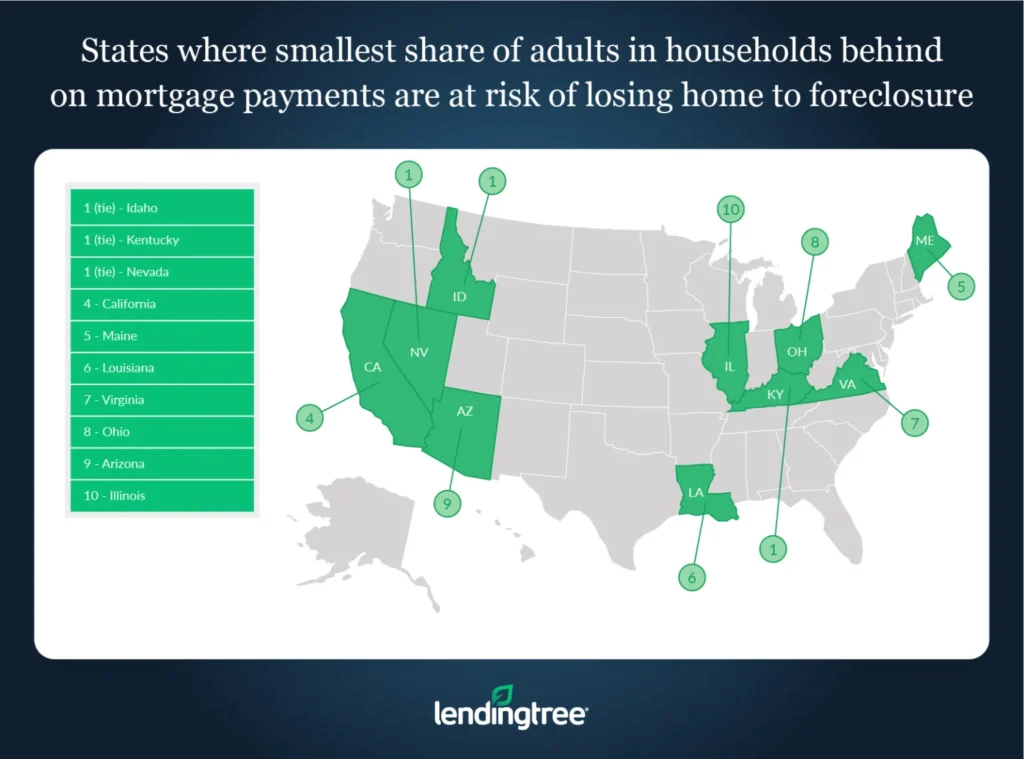

- Though an average of 2.81% of adults living in owner-occupied households report being behind on their mortgage payments in Nevada, Kentucky and Idaho, nobody in these states reports being at risk of losing their home to foreclosure in the next two months. Our study is based on self-reported survey data, so it doesn’t mean there are absolutely zero people in these states at risk of losing their home to foreclosure.

States where largest share of adults in households behind on mortgage payments are at risk of losing home to foreclosure

1: South Dakota

- Total adult population in owner-occupied households: 427,615

- Percentage of adult population in owner-occupied households caught up on mortgage payments: 54.66%

- Percentage of adult population in owner-occupied households not caught up on mortgage payments: 2.38%

- Percentage of adult population in owner-occupied households owned free and clear: 42.96%

- Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 71.28%

- Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 28.73%

2: Oregon

- Total adult population in owner-occupied households: 1,891,583

- Percentage of adult population in owner-occupied households caught up on mortgage payments: 65.90%

- Percentage of adult population in owner-occupied households not caught up on mortgage payments: 2.80%

- Percentage of adult population in owner-occupied households owned free and clear: 31.30%

- Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 49.59%

- Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 50.41%

3: New Mexico

- Total adult population in owner-occupied households: 900,679

- Percentage of adult population in owner-occupied households caught up on mortgage payments: 50.24%

- Percentage of adult population in owner-occupied households not caught up on mortgage payments: 5.07%

- Percentage of adult population in owner-occupied households owned free and clear: 44.19%

- Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 45.47%

- Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 54.53%

States where smallest share of adults in households behind on mortgage payments are at risk of losing home to foreclosure

1 (tie): Idaho

- Total adult population in owner-occupied households: 758,831

- Percentage of adult population in owner-occupied households caught up on mortgage payments: 60.31%

- Percentage of adult population in owner-occupied households not caught up on mortgage payments: 4.12%

- Percentage of adult population in owner-occupied households owned free and clear: 35.58%

- Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 0.00%

- Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 100.00%

1 (tie): Kentucky

- Total adult population in owner-occupied households: 1,803,552

- Percentage of adult population in owner-occupied households caught up on mortgage payments: 57.60%

- Percentage of adult population in owner-occupied households not caught up on mortgage payments: 2.36%

- Percentage of adult population in owner-occupied households owned free and clear: 40.04%

- Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 0.00%

- Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 100.00%

1 (tie): Nevada

- Total adult population in owner-occupied households: 1,251,594

- Percentage of adult population in owner-occupied households caught up on mortgage payments: 64.43%

- Percentage of adult population in owner-occupied households not caught up on mortgage payments: 1.96%

- Percentage of adult population in owner-occupied households owned free and clear: 33.60%

- Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 0.00%

- Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 100.00%

Despite high home prices, foreclosures remain rare in the U.S.

With recession talk becoming louder and louder and the housing market still as pricey as it is, some may believe most homeowners are at a greater risk of being foreclosed on than they are.

Certainly, foreclosure rates have increased since 2021 — due largely to the end of pandemic-era foreclosure moratoriums — but they’re still slightly lower than in 2019. This, combined with fewer than 1% of all adults in owner-occupied households across the U.S. reporting that they’re at risk of losing their home to foreclosure in the next two months, shows that foreclosure isn’t common.

This doesn’t diminish the challenges that those who face foreclosure must deal with, but it highlights how the market is in a fundamentally different place than during the Great Recession of 2007 to 2009, when foreclosures were much more common.

A combination of factors — from tighter lending standards after the Great Recession to the greater prevalence of generally easier to manage fixed-rate mortgages — mean that today’s homeowners are in a much better position to handle their housing payments than 15 years ago. Because of this, foreclosure rates remain relatively low and show few signs of returning to Great Recession levels anytime soon.

Tips for managing a potential foreclosure

Though most Americans are unlikely to face losing their homes in the immediate future, the reality is that foreclosures happen. If you’re at risk of foreclosure, here are three tips to help you navigate your situation.

- Don’t wait to ask for help. If you’re struggling to keep up with your mortgage payments, contact your lender as soon as possible. The faster you act, the more time you’ll give yourself and your lender to solve your problem, like selling your home or entering into mortgage forbearance.

- Know that you’ll have time before you lose your residence. Even if your lender begins the foreclosure process, that doesn’t necessarily mean you have to leave your home right away. Typically, you’ll be given time to collect your belongings and find another living arrangement before you’re removed from your home.

- Consider moving in with family. If you have the option, living with family can be a good way to help you recover your finances and get back on your feet after a foreclosure. Though it may not be ideal for you to share someone else’s space, there’s no shame in relying on loved ones to help get you through a tough spot in life.

Methodology

Data was analyzed from the latest U.S. Census Bureau Household Pulse Survey, fielded July 27 to Aug. 8, 2022.

Because of rounding and the share of the population that didn’t respond to the survey, some of the percentages referenced in this study may not add to 100%. Further, because this data is based on responses gathered over a short period, some figures reported here could be smaller or larger.

View mortgage loan offers from up to 5 lenders in minutes