Although 63% of Homebuyers Have Negotiated the Purchase Price, Only 39% Negotiated the Mortgage or Refinance Rate Despite the Likelihood of a Better Deal

The art of homebuying negotiation can hold the key to substantial savings, even if many prospective buyers miss out on related opportunities.

In fact, just 39% of prospective homebuyers negotiated the initial APR or refinance rate on their most recent home purchase, despite the high success rate.

We asked nearly 2,000 U.S. consumers about their negotiation experiences while buying a home — here’s what we found.

Key findings

- Prospective homebuyers aren’t strangers to price haggling, but the real savings is in the home loan — and most aren’t taking advantage. Only 39% of homebuyers say they negotiated the initial APR or refinance rate on their most recent home purchase, even with a success rate of 80%.

- Negotiating a lower APR could greatly impact how much you pay over the lifetime of your mortgage. With a $350,000 30-year fixed-rate mortgage with a 6.50% APR, even just a quarter-point reduction to 6.25% translates to a savings of $57 a month, $684 a year or $20,520 over the life of the loan — a significant difference compared to a few thousand dollars off the listing price.

- Significant savings may come from negotiating a lower mortgage rate, but 63% of homebuyers prioritize reducing the price of a home. 38% of buyers who negotiated did so with closing costs, while 36% had sellers pay for repairs. However, 24% of buyers say they regret making certain concessions when haggling.

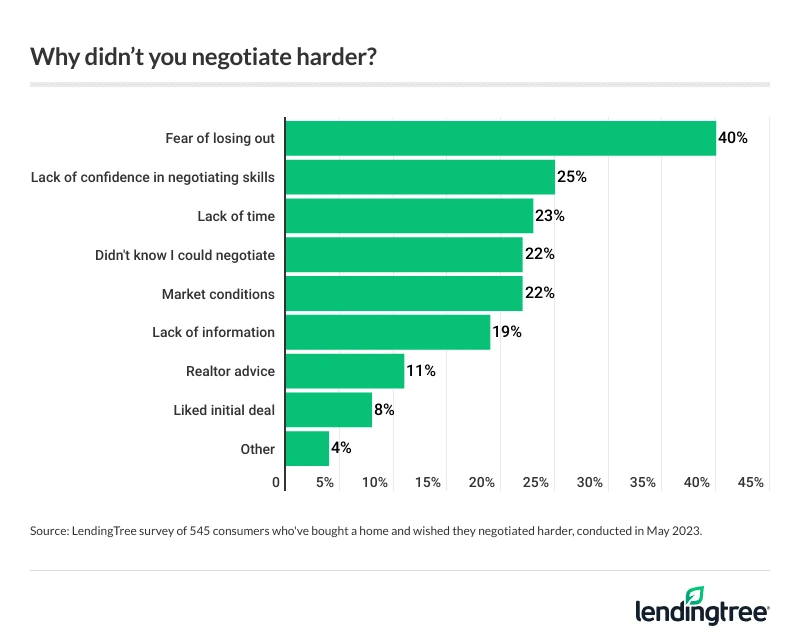

- The art of the deal hasn’t been mastered. Almost a quarter of homebuyers (23%) say they’ve negotiated too hard and lost a home they wanted to buy. Meanwhile, others wish they would have pushed for more. Of the 36% of buyers who say they wish they negotiated harder, 40% say fear of losing the home held them back, 25% say they lacked confidence in their negotiating skills and 22% say they didn’t know that they could negotiate.

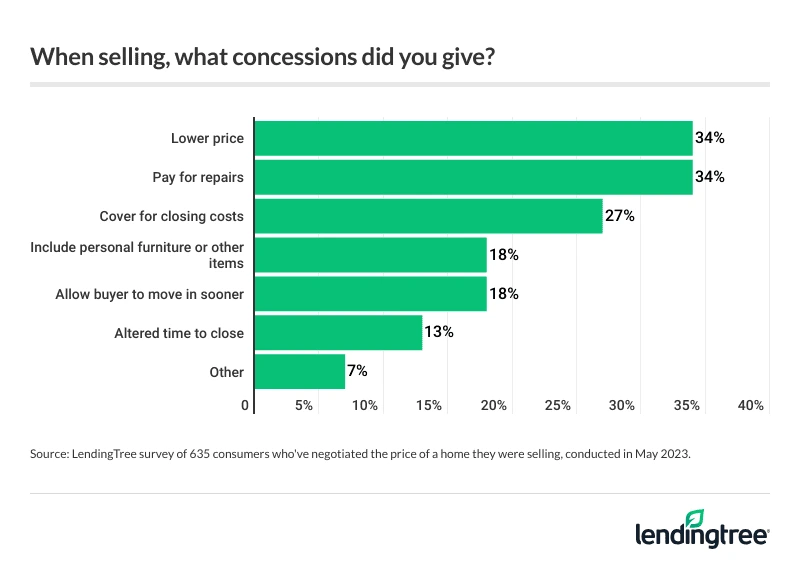

- The market could be shifting toward buyers, as only 42% of sellers are likely to negotiate (versus 63% of buyers) — still, regret is common regardless of position. About a third of sellers (34%) say they’ve settled for a lower price and/or paid for repairs, and 27% say they’ve covered closing costs. And although it may have seemed right then, 32% of sellers say they regret the concessions they offered to make the sale.

Only 39% of homebuyers negotiated initial APR or refinance rate on most recent purchase

Although homebuyers are familiar with bargaining over the cost of the home, a realm of savings often remains untapped — and it lies within their loans. In fact, only 39% of homebuyers negotiated the initial APR or refinance rate on their most recent home purchase.

Men (45%) were more likely to negotiate their home loan terms than women (34%). By age group, younger homebuyers were more likely to negotiate these terms than older consumers. Gen Z homebuyers (ages 18 to 26) were the most likely to do so, at 49%, followed by:

- Millennials (ages 27 to 42) (44%)

- Gen Xers (ages 43 to 58) (37%)

- Baby boomers (ages 59 to 77) (31%)

Homebuyers making between $75,000 and $99,999 were the most likely demographic to negotiate the initial APR or refinance rate, at 50%. Meanwhile, those making less than $35,000 (29%) were the least likely.

Homebuyers with children younger than 18 (47%) were significantly more likely to negotiate these terms than those with no children (38%) and those with adult children (33%).

Though most people don’t attempt it, LendingTree senior economist Jacob Channel says that asking your lender for a lower rate on your mortgage when you’re buying or refinancing can pay off — especially if you’ve got a high credit score and little debt.

“While your lender won’t always accommodate your request, it doesn’t hurt to ask,” he says. “If you successfully negotiate a lower rate — even a modest one of around a quarter of a percentage point — you could potentially save tens of thousands of dollars in interest over the lifetime of your loan, depending on factors like the size of your loan and the specific mortgage rate you received.”

Among those who negotiated these terms, the success rate was 80%. Gen Zers (88%), those making six figures or more (84%), parents with children younger than 18 (83%) and millennials (83%) were the most successful.

How much can you save by negotiating a lower APR?

Given how successful these homebuyers have been, it’s worth exploring how much they could save.

Using a $350,000 30-year fixed-rate mortgage with a 6.50% APR as an example, a quarter-point reduction to 6.25% could save you:

- $57 a month

- $684 a year

- $20,520 over the life of the loan

That’s a significant difference, particularly compared to negotiating the list price — which often saves just a few thousand dollars (though still a nice chunk of change).

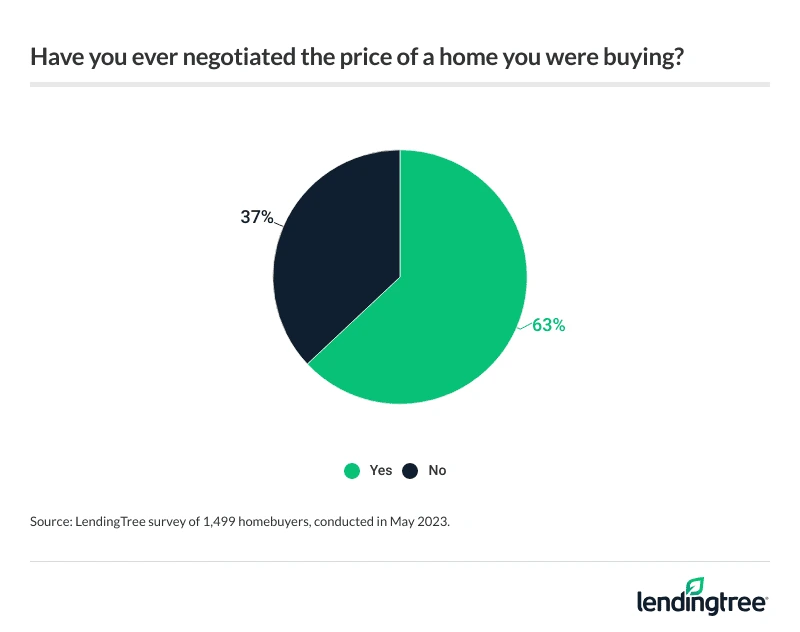

63% of homebuyers have negotiated home price reductions

While negotiating a lower mortgage rate may save the most money, the majority (63%) have negotiated the price of the home. Men (67%) were again more likely to do so than women (60%). By age group, Gen Z homebuyers were the most likely to negotiate home prices, at 67%. That’s followed by:

- Gen Xers (64%)

- Baby boomers (63%)

- Millennials (61%)

Meanwhile, those earning six figures were the most likely demographic to negotiate home prices, at 79%. Conversely, those earning less than $35,000 were the least likely (47%). Homebuyers with children younger than 18 (69%) were again significantly more likely to negotiate in this realm than those with adult children (62%) and those with no children (59%).

“Today’s housing market is tough, but sellers are nonetheless more willing to negotiate with buyers than over the past two years,” Channel says. “In the same way that asking your lender for a lower rate can help you save money, so too can asking a seller to cover things like closing costs or to pay for repairs.”

In what other ways did homebuyers negotiate? Beyond the price point, the most popular choice was closing costs (38%) (particularly among Gen Xers (48%)), followed by repairs (36%) — a choice especially common among homebuyers with kids younger than 18 (40%).

Still, it’s worth noting that nearly a quarter (24%) of buyers say they regret making certain concessions when negotiating. That’s a sentiment particularly felt among Gen Z homebuyers (39%), parents with kids younger than 18 (34%) and millennials (34%).

Can a homebuyer negotiate too hard?

While negotiations might end well for some, others might not be so lucky. In fact, 23% of homebuyers who’ve negotiated the price say they lost a home they wanted to buy because they haggled too hard.

“In some instances, an overly aggressive buyer can alienate a seller and lose out on a chance to buy a great home,” Channel says. “With that in mind, while buyers are well within their right to ask for concessions from sellers, they should always be polite and reasonable.”

On the other hand, 36% of buyers say they wish they’d negotiated harder. Of these buyers, 40% say fear of losing the home held them back, making it the most popular reason for not pushing harder. Another 25% say they lacked confidence in their negotiating skills and 22% say they didn’t know they could negotiate.

Sellers are less likely to negotiate, but regret is common among both parties

It’s worth noting that sellers are less likely to negotiate than buyers (at 42% versus 63%). Among sellers, six-figure earners (60%) and those making between $75,000 and $99,999 (50%) are the most likely to negotiate.

When it comes to the most common concession point for sellers, lower prices and/or repairs are the most common (34%). Meanwhile, 27% say they’ve covered closing costs.

Still, just as buyers did, sellers also expressed regret over concession points. In fact, 32% of sellers say they regret the concessions they offered to make the sale.

But even in a slow housing market like this current one, Channel says that sellers shouldn’t feel obligated to accommodate every potential buyer.

Still, just as buyers did, sellers also expressed regret over concession points. In fact, 32% of sellers say they regret the concessions they offered to make the sale.

But even in a slow housing market like this current one, Channel says that sellers shouldn’t feel obligated to accommodate every potential buyer.

“While making a few reasonable concessions can help you sell your house faster, you shouldn’t be so quick to do whatever a buyer asks that you overcompensate and make more sacrifices than what would’ve been necessary to sell your house,” he says. “There’s a big difference between being completely unreasonable as a seller and holding your ground on certain issues.”

Top expert tips for home shoppers

More than 4 in 10 (42%) consumers say they’ve shopped for a home in the past five years. Among homebuyers, nearly three-quarters (74%) say they’ve shopped for a home more than once.

While nearly half (49%) say their most recent homebuying experience was similar to those they’ve had before, a third (33%) say it was more difficult. With that in mind, Channel offers the following tips for home shoppers:

- Don’t be afraid to negotiate. “Ultimately, homebuyers shouldn’t be afraid to ask for a better deal from both lenders and sellers, especially in today’s expensive housing market,” he says. “That said, buyers should also keep their expectations in check and realize they won’t necessarily get everything they’re asking for, even if they really, really want it.”

- Understand you may not get your perfect deal. Sometimes, perfection can be the enemy of progress. Accepting a good mortgage rate or home price (even if it’s not ideal) might be your best option when buying a house.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,984 consumers from May 3-4, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

View mortgage loan offers from up to 5 lenders in minutes