What is Quicken Loans?

Quicken Loans was founded in 1985 and launched as Rock Financial. The company was renamed Quicken Loans in 1999, after it was purchased by tax and accounting software firm Intuit. Then, in 2002, original founder Dan Gilbert gathered a group of private investors who purchased Quicken Loans back from Intuit. Quicken Loans, headquartered in Detroit, claimed the title of largest mortgage lender in the United States in early 2018, ousting Wells Fargo from the top spot. That was after it originated $25.1 billion in mortgages during the fourth quarter of 2017, compared to Wells Fargo’s $22.91 billion, according to data from Inside Mortgage Finance. Quicken Loans also took the No. 1 spot in 2017 as the highest-volume lender, according to a report by the Consumer Financial Protection Bureau, originating just under 396,000 loans. For the first quarter of 2018, Quicken reported $20.5 billion in mortgage loans.

Note : (Lender CTA are remaining to add.)

Working with Quicken Loans

Quicken Loans has no physical branches but is licensed in all 50 states and the District of Columbia. It offers homebuyers the option to work exclusively online through its digital Rocket Mortgage product or to talk to a loan expert along the way (or both).

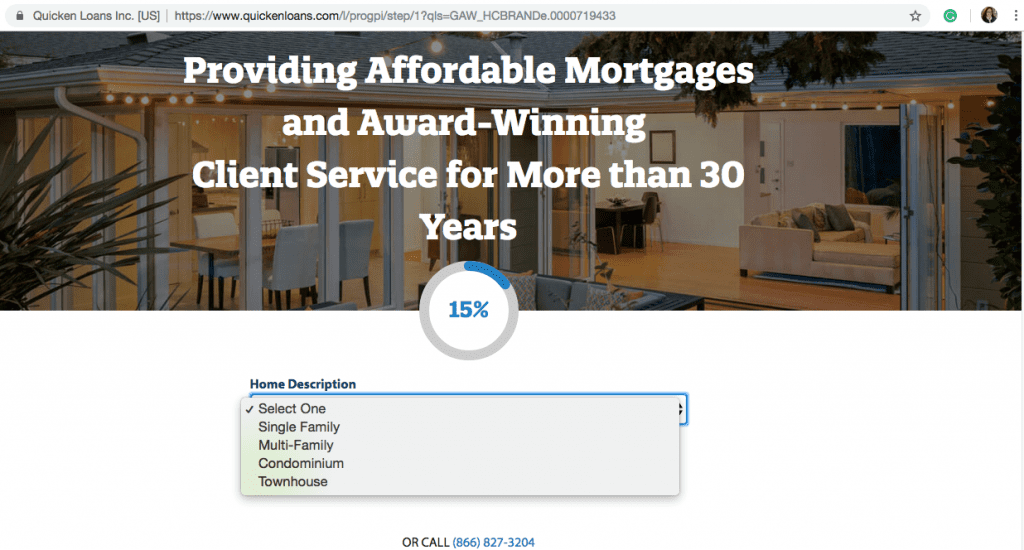

The minimum credit score for Quicken Loans is 580 (for an FHA loan, which the lender offers), and the company has a manual underwriting process. Borrowers can apply for loans on:

- Single-family homes

- Multi-family homes

- Condominiums

- Townhouses

Quicken Loans mortgage products

Quicken Loans offers these terms for mortgage products:

- 15-year fixed

- 30-year fixed

- 5, 7 and 10-year ARMs with annual interest-rate changes after the fixed term

Purchase

- Conventional mortgage

- FHA loan

- VA loan

- USDA loan

- Jumbo, including jumbo VA and jumbo FHA loans

Refinance

- Traditional refinance

- Cash-out refinance

- FHA streamline refinance

- Reverse mortgages

- VA cash-out refinance

Home equity

Quicken doesn’t currently offer any home equity options.

Quicken Loans special mortgage programs

Quicken Loans has many customization programs and options that can help homebuyers create a mortgage they can easily afford and terms with which they are comfortable. Let’s take a look at each program and its benefits:

- YOURgage®. This proprietary program allows borrowers to adjust the length of their loan instead of going with traditional 15- and 30-year options and, as a result, save money on interest payments. Through YOURgage®, borrowers can:

- Choose a mortgage term anywhere between eight and 29 years

- Make a low down payment, starting at 3%

- Enjoy a fixed interest rate

- Power Buying Process TM. When you make an offer on a home, it helps to have a preapproval. Quicken Loans’ Power Buying ProcessTM offers three stages of approval, each of which comes with a letter for sellers:

- Prequalified approval: Based on a few questions and a credit check

- Verified approval: Issued after your credit is checked and your income and assets are verified

- RateShield: For potential homeowners still searching for their new residence, RateShield allows them to lock in a rate for 90 days on a 30-year, fixed-rate FHA or VA loan. Doing so provides borrowers with an approval letter that can help strengthen any offers they make.

The mortgage application process

Quicken Loans does a good job of breaking down its loan process so borrowers can evaluate whether they want to go through the company. On its “Our Mortgage Process” page, Quicken Loans outlines the four-step process as follows:

- Apply for the loan online by answering a few questions on QuickenLoans.com or request follow-up by a home loan expert. Borrowers can choose from a variety of methods for communicating, getting notifications and submitting forms. These methods include email, chat, fax, phone and online dashboard.

- Once you apply and your information is processed, you’ll be given several options to review. You can compare the costs, rates and terms to help decide which fits your needs.

- At this point, you’ll have chosen the loan you want, so now it’s time to verify your information. One thing that makes Quicken Loans extra convenient is its option to import your verification information online. This means you can easily scan or capture images of your documents, or import them and submit them without leaving your home or office. You can also monitor your loan updates online.

- Borrowers are notified of the availability of their closing disclosure online and by email. The disclosure can be downloaded and signed, or the borrower can log into their account to acknowledge receipt.

- After approval and verification, it’s time to close the loan. While loan documents do need to be signed in person, you can get copies online ahead of time to review them at your leisure. You can also set the time and place of your signing.

Communication during the process

When communicating with Quicken Loans, borrowers have plenty of options: The lender has an online chat function, customer service phone lines for new loans and loans either in-process or already closed, as well as an email address to which you can direct questions. Quicken Loans staffs both the online chat and phone lines seven days a week.

Pros and cons of a Quicken Loans mortgage

Let’s start with the advantages:

- Operates in all 50 states and territories. Borrowers do not need to look for a local branch.

- Fast online loans. Quicken Loans is great for those who want a mostly online experience and the ease of taking out a mortgage on their phone.

- Options for those with low credit. The USDA loan program can help people with credit scores as low as 620. The FHA loan option is good for those with credit scores as low as 580.

- Flexible terms. With YOURgage®, homebuyers can control and reduce the amount of interest they pay by customizing repayment time.

- Tech integration. In addition to the responsive Rocket Mortgage program, Quicken Loans offers other points of integration, such as the ability to make payments by voice with Amazon’s Alexa.

- Option for a low down payment. The YOURgage® program allows for a down payment as low as 3%, and qualifying property purchases can skip the down payment altogether through the USDA program.

- Digital application process. For consumers who want a truly digital experience from start to finish, Quicken Loans can be a good choice.

And now the disadvantages:

- Unknown fees. Without a published fee schedule, it’s difficult to compare costs with other lenders.

- No local branches or in-person borrower experience. While the completely online experience of Rocket Mortgage or the hybrid telephone experience of the Quicken Loans site may appeal to some borrowers, the lack of local branches for face-to-face contact might be a dealbreaker for others.

- Doesn’t offer home equity loans. While it may change in the future, at this time Quicken doesn’t have equity loan options for homeowners.

- Limited options for property types. At the moment, Quicken Loans doesn’t offer loans for manufactured homes.

Alternative mortgage options

Note : (Alternative lenders CTA are remaining to add.)