54% of Buyers Don’t Shop Around for a Mortgage, Even Though 45% of Those Who Do Receive a Better Offer

Homebuying is no simple feat. It can be time-consuming, expensive and confusing, so it’s no wonder people want to cut corners. But those cuts can be costly, especially when mortgage shopping.

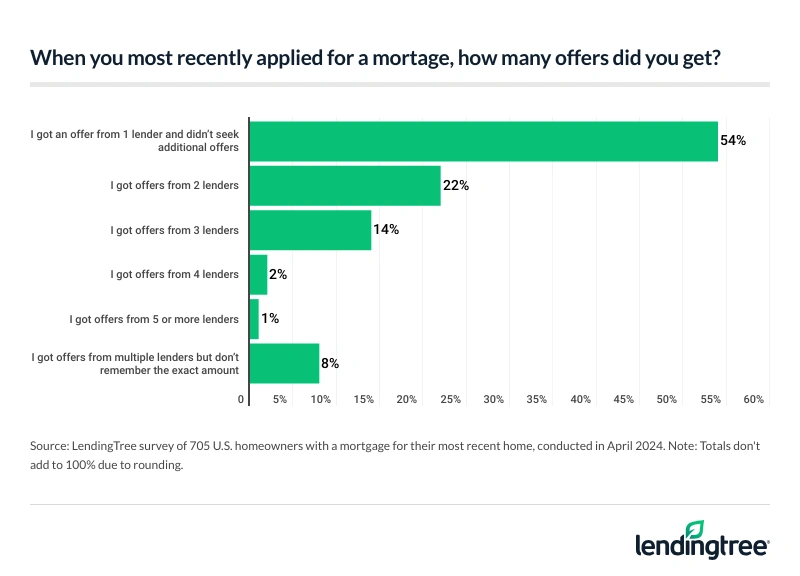

The newest LendingTree study finds that 45% of homebuyers with a mortgage who shopped around got a lower offer than their first. Yet over half (54%) of those with a mortgage for their most recent home only got one mortgage offer.

Here’s more about why people cut mortgage shopping short, and what that means for them.

Key findings

- Most homebuyers still aren’t shopping around for their mortgage despite the potential savings. Over half (54%) of those who took out a mortgage for their most recent home purchase only got one loan offer. Meanwhile, 22% got two offers and 17% got three or more. By generation, baby boomers are the least likely to comparison shop, with just 28% doing so. That compares with 62% of millennials.

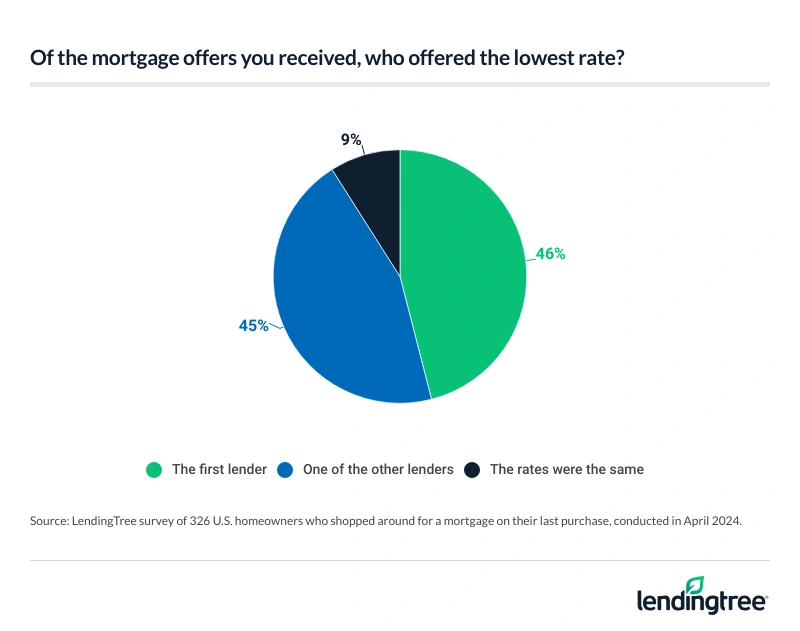

- Homebuyers are likely leaving money on the table when not shopping around. Among those who compared more than one mortgage offer, 45% say the lowest offer didn’t come from their first lender. Going further, 46% of those who got a mortgage say they went with a lender they didn’t have a prior relationship with.

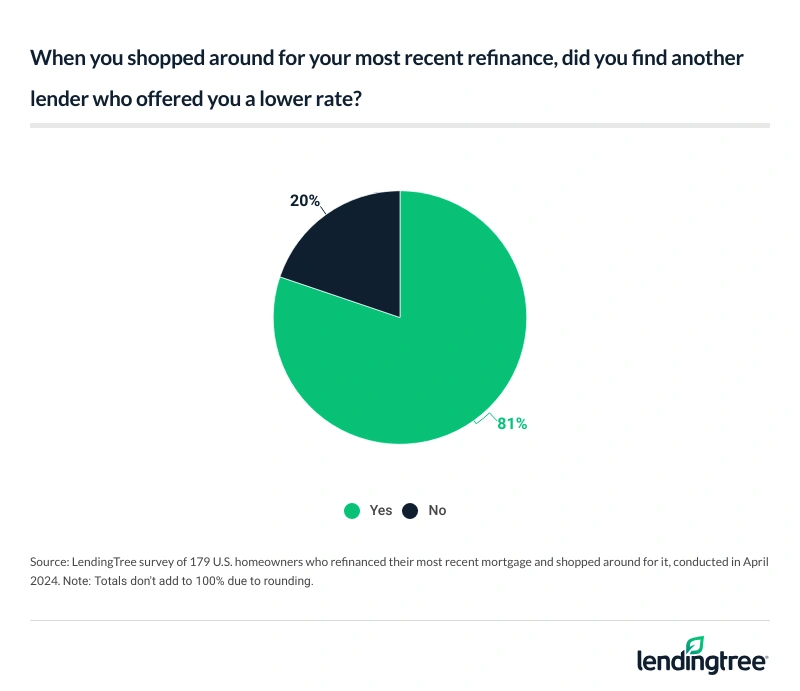

- Refinancers are more savvy with comparison shopping. Among the 45% of homebuyers who’ve refinanced the mortgage on their current home, 56% shopped around. Comparison shopping paid off for these refinancers, as 81% found a lower rate than their current lender offered.

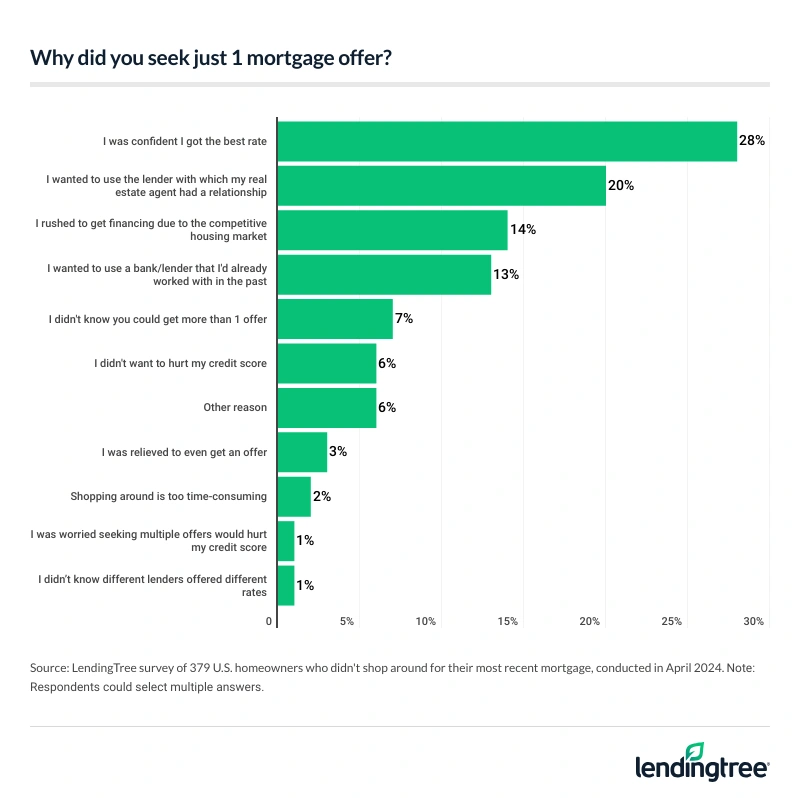

- Shopper confidence (warranted or not) is the top reason for not seeking more mortgage offers. Among those who sought just one mortgage offer, the top reason for doing so was confidence that they got the best rate (28%), followed by a desire to use the lender with whom their real estate agent had a relationship (20%). Additionally, 14% say they rushed to get financing due to the competitive housing market.

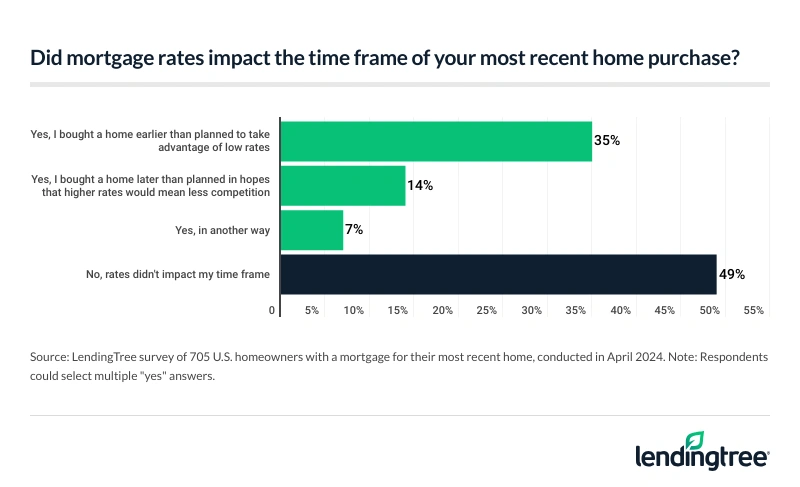

- Mortgage rates influence buyer timelines. Over a third (35%) of buyers say they purchased a home earlier than planned to take advantage of low rates. That’s especially true for men, at 43%, versus 26% of women.

Most homebuyers aren’t shopping around for mortgage

It’s one and done for most homebuyers looking for a mortgage. Our study finds that 54% of homebuyers with a mortgage for their most recent home got just one offer from one lender.

Women (62%) are more likely than men (46%) to accept the first offer without shopping around. Older generations are also more likely to do so — 72% of baby boomers ages 60 to 78 versus 59% of Gen Xers ages 44 to 59 and 38% of millennials ages 28 to 43.

Some do a bit more shopping, with 22% of homebuyers saying they got two offers when they applied for their current mortgage. Only 14% got three offers, and 2% got four.

How many offers are enough? Jacob Channel, LendingTree senior economist, says there’s no magic number for how many offers homebuyers should compare before they pick a lender. However, looking at at least two can help people save serious cash.

“Different lenders can offer different rates to the exact same borrower,” he says. “With that in mind, the first rate you’re offered may not be the lowest one you can get. The more offers you can look at, the better.”

Homebuyers more likely to look at homes before meeting with lender

Which comes first: meeting with a lender to see how much home you can afford, or meeting with a real estate agent to look at houses? For most with a mortgage on their current home, it was the latter. In fact, 57% say they met with a real estate agent before they met with a lender.

Meanwhile, we asked homebuyers about July 2024 changes that’ll make it easier for sellers to opt out of paying their buyer’s real estate agent commission fees. Amid this, do they think they’ll be as reliant on their lender for advice should they buy again? Nearly 4 in 10 (39%) say no.

Rate shoppers often likely to find better offer

Smokey Robinson’s mama may not have been talking about mortgages when she told him, “You better shop around,” but it’s advice that could pay off. Of those who say they compared mortgage offers from more than one lender when buying their current home, 45% say their persistence paid off — the lowest offer they got didn’t come from the first lender. Interestingly, it paid off more for men (49%) than women (39%).

How big of a payoff are we talking about? Channel says the amount a borrower can save by shopping around for a mortgage will vary based on factors such as the rates offered and the size of their loan. But it’s possible for someone who received multiple offers and picked the one with the lowest rate to save hundreds of dollars a month, thousands of dollars a year and tens, if not hundreds, of thousands of dollars over the lifetime of their loan.

“Because savings can be so large and you can compare lenders for no charge, pretty much everyone should at least try to shop around before they get a mortgage,” he says.

Do people avoid shopping around because they’ve already established a relationship? Perhaps, as 54% of homebuyers say they got their current mortgage from a lender from whom they’ve used other services, such as a checking account, auto loan or credit card. Men (58%) are more likely to go with a lender they’ve used before than women (50%), while millennials (65%) are much more likely to do so than their older peers (50% of Gen Xers and 39% of baby boomers).

Refinancers more likely to shop around

People shop more when refinancing. More than 4 in 10 (45%) who took out a mortgage for their most recent home purchase have since refinanced. Of them, 56% say they shopped around for their refinance.

Did it pay off? Overwhelmingly so, with 81% of them saying they found another lender that offered a lower rate.

With interest rates as high as they are, Channel cautions that refinancing probably isn’t best for most people right now. That’s because many current homeowners locked in their loans years ago with sub-5.00% interest rates.

“If (or when) rates come down and more people start thinking about refinancing, those considering it should recognize it isn’t free,” he says. Typically, the closing costs on a mortgage refinance range between 2% and 6% of a loan’s value. “While refinancing could help you get a lower rate and lower your monthly payments, you’ll want to be sure that you stay in your house long enough for those lower payments to offset any upfront costs.”

He stresses never rushing into refinancing and always taking the time to carefully weigh its pros and cons before making a decision. The LendingTree refinance calculator can help you figure out how long it’ll take for a refinance to be worth it.

Why homebuyers don’t shop around

What’s stopping homebuyers from shopping around more for mortgages? Most who just got one offer say it’s because they’re confident they got the best rate from the first lender (28%), while 20% say they wanted to go with a lender who had a relationship with their real estate agent.

Rushing to get financing due to the competitive housing market is the reason 14% say they didn’t shop around for a mortgage. Another 13% say they wanted to work with a lender they’d dealt with in the past, and 7% say they didn’t know you could get more than one offer. (You can!)

Most homeowners with a mortgage got preapproved for their most recent one (84%), and nearly all of them (99%) were happy with that preapproval either meeting or exceeding the amount they expected.

But not everyone uses the full amount for which they’re preapproved. While 52% say what they paid for their current mortgage was roughly the same as the amount for which they were preapproved, 37% paid less for their home than the preapproved amount.

Homebuyers may rush process to take advantage of rates

Are interest rates stopping consumers from shopping around for better mortgages? In some cases, yes, as over a third (35%) of buyers with a mortgage on their current home say they purchased earlier than planned to take advantage of low rates. Men are more likely to do so than women — 43% versus 26% — while millennials (52%) are much more likely to do so than their older counterparts (25% of Gen Xers and 19% of baby boomers).

But is that a wise move? Channel says shopping around for a mortgage is a good idea regardless of whether rates are high or low.

“Even when average interest rates are lower than they are currently, different lenders can still offer different rates to different borrowers,” he says. “Mortgage rates aren’t typically super volatile (though they do fluctuate weekly), so as long as you’re not taking months to shop around and compare offers, you probably don’t need to worry about rates skyrocketing if you don’t immediately lock in the first rate you’re offered.”

4 expert tips on shopping around for mortgage rates

Here are some things you can do when you’re looking for a mortgage to help make sure you don’t leave money on the table:

- Just do it: Channel says the biggest tip he can offer to someone thinking about shopping around for a mortgage is to do it. “Yes, dealing with calls from multiple lenders can be daunting, and comparing offers isn’t the most fun activity in the world,” he says. “Nonetheless, significant savings can be made possible by shopping around, and the extra work that shopping around might take is often well worth it.”

- Explore loan types: While 30-year loans are popular, you might save more with a shorter-term loan or an adjustable-rate mortgage (ARM). You may also want to explore government loans, such as those offered through the Federal Housing Administration (FHA), U.S. Department of Agriculture (USDA) and Department of Veterans Affairs (VA).

- Compare and contrast loans: Make sure you compare apples to apples when looking at offers. Our online mortgage calculator helps you break down the details. We also round up the best mortgage lenders each month.

- Look at different types of lenders: There are several different types of lenders you may want to consider when gathering mortgage offers. The three most common are banks, mortgage brokers and mortgage banks.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,001 U.S. consumers ages 18 to 78 from April 15 to 17, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

View mortgage loan offers from up to 5 lenders in minutes