1.45 Million Single Mothers Across the Nation’s Largest Metros Are Homeowners, but Millions More Struggle to Buy

LendingTree has reported that single women own considerably more homes in the U.S. than single men. This is despite the fact that women tend to earn less money than men.

With Mother’s Day fast approaching, we revisited this topic by researching single mothers. Specifically, we used the latest U.S. Census Bureau American Community Survey data to analyze homeownership rates among women who live without a spouse in a household with children younger than 18.

We found that while homeownership rates among single moms vary across the nation’s 50 largest metropolitan areas, they tend to hover around 30% to 40% and are lower than those among single dads.

Key findings

- Across the nation’s 50 largest metros, 4.23 million households are occupied by single mothers and their children younger than 18. Of those households, 1.45 million are owner-occupied. That means the homeownership rate among single moms is about 34%.

- Comparatively, only 1.53 million households are occupied by single fathers and their under-18 children. However, the homeownership rate among this group is higher at about 49%. In other words, while there are fewer single-dad homeowners than single-mom homeowners, single dads are proportionally more likely to own their houses than single moms.

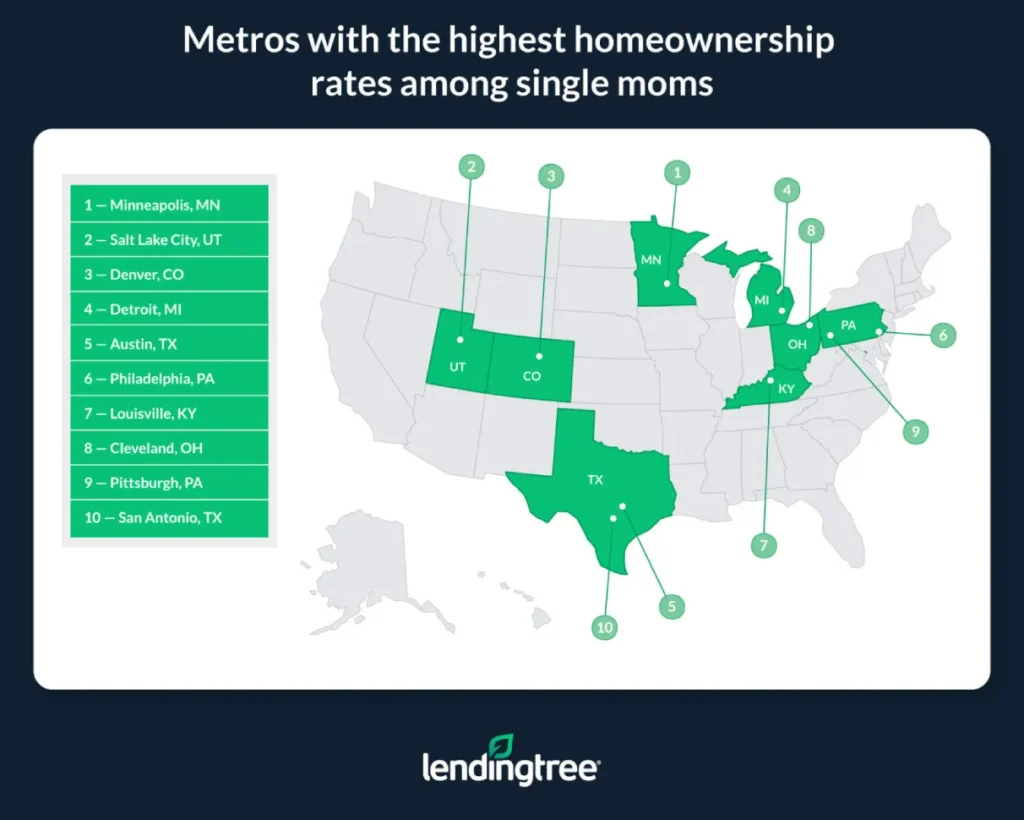

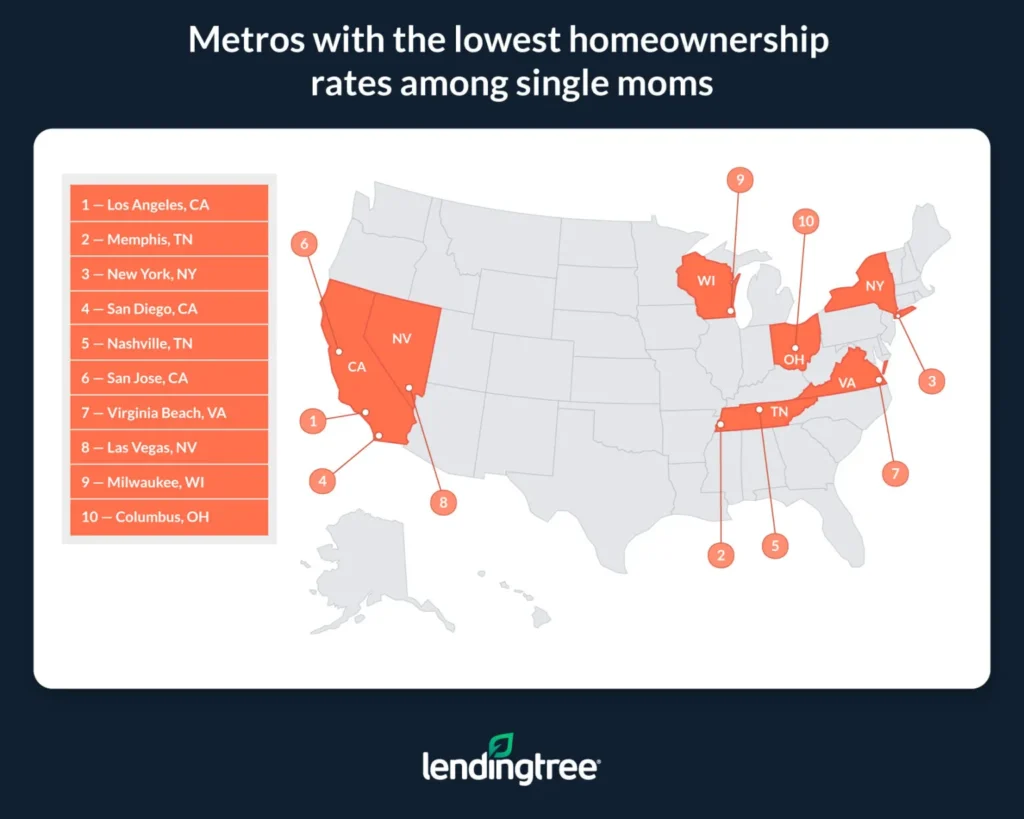

- Homeownership rates are highest among single mothers in Minneapolis, Salt Lake City and Denver. The homeownership rate for single moms in these metros averages 46.86%. Conversely, homeownership rates among single moms are lowest in Los Angeles, Memphis, Tenn., and New York, averaging 24.10%. Various factors — including income, home prices, job opportunities and child care costs — can influence single-mother homeownership rates.

- New York, Chicago and Philadelphia have the most single-mom homeowners. 260,138 single mothers across these metros live in owner-occupied homes. That’s 229,417 more than the number of single-mom homeowners in San Jose, Calif., Birmingham, Ala. and Salt Lake City, where the fewest live.

- Incomes for single-mom households are highest in San Jose, Calif., San Francisco and Seattle. The median incomes for households headed by single moms in these metros are $67,608, $61,387, and $56,688, respectively. In contrast, median incomes for single-mom households are lowest in Houston, New Orleans and San Antonio, at $30,707, $31,759 and $32,588, respectively.

Metros with the highest homeownership rates among single moms

No. 1: Minneapolis

- Total households occupied by single moms: 75,685

- Total households owned and occupied by single moms: 37,265

- Homeownership rate among single moms: 49.24%

- Median household income for single-mom households: $45,666

No. 2: Salt Lake City

- Total households occupied by single moms: 24,938

- Total households owned and occupied by single moms: 11,424

- Homeownership rate among single moms: 45.81%

- Median household income for single-mom households: $50,856

No. 3: Denver

- Total households occupied by single moms: 53,501

- Total households owned and occupied by single moms: 24,365

- Homeownership rate among single moms: 45.54%

- Median household income for single-mom households: $51,806

Metros with the lowest homeownership rates among single moms

No. 1: Los Angeles

- Total households occupied by single moms: 254,950

- Total households owned and occupied by single moms: 57,821

- Homeownership rate among single moms: 22.68%

- Median household income for single-mom households: $42,882

No. 2: Memphis, Tenn.

- Total households occupied by single moms: 54,714

- Total households owned and occupied by single moms: 13,315

- Homeownership rate among single moms: 24.34%

- Median household income for single-mom households: $33,148

No. 3: New York

- Total households occupied by single moms: 431,709

- Total households owned and occupied by single moms: 109,200

- Homeownership rate among single moms: 25.29%

- Median household income for single-mom households: $41,415

For many single moms, homeownership is out of reach

While exceptions certainly exist, it’s often a struggle for single-mother households to get by.

One area where this struggle is clear is homeownership. As mentioned above, the homeownership rate among single moms across the nation’s 50 largest metros is about 34%. For single dads, it’s about 49%. This suggests it’s harder for a single mom to become a homeowner than a single dad.

There are various reasons why. Single moms tend to earn less than single dads. In the face of today’s high home prices and mortgage rates, these lower earnings can make buying a house especially difficult. Other, less easily identifiable reasons that influence this trend can be related to discrimination or societal bias that make it harder for single mothers to advance in their careers or get approved for loans.

Of course, this isn’t to say homebuying is out of reach for single mothers, nor does it mean single dads always have an easier time financially than single moms. Regardless of gender, being a single parent is often challenging, especially when it comes to finances.

Even so, it’s impossible to deny just how disproportionately difficult it can be for single moms to navigate economic hurdles like buying a home.

Tips for single moms looking to buy a home

Because single mothers tend to earn relatively lower incomes, buying a home can be especially challenging. Nonetheless, the following three tips could help would-be buyers save money and get approved for a loan — regardless of gender.

- Boost your credit score. The better your credit, the more likely you are to be approved for a mortgage. Not only that but the higher your score, the lower your mortgage rate is likely to be. You don’t need a perfect credit score to buy a house, but those with higher scores usually find buying more manageable.

- Explore down payment assistance programs. While a 20% down payment on a home isn’t typically necessary, larger down payments can still be beneficial because they can increase your chances of being approved for a loan and help you get a lower rate. But coming up with tens of thousands of dollars is often easier said than done. Some buyers may qualify for help from a down payment assistance program that can give them access to cash they can use for a down payment and other charges like closing costs.

- Shop around for a mortgage before buying. Because different lenders can offer different rates to the same borrowers, shopping around for a mortgage and comparing offers from different lenders before making a purchase could help homebuyers get a lower rate on their loan. The lower the rate offered, the lower the monthly payment and the more affordable buying a house is likely to be.

Methodology

Data for this study came from the U.S. Census Bureau 2022 American Community Survey with one-year estimates — the latest available at the time of writing — and was compiled at the metropolitan statistical area (MSA) level.

Single-mother households were defined as households headed by female householders without a spouse present who were living with their children younger than 18.

The homeownership rate for single mothers was calculated by dividing the number of households owned and occupied by single mothers by the number of households occupied by single mothers.

View mortgage loan offers from up to 5 lenders in minutes