31% of Americans Would Rather Go Into Debt Than Borrow From Loved Ones

Life can be unpredictable, and unforeseen circumstances often come at a cost. 2020 has been no exception, with many Americans struggling to make ends meet due to job loss and other hurdles caused by the coronavirus pandemic. With few sources of financial relief, many people have turned to friends or family to ask for help.

More than half of Americans borrowed money from or loaned money to a loved one within the past year, according to a November 2020 LendingTree survey of more than 2,000 Americans. Nearly a third of Americans would rather go into debt than ask friends or family for money. See what else we uncovered in the report below.

Key findings

- Lending between friends and family is a common practice. More than half (53%) of Americans have either borrowed from or loaned money to a loved one in the last year. On average, lenders fronted $1,497 and borrowers asked for $1,067.

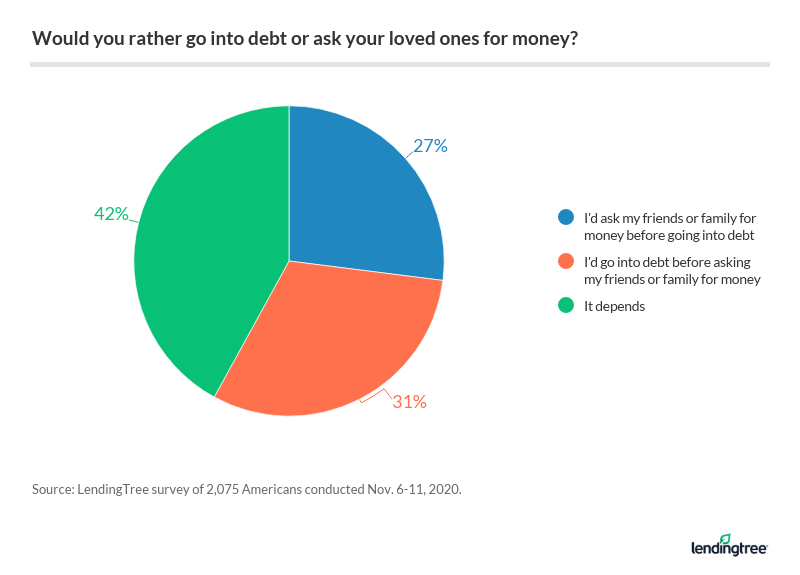

- Asking for help from a loved one is a last resort for many who are struggling. Nearly a third (31%) of Americans would rather go into debt than ask a friend or family member for money.

- Those who lend money to friends and family may experience remorse. Forty-one percent of Americans have lent money to a loved one in the last year, and more than a quarter (27%) them regret it. Still, 84% would lend money again.

- Most borrowers feel guilty asking a loved one to loan them money. More than a third (35%) have borrowed money from friends or family, and 71% felt guilty asking for the loan.

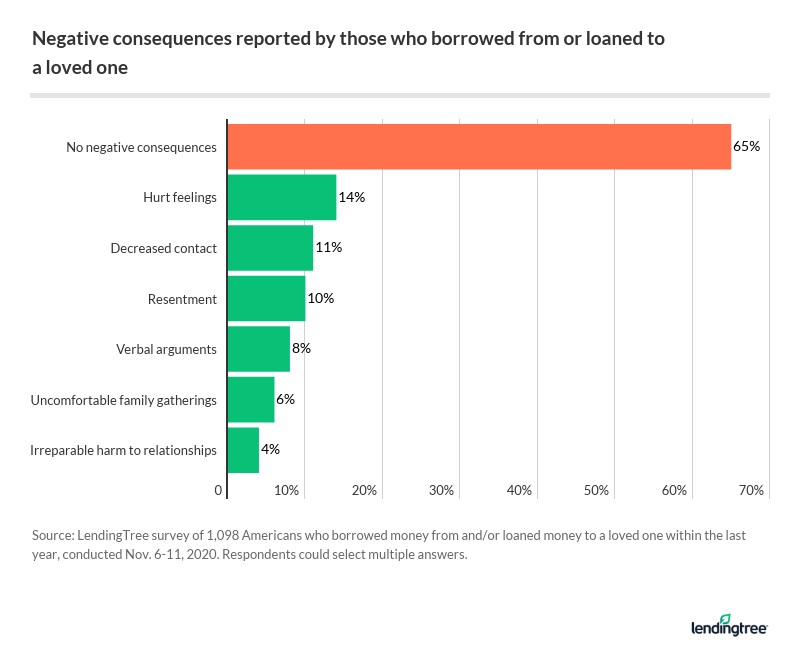

- Among both lenders and borrowers, the exchange can cause tension. More than a third (35%) said that borrowing from or lending to a loved one resulted in some form of negative consequences, including hurt feelings (14%), decreased contact (11%) and resentment (10%).

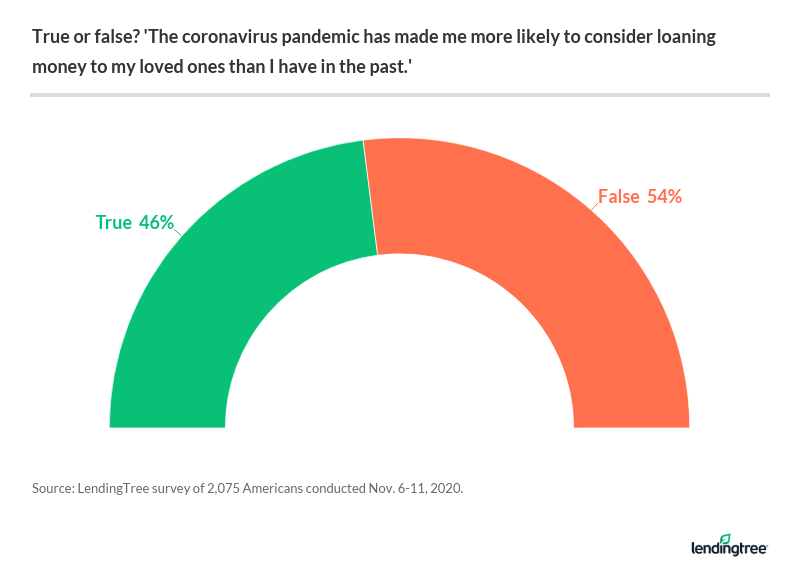

- Americans are more willing to loan money amid the coronavirus pandemic. Nearly half (46%) of Americans said the pandemic has made them more likely to consider loaning money than they have in the past.

53% of Americans loaned to or borrowed from a loved one in the past year

When you’re in a pinch and need a bit of money to tide you over, you might consider charging your credit card or taking out a personal loan. But if you have the ability to borrow the money from a loved one, then you might be able to save money on financing costs along the way.

More than half (53%) of Americans either borrowed money from or loaned money to a friend or family member in the past year, potentially avoiding interest charges and late fees charged by a traditional bank or lender. The vast majority (82%) of lenders didn’t charge interest on the loan.

Many would rather go into debt than borrow from a loved one

Although the practice is common, there’s still a stigma around asking a loved one for money. Perhaps that’s why 31% of Americans would rather go into debt than ask for a loan from a friend or family member.

Of those who did borrow from a loved one, 71% felt guilty asking for the loan. Still, about the same number (69%) would ask to borrow money again. Asking a loved one for money can be daunting, but it’s necessary to reach out when times are tough, said Matt Schulz, LendingTree chief consumer finance analyst.

“No one likes to admit they’re struggling,” Schulz said. “Sometimes you just have to swallow some pride, though, and do what’s best for you, especially in crazy economic times like these.”

41% of Americans have loaned money to a friend or family member

About two in five Americans have loaned money to a loved one within the last year. On average, lenders fronted $1,497, and 62% have been paid back already.

Of those who loaned money, 38% did so for a friend and 31% lent to a sibling. About a quarter (23%) loaned money to a parent. Gen Z (55%) and millennials (47%) were more likely to have loaned money than Gen X (40%), baby boomers (31%) or the silent generation (24%).

About 1 in 4 lenders regret giving the loan

Lending money to a loved one doesn’t typically come with an airtight financial agreement, which means that lenders aren’t guaranteed to get that money back. About one in four (27%) regret lending the money to their loved one.

While it’s a righteous impulse to want to help a loved one who’s struggling, it’s still important to consider the effects it will have on your own finances before doing so, said Schulz.

“It’s important to make sure that you don’t dig yourself into a hole while trying to dig someone else out of theirs,” Schulz said. “Be thoughtful in how much you’re willing to lend, and understand that there are times when you just might not be able to lend anything at all.”

Although some lenders express remorse, ultimately 84% would lend money again. When it comes down to it, people just don’t want to see their friends or family struggle — even if that means losing money themselves.

About 1/3 have borrowed money from friends or family

Thirty-five percent of Americans have borrowed money from friends or family within the last year. On average, borrowers got $1,067 from their loved one. Most (65%) have paid back that sum already.

Of those who borrowed money, more than half (53%) borrowed from their parents. Borrowers also tapped friends (32%) and siblings (28%) to front them some cash.

Unsurprisingly, Americans who are younger and make less money are more likely to report borrowing from a loved one, than their older, more well-established counterparts.

Americans under 40 are much more likely to borrow money from their loved ones compared with those over 40. The likelihood to borrow from friends or family also decreases as income goes up, but even 23% of those with a household income of $100,000 or more asked a loved one for money.

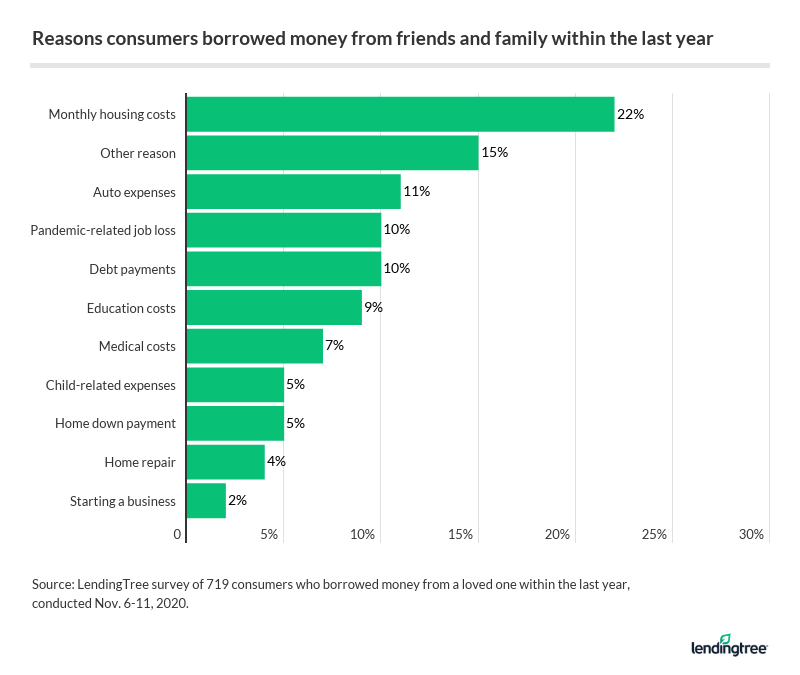

Borrowers are using loans to cover necessary expenses amid pandemic

Cutting a financial deal with a loved one is a commitment built on trust, and it shouldn’t be taken lightly. This could be why most borrowers use the money to cover necessary expenses like housing costs and car expenses rather than discretionary purchases. One in 10 borrowers directly cites pandemic-rated income loss as the reason why they asked for a loan.

More than half (54%) of those laid off or furloughed due to the pandemic borrowed money, compared with 22% of Americans whose income was not affected. This shows that people who lost income due to the coronavirus pandemic were more likely to need to tap a loved one for financial support.

The coronavirus pandemic has also made some Americans more willing to consider lending money to their loved ones:

It’s no question that the pandemic has had a lasting effect on the finances of people around the nation. In fact, four in 10 Americans weren’t financially prepared for the pandemic, an October 2020 LendingTree survey found. When we see our loved ones grapple with the financial impact this year has had, it’s no wonder why people are more likely to lend a helping hand.

Lending to or borrowing from a loved one can cause tension

The consequences of defaulting on a bank loan or credit card payments include interest charges, late fees and a hit to your credit score. But the consequences of not repaying a loan made between loved ones can be more personal.

Thirty-five percent of those who borrowed from or loaned to a friend or family member say the exchange had negative consequences, most notably hurt feelings (14%), decreased contact (11%) and resentment (10%).

Know the terms before you agree to borrow or lend money

Don’t make assumptions when lending to or borrowing from a loved one. It’s critical to be open and honest about expectations upfront, even if it’s an uncomfortable conversation.

“It may make for some awkward conversation at the dinner table, but it is way easier than doing it after something has gone wrong and feelings have gotten hurt,” Schulz said. “Lay out your terms before agreeing to lend the money.”

Keeping both sides happy is the key to a successful deal, so don’t be afraid to negotiate a bit when working out an agreement. The most important thing is that everyone involved knows what’s expected so there aren’t any surprises down the line.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,075 Americans, with the sample base proportioned to represent the overall population. Of the total sample size, 719 had borrowed money from a family member or friend within the last year and 859 had loaned money to a family member or friend during the same time frame. The survey was fielded Nov. 6-11, 2020.

We defined generations as the following ages in 2020:

- Generation Z: 18 to 23

- Millennial: 24 to 39

- Generation X: 40 to 54

- Baby boomer: 55 to 74

- Silent generation: 75 and older

Get personal loan offers from up to 5 lenders in minutes