Knowledge Is Power — and Savings: Americans Who Refinance Cut Auto Payments by an Average of $142 a Month

If you’ve thought about refinancing your car loan but haven’t taken the next step, you’re not alone — and it could be worth it. A LendingTree study shows that Americans who refinance their auto loan save an average of $1,346 over the life of the loan, and those who shorten their loan term save even more — $6,291 on average.

In just a few minutes, you could find out if refinancing helps you keep more of your money where it belongs — in your wallet.

- Men, millennials and parents of young kids are more likely to have an auto loan. Millennials (42%) are almost twice as likely to have an auto loan as Gen Zers (23%) and baby boomers (22%). Parents of young kids (49%) are over twice as likely to have one as people without children (19%). The numbers differ by gender, too — men have more car loans than women (38% versus 28%).

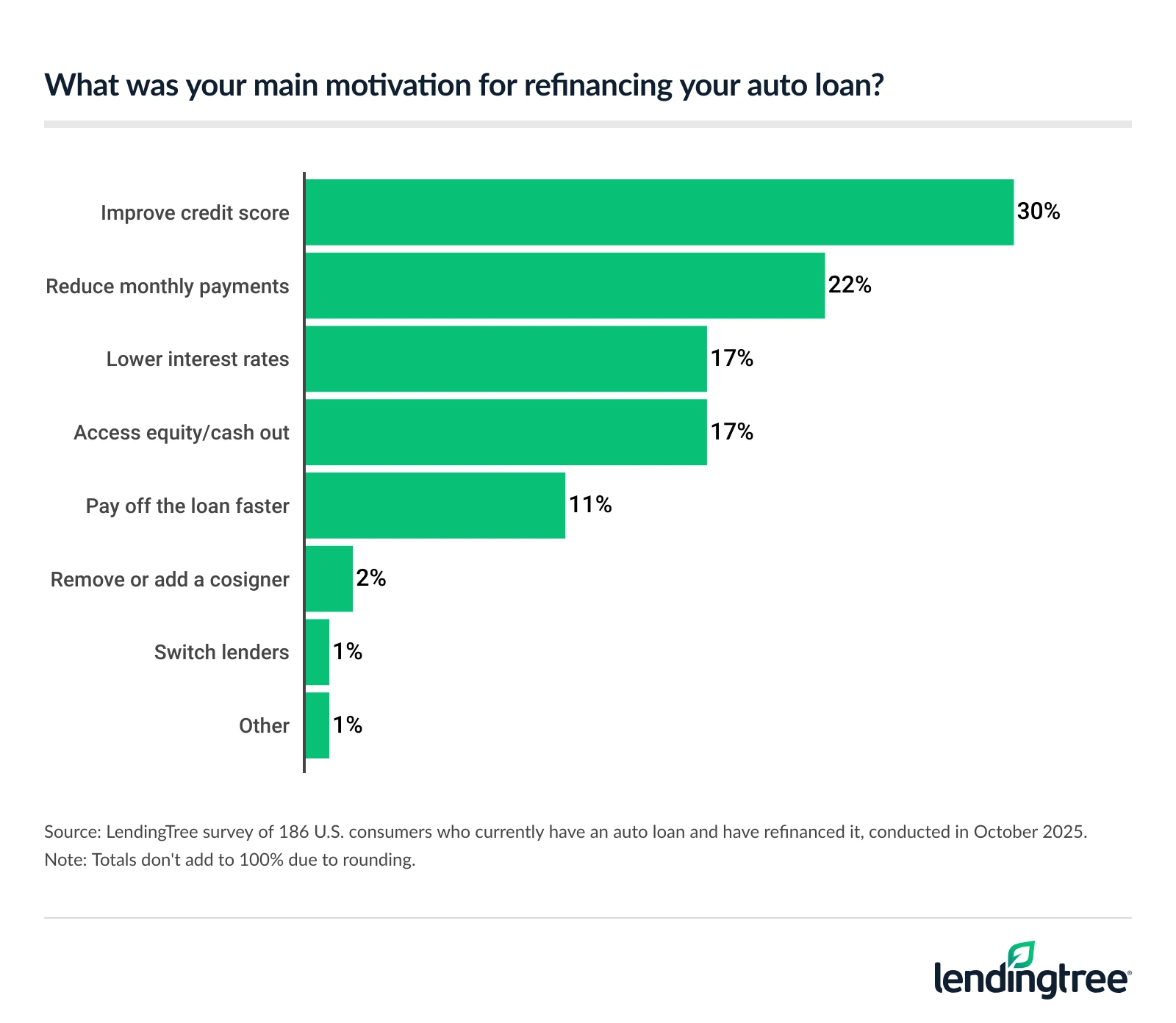

- More than 6 in 10 have refinanced or considered refinancing their auto loan. Men and millennials lead the way — 41% of millennials and 36% of men with an auto loan have refinanced. Regardless of age or gender, 30% say they refinanced to improve their credit, 22% sought lower monthly payments and 17% wanted lower rates or cash-outs.

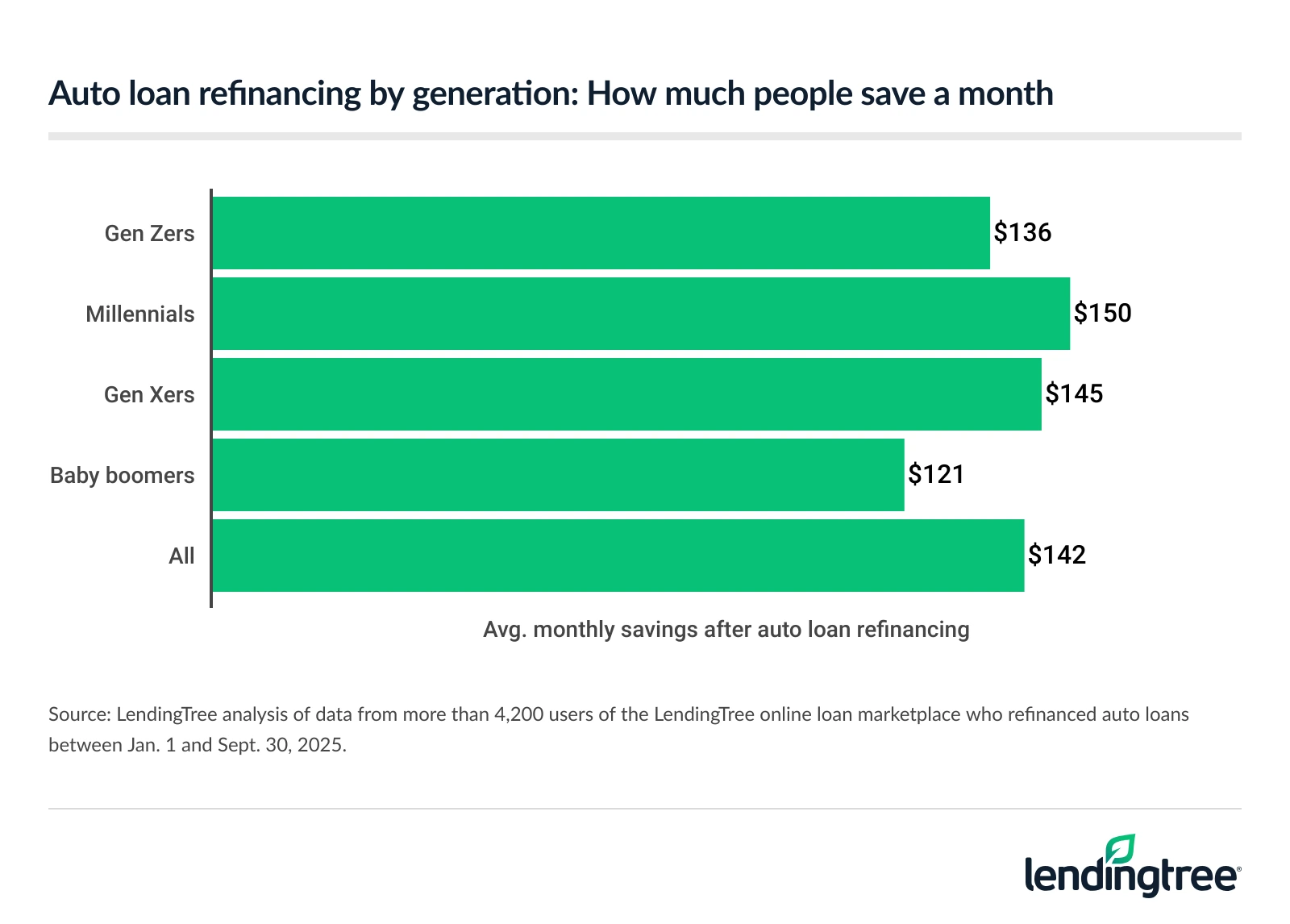

- Borrowers who refinanced in 2025 cut their auto payments by an average of $142 a month, resulting in $1,346 in savings on loan costs. Millennials pocketed the most per month with an average monthly savings of $150, while Gen Xers saved $145, Gen Zers saved $136 and boomers saved $121.

- Savings depend on loan terms, with shorter terms scoring the highest returns. Among refinancers, 85% extended their loan term, reducing monthly payments by $167 but saving only $460 in total loan costs. 13% of borrowers shortened their loan term, exchanging slightly higher monthly payments ($7) for the largest total savings, $6,291. The 2% who kept the same term saved $73 a month and $5,690 in loan costs.

Men, millennials, parents of young kids have more auto loans

Car loans are a common form of financing in America — a third of people have one. But the numbers shake out differently by demographic.

So who’s most likely to finance their car? Almost half of parents with young children (49%), 42% of millennials ages 29 to 44 and about 4 in 10 men (38%) report having a car loan.

Here’s a closer look at the numbers:

What’s your car loan interest rate? If you’re not sure, you’re in good company. Nearly a third of Americans with an auto loan say they don’t know their interest rate. This is most common with baby boomers ages 61 to 79 (53%), those with adult children (47%) and women (45%). Not knowing your rate could mean missing out on savings when you see lower rates advertised online.

Coincidentally, the three demographics most likely to have auto loans are also the ones most likely to know their rate. The number is about the same for each group — 80% of men and millennials and 79% of parents with young children who have an auto loan report knowing their interest rate.

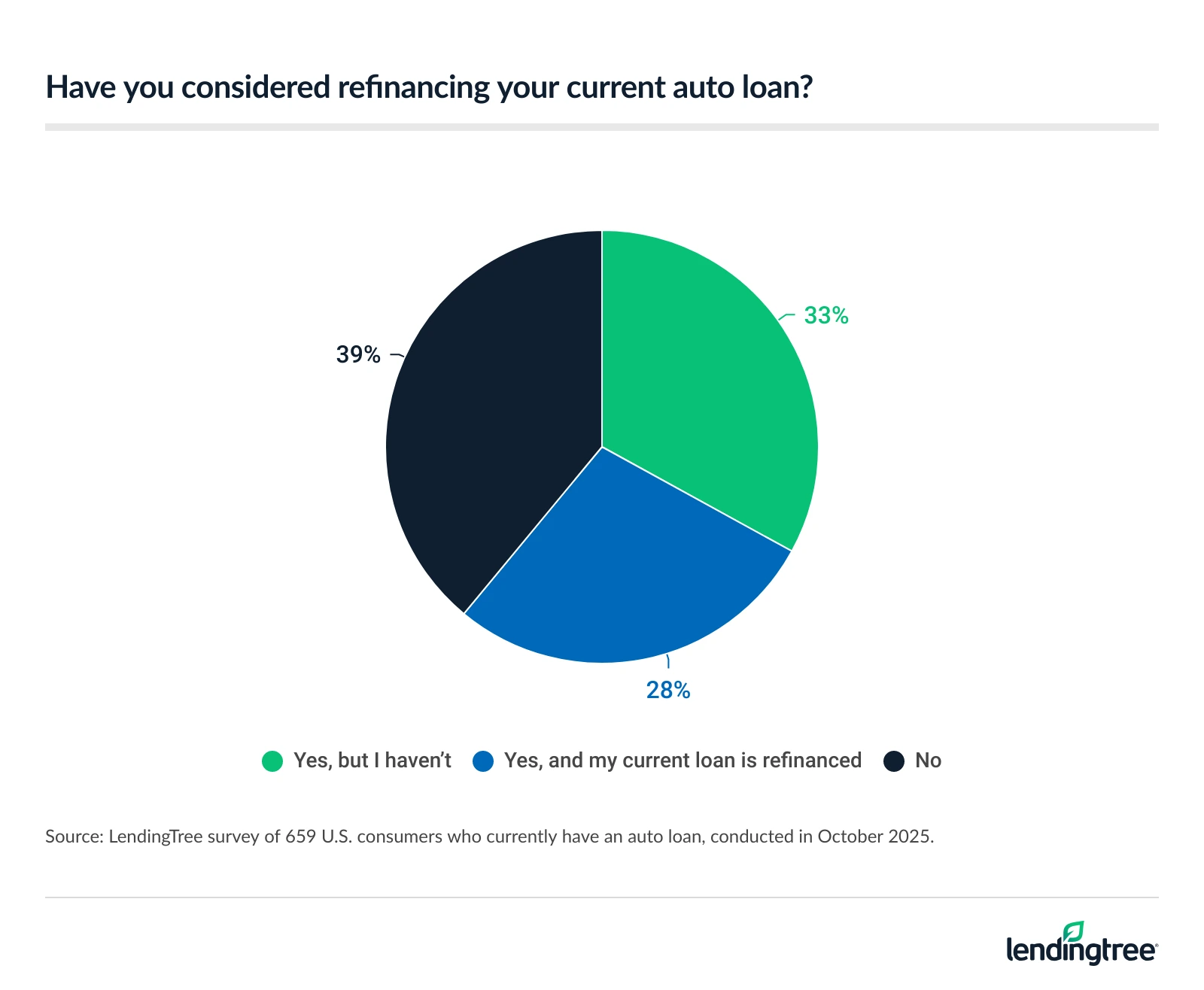

More than 6 in 10 have refinanced or considered refinancing

Many people have considered refinancing their car loan, and 28% have done so. Men are more than twice as likely to refinance as women (36% versus 17%), while millennials are over 10 times as likely as baby boomers (41% versus 4%) to follow through with an auto refi.

Why refi? People who have refinanced cite credit score improvement (30%) and reducing monthly payments (22%) as their primary motivations.

Refinancing your auto loan doesn’t automatically improve your credit — in fact, you could see your credit score go down by a few points with a hard inquiry. But refinancing can help you get affordable payments, and making payments on time and in full will improve your credit score.

Still, nearly a third of people with auto loans have considered refinancing but haven’t done so, and 39% haven’t considered it at all. The common barriers for those who haven’t refinanced are satisfaction with current auto loans (40%), the time and effort it takes to refinance (26%) and small potential savings (23%).

If you’re happy with your current loan, there’s no need to refinance. But 95% of people who refinance their car are satisfied with the outcome. You can save time — and big money — when you refinance with our expert refinancing tips.

Refinancers save an average of $142 a month, $1,346 overall

People who refinance their auto loans net huge savings of an average of $142 per month. Here’s how it breaks down across generations:

Millennials lead the way with refinance savings per month — their monthly payments drop by $29 more than those of baby boomers. So why are these numbers so different? The answer may lie in who they trust to refinance.

More millennials (59%) than baby boomers (47%) trust credit unions for refinancing. Experian’s latest State of the Automotive Finance Market Report shows people save the most money by refinancing with credit unions, so it’s possible that some baby boomers are missing out on the best deals by going to dealerships and banks.

Across the board, auto loan holders trust credit unions (57%) over banks (33%) and local dealerships (11%).

The average refinanced loan was $32,947, and borrowers had an average credit score of 693, which falls in the good credit band.

Shorter loan terms see highest savings

An overwhelming majority (85%) of people who refinance extend their loan term and see modest average savings of $460 over the course of their loan in exchange for significantly cheaper monthly savings of $167.

Just 2% of refinancers keep their loan term, but they still save with lower rates. They pocket an average of $73 per month and a total savings of $5,690. You can typically get lower rates when market rates are down or your credit score has improved since you first took out your car loan.

But it’s the 13% of auto refinancers who shorten their loan term who walk away with the biggest payday — they see a slight $7 increase in monthly payments but save $6,291 on the total cost of their car loan.

This trend carries over to car financing, where shoppers with the highest credit scores tend to choose shorter loan terms to save money on their loans. According to Experian, super prime borrowers currently have the shortest loan terms of any credit band on average at just under 65 months, while borrowers in other credit bands choose loan terms of more than 72 months.

How to save with an auto refi

- Build your credit. If you can afford to take some time before you refinance, work to improve your credit. Higher credit scores mean lower rates and more savings. Learn how to boost your credit score fast.

- Shorten your loan term. Shorter loan terms can mean huge savings. Use the LendingTree auto refinance calculator to see how much you can save with a shorter term, and make sure your new payments fit into your budget.

- Shop around. You don’t have to take the first offer that comes your way. Each lender could offer you slightly different auto refinance rates, so get quotes from multiple lenders before committing to one. By rate shopping on LendingTree, car buyers could save $2,346 on average, a LendingTree study showed.

Methodology

LendingTree researchers analyzed data from more than 4,200 users of the LendingTree online loan marketplace who refinanced auto loans between Jan. 1 and Sept. 30, 2025.

For each borrower, we calculated:

- The difference between the original and refinanced auto loan monthly payments (to estimate monthly savings).

- Estimated savings on loan costs by calculating payments made so far (actual payments minus principal reduction), subtracting that from total interest on the original loan, and comparing the remaining cost to the total cost of the refinanced loan.

We then averaged these values across all borrowers, by generation and by term change (shorter, same and longer). To avoid distortion by extreme cases, calculations were performed at the individual level before aggregation. Lifetime and monthly savings estimates don’t include refinance fees or other closing costs, so actual savings may be lower.

Additionally, LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Oct. 2 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennials: 29 to 44

- Generation X: 45 to 60

- Baby boomers: 61 to 79

Get auto loan offers from up to 5 lenders in minutes