Hospitality Hustle: Food and Lodging Entrepreneurs Seek $185,000 on Average to Start or Buy Businesses

Starting or buying a restaurant or hotel can be both exciting and daunting. The hospitality industry is known for high failure rates, with many businesses closing within just a few years of launching. Beyond the day-to-day challenges of staffing and operations, the startup costs alone can be overwhelming. From securing a location to purchasing equipment, entrepreneurs often need significant capital before welcoming their first guest.

A LendingTree analysis highlights this reality. On average, food and lodging entrepreneurs request $185,679 to start or buy a business — $61,865 more than the typical loan request for other financing needs. The research reveals not only the steep costs of launching in this high-stakes industry but also where aspiring hospitality owners are looking to break in.

- Food and lodging entrepreneurs requested an average of $185,679 when seeking funds to start or buy businesses. That’s $61,865 more than the average request for other purposes, such as expansion or equipment purchases.

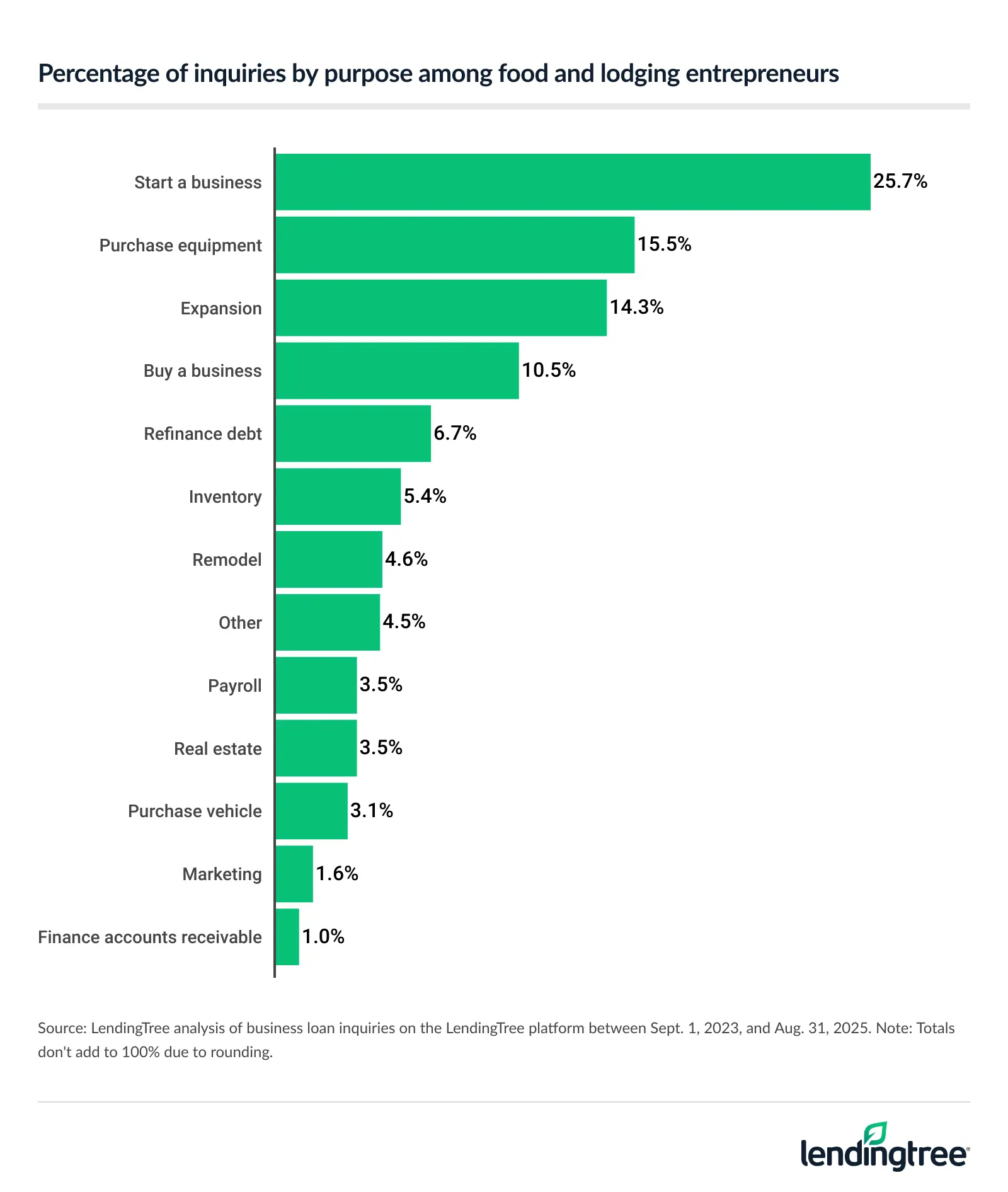

- Starting and buying businesses are big drivers of loan demand in this industry. Starting a business accounts for 25.7% of food and lodging industry loan inquiries, while another 10.5% are for buying a business, totaling 36.2%.

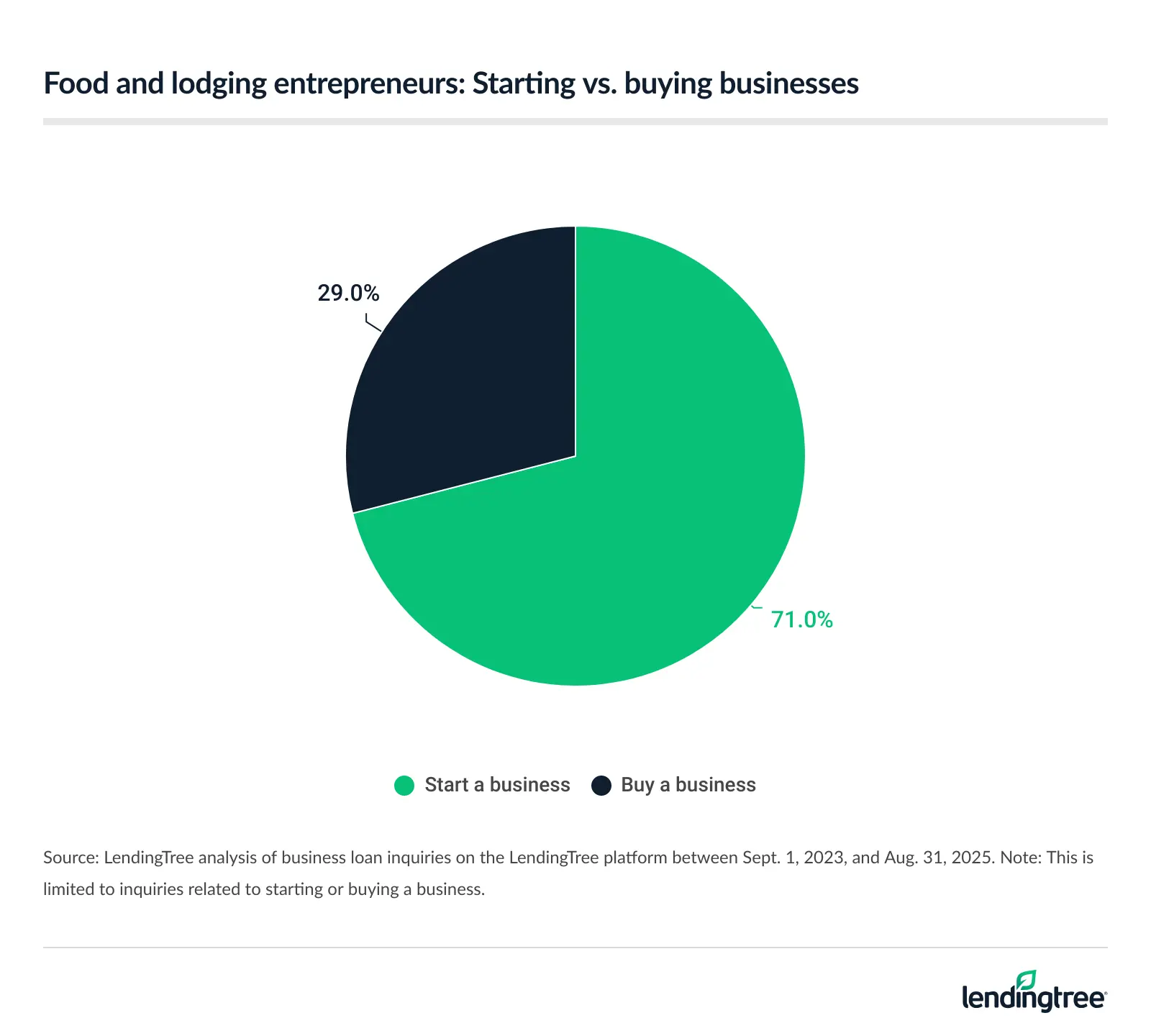

- When food and lodging entrepreneurs seek financing, they’re far more likely to want a fresh start. Among those choosing between starting and buying, 71.0% hope to start a business and 29.0% hope to buy an existing one. But those looking to buy request double that of those looking to start — $287,656 versus $144,075.

- Boston pops for hospitality entrepreneurs. Boston entrepreneurs in this industry seek an average of $236,594, ahead of Pittsburgh ($233,612) and Seattle ($229,029). Meanwhile, aspiring businesspeople in Memphis, Tenn., seek less than half of that, with the average request at $111,648.

Food, lodging entrepreneurs request $185,679 on average to start or buy businesses

Launching a business in the food and accommodations industry is a six-figure endeavor for many aspiring owners. Entrepreneurs borrowing funds to start or buy a food or lodging business seek loans of $185,679 on average — $61,865 more than the average request for all other funding purposes ($123,814), including business expansion, equipment purchase or debt refinancing.

While average amounts run higher, the median loan request for buying or starting a food or lodging business is $85,000, and the median loan amount for all other financing needs is $50,000.

Businesses within the food and lodging industry

- Accommodation and food services

- Cafes and bakeries

- Catering

- Drinking establishments

- Hotels and motels

- Limited-service restaurants

- Restaurants

Entrepreneurs — regardless of industry — face hurdles before they even launch their businesses. From writing a business plan and securing financing to navigating permits and marketing, the path to ownership is rarely straightforward.

In the food and lodging industry specifically, the obstacles stack even higher. Costly startup expenses, such as securing high-traffic locations, outfitting commercial kitchens or completing room renovations and meeting strict health and safety regulations, require significant upfront capital.

And even after opening their doors, owners must contend with intense competition, fluctuating demand, rising operational costs, labor shortages and ongoing compliance requirements.

“Food and lodging businesses require a lot of overhead,” says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“Depending on the specifics of your business, you may need real estate, costly equipment, significant staffing and more just to get off the ground. That doesn’t even factor in costs of regulatory compliance, marketing and other related expenses. It’s definitely a situation where it takes money to make money, as the saying goes.”

Starting or buying businesses big drivers of loan demand

Entrepreneurs seek financing for various reasons. However, borrowing funds to either launch or purchase a business makes up more than a third of loan requests among owners in the food and lodging industry.

About one-fourth of loan inquiries (25.7%) are from entrepreneurs seeking to start a business, while another 10.5% come from those looking to purchase one — a combined 36.2%. The sizable portion makes sense. While small business startup costs can range from $0 to $400,000 or more, depending on the industry, launching a business in food and accommodation services requires at least some capital, even when done on a small scale.

For context, funding requests for starting or buying a business account for 23.6% of loan inquiries across all other industries.

Food, lodging entrepreneurs more likely to start than buy

Of the food and lodging entrepreneurs seeking loans to start a business or purchase an established one, a majority — 71.0% — choose to start a business from the ground up rather than buying an existing one — 29.0%.

There’s also a significant difference in the amount of money those who purchase an existing business request compared to those who start fresh — $287,656 on average versus $144,075, almost twice as much.

Notably, the median loan amount for food and lodging entrepreneurs purchasing a business is $200,000, compared to $55,000 for those starting fresh.

“While there can certainly be some advantages to buying an existing business, I’m not surprised that most entrepreneurs prefer a fresh start,” Schulz says. “Starting a business is a massive undertaking, requiring blood, sweat, tears and a staggering time commitment, so it makes sense that you’d want to control as many aspects of your new project as possible.

“Building something new gives you a completely blank slate. You’re not beholden to choices made by previous owners, and that can make a huge difference.”

That said, there can be benefits to buying a business that’s already in existence — though there are drawbacks to it as well.

More than 21% of U.S. businesses fail in their first year, according to data from the U.S. Bureau of Labor Statistics (BLS). In the accommodation and food service industry, 42.6% of businesses shutter within five years of launching. With such high stakes, some entrepreneurs may view purchasing an established business as a less risky option.

“Buying a business could potentially allow you to skip some steps in the creation of your company,” Schulz says. “For example, you may already have significant brand recognition, so there could be less marketing cost required. You may also have property, equipment, staff and other fundamental parts of the company in place, taking a huge burden off of you.

“However, in purchasing a company, you’re also likely purchasing the problems that it had. Aging infrastructure, poor word of mouth, unhappy or incompetent staff and changing customer tastes are just a small sample of what you could be facing. Most entrepreneurs would prefer the ability to start from scratch and make their own mistakes rather than to pay the price for goof-ups made by others.”

Hospitality entrepreneurs seek most in Boston, least in Memphis

Loan amounts requested by food and lodging entrepreneurs vary significantly by region. Hospitality entrepreneurs in Boston seek the highest loan amounts when buying or starting a business, at $236,594, on average. Pittsburgh and Seattle business owners seek the next highest amounts — $233,612 and $229,029, respectively.

The higher average loan requests in these three metros reflect both regional and industry-specific factors. Boston, Pittsburgh and Seattle have elevated real estate prices and robust economic environments, making the cost of acquiring or leasing commercial space especially high. Purchasing existing businesses with established customer bases and brand recognition often requires a substantial investment, contributing to larger loan requests.

On the other end of the spectrum, business owners in Memphis, Tenn., request the lowest loan amounts when starting or buying a food and lodging business — $111,648 on average. Entrepreneurs in Birmingham, Ala., and Richmond, Va., seek the next lowest amounts, at $134,955 and $143,317, respectively.

Interestingly, inquiries for starting or buying a business account for 37.8% of food and lodging business loan requests in Memphis, compared to 35.0% in Boston.

Full rankings: Metros where food and lodging entrepreneurs seek highest/lowest loan amounts for starting or buying businesses

| Rank | Metro | Avg. loan request | % of inquiries |

|---|---|---|---|

| 1 | Boston, MA | $236,594 | 35.0% |

| 2 | Pittsburgh, PA | $233,612 | 34.7% |

| 3 | Seattle, WA | $229,029 | 39.5% |

| 4 | Salt Lake City, UT | $227,813 | 32.9% |

| 5 | Minneapolis, MN | $223,552 | 37.4% |

| 6 | San Diego, CA | $218,853 | 36.0% |

| 7 | San Jose, CA | $215,682 | 32.4% |

| 8 | Buffalo, NY | $210,833 | 30.8% |

| 9 | San Francisco, CA | $208,368 | 34.1% |

| 10 | New York, NY | $207,779 | 32.7% |

| 11 | Detroit, MI | $205,790 | 31.1% |

| 12 | Washington, DC | $201,135 | 32.7% |

| 13 | Kansas City, MO | $200,833 | 37.9% |

| 14 | Louisville, KY | $200,206 | 35.8% |

| 15 | Jacksonville, FL | $199,003 | 38.5% |

| 16 | Los Angeles, CA | $197,799 | 30.7% |

| 17 | Indianapolis, IN | $196,231 | 42.8% |

| 18 | Phoenix, AZ | $195,902 | 40.5% |

| 19 | Nashville, TN | $194,357 | 37.7% |

| 20 | Riverside, CA | $193,031 | 32.9% |

| 21 | Philadelphia, PA | $192,740 | 33.2% |

| 22 | Sacramento, CA | $189,930 | 40.9% |

| 23 | Cleveland, OH | $189,000 | 36.1% |

| 24 | Tampa, FL | $187,482 | 39.5% |

| 25 | Columbus, OH | $186,990 | 41.6% |

| 26 | Dallas, TX | $184,758 | 38.7% |

| 27 | Charlotte, NC | $183,659 | 36.7% |

| 28 | Virginia Beach, VA | $183,032 | 37.9% |

| 29 | Denver, CO | $181,842 | 36.2% |

| 30 | Grand Rapids, MI | $178,239 | 39.0% |

| 31 | Cincinnati, OH | $176,846 | 38.9% |

| 32 | Baltimore, MD | $176,078 | 33.1% |

| 33 | Houston, TX | $175,184 | 34.5% |

| 34 | Austin, TX | $172,910 | 34.1% |

| 35 | Chicago, IL | $171,454 | 35.3% |

| 36 | Fresno, CA | $170,677 | 33.9% |

| 37 | Providence, RI | $168,090 | 38.6% |

| 38 | Milwaukee, WI | $167,051 | 33.6% |

| 39 | Orlando, FL | $166,309 | 37.8% |

| 40 | Atlanta, GA | $163,694 | 33.0% |

| 41 | Miami, FL | $163,529 | 31.6% |

| 42 | St. Louis, MO | $158,723 | 32.5% |

| 43 | Las Vegas, NV | $158,542 | 38.3% |

| 44 | Raleigh, NC | $155,354 | 35.6% |

| 45 | Portland, OR | $154,684 | 39.0% |

| 46 | San Antonio, TX | $145,632 | 35.3% |

| 47 | Oklahoma City, OK | $143,882 | 41.1% |

| 48 | Richmond, VA | $143,317 | 35.6% |

| 49 | Birmingham, AL | $134,955 | 35.9% |

| 50 | Memphis, TN | $111,648 | 37.8% |

Starting or buying a food or lodging business: Top expert tips

While launching or buying a business in food or accommodation services comes with challenges, these tips can help you plan wisely, manage costs and hit the ground running.

- Know your market. The importance of conducting thorough market research can’t be overstated. You’ll want to have a deep understanding of your customer base, competitors and any seasonal trends before committing. If purchasing an existing business, be sure to inspect financials, equipment, staff and brand reputation carefully.

- Start small or scale smart. Even with a solid business idea and plan, it’s wise to launch lean, then grow as revenue and customer loyalty build. Consider testing your business through a pop-up, short-term rental or pilot menu to validate demand.

- Borrow strategically. “Only take the amount that you’re really sure you need and that you’re confident you can pay back,” Schulz says. “When you’re thinking about repaying that small business loan, be conservative in your estimates. While you may be convinced that you’re going to make a certain amount of revenue in the coming year or two, you really don’t know, especially if you’re new to the industry you’re working in.”

- Leverage small business programs. “Running a small business is so tough; don’t feel like you have to do it all by yourself,” Schulz says. The Small Business Administration, U.S. Department of Commerce and numerous state and local organizations provide support to entrepreneurs. “Googling ‘small business resources near me’ can reveal a wealth of options for everything from funding and networking to marketing and training,” Schulz says.

- Plan for the unexpected. Even the best-laid plans can be disrupted by staffing shortages, seasonal fluctuations or rising costs. Budget for emergencies, build a cash buffer and be ready to adjust operations quickly to keep your business resilient.

Additionally, Schulz advises new business owners to prioritize health. “Entrepreneurship is tough. You’re much more likely to succeed if you have a support system and take time to breathe now and then.

“Whether you’re seeking professional or personal advice from friends, family and colleagues or just rescheduling a meeting every once in a while to go for an extended walk or meditate, it all matters.”

Lastly, be patient, Schulz cautions. “Go in with your eyes open and have a plan. Entrepreneurship is grueling, often thankless work, and success almost never comes overnight.”

Methodology

LendingTree researchers analyzed business loan inquiries on the LendingTree platform, with a specific focus on businesses in the food and lodging industry between Sept. 1, 2023, and Aug. 31, 2025. This includes the following business types:

- Accommodation and food services

- Cafes and bakeries

- Catering

- Drinking establishments

- Hotels and motels

- Limited-service restaurants

- Restaurants

Researchers specifically examined loan purposes related to starting or buying a business, comparing them to other purposes. Percentages represent the share of inquiries within the industry during the study period.

Analysts calculated average loan amounts and the share of start and buy inquiries in the food and lodging sector across the 50 largest metros. Researchers used the U.S. Census Bureau 2023 American Community Survey (ACS) with five-year estimates to identify the 50 largest metros.

Compare business loan offers