What Is APR on a Credit Card? Types of Credit Card APRs Explained

- The annual percentage rate (APR) on a credit card is the total amount you’ll pay to borrow money from a credit card company, including interest. This percentage is set when you’re approved for a credit card.

- Unlike other types of loans including mortgages and personal loans, APR for credit cards means the same thing as interest rate. Your APR doesn’t include annual fees, balance transfer fees, late fees or foreign transaction fees.

- Most credit cards have multiple APRs depending on the transaction type. This includes a purchase, balance transfer, intro, cash advance and penalty APR.

- Most credit cards have variable APRs, which can go up and down over time based on the Prime Rate determined by the Federal Reserve.

How does APR work on a credit card?

A credit card APR, or interest rate, is set by your credit card company when you’re approved for a credit card. Whenever you carry a balance on your card into the next month, you’re charged interest based on your credit card’s APR. You’ll also build interest on new purchases until you pay off your balance. The total will be added to your account at the end of your billing cycle.

Credit card interest is charged at a daily rate, which you can calculate by taking your APR and dividing it by the credit card billing year. This will be either 365 or 360 days, depending on what number your credit card company uses. You can find the specific terms of your APR in your cardholder agreement. For example, if your APR is 29.99%, 29.99% divided by 365 days is 0.082% per day in interest.

Your credit card company usually offers a grace period between your statement closing date and your due date. You won’t owe interest if you pay your balance in full by the due date.

What are the different types of APR?

You may be the most familiar with your purchase APR because it’s the most common type of credit card APR. However, credit cards can have several types of APRs. Depending on your credit card company, the rates for different types of APRs can vary. For instance, cash advance APRs tend to be higher than purchase APRs. You’ll want to check your credit card agreement to see the terms of each.

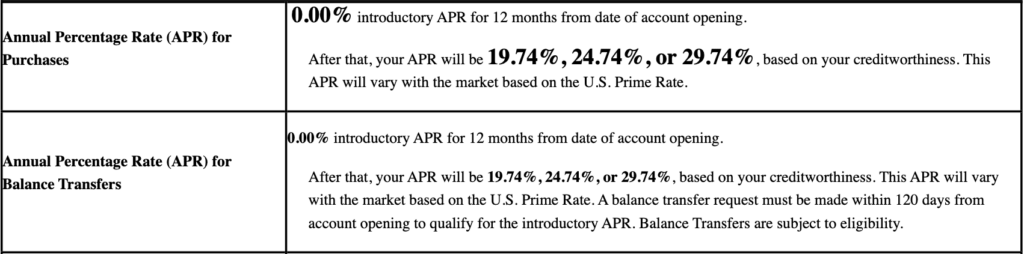

Purchase APR

Purchase APR is the interest rate you’ll be charged for new purchases made with your card that are not repaid in full before the end of the card’s grace period — the amount of time between the end of a billing cycle and when your bill is due.

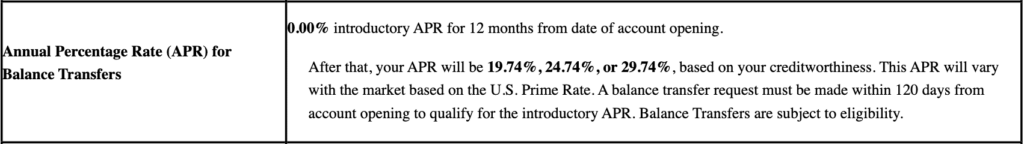

Balance transfer APR

If you use a credit card to transfer a balance from one credit card to another, you’ll pay a balance transfer APR on that portion of your credit card balance. This percentage is typically the same as your purchase APR.

Learn more about balance transfer credit cards.

Introductory APR

Some credit cards offer an introductory APR on purchases, balance transfers or both. This means that you’ll pay a lower interest rate (typically 0%) for the time period designated in the credit card terms (typically between six and 21 months). This is a great way to pay off a large purchase without paying interest.

For example, you may get a card offering a 0% intro APR for 12 months on purchases and balance transfers. If you take advantage of these offers, you won’t be charged interest during the 12-month period. Any balance left on the card after the intro period expires will begin to incur interest at the standard purchase and balance transfer APR.

Note that if you don’t pay off your balance in full before the intro period ends, some cards (typically store cards) will charge you all the interest accrued since the purchase or balance transfer date. This is called deferred interest and is not the same as a 0% APR offer.

See the top 0% APR credit cards.

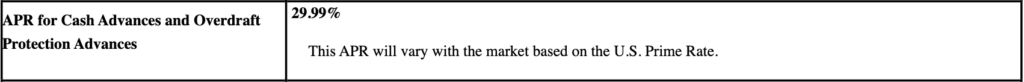

Cash advance APR

A cash advance is a way to borrow cash against your credit line, rather than charging purchases directly to your card. This type of transaction has its own APR that’s usually much higher than the purchase APR.

There’s also usually a substantial fee for a cash advance and no grace period, which means you’ll immediately accrue interest. We don’t recommend taking out a cash advance, unless it’s an emergency and you can repay the advance quickly.

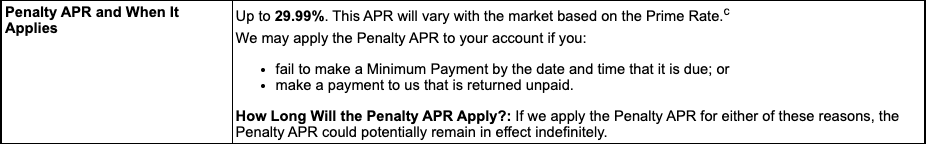

Penalty APR

Some credit cards come with a penalty APR that applies when you’re late on payments by 60 days or more. This amount is usually significantly higher than the purchase APR and remains in place for a minimum of six months. In addition to an increased APR, you risk termination of any intro 0% APR offers and damage to your credit score.

Not all credit cards charge a penalty APR. If a card charges a penalty APR, it must be listed in the rates and fees table on a card’s application page. You can avoid penalty APRs completely by checking rates and fees before you apply, and avoiding cards that charge them.

Learn more about what happens when you miss a credit card payment.

How to calculate APR on a credit card

Let’s say your credit card APR for purchases is 29.99% and you want to find out how much interest you’ll owe daily on purchases. You’ll divide your total APR by 365 days to find this value.

29.99% APR / 365 days = 0.082% daily rate

For simplicity’s sake, let’s say you also only make two $50 charges on your card. The first $50 charge occurs on the first day of your billing cycle. You would multiply this charge by the daily rate, like so:

Day 1: $50 daily balance x 1 day x 0.082% daily rate = $0.04 daily interest charge

If you make the second $50 charge on the second day of the month, your balance would increase to $100. To calculate the remainder of interest for the month, you would multiply this new amount by the remaining days in the month (30) and the daily interest rate:

Days 2-31: $100 daily balance x 30 days x 0.082% daily rate = $2.46 daily interest charge

Then, you would add up your daily interest charges to calculate the total interest for the month:

$0.04 + $2.46 = $2.50 monthly interest charge

Of course, this is a simplistic scenario. The calculation will be more complicated if you use your card on a regular basis. Since your daily balance would change frequently throughout the month, you would need to calculate your daily interest rate by each day, then add all the interest charges together.

Note also, these numbers may vary based on other factors like cash advance or balance transfer APRs or the terms of your monthly credit card statement and cardholder agreement. You should carefully read your credit card agreement to understand the terms.

What is a variable APR on a credit card?

You’ll see the term “variable” at the end of the APR for most credit cards. A variable APR means that your rate will increase or decrease based on the movement of an index rate like the U.S. Prime Rate. Variable rates don’t offer the same advance notice for a rate change as fixed rates.

A fixed APR is a rate that won’t change after the 0% intro period unless you make late payments or violate the credit card terms. This is a more stable type of APR because your rate is locked in for a specific period of time. Credit card companies can change a fixed rate, but they’re required to give you advance notice.

Although a fixed APR credit card may seem like a better choice, they’re hard to find and are usually only offered if you belong to a credit card union. Credit cards with variable APRs are typically offered to a wider audience and often come with much more valuable benefits like rewards programs and 0% intro APRs that can save you money long term.

How to find your credit card’s APR

- You can find your APR by logging into your online account for your credit card. It’s listed either with your account or on your most recent statement.

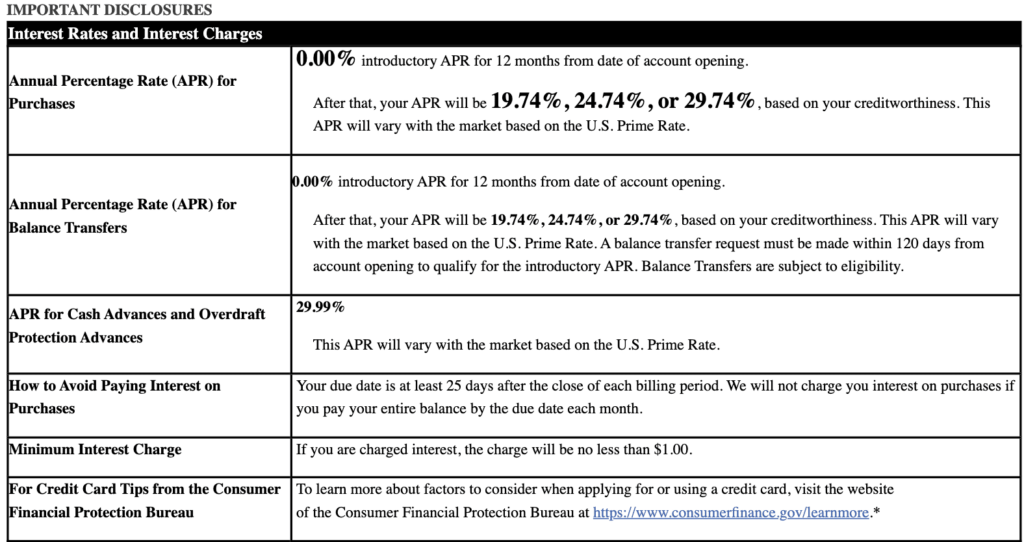

- You can find your APR in the disclosures of the terms and conditions when you open your card. The APRs for cash advances and penalty APRs will appear there as well.

- You can find the APR range for a card on the application page. There is usually a link labeled “Terms and Conditions,” “Rates and Disclosures” or “Pricing and Information.”

- Your monthly credit card statement will also show APR for different types of balances.

- You can find your APR by calling your credit card company.

Here’s an example of where you can find your credit card APR:

Most credit cards have an APR range. You won’t know what your exact APR will be until you’re approved for the card. If your credit score isn’t the greatest, you’ll most likely be offered an APR closer to the higher end of range.

What is a good APR on a credit card?

A 0% APR is obviously the best option for a credit card, but 0% APRs typically end after six to 21 months. After that, you’ll be subject to the ongoing APR for your card. You can consider any credit card APR below the national average to be a good credit card APR.

What is the average APR on a credit card? According to a LendingTree study, here is the current average credit card APR based on credit card type:

| Category | Minimum APR | Maximum APR | Average | Previous month |

|---|---|---|---|---|

| Average APR for all new card offers | 21.48% | 28.36% | 24.92% | 24.92% |

| 0% balance transfer cards | 19.02% | 28.13% | 23.58% | 23.53% |

| No-annual-fee cards | 20.94% | 27.93% | 24.43% | 24.43% |

| Rewards cards | 21.21% | 28.50% | 24.85% | 24.85% |

| Cash back cards | 21.65% | 28.38% | 25.01% | 24.94% |

| Travel rewards cards | 21.08% | 29.05% | 25.07% | 25.13% |

| Airline credit cards | 21.30% | 29.49% | 25.39% | 25.39% |

| Hotel credit cards | 21.19% | 29.39% | 25.29% | 25.58% |

| Low-interest credit cards | 13.45% | 22.66% | 18.06% | 17.77% |

| Grocery rewards cards | 20.97% | 28.58% | 24.78% | 24.78% |

| Gas rewards cards | 21.53% | 28.39% | 24.96% | 24.96% |

| Dining rewards cards | 20.90% | 28.65% | 24.78% | 24.77% |

| Student credit cards | 19.14% | 28.74% | 23.94% | 23.94% |

| Secured credit cards | 27.41% | 27.41% | 27.41% | 27.41% |

If you’re worried about the current credit card APRs, you can also look for a low interest credit card. These cards may not offer the same level of rewards or benefits, but you’ll be able to get an APR below 20%.

Your credit score is a major factor in determining what your APR will be. You’ll notice that the APR is often listed as a range in a credit card’s terms and conditions. For example, the offer terms may state “21.49% to 28.49%, based on your creditworthiness and other factors.” When making a credit card decision, it’s important to consider the full range of APRs rather than just the low end in case you’re unable to qualify for the lowest rate.

Learn more about what is a good credit card APR.

How can you avoid paying interest on credit card purchases?

Paying your statement balance in full each month is the only way to avoid credit card interest entirely. Opening a 0% intro APR credit card is another way to avoid credit card interest, but only temporarily. If you’re planning to use a 0% intro APR to finance a large purchase or transfer and pay down a balance, you should choose a card with a longer intro period.

Setting up auto pay on your credit card is an easy way to make sure you pay your balance on time each month and avoid credit card interest.

Learn more about how to avoid interest on a credit card.

How to get a lower APR

If you’re unhappy with your credit card’s current interest rate, you have options. If your goal is lowering your credit card’s interest rate, consider one of the following:

-

Call your credit card issuer and ask:

If you like the credit card you have and don’t want to change it, call the number on the back of your card to inquire about getting a lower rate. According to a LendingTree study, 76% of those who asked for a lower interest rate on one of their credit cards in the past year were successful, with the average reduction being 6.5 points. -

Improve your credit score:

In some cases, your credit score may be the reason your credit card APR is higher than you wish it was. If you improve your credit score, you’ll have a better shot at a lower APR whether you ask your card issuer for a lower rate or apply for a new card.

Learn about how to build credit with a credit card.

-

Consider a balance transfer:

You can consider transferring your existing debts to a balance transfer credit card with a 0% intro APR and a lower ongoing APR. This will give you time to pay off existing debt while avoiding high interest if you carry a balance in the future. Just keep in mind that you’ll have to pay a balance transfer fee (usually 3% to 5% of the amount you transfer).

See the top balance transfer credit cards.

-

Apply for a different credit card:

You can also look for a new credit card that has a lower variable APR in general. While low-interest credit cards are relatively rare, they do exist.

Frequently asked questions

Credit card issuers consider a consumer’s credit score when determining their APR, and customers with the best credit tend to get interest rates at the lower end of the scale listed with any type of card. Credit card APRs are usually variable, which means issuers may increase or decrease the APR as the federal prime rate increases or decreases.

You can check your credit card’s APR by looking online, logging into your online account management page, or reading over the terms and conditions that were sent to you when you received your credit card in the mail.

Your credit card’s APR will not impact you if you pay your credit card balance in full and never pay interest. However, other costs associated with credit cards, such as annual fees, should still be taken into account.

Recommended Articles