On this page

- Pros and cons of deferred interest

- How does deferred interest work?

- How is deferred interest calculated?

- Deferred interest vs. 0% interest credit card offers

- Compare 0% APR credit cards

- How to spot a deferred interest credit card offer

- How to manage a card with deferred interest

- How to fight deferred interest charges

- Alternatives to deferred interest credit cards

- Frequently asked questions

What is Deferred Interest?

Key takeaways

- Deferred interest is when your interest payments on a credit card are put off for a period of time while you make monthly payments on your purchase.

- You can avoid paying the interest charges if your purchase is paid in full by the end of the promotional financing offer.

- Deferred interest offers can be worth it because you can save hundreds or thousands of dollars in interest charges.

- Deferred interest offers can also be very risky because you must pay your balance in full to avoid paying interest. Even having a balance of $0.01 at the end of the promotion means you’ll need to pay all of the deferred interest.

- A 0% APR credit card offer or balance transfer credit card may be less risky because interest only accrues after the promotional period ends. You may also get a longer interest-free period.

Pros and cons of deferred interest

- Allows you to make a purchase without needing to pay in full

- Offers flexible payment schedules

- May be easier to get than a credit card with a 0% intro APR

- High interest rates

- Potentially high risk if you’re unable to pay the balance before the promotion ends

- A single missed payment could void the offer

How does deferred interest work?

Deferred interest allows cardholders to carry a balance from month to month without paying interest for a specified time. If you don’t pay your credit card balance in full by the end of the promotional period, you are responsible for all the interest that was waived during the promotional period. Plus, going forward, you’ll pay interest on any balance remaining.

Deferred interest is different from a 0% APR credit card offer. With a 0% APR credit card, you only pay interest on the amount that remains at the end of the introductory period. If you charge $1,000 and only pay off $900, you’ll only pay interest on the remaining $100.

However, with a deferred interest credit card, you’ll pay interest on the full $1,000 even if you paid $900.

Example:

Let’s say you purchase a sofa for $1,200 using a credit card that offers deferred interest for six months and an ongoing 22% APR (variable).

If you make payments of $200 each month for six months, you will not owe any interest, since the balance will have been paid in full within the promotional period.

However, if you only pay $100 a month, you will be responsible for paying six months of interest — at an APR of 22% (variable) — on the original $1,200 you borrowed, which comes to over $100. Plus, you’ll be hit with interest charges on the remaining balance until it is paid off.

How is deferred interest calculated?

To estimate the deferred interest that you’ll owe, you divide the APR by 365 by the daily interest rate, then multiply that amount by the original balance and the number of days in the billing period to get the total monthly interest. You then add up the interest for each month of the promotional period to get your total deferred interest.

Deferred interest formula

APR ÷ 365 days = daily interest rate

Daily interest rate x daily balance x days in billing period = monthly interest

Here’s how to use the formula with the numbers in the previous example:

0.22 ÷ 365 = 0.0006 daily interest rate

- Month 1: $1,200 x 0.0006 x 31 days = $22.32

- Month 2: $1,100 x 0.0006 x 28 days = $18.48

- Month 3: $1,000 x 0.0006 x 31 days = $18.60

- Month 4: $900 x 0.0006 x 30 days = $16.20

- Month 5: $800 x 0.0006 x 31 days = $14.88

- Month 6: $700 x 0.0006 x 30 days = $12.60

Total deferred interest = $103.08

Deferred interest vs. 0% interest credit card offers

If you want a safer option for financing a new purchase, you may want to opt for a 0% intro APR card.

Like a deferred interest credit card, a 0% APR credit card allows you to carry a balance from month to month without paying interest for a specified time period (usually between six and 21 months). However, if you have a remaining balance at the end of the promotional period, you will only be responsible for paying interest on the remaining balance. You don’t have to worry about incurring hundreds of dollars of interest if you don’t pay off the full balance by the end of the promotional period. Also, most 0% APR offers are for more than six months. which gives you more time to pay off your balance before interest kicks in.

Here’s a look at how much you would pay in interest with a deferred interest versus a 0% APR card if you charge $1,200 and make six monthly payments of $100. In the seventh month (after the intro period is over) you would owe over $110 in interest with the deferred interest offer versus only $10.80 with the 0% APR card.

Deferred interest vs. no interest credit card costs

| $1,200 purchase with 22% APR | Remaining balance | Deferred interest for six months | 0% APR for six months |

|---|---|---|---|

| Month 1 | $1,200 | $22.32 | $0 |

| Month 2 | $1,100 | $18.48 | $0 |

| Month 3 | $1,000 | $18.60 | $0 |

| Month 4 | $900 | $16.20 | $0 |

| Month 5 | $800 | $14.88 | $0 |

| Month 6 | $700 | $12.60 | $0 |

| Month 7 | $600 | $10.80 | $10.80 |

| Total interest paid | $113.88 | $10.80 |

Compare 0% APR credit cards

| Credit Cards | Our Ratings | Best for | Intro Purchase APR | Regular APR | |

|---|---|---|---|---|---|

Chase Freedom Unlimited®

|

0% APR credit card | 0% Intro APR on Purchases for 15 months | 18.24% - 27.74% Variable | ||

Wells Fargo Active Cash® Card*

|

0% APR card with rewards | 0% intro APR for 12 months from account opening on purchases | 18.49%, 24.49%, or 28.49% Variable APR | ||

U.S. Bank Visa® Platinum Card*

|

21-month 0% APR | 0% intro APR for 21 billing cycles on Purchases | 17.74% - 28.74% (Variable) | ||

BankAmericard® credit card*

|

Balance transfer savings | 0% Intro APR for 21 billing cycles for purchases | 14.74% - 25.74% Variable APR | ||

Chase Slate Edge℠*

|

18-month 0% APR | 0% Intro APR on Purchases for 18 months. | 18.24% – 28.24% Variable |

How to spot a deferred interest credit card offer

The most common deferred-interest credit cards are store credit cards and medical credit cards.

You can find out if your credit card charges deferred interest by scanning the terms and conditions of your cardmember agreement for the terms “deferred interest,” “retroactive interest” or “no interest if paid in full.” The issuer may also include these terms in the fine print on the card’s website.

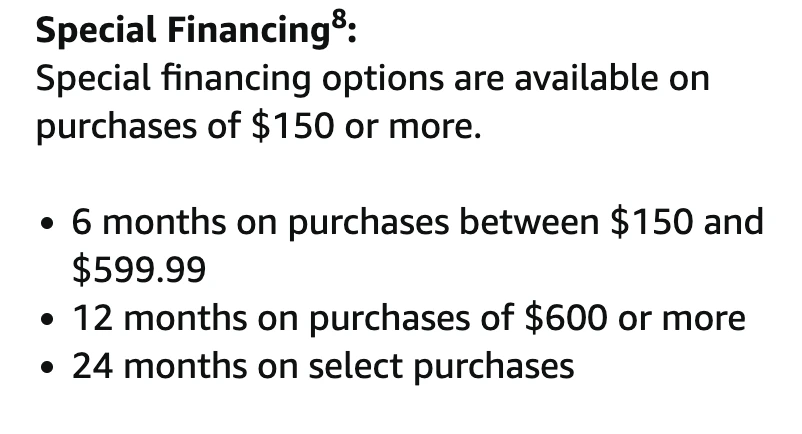

For example, the Amazon Prime Store Card, which charges deferred interest, states the following on its landing page:

The MyLowe’s Rewards Credit Card, which also offers deferred interest, includes the following deferred interest promotion on its special financing web page:

How to manage a card with deferred interest

Deferred interest credit cards can allow you to pay off a large purchase interest-free. Carol Pope, staff writer at LendingTree, uses the CareCredit® credit card for its deferred interest promotions because “it gives me a little bit of breathing room since there’s an intro APR period as long as I charge at least $200.” Such offers financial flexibility when an emergency pops up.

But if you aren’t able to pay off the balance within the promotional period, you risk incurring extremely high deferred interest charges, which defeats the purpose of the special financing offer.

Pope uses the following tips to help ensure that she avoids paying deferred interest charges:

-

1. Keep spending to a minimum

Many credit cards that charge deferred interest offer various special financing options each time you make a qualifying purchase. Pope uses her CareCredit® credit card mostly for vet bills for her pets as well as larger medical bills that qualify. The interest-free periods and ability to pay over time may tempt you to make numerous charges, which could cause you to fall into debt. Use a cash back credit card for your regular spending so you can more easily manage your deferred interest card.

-

2. Pay your balance in full before the offer ends

This lets you benefit from the interest-free offer without being hit with deferred interest charges. Calculate what your monthly payments need to be to pay off the loan before the deferred interest payments kick in. Be aware that this amount will likely be much more than the minimum payment required by the issuer each month.

Pope notes that when you have more than one deferred interest charge, “it’s a little tricky to juggle multiple offers. I make sure that the payments I’m making will keep me interest-free by ignoring my minimum amount due. It doesn’t always reflect what I actually need to pay to avoid interest if you’re carrying multiple balances.”

Reminder: The minimum payments usually are not enough to pay off the full amount before the deferred interest period ends. On a $500 charge, the minimum payment might only be $29 but when the 12-month term ends, you will have only paid $348.

-

3. Pay your bill on time each month

If you fail to pay at least the minimum amount due each month — in addition to potentially having a negative impact on your credit score — the lender may end the deferred period prematurely and charge you the full amount of interest.

Setting up automatic payments ensures you don’t miss a payment, or you can set a calendar reminder to log in and make your payment the day before it’s due.

-

4. Set a reminder two months before your offer ends

Once you have two months remaining, evaluate your balance to see if you need more time to pay off your debt. Pope says, “I regularly track my current promotions under the ‘Promotions’ tab on my online account. I can see my promotional balance (or what I owe for that single charge) and my promotion expiration date.”

If you can’t afford to pay your balance in full before the special financing period ends — you may want to transfer the debt to a balance transfer card that offers a 0% intro APR period.

How to fight deferred interest charges

If you find yourself stuck with a large, unexpected bill due to deferred interest, calling the customer service line may be your best option for fighting those charges. Some issuers may opt to remove the charges if you notify them soon after billing and you’re able to immediately pay the balance. You should also check to see if your credit card issuer offers a grace period.

For example, CareCredit has a 30-day grace period on deferred interest promotions. This means that — if you don’t have the funds to pay the balance in time or you made a mistake posting your payment — you have 30 days to fix the problem before the charges stick. Customers who’ve taken advantage of CareCredit’s grace period note that you have to call customer service to have the interest charges removed manually.

If you feel as though your deferred interest charges are incorrect or there’s a different issue, you can dispute credit card billing errors. You’ll want to start by contacting your credit card issuer. Send a certified letter with your name, address, credit card account number and description of the error to your credit card issuer, who will investigate your dispute.

Alternatives to deferred interest credit cards

Deferred interest credit card offers are attractive, but the risk may be more than the potential savings, especially if the offer period is less than a year. The following options may be more cost-effective or less risky for financing a purchase:

- 0% interest credit cards: There are many credit cards with 0% interest on new purchases for a year or longer. Additionally, if you don’t pay off the balance by the time the promo ends, you only pay interest on the remaining balance.

- Balance transfer credit cards: You can use a balance transfer credit card for current debt or to transfer the remaining balance on a credit card with deferred interest.

- Personal loans: A personal loan charges interest from day one but typically you can get a lower interest rate than you would on a credit card.

- Home equity line of credit: Homeowners can tap into the equity on their home with a home equity line of credit. Like personal loans, you’ll pay interest but the rate will likely be less than that of your credit card.

- Buy now pay later offers: Depending on your purchase you may be able to use a buy now, pay later offer from Affirm, Cash App Afterpay, Klarna or PayPal.

Our data

According to LendingTree’s research team, nearly 1 in 3 Americans are considering using a buy now, pay later offer for an upcoming purchase.

Frequently asked questions

Deferred interest doesn’t hurt your credit as long as you’re paying your monthly payment and lowering your overall balance. What will hurt your credit is if you miss a credit card payment or continue adding to your balance, thereby raising your credit utilization ratio. Additionally, if you don’t pay your balance in full before the promotion ends and a large sum of deferred interest is added to your balance, your credit utilization percentage will increase and can cause your credit score to drop.

Interest does accrue during deferment, but it is not charged during this time. You only have to pay deferred interest if you don’t pay off the entire amount owed before the promotional offer term ends.

The information related to the Wells Fargo Active Cash® Card, U.S. Bank Visa® Platinum Card, BankAmericard® credit card, Chase Slate Edge℠, Amazon Prime Store Card, MyLowe’s Rewards Credit Card and CareCredit® credit card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.