What Is a HELOC? Home Equity Lines of Credit Explained

A home equity line of credit (HELOC) is a secured loan tied to your home that allows you to access funds as needed.

You can make as many purchases as you’d like, as long as they don’t exceed your credit limit. But unlike a credit card, you risk foreclosure if you stop making payments because HELOCs use your house as collateral.

In this guide, you’ll learn the ins and outs of HELOCs, including their benefits, disadvantages and qualification requirements, to help you decide if it’s the right option for you.

- You can use a HELOC to access cash for any purpose you choose, including home improvements or debt consolidation.

- You may be able to make interest-only payments during the HELOC’s draw period, which typically lasts for 10 years.

- HELOC interest rates are variable and will likely change during the repayment period.

- HELOCs often have lower rates than home equity loans but higher rates than cash-out refinances.

How does a HELOC work?

A HELOC allows you to tap some of your home equity to fund purchases you may not have the cash for upfront. Your home equity is the difference between your home’s value and your remaining mortgage, and lenders generally allow you to borrow up to 85% of that, minus your outstanding mortgage balance. Let’s say your home is worth $300,000 and you owe $150,000 on your mortgage. In this case, you can borrow up to $105,000.

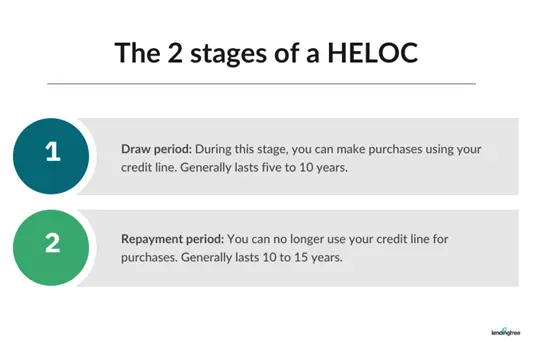

HELOCs have a draw period and a repayment period. The draw period typically lasts anywhere from five to 10 years, while repayment periods generally range from 10 to 15 years. During the draw period, you may only need to make interest payments or a combination of both interest and principal, depending on your plan structure. Once you reach the repayment period, you can no longer draw from the credit line.

Disclaimer: To see your rates, you’ll need to provide personal information, including your property type, ZIP code and what you plan to use the loan for.

How much can you borrow with a HELOC?

Your loan-to-value (LTV) ratio is a large factor in how much money you can borrow with a home equity line of credit. The LTV borrowing limit that your lender sets based on your home’s appraised value is normally capped at 85%. For example, if your home is worth $300,000, then the combined total of your current mortgage and the new HELOC amount can’t exceed $255,000. Remember that some lenders may set lower or higher home equity LTV ratio limits.

Use our HELOC calculator to estimate how much money you might qualify for.

You’ll usually have to pay HELOC closing costs ranging from 2% to 5% of the credit line amount. In addition, some lenders charge monthly maintenance fees, and you could face a prepayment penalty if you close your HELOC early.

| Lender | User ratings | Best for | |

|---|---|---|---|

|

(645)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Large HELOC loans | |

|

(1455)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Fast HELOC closing | |

|

(18)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| No HELOC closing costs | |

| User reviews coming soon | High-LTV HELOCs | |

| User reviews coming soon | Fixed-rate HELOCs |

How to qualify for a HELOC

To meet HELOC eligibility requirements, you’ll need decent credit, a manageable debt-to-income (DTI) ratio and sufficient home equity. You’ll also need to provide your financial documents, like W-2s and bank statements — these allow the lender to verify your income, assets, employment and credit score.

You should expect to meet the following HELOC loan requirements:

- Minimum 620 credit score. You’ll need a minimum 620 score, though the most competitive rates typically go to borrowers with 780 scores or higher.

- Maximum 43% DTI ratio. Your DTI is your total debt (including your housing payments) divided by your gross monthly income. Typically, your DTI ratio shouldn’t exceed 43% for a HELOC, but some lenders may stretch the limit to 50%.

- Maximum 85% LTV ratio. Your lender will order a home appraisal and compare your home’s value to how much you want to borrow to get your LTV ratio. Lenders normally allow a max 85% LTV ratio.

It’s not easy to find a lender who’ll offer you a HELOC when you have a credit score below 620. If your credit needs some work, it may be wise to hold off on applying for a HELOC to instead focus on repairing your credit.

Don’t know your credit score? Get your free score on LendingTree Spring.

Disclaimer: To compare offers, you’ll need to provide personal information, including your property type, ZIP code and what you plan to use the loan for.

HELOC interest rates

HELOC rates have been falling since the summer of 2024. However, the exact rate you get on a HELOC will depend on your lender and overall personal financial situation.

Variable vs. fixed HELOC loan rates

HELOCs carry variable interest rates in most cases, making your monthly payments more difficult to predict than, say, home equity loans, which typically have fixed rates. Fixed-rate HELOCs do exist, but they’re less common.

Some lenders offer HELOC rate discounts for enrolling in automatic payments or making an initial withdrawal when you open the account.

Pros and cons of a HELOC

Pros

- Money is easy to use. You can access money when you need it, in most cases simply by swiping a card.

- Reusable credit line. You can pay off the balance and reuse the credit line as many times as you’d like during the draw period, which usually lasts several years.

- Interest accrues based on use. You’ll only pay interest on the amount you use, not the total credit line amount.

- Competitive interest rates. You’ll likely pay a lower interest rate than a home equity loan, personal loan or credit card, and your lender may offer a low introductory rate for the first six months. Plus, your rate will have a cap and can only go so high, no matter what happens in the broader market.

- Low monthly payments. You may have the option to make low, interest-only payments during the draw period if your lender offers it.

- No mortgage insurance. You can avoid private mortgage insurance (PMI), even if you finance more than 80% of your home’s value.

Cons

- Your home is collateral. You could lose your home if you can’t keep up with your HELOC payments.

- Tough credit requirements. You may need a higher minimum credit score to qualify than you would for a standard purchase mortgage or refinance.

- Higher rates than first mortgages. HELOC rates are higher than cash-out refinance rates because they’re second mortgages.

- Changing interest rates. Unlike a home equity loan, HELOC rates are usually variable, which means your payments can change over time. If your rate rises, you could end up with a higher monthly payment.

- Potential balloon payment. You may have a very large balloon payment due after the interest-only draw period ends.

- Sudden repayment. If you sell your house soon after taking out a HELOC, you’ll likely have to pay back the credit line in full — in addition to your first mortgage.

Ways to use a HELOC

Some of the most common reasons to get a HELOC include:

- Home improvements

- Debt consolidation

- College expenses

- Buying a second home

- Buying an investment property

- Emergency fund

We bought an older home in our dream neighborhood, knowing it would need some work (new siding, a new roof, etc.) We explored several options, including a home improvement loan, but a HELOC made the most sense to us. We shopped around but ultimately decided to go with our primary bank, Truist, since they offered a great intro APR and covered our closing costs.

Is a HELOC right for you?

A HELOC can be a good idea for you if:

- You’re planning smaller home improvement projects. You can draw on your credit line for home renovations over time, instead of paying for them all at once.

- You need a cushion for medical expenses. A HELOC gives you an alternative to depleting your cash reserves for unexpectedly hefty medical bills.

- You need help covering the costs of starting or running a small business. A HELOC can help you pay for business startup costs, such as licensing fees and equipment, as well as ongoing business expenses like inventory or payroll.

- You’re involved in fix-and-flip real estate ventures. Buying and fixing up an investment property can drain cash quickly — a HELOC leaves you with more capital to buy other properties or invest elsewhere.

- You need to bridge the gap in variable income. A credit line gives you a financial cushion during sudden drops in commissions or self-employed income.

A HELOC may not be a good fit if:

- You can’t afford the payments. If your budget is stretched thin due to other expenses, a HELOC may not be the best option. Missing HELOC payments would put your home at risk.

- You’ll be tempted to overspend. It’s best not to get a HELOC if you think it will cause you to spend more than you’ll be able to repay.

- Your job is unstable. If your job is at risk or you expect a significant decrease in your income, it’s best to postpone getting a HELOC.

- You think it would cause you to rack up more debt. Using a HELOC to consolidate high-interest debt, like credit cards, can be a smart option. But if you rack up additional credit card debt after paying the cards off, you now have more debt than you started with.

- You wouldn’t earn a good return. If you use HELOC funds to buy an investment property, make sure the return will be worth the risk.

How to get a HELOC

Step 1. Make sure a HELOC is the right move for you

HELOCs are best when you need large amounts of cash on an ongoing basis, like when paying for home improvement projects or medical bills. If you’re unsure what option is best for you, compare different loan alternatives, including a cash-out refinance or home equity loan.

But whatever you choose, be sure you have a plan to repay your loan.

Step 2. Gather documents

You’ll need to provide lenders with documentation about your home and finances, including your income and employment information, and any other debt you’re carrying.

Step 3. Apply to HELOC lenders

Apply with a few lenders and compare what they offer in terms of rates, fees, maximum loan amounts and repayment periods. Credit-scoring bureaus will likely treat your multiple HELOC applications as a single inquiry, as long as you submit all of the applications within a 14- to 45-day window — depending on the scoring model.

Learn more about our picks for the best HELOC lenders.

Step 4. Compare offers

Take a critical look at the offers on your plate. Consider total costs, the draw period and repayment period lengths and any minimums and maximums.

Step 5. Close on your HELOC

If everything looks good and a home equity line of credit is the right move, you’re ready to close on your HELOC. Make sure you can cover the closing costs, which can run up to 5% of the credit line amount.

HELOC alternatives

- Home equity loan: A home equity loan allows you to borrow against your home equity in a lump sum. The loan amount depends on your home’s value and your remaining mortgage balance. Home equity loan rates are usually fixed, and loan repayment terms range from five to 30 years.

- Personal loan: A personal loan is generally an unsecured loan that’s available through private lenders. Personal loan repayment terms are usually shorter than HELOCs, and the interest rates are usually higher.

- Credit card: Using a credit card can be a quick, convenient way to make purchases, but the interest rates are generally much higher than HELOCs.

- Cash-out refinance: A cash-out refinance replaces your current mortgage with a larger loan, allowing you to “cash out” the difference between the two amounts. The maximum LTV ratio for most cash-out refinance programs is 80%.

- Reverse mortgage: If you’re aged 62 or older, a reverse mortgage allows you to convert some of your home equity into an income stream and doesn’t require monthly payments. A reverse mortgage loan is typically repaid when the borrower moves out, sells the home or dies.

Learn more about how to choose between a HELOC, home equity loan and cash-out refinance.

Frequently asked questions

You may be able to write off your HELOC interest at tax time if you use the funds for home improvements that substantially improve your home.

It’s possible to get a HELOC on an investment property, but lenders typically impose stricter eligibility requirements, such as higher income and larger cash reserves.

Some of the drawbacks of HELOCs include the risk of foreclosure if you default on the payments, variable interest rates, closing costs and ongoing fees.

Compare Home Equity Offers