49% of AI Chatbot Users Say AI Has Influenced a Financial Decision

Has the rise of AI (artificial intelligence) influenced how and where people are getting their financial advice? According to our survey, yes. Nearly half of all the AI chatbot users we surveyed say that LLMs (or large language models) have had a hand in their personal finances.

To find out whether turning to ChatGPT for money advice is prudent, we put chatbots to the test. After asking ChatGPT, Claude and Gemini a series of money-related questions, we found that chatbots are often technically correct but don’t always paint a realistic picture.

- More than half of Americans (59%) have used an AI chatbot at least once. Gen Zers (74%) are significantly more likely to have used AI than baby boomers (40%), while men (65%) are more likely than women (53%).

- 89% of users believe AI chatbots are at least moderately accurate. That plays a role in whether users take chatbot advice. Nearly half (49%) of AI chatbot users say AI has influenced at least one of their financial decisions, leading with budgeting (33%), financial aid or scholarships (32%), taxes (31%) and opening or closing a financial account or loan (30%).

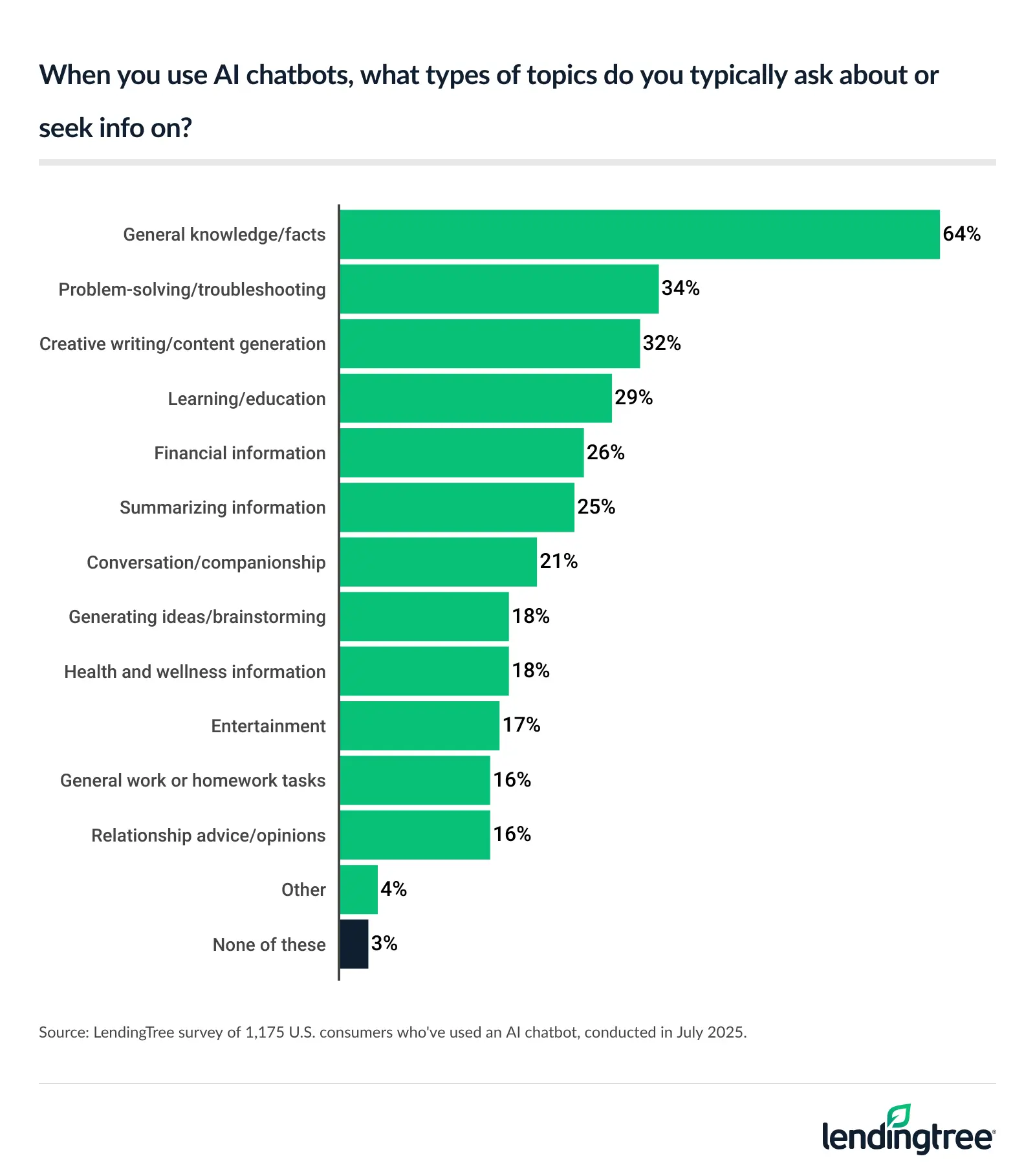

- Chatbot users are most likely to ask AI for general knowledge. 64% of users say they typically ask about general knowledge or facts. Problem-solving or troubleshooting for coding or technical issues (34%) and creative writing or content generation (32%) follow.

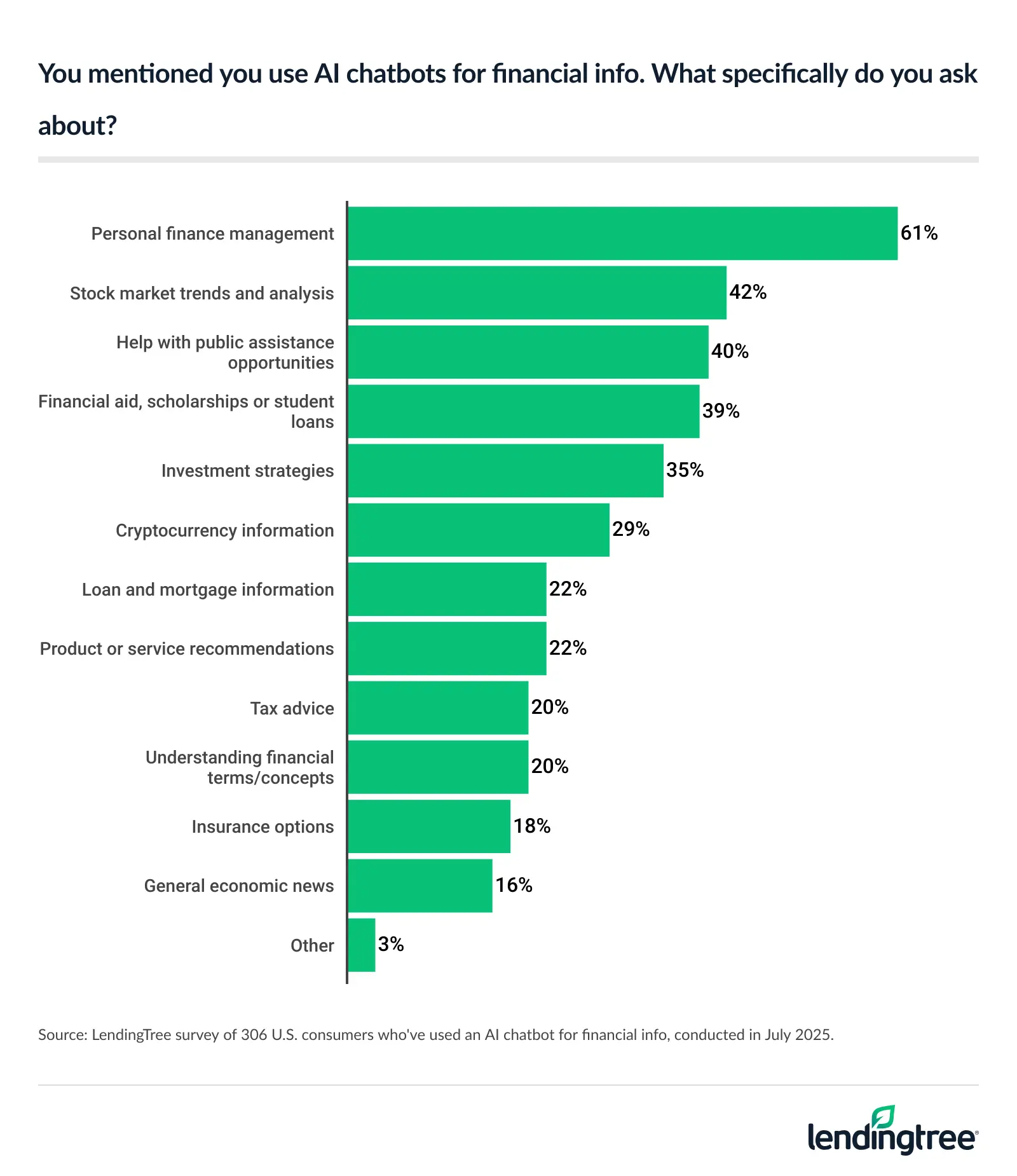

- 26% of users typically turn to chatbots for financial information. Among them, 61% ask about personal finance management, 42% ask about stock market trends and analysis, and 40% ask for help with public assistance like the Supplemental Nutrition Assistance Program (SNAP) or Medicaid.

- Across 20 prompts, ChatGPT generally provided accurate and responsible financial advice, but it tended to be overly optimistic when key details were missing. When asked about retirement planning with specific incomes and ages, the chatbot offered detailed explanations. However, when asked about retirement planning for a 50-year-old couple with just $100,000 saved, it recommended saving over $30,000 annually to catch up in 17 years — without asking about income or reasons for being behind. That’s an unrealistic goal for many households, especially given their financial history.

More than half have used a chatbot at least once

About 6 in 10 Americans (59%) have used a chatbot like ChatGPT, Claude or Gemini at least once.

The younger the survey respondent, the more likely it is that they have used a chatbot. Almost three-quarters (74%) of Gen Zers (ages 18 to 28) have used a chatbot, compared with less than half of baby boomers (ages 61 to 79), at 40%.

Men also use chatbots more than women, at 65% versus 53%. This tracks with another LendingTree survey, which found that more men (39%) than women (22%) think they could get rich using AI.

The overwhelming majority of users believe chatbots are accurate to some degree

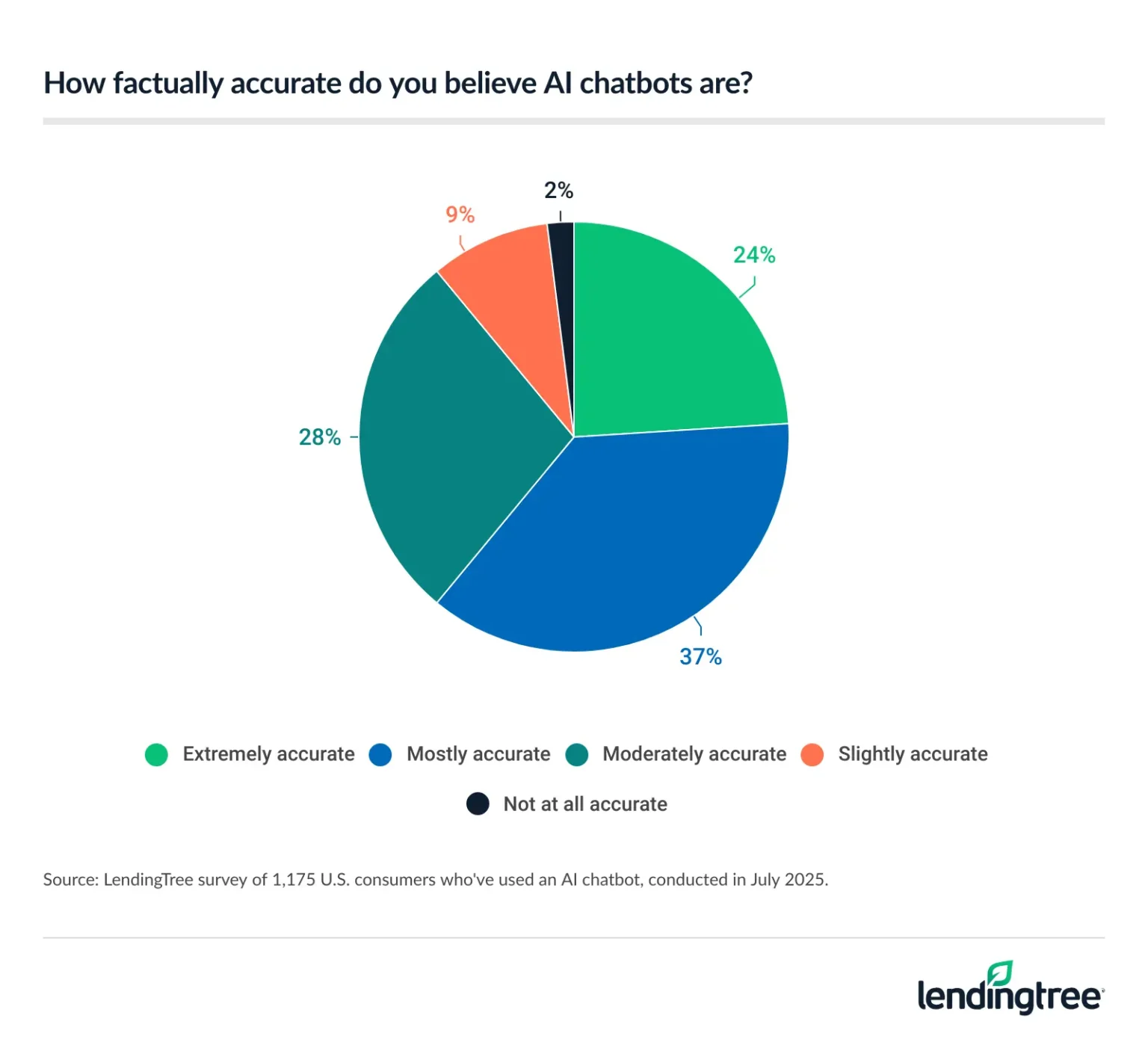

It may come as no surprise, but 89% of users think that chatbots are at least moderately accurate. Otherwise, why would they use them?

At 37%, users are most likely to think that chatbots are mostly accurate. Less than a third (28%) think they’re moderately accurate, and less than a quarter (24%) think they’re extremely accurate.

Trust varies sharply by generation

Out of all the age groups we surveyed, millennials (ages 29 to 44) are the most trusting of AI chatbots — 32% say they believe chatbots are extremely accurate. But only 9% of baby boomers agree.

Interestingly, this trend continues for buy now, pay later (BNPL), a more contemporary way of borrowing money.

According to our BNPL tracker, only 20% of baby boomers say that they would consider applying for a BNPL loan, the lowest percentage of all generations. In contrast, over half of millennials say they would use BNPL.

Users mainly turn to chatbots for general knowledge and fact gathering

To put it simply, people use chatbots to look stuff up. General knowledge and fact gathering is far and away the most common reason our users turn to AI chatbots (64%). Problem-solving and troubleshooting is next, at 34%.

26% of AI users turn to chatbots for financial info

People are a bit more hesitant to ask chatbots for money advice. Only about a quarter of users typically turn to chatbots for financial information (26%).

Those who do use chatbots for financial advice tend to ask about personal finance management (61%), stock market trends and analysis (42%), and help with public assistance (40%).

When shopping for a financial product, Google Search is the most common source

We asked our AI users which step they would take first to find a good deal on a new financial product, like a personal loan or a mortgage. Many said the traditional search engine Google, at 41%. After that, these respondents would turn to AI chatbots before banks and financial advisors when shopping for a new financial product.

Here’s a breakdown of the numbers:

- Google: 41%

- Ask friends or family for advice: 18%

- AI chatbot: 16%

- Talk to my bank: 13%

- Talk to my financial advisor: 9%

- Other: 3%

Financial advice from chatbots is usually solid but often lacks depth

We’ve established that some people use AI chatbots for financial advice — but is that advice any good? We asked ChatGPT, Claude and Gemini the same set of 20 personal finance questions to find out.

For the most part, advice was similar across chatbots. Answers were mostly correct, too. But the feasibility of its advice depended on the type of question and how many details we provided.

When asked for more general personal finance advice, AI gave sound guidance

Although the question above might not seem very general, it is in the personal finance world. At its core, this question is asking for pros, cons and risks of saving the down payment or investing it.

ChatGPT gave us factors to consider, including how much we should expect to put down on a house, and how volatility might wipe out any potential stock market growth. Based on that, it gave us a couple of options.

Notably, it steered us away from the riskiest option (put all of the money in stocks) and instead recommended a more balanced approach (put $400 in a high-yield savings account each month, and allocate $100 to an investment account).

Overall, this is guidance that you might expect from a meeting with a financial advisor.

When asked for personalized retirement recommendations, AI fell a bit short

This question is more nuanced. To give proper advice, ChatGPT would need to know how much the couple makes per year, how much they’re currently saving, what kind of retirement account the couple has now, among other details.

Instead of asking clarifying questions, ChatGPT made assumptions that led to (mostly) correct yet impossible-to-follow advice.

ChatGPT provided a litany of information, including which retirement accounts to prioritize. It said to max out tax-advantaged accounts, like 401(k)s and IRAs. This means that the couple would have to invest more than $35,000 a year.

Although maxing out tax-advantaged accounts is wise, ChatGPT gave blanket guidance without considering how much of a financial strain this would be for the average person.

What’s more, the max contribution limits it gave were a year outdated, although it presented them as rules for 2025. It advised that:

- For a 401(k)/403(b), you can contribute $23,000 + $7,500 catch-up for age 50+ in 2025

- For a traditional or Roth IRA, you can contribute $7,000 + $1,000 catch-up

This is close, but not quite accurate. The IRS bumped max contributions for 401(k) and 403(b) accounts to $23,500 in 2025.

Surprisingly, chatbots were accurate when it came to interest and loan calculations

LLMs are trained on text. They don’t recognize numbers as easily because chatbots are language predictors. When it comes to math, sometimes they’ll flat out guess based on patterns in similar math problems, but not the actual problem being asked.

In other words, LLMs are usually pretty bad at math.

With that said, we ran some hypothetical scenarios through ChatGPT and our auto loan calculator, mortgage calculator and personal loan calculator. Cross-referencing ChatGPT’s numbers with our own, ChatGPT’s calculations and the action plans it subsequently provided were correct and/or made sense.

My personal experience with AI and financial advice

I lost my mom in late 2023, three years after her cancer diagnosis. Along with navigating my own grief, I had to figure out the financials, too. She had all her affairs in order, and I was grateful for that, but I had no idea what to do with the small IRA I inherited.

I’ve always been a “set it and forget it” investor. My 401(k) and Roth IRA are robo-managed, and I’ve never had to think about much outside of a target retirement date.

The inherited IRA was different. It was parked in money market funds, earning next to nothing. I didn’t know how to reallocate it, or that I even needed to sell those holdings first before reinvesting.

I told my story to ChatGPT. It walked me through the process step by step — where to click, how to sell, which mutual funds to consider — almost like a financial advisor would. Coupled with my own research, I found it gave me good advice.

Chatbots can be a helpful resource for personal finance guidance, but it’s crucial to approach their recommendations carefully and follow some best practices before making moves. And if you’re in doubt, talk to a trusted human.

- Set the role: LLMs are quick to agree and quick to assume. Before starting a chat, instruct it with this prompt: “Take the role of a skeptical subject matter expert. Ask questions, push back where needed and don’t soften feedback to be polite. If the requested information is unavailable or you lack sufficient information to provide a confident answer, state that you do not know or cannot answer.”

- Better context, better answers: The more details you give the chatbot, the more personalized the advice will be. Just don’t give out any sensitive information that you wouldn’t want to be public, like your banking information.

- Always check sources: LLMs will present misinformation as fact and sometimes even provide false sources. Double-check all information by clicking on and reading links to make sure the LLM is using sources that actually exist.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from July 14 to 15, 2025. The survey used a nonprobability-based sample with quotas to ensure representation of the overall population. All responses underwent quality control review by researchers.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

To evaluate how well AI chatbots provide personal financial advice, LendingTree researchers also created 20 prompts covering various aspects of personal finance. Researchers assessed the responses for mathematical accuracy and checked references to specific figures, such as individual retirement account (IRA) contribution limits.

Researchers then selected 10 of those prompts and tested them across ChatGPT (GPT-5), Google Gemini 2.5 Flash and Claude Sonnet 4 to compare their performance. All prompts were run on Aug. 13, 2025.