Americans: We’re Doing Fine, but the Economy Isn’t

When it comes to their own finances, Americans today are far more likely to describe them as good than as bad, according to a LendingTree survey of 2,000 U.S. consumers.

Zoom out to views of the economy as a whole, however, and the sentiment changes. Far more Americans have a negative outlook on the broader economy than those who view it positively.

Beneath those seemingly contradictory viewpoints, our survey found clear signs of a divided nation, with many flourishing while many others are struggling mightily. However, there’s little debate about the primary cause of Americans’ economic worries, and it likely won’t come as a surprise.

Here’s a closer look at what we found.

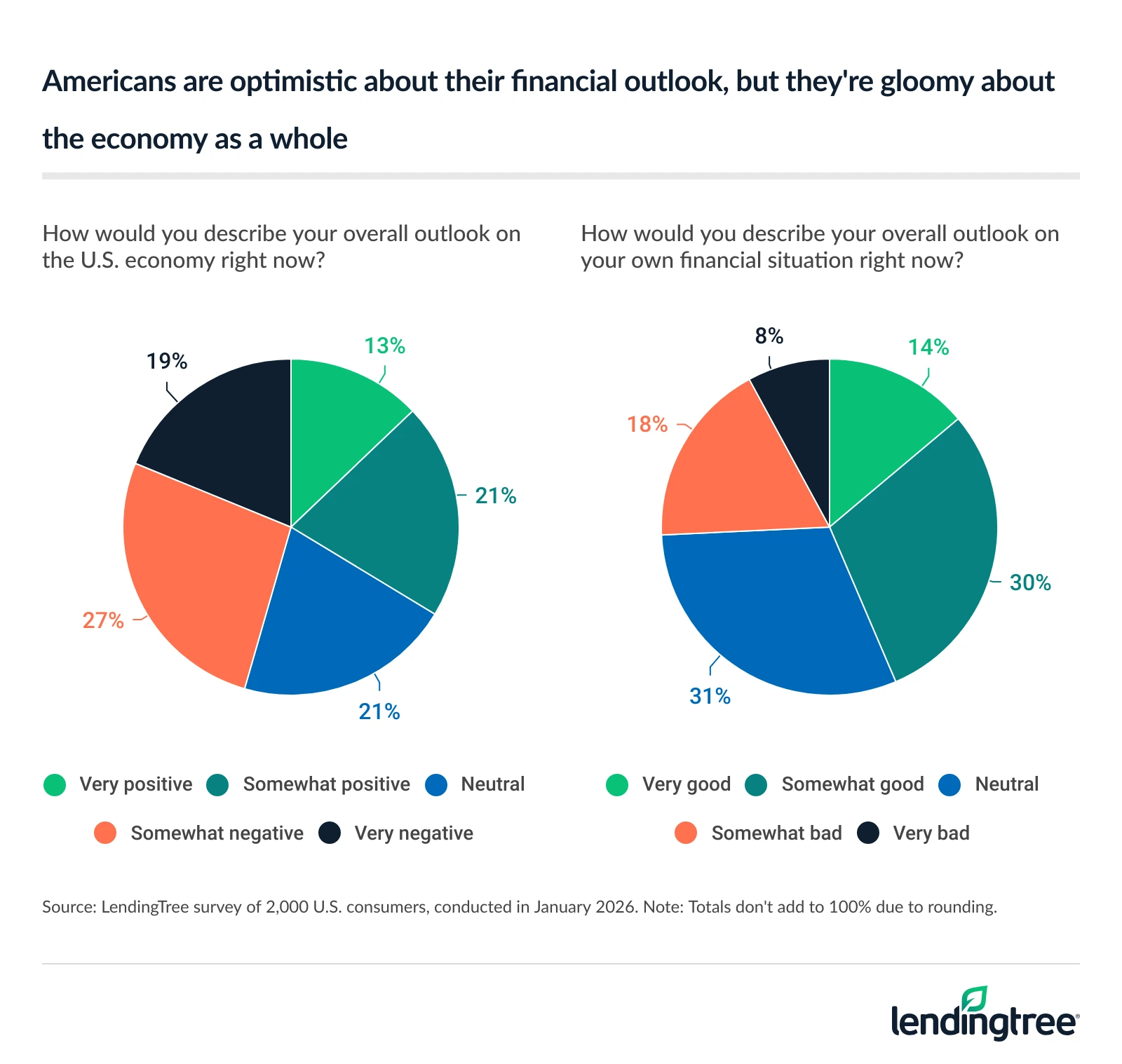

- Americans are optimistic about their personal financial situation, but they’re gloomy about the economy as a whole. 44% say their outlook on their own financial situation is good, while just 25% say it’s bad. (31% say it’s neutral.) However, when asked about the overall U.S. economy, 46% said their outlook was negative, versus 33% who said it was positive and 21% neutral.

- Slightly more Americans expect the economy to worsen rather than improve in the next 12 months. 38% expect a worse economy in a year, while 33% say things will be better and 30% say things will remain the same. Older Americans are more likely to be pessimistic, while higher-income earners are more likely to be optimistic. Men are also significantly more likely than women to be optimistic about the next 12 months.

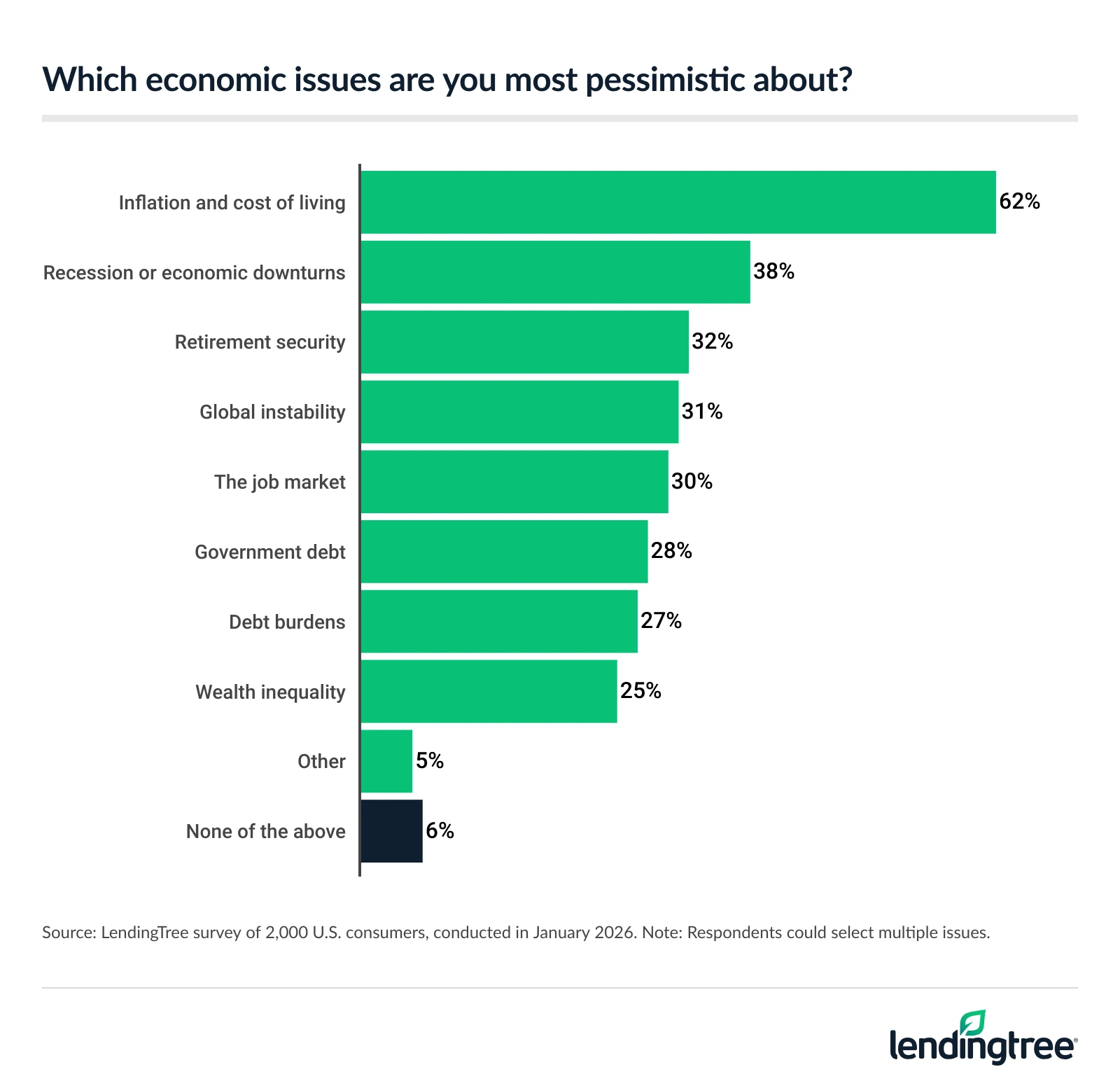

- Inflation remains the top economic concern. When asked which economic issues they were most pessimistic about, 62% of Americans cited inflation and the cost of living, followed by a recession or economic downturn (38%) and retirement security (32%), while 38% of millennials and 36% of Gen Zers cited concerns about the job market. Overall, nearly 3 in 4 Americans (74%) are at least somewhat concerned about continued inflation in 2026, including 38% who are very concerned. Just 8% aren’t concerned at all.

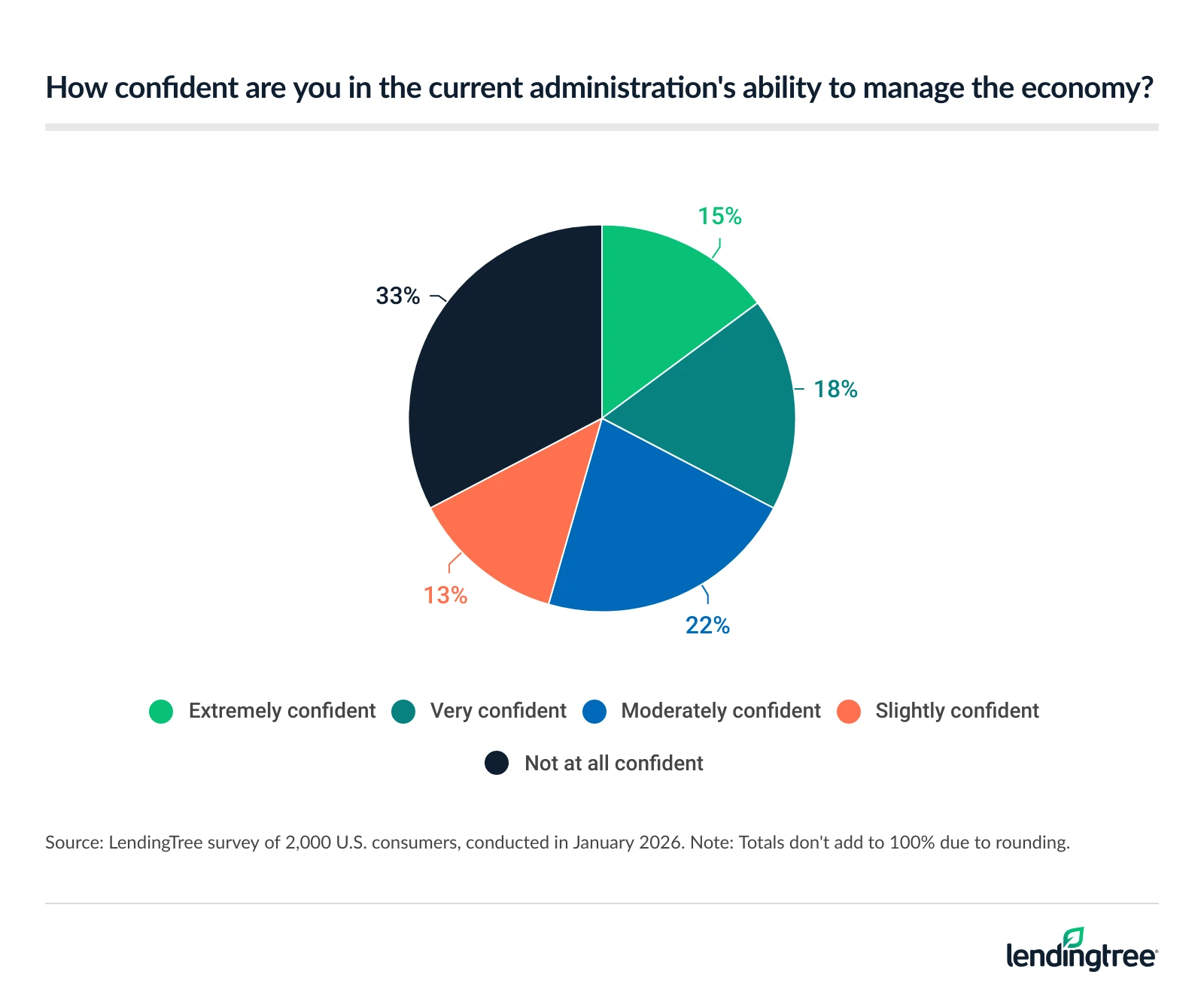

- Americans are split on the current administration’s ability to manage the economy. 33% are very or extremely confident in the Trump administration’s ability to manage the economy, while another 33% are not at all confident. (35% are only moderately or slightly confident.) Among those most likely to be very or extremely confident: Parents of young children (44%), men and high-income earners (both 40%), and millennials (37%). There’s also a predictable split by political party, while independents are more than twice as likely to say they’re not at all confident as to say they’re extremely or very confident (41% versus 18%).

Americans are optimistic about their personal financial situation, but they’re gloomy about the economy as a whole

Americans are nearly twice as likely to say their own financial situation is good right now as they are to say it is bad (44% versus 25%, with 31% saying it’s neutral).

Men are much more likely than women to say their situation is good (51% versus 37%), and the higher your income, the more likely you are to say you’re in a good place financially. Perhaps surprisingly, there’s little difference among age groups, except for Gen Xers ages 46 to 61. Either 47% or 48% of Gen Zers ages 18 to 29, millennials ages 30 to 45 and baby boomers ages 62 to 80 feel their personal financial situation is good, while just 35% of Gen Xers agree.

However, when we asked those same Americans what they thought of the overall U.S. economy right now, we heard decidedly more negativity. Nearly half (46%) say their outlook on the broader economy is negative, compared with 33% who say it’s positive and 21% who are neutral.

That’s not as stark a divide as we saw in people’s views about their personal financial situation, but it’s significant. It’s perhaps even more noteworthy given that it seems to stand in stark contrast to their views about their personal finances. Put simply, people are saying, “I’m doing fine, but I don’t think the economy is.”

The demographic breakdowns look similar, in many ways, to what we saw with the personal finance question. Men are much more likely than women to say their outlook on the economy is positive (41% versus 26%), and the higher your income, the more likely you are to say your outlook on the economy is positive. And Gen X is the Gloomy Gus among the age groups.

However, a deeper look shows a key difference: There’s greater negativity almost across the board when people speak of the broader economy. Even those who are among the most positive about the economy are likely to view it more negatively than they view their own financial situation.

- Men: 39% view the economy negatively, versus just 20% who view their own personal situation negatively

- Gen Zers: 39% view the economy negatively, versus just 23% who view their own personal situation negatively

- $100,000-plus earners: 38% view the economy negatively, versus just 13% who view their own personal situation negatively

Slightly more Americans expect the economy to worsen rather than improve in the next 12 months

Asked about the prospects for the economy over the next 12 months, Americans are split. Our survey reveals that 38% expect the economy to be worse in a year, while slightly fewer (33%) say things will be better and slightly fewer than that (30%) say things will remain the same.

Women are far more likely than men to be pessimistic, with 44% expecting economic conditions to worsen, versus 31% of men. Additionally, the older you are and the lower your income, the more likely you are to be pessimistic.

Predictably, there’s also an enormous gap in economic expectations between Republicans and Democrats. They’re nearly opposites.

- Republicans: 55% expect improvement, 17% expect worsening

- Democrats: 20% expect improvement, 56% expect worsening

However, in potentially troubling news for Republicans at the start of a midterm election year, independents’ views on the economy are far more similar to those of Democrats than Republicans. Just 21% expect improvement, while 45% expect the economy to worsen.

Inflation remains the top economic concern

While Americans are divided in many ways when it comes to their views of the economy, there’s little debate over their biggest concern. Asked what economic issues they were most pessimistic about, 62% of Americans said inflation and the cost of living. That was the most common answer for both men and women, as well as across every age bracket, income level, parental status and political affiliation.

A recession or economic downturn was the second-most common response, named by 38% of those surveyed, followed by retirement security (32%), global instability (31%) and the job market (30%).

Younger Americans are most likely to say they’re pessimistic about the job market, with 38% of millennials and 36% of Gen Zers saying so, versus 29% of Gen Xers and just 15% of boomers.

To dig deeper into Americans’ views on inflation in particular, we asked how worried people are about continued inflation in 2026. Nearly 3 in 4 Americans (74%) say they’re at least somewhat concerned about continued inflation in 2026, including 38% who are very concerned. Just 8% aren’t concerned at all, and 19% say they’re only “a little concerned.”

Among the most likely to say they’re very concerned about inflation are Democrats (52%), parents of young kids (45%), Gen Zers (44%) and those earning $100,000 or more a year (41%).

Americans are split on the current administration’s ability to manage the economy

There’s also a clear — though perhaps predictable — divide when it comes to people’s confidence in President Donald Trump’s administration’s ability to manage the economy.

One-third of Americans (33%) are very or extremely confident, while another 33% are not at all confident. (Another 35% say they’re only moderately or slightly confident.)

Among those most likely to be very or extremely confident are parents with kids under 18 (44%), men and high-income earners (both 40%), and millennials (37%).

There’s also a predictable split by political party — 54% of Republicans are very or extremely confident, versus just 21% of Democrats. However, independents are the least likely to be very or extremely confident (just 18% say they are). They’re twice as likely to say they’re not at all confident than to say they’re very or extremely confident (41% versus 18%).

Prepare for the worst, but hope for the best

These are uncertain times. No one can tell you what the next 12 months will look like, so your best move is to firm up your financial foundation as much as possible so you’re ready as can be for whatever the future holds.

Yes, these things can be far easier said than done, but what matters most is progress, not perfection. Improving even just a little bit every day makes you better able to handle the storms that inevitably arise.

- Focus on paying down high-interest debt. This is a big challenge, but it’s so important. Interest that you’re paying on debt is money that can’t go toward other priorities. Lowering your interest rates on your credit cards is key. A 0% balance transfer credit card is perhaps your best weapon in the fight against credit card debt. A low-interest personal loan can be useful as well. You can even negotiate your card’s rate with your issuer, which works way more often than you’d think. You can do it yourself or, if you’d prefer, enlist an accredited nonprofit credit counselor to help you.

- Build your emergency fund, even as you’re paying down debt. This isn’t an either-or decision. You need to do both at the same time. Yes, it means it’ll take a little longer and cost a little more to pay down the debt. However, it also means that you’ll have extra cash once your card balance hits $0. That means that when the next big unexpected expense hits, you might be able to pay it off with cash rather than immediately going right back into debt. That’s a big deal. To turbocharge your savings, have a portion of each paycheck — even a small amount — sent automatically to a high-yield savings account.

- Make sure your spending aligns with your priorities. It certainly isn’t true of everyone, but most of us are likely spending more than we probably should on things that don’t matter to us. Priorities change. People evolve. It happens, and it’s OK. What isn’t OK is continuing to spend on the same things after our priorities change. If you haven’t recently, take the time to review your checking account and credit card statements to better understand your current spending so you can decide if you need to make changes.

- Take time to focus on your health. Little in life is more expensive than having poor health. Medical issues are a common cause of debt in this country, and while much of it isn’t preventable, some of it surely is. While it’s easy to focus on other things, especially when financial times are tough, a little bit of preventive maintenance can go a long way.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 80 on Jan. 14-17, 2026. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2026:

- Generation Z: 18 to 29

- Millennials: 30 to 45

- Generation X: 46 to 61

- Baby boomers: 62 to 80