How Debt Consolidation Affects Your Credit Score

- Debt consolidation can raise your credit score by more than 80 points. The more debt you pay off, the more your score should go up in the long term.

- On the other hand, you can experience a short-term credit score dip when a debt consolidation lender performs a hard inquiry on your credit report, or when you close old credit card accounts.

- If you use a debt consolidation loan to pay off your credit cards, only use your cards for expenses that you can afford to pay off every month. Spending too much and adding to your debt can make your credit score go down.

- Keep your old credit card accounts open if possible. This will help minimize damage to your credit score.

How does debt consolidation affect your credit?

Paying off credit card debt with a personal loan can add more than 80 points to your credit score, according to a recent LendingTree study.

It’s possible for debt consolidation to temporarily hurt your score, too. Overall, though, the long-term benefits of consolidating should cancel out any smaller, immediate hits to your score. As long as you make on-time loan payments (and reduce spending in the meantime), your score is likely to improve if you consolidate.

Ways debt consolidation can improve your score

- Improves your payment history. Snagging lower rates with your debt consolidation loan can lower your monthly payments, making you more likely to make payments on time. Your payment history is worth 35% of your FICO Score, making it the most important of the factors that affect your credit score.

- Lowers the amount of credit you’re using. When you pay off your cards with a debt consolidation loan, you eliminate high credit card balances. This will improve your credit utilization ratio — a key part of how much you owe. Utilization is worth 30% of your FICO Score.

- Adds a new type of credit. Your credit mix — the types of credit accounts you have — makes up 10% of your credit score. Adding a new type of credit (like a personal loan) when you’ve only used cards in the past could improve your credit mix and give your score a small boost.

Ways debt consolidation can hurt your score

- Hard credit pull. When you apply for a loan, the lender will do a hard credit check to review your credit history. This will ding your credit score, but likely only by 5 points or fewer. Any damage to your score is typically gone in a year.

- Opening a new account. When you get a debt consolidation loan, you’re adding a new type of credit to your credit history. This will lower the average age of your credit accounts. Since length of credit history makes up 15% of your FICO Score, this may lower your credit score.

-

Closing old credit card accounts. If you close an old credit card after consolidating its debt, this will decrease the average age of your accounts (a key factor in length of credit history, worth 15% of your score). You’ll also have less credit available (a factor in amounts owed, worth 30%). Both effects can lower your credit score.

If you do keep your accounts open, make sure to pay off any charges every month — otherwise, you’ll just keep adding to your debt. -

Racking up more debt now that your credit is freed up. If you start to overspend on your cards again once you’ve paid them off with a debt consolidation loan, you’ll just add to your debt.

This can impact your score in a lot of (bad) ways. You’ll increase how much you owe (worth 30%). You’ll also be more likely to miss your payments, a key part of payment history (worth 35%).

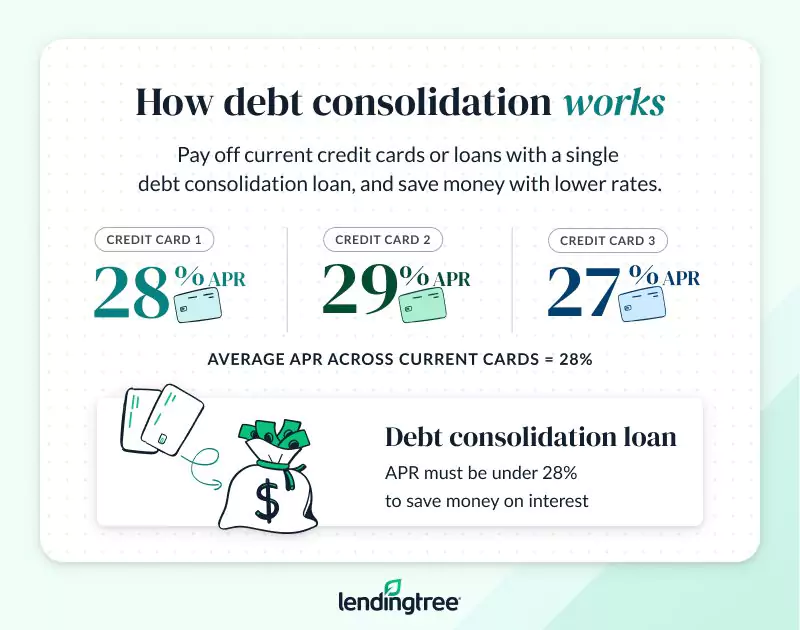

How debt consolidation works

Now you know how consolidation affects your credit. But how does debt consolidation work, and how much can you save?

How much can you save by consolidating your debt?

People can save up to $3,000 and pay off debt 10 months faster by consolidating $10,000 worth of credit card debt with a personal loan, according to a LendingTree study.

But how much can you save? Tell us about your current debts and credit score. We’ll tell you how much money and time you can save by consolidating.

You can get your credit score for free on LendingTree Spring with no impact to your credit. In addition, we’ve compiled some of the best credit monitoring services that can also provide your score.

You can find all this information on your credit card statement or monthly loan statement for each debt you owe. These statements are typically available on your online account with your credit card company or lender.

How to find a consolidation loan with LendingTree

- Fill out a form. It’ll take about two minutes to answer our questions about you and your current debt.

- Compare your offers. We’ll send you offers from up to five lenders if you qualify. It’s typically a good idea to choose the lender with the lowest rates and the shortest loan term to save on interest payments. Still, you should also make sure you can afford the monthly payments.

- Get your money. You’ll submit an application with the lender you choose. If you pass their hard credit check, they’ll send you the money once you sign your loan agreement.

Protect your credit score while consolidating

Cut down on spending

Spending more on your cards after transferring your debt to a consolidation loan will only damage your credit score down the line if you’re unable to make payments. Learn more about how to save money to prevent overspending.

Make a plan

Making your debt consolidation loan payments on time (and not racking up more debt in the meantime) is crucial to protecting your credit score. Create a budget to pay off debt — and stick to it.

Shop around for the best rates

Lower rates mean lower monthly payments, and affordable monthly payments can make the difference between missing payments and making them on time. On-time payments will keep your payment history — worth 35% of your score — strong.

Check out ways to improve your credit score, whether or not you decide to consolidate.

Frequently asked questions

Whether debt consolidation is good or bad depends on whether you’re able to save money with lower interest rates and make your payments on time every month over the course of your loan.

Consider other debt relief options — like credit counseling or debt settlement — if you can’t afford the monthly payments on your debt consolidation loan offer.

You’ll still have your credit cards if you use a debt consolidation loan to pay them off. You can choose to close your credit card accounts or leave them open.

Try to keep your accounts open unless they charge high annual fees or you’re tempted to spend on them while you’re paying off your debt.

You can’t. Consolidating debt affects your credit in both positive and negative ways. The good news? As long as you’re able to pay off your loan on time and not rack up more debt in the meantime, your credit score can recover from any damage — and may even improve over time as a result of making more on-time payments.

Get debt consolidation loan offers from up to 5 lenders in minutes