2024 Football Spending Report: More Than Half of Americans Expect to Spend on Football This Fall, While Nearly Half of Them May Take on Debt

More than half of American adults will spend money on football as a fan this fall, according to LendingTree’s 2024 Football Spending Report. And about half of those who will spend money say they may take on debt because of that spending.

LendingTree asked consumers about their professional, college and even high school football spending plans this fall. We asked how much they expect to spend, what they’ll spend on, how much debt they expect to take on, and even whether Taylor Swift affects their plans. (Spoiler: For many people, she does.)

Here’s what we found.

Key findings

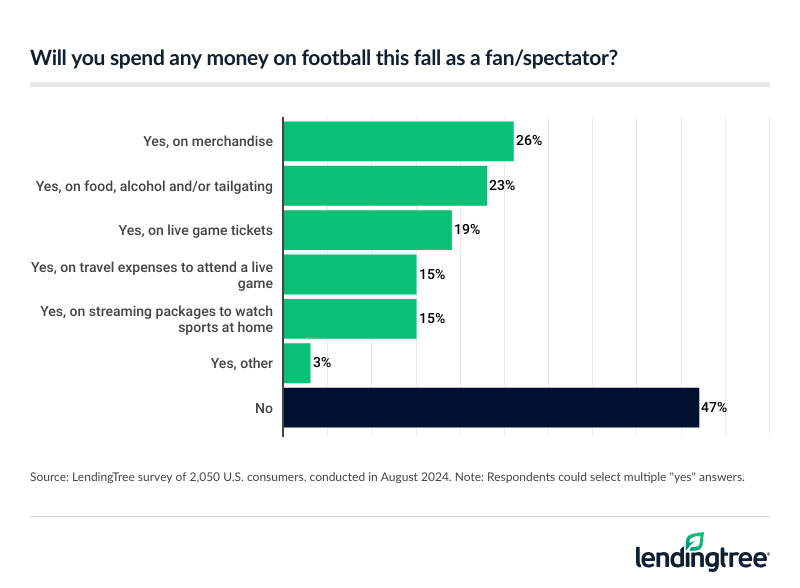

- Most Americans will spend money on football this year. Over half (53%) of Americans will spend money on football this fall. The most common expenditures planned are merchandise (26%), tailgating and refreshments (23%), and tickets (19%).

- About half of those who’ll spend on football say it might lead them to debt. 48% say so, including 62% of Gen Zers. Among consumers who say they’ll go into debt, they expect to take on $576, on average.

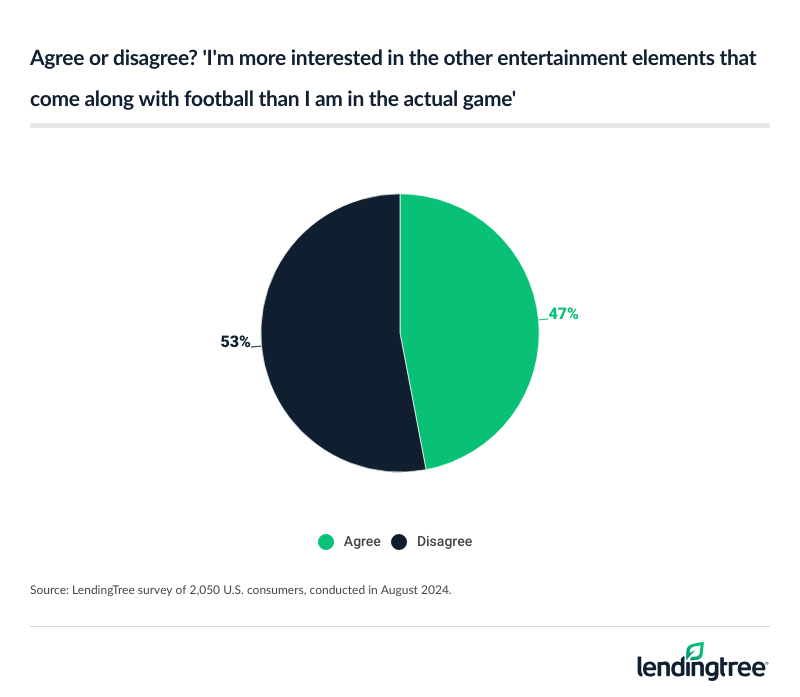

- The sport isn’t the main attraction for everyone. Almost half (47%) of Americans admit they’re more interested in the other entertainment elements (such as cheerleading, gambling and drinks) than the game. This figure is equal by gender but higher among Gen Zers at 71%.

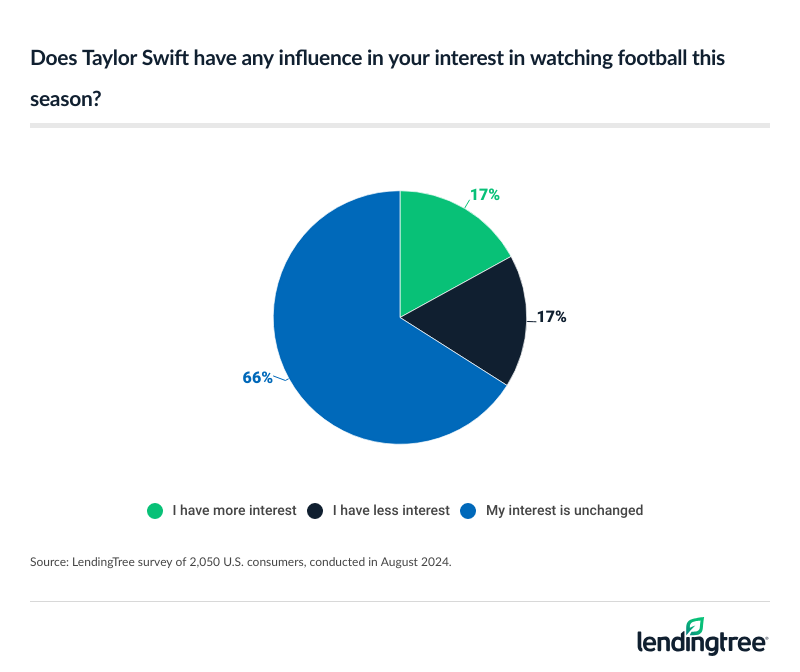

- While one artist has influenced the football world, some have bad blood with her effects. 17% of Americans have more interest in football this season due to Taylor Swift, with men (22%) more likely to agree than women (13%). In fact, 14% of Americans say they’ll spend more on football this season due to her. However, 44% say they hate what she’s done to the NFL.

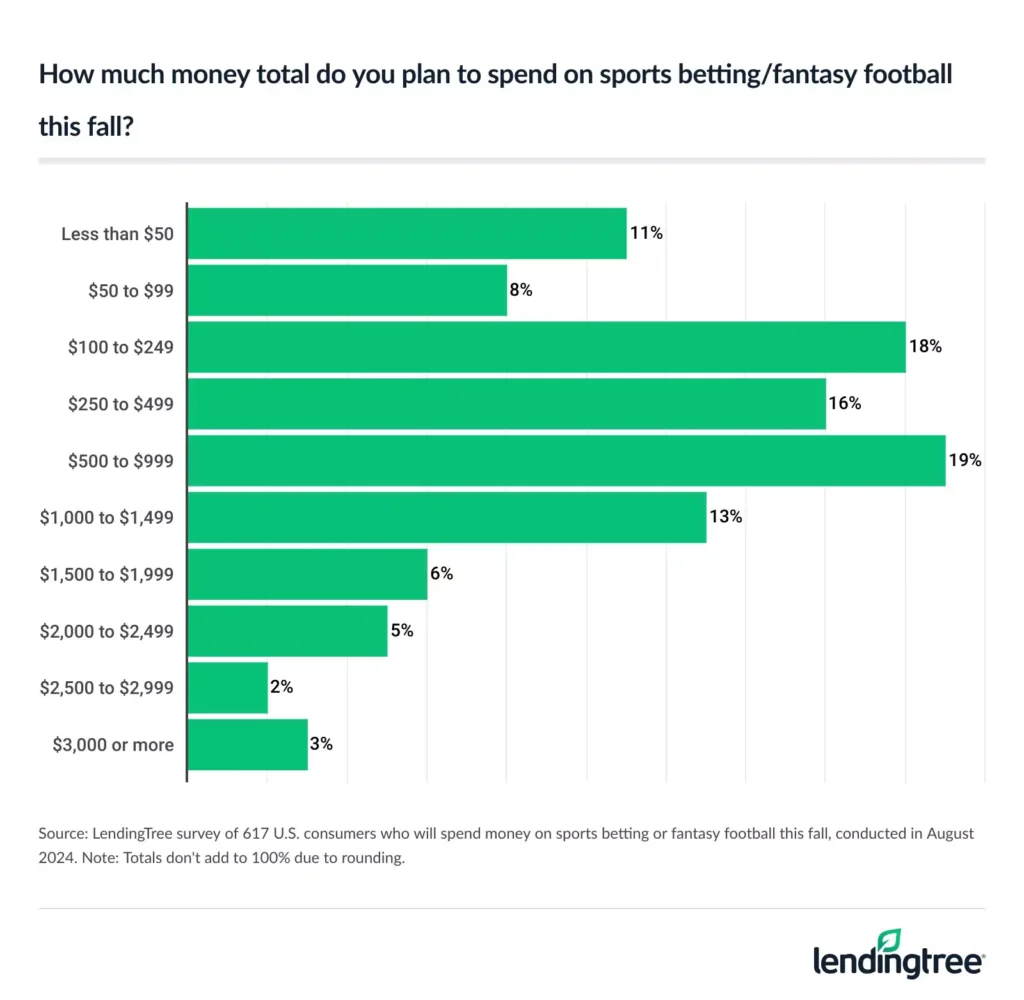

- Many expect to go big with gambling this year. 30% of Americans will spend money on betting or fantasy football this year, with men much more likely to do so than women (43% versus 18%). Additionally, 48% who plan to spend on betting or fantasy will dole out at least $500 on it this fall. However, many hope to recoup their investment, as 62% say they aren’t willing to lose that much.

Most Americans will spend money on football this fall, and many will take on debt in the process

This just in: Americans love football. They’re also willing to spend their hard-earned money on it to a big degree.

As our survey shows, many are even willing to go into debt over the game they love. Those who say they’ll take on debt this season expect to take on an average of $576. This figure is higher among millennials ages 28 to 43 ($678) and men ($633).

Younger fans are the most likely to say they may take on debt because of football spending. More than 6 in 10 (62%) Gen Zers ages 18 to 27 who plan to spend on football this fall say they may take on debt, and more than half (55%) of millennials say the same. Contrast that with just 40% of Gen Xers ages 44 to 59 and 27% of baby boomers ages 60 to 78.

Higher-income fans are more likely as well. Among those who expect to spend on football this fall, more than half of those making $50,000 or more a year say they may take on debt. That compares to less than 45% of those with lower incomes.

What’s driving this spending? Merchandise is the most common thing people say they’ll spend on, at 26% of Americans. Food, alcohol and/or tailgating is the second most common, at 23%.

Millions of Americans will spend to watch the games, too. Nearly 1 in 5 (19%) Americans say they’ll buy live game tickets, 15% say they’ll spend to travel to live games and 15% say they’ll purchase streaming packages to watch at home.

About 4 in 10 (39%) Americans expect to attend a pro or college football game this season. Of this group, 44% say they expect to drop $1,000 or more to do so.

The sport isn’t the main attraction for everyone

While millions of Americans obsess over every detail of what goes on on the field, nearly half of Americans say they’re more interested in all the things surrounding the game than the game itself.

Men and women are equally as likely to say so, while a stunning 71% of Gen Zers, 60% of parents with young children and 57% of millennials say the same.

Our question included such entertainment elements as cheerleading, food, drinks, fantasy football and betting. While we didn’t specifically ask respondents to pick which of these things drew their attention the most (or to add others we didn’t include), other parts of the survey make it clear that a few things drive intense interest.

Gambling, including fantasy sports, does. No question about it. So does a certain hit-making singer-songwriter who’s become a lightning rod among football fans in the past year.

Taylor Swift drives spending for some, but she stirs some bad blood with many

Are you ready for it, football fans? Our survey finds that 17% of Americans have more interest in watching football this season because of Taylor Swift, while an equal rate say they have less interest because of her. (The remaining 66% choose to shake it off, saying their interest is unchanged.)

Men are significantly more likely than women to say they have more interest in watching football this season because of Swift (22% of men, versus 13% of women). Younger generations are also more likely, with 25% of Gen Zers agreeing, compared with 24% of millennials, 14% of Gen Xers and 6% of boomers. However, Gen Zers are also the most likely to say Swift makes them less likely to watch football. Twenty-four percent of Gen Zers say so, versus 17% of millennials and Gen Xers and 13% of boomers.

We also asked whether respondents agree with the following: “I hate the impact that Taylor Swift has had on the NFL.” While a significant majority of Americans (56%) disagree, 44% agree. Parents of young kids (52%), Gen Zers (51%), millennials (48%) and men (46%) are among the most likely to agree.

Many expect to go big with gambling this year

While no one should ever underestimate the power and influence of Swift, our survey indicates that gambling likely holds more football sway.

Three in 10 Americans say they’ll spend money on sports betting and/or fantasy football this season. More than half of parents of young kids (51%) say they will. Men are more than twice as likely as women to say so (43% versus 18%), and millennials (45%) are the most likely age group to say so.

Spending can vary widely. Nearly half (48%) say they expect to spend at least $500 on sports betting this year, including 29% who expect to spend $1,000 or more. However, 18% plan to spend less than $100.

Three-fourths of these gamblers say they’ll spend more on betting or fantasy football than they will on supporting their real-life favorite team.

We also asked how much people are willing to lose on betting and fantasy football this fall. Again, responses vary greatly, but more than 6 in 10 bettors (62%) say their total acceptable losses would be less than $500, including 26% who say less than $100. Conversely, 5% of bettors are willing to lose $2,500 or more.

Making a game plan and communicating are key

Successful money management and football have a lot in common. Sure, it can help to be lucky, but the real magic happens when you do your homework, create a great plan and execute it — even if you need to make a few tweaks along the way.

Of course, communication is key, too. Even the best-laid plans fail if not communicated properly or if people aren’t motivated to make them work.

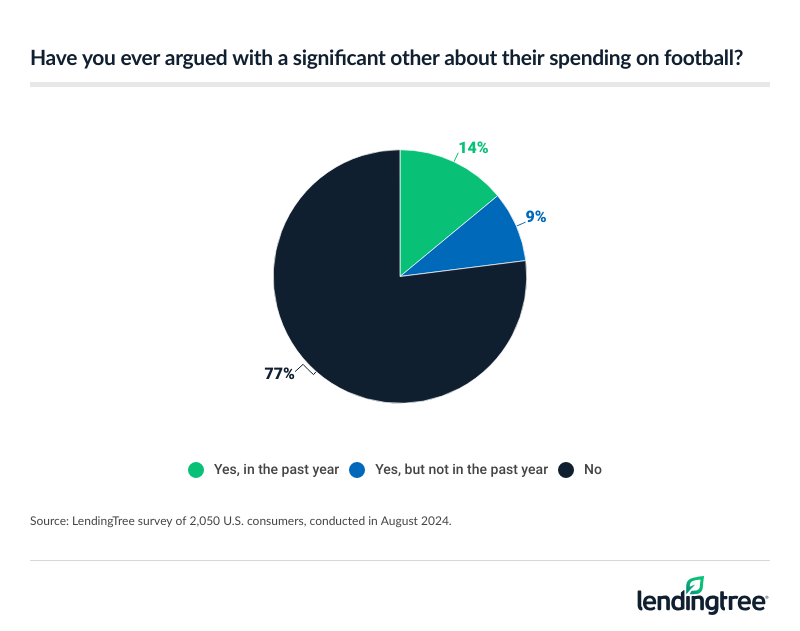

Our survey shows that many football fans are struggling with that communication. We find that nearly 1 in 4 Americans (23%) have argued with their significant other about football-related spending, including 14% who have done so in the past year.

Three in 10 men say they’ve done so, with 19% saying they have in the past year. Perhaps surprisingly, people earning $100,000 or more a year are more likely than any other income group to have fought about football spending in the past year: 21%, compared with just 9% of those making less than $50,000.

Here are a few tips to help you manage your football spending:

- Budget for it. If something is important to you and you spend a significant amount of money on it, it needs to be accounted for in your budget. That way, you can make sure your passion isn’t going to wreck your finances. Plus, when you win your fantasy league and take home that $500 prize, a budget can help you see where those winnings could be most useful.

- Consider a 0% balance transfer credit card. If you’re struggling with football-related credit card debt, reducing your interest rate should be one of your top priorities. You can do that by calling your card issuer and asking it for a lower rate — which works more often than you’d imagine. You can consider a low-interest personal loan, too. However, the best weapon against credit card debt is a 0% balance transfer credit card that can let you go up to 21 months without accruing interest on the transferred balance. You’ll need good credit, and you should be aware of the fees and other terms and conditions before applying, but it can be an absolute game-changer if you can get one of these cards.

- Talk about it. Great relationships are built on a foundation of trust and open and honest communication. You don’t have to tell your partner about every cent you spend. But if you’re spending substantial amounts of money in a risky way and not telling your significant other, that’s a recipe for disaster. How much you spend is up to you and your partner to work out. Just know that it may require a bit of compromise.

- Don’t forget about freebie leagues. While a financial windfall can be an amazing rush, bragging rights can be incredible. Consider starting a fantasy league with no money involved. You’d be amazed how much of a rush you can get when there’s nothing more on the line than the ability to hold your victory over your buddy’s head.

- Get help if you need it. Gambling addiction is real and can be devastating in myriad ways. If you or someone you love needs help, find it. It can change your life.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 78 from Aug. 1 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get debt consolidation loan offers from up to 5 lenders in minutes