Where People Work Multiple Jobs — Demographics and Metros

It’s understandable in today’s tough economy that people are juggling multiple jobs to make ends meet or pursue passions.

According to a LendingTree analysis, 5.3% of workers hold two or more jobs — a figure that rises to 9.1% in our top-ranking metro. Here’s a closer look at the demographics most likely to hold multiple jobs and where it’s most common.

Key findings

- 5.3% of workers hold two or more jobs. This rate, as of May 2025, is similar to the 5.5% six months earlier in December 2024. While the average age across workers with one job is 39, the average among those with multiple jobs is 37. These multiemployed Americans work an average of 44 hours a week, spending 13 hours at their second job.

- Consumers with a primary job in educational and health services are the most likely to hold a second one. Of those primarily employed in this industry, 7.3% work a second job as of May 2025. Transportation and utilities (6.6%) and leisure and hospitality (6.0%) follow. As for their second job, 23.8% of multiemployed workers take on a role in educational and health services, while 22.3% have it in leisure and hospitality.

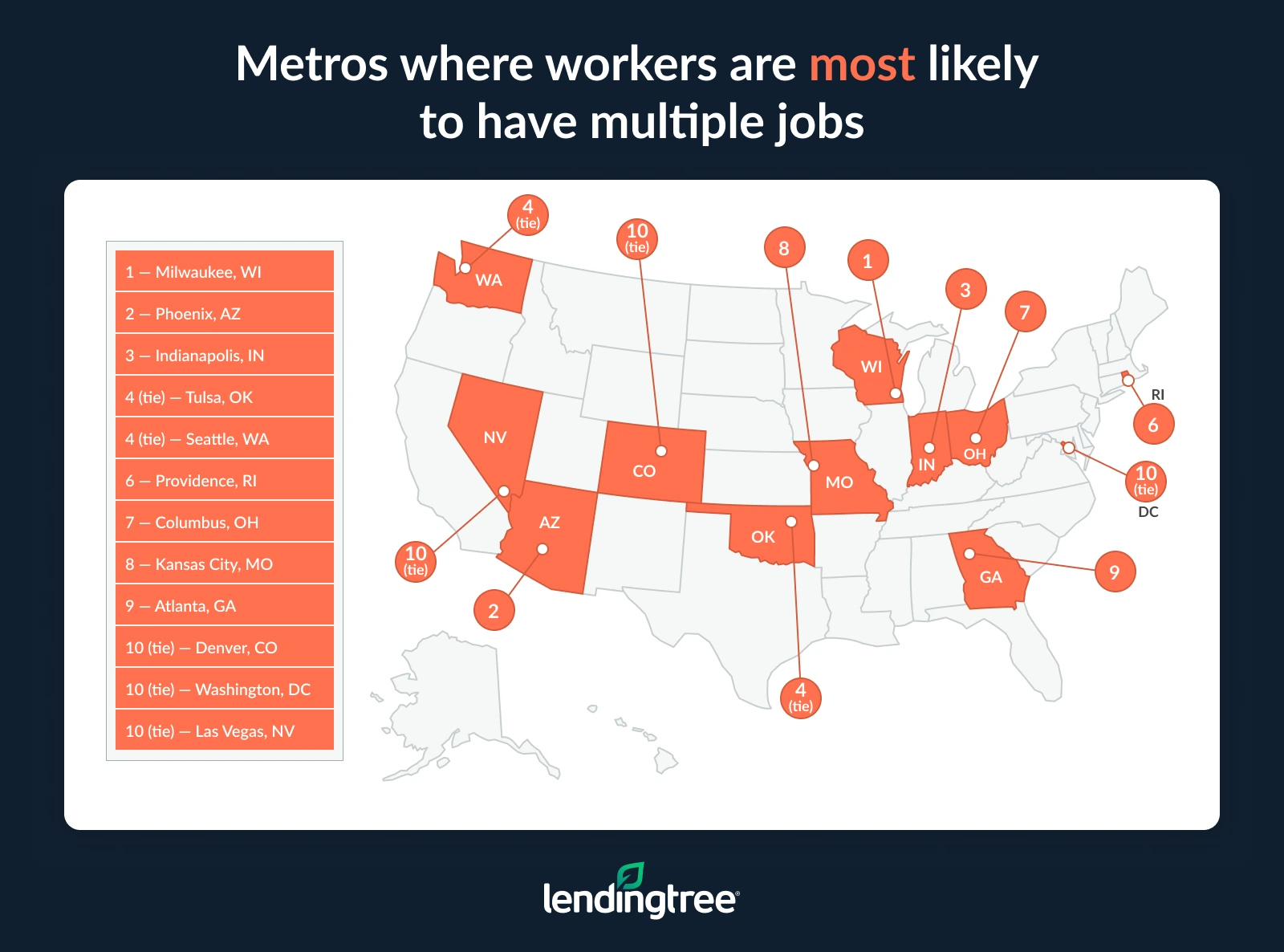

- Midwestern metros tend to have a higher share of workers juggling more than one job. Milwaukee ranks first at 9.1% based on an average from December 2024 and May 2025. There, average hourly wages are $31.18 across workers regardless of status. Of the other Midwest metros in the top 10, Indianapolis ranks third (8.7%, with average hourly wages of $30.25), Columbus, Ohio, ranks seventh (7.9% and $31.39) and Kansas City, Mo., ranks eighth (7.8% and $30.78).

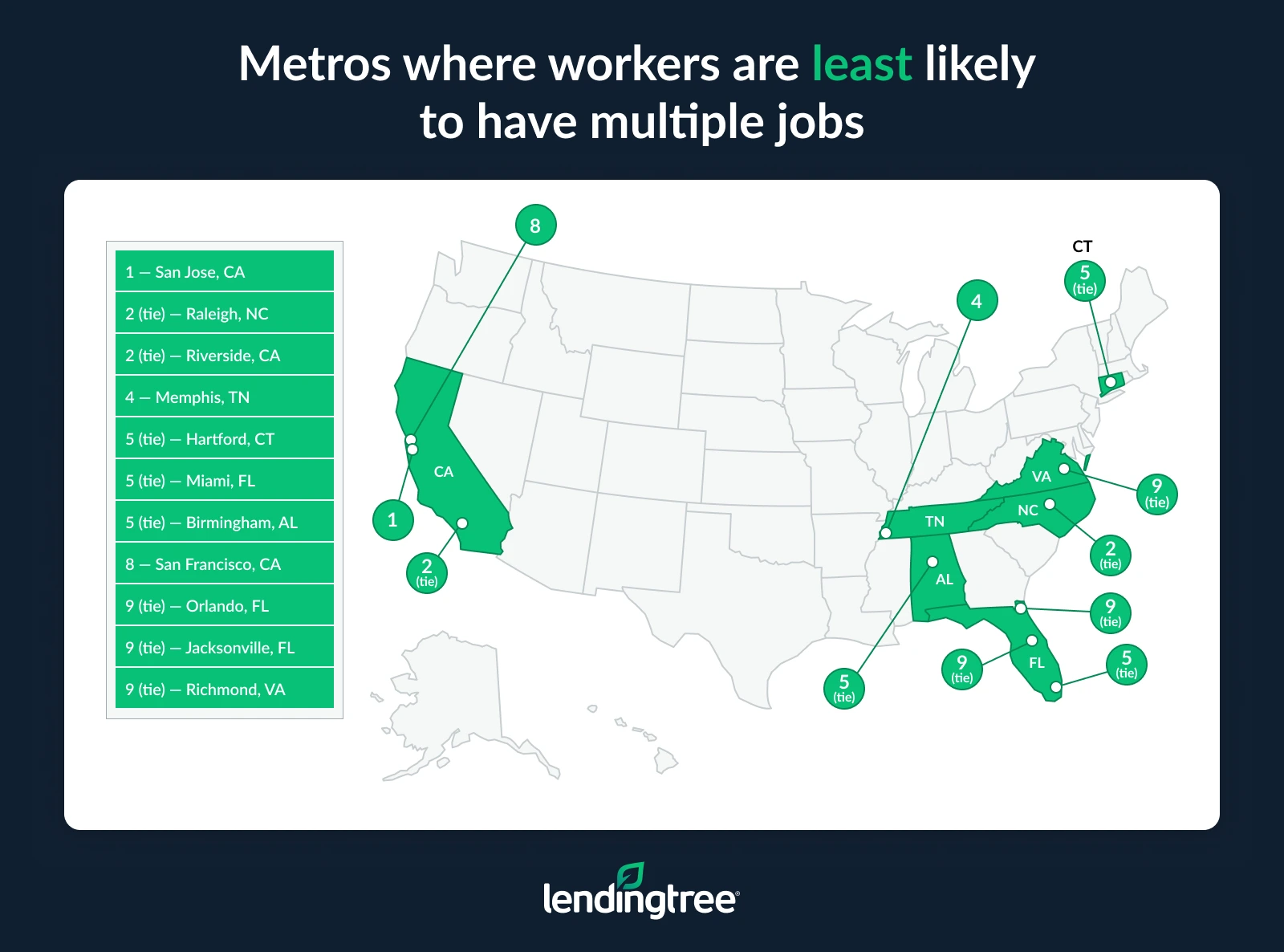

- A high-income California metro has the lowest rate of workers with multiple jobs. San Jose, Calif., ranks last, at just 1.3%. Average hourly earnings are a healthy $58.25 there. Raleigh, N.C., and Riverside, Calif., tie for second-lowest at 2.0%. The average hourly earnings in these metros are $32.70 and $30.90, respectively.

5.3% of workers have multiple jobs — here’s a demographic breakdown

Across all U.S. workers, 5.3% hold two or more jobs as of May 2025. That’s similar to the 5.5% who reported doing so in December 2024.

There are several demographic discrepancies between workers with one job and those with multiple jobs. Across workers with a single job, the average age is 39, but this figure falls to 37 among those with multiple jobs. Female workers (5.5%) are also slightly more likely to be overemployed than male workers (4.0%).

Those working multiple jobs typically earn less than those working a single job. Across multiemployed Americans, the average hourly earnings are $24.01, while the average across workers with one job is $23.46. That translates to average weekly earnings of $841.66 and $923.46, respectively.

Differences between employees who work one job and those who work multiple jobs

| Key stats | One job | Multiple jobs |

|---|---|---|

| Avg. weekly earnings | $923.46 | $841.66 |

| Avg. hourly earnings | $23.46 | $24.01 |

| Avg. age | 39 | 37 |

| Avg. total hours worked | 35 | 44 |

Notably, consumers who hold two or more jobs don’t necessarily work significantly longer. These Americans work an average of 44 hours a week (just four hours above the standard 40-hour workweek many Americans have). Of these hours, they’re spending 13 hours at their second job. Across workers with one job, the average number of hours worked is 35.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — suspects most of these people working two jobs are doing so because they need the money.

“Some may need both jobs to keep the lights on or to keep food on the table, while some may be doing it to pay off their debts, build their savings or give them some extra wiggle room in their budget,” he says. “While I’m sure some people’s second job is about chasing a dream or following a passion alongside their day job, most people likely have their second or third jobs out of necessity rather than choice.”

Educational and health service workers are most likely to be overemployed

By industry, consumers with a primary job in educational and health services are the most likely to hold a second job, at 7.3% as of May 2025. According to the Bureau of Labor Statistics, jobs in this field include teachers, nurses, home health aides and more.

Transportation and utilities (6.6%) follows, which includes jobs like truck drivers, electrical engineers and more. Leisure and hospitality (6.0%) rounds out the top three, including those with jobs like hotel desk clerks, waiters, amusement and recreation attendants, and more.

Percentage of workers with a main job in these industries who have a second job

| Industry | Percentage |

|---|---|

| Educational and health services | 7.3% |

| Transportation and utilities | 6.6% |

| Leisure and hospitality | 6.0% |

| Public administration | 5.0% |

| Other services | 4.8% |

| Financial activities | 4.6% |

| Wholesale and retail trade | 4.5% |

| Agriculture, forestry, fishing and hunting | 4.2% |

| Professional and business services | 2.7% |

| Manufacturing | 1.9% |

| Construction | 1.3% |

| Mining | 0.0% |

| Information | 0.0% |

There are several reasons why workers in these fields may be more likely to hold other jobs. Education and health service roles often come with nonstandard hours — whether that means summer breaks for teachers or three 12-hour shifts for nurses. Those hours mean workers may have more time available during the standard workweek, offering an easier path to a second job. Similarly, transportation workers often work irregular or overnight shifts.

Meanwhile, leisure and hospitality jobs are often seasonal, with many workers taking on more hours during holiday and tourist seasons and fewer hours during offseasons, which also provides some flexibility for a second job.

In addition to having schedules that may better align with a second job, roles in these industries often offer low pay or fewer hours, incentivizing workers in these fields to pursue a second role.

As for their second job, 23.8% of these multiemployed Americans take on a role in educational and health services — the most common. Leisure and hospitality (22.3%) and wholesale and retail trade (15.6%), which includes roles like selling to businesses or the general public, follow.

Industries in which workers have their second jobs, by percentage

| Industry | Percentage |

|---|---|

| Educational and health services | 23.8% |

| Leisure and hospitality | 22.3% |

| Wholesale and retail trade | 15.6% |

| Professional and business services | 14.6% |

| Other services | 7.2% |

| Transportation and utilities | 5.0% |

| Agriculture, forestry, fishing and hunting | 4.0% |

| Financial activities | 3.1% |

| Construction | 2.1% |

| Information | 1.3% |

| Manufacturing | 0.6% |

| Public administration | 0.4% |

| Mining | 0.0% |

Midwesterners are most likely to work multiple jobs

Drilling into data across the 50 metros with the largest total labor force, Midwestern metros tend to have a higher share of workers juggling more than one job.

Milwaukee ranks first at 9.1% based on an average from December 2024 and May 2025. (We combined two periods in the metro data to get a more exhaustive analysis.) Regardless of status, average hourly wages there are $31.18.

Of the other Midwest metros in the top 10:

- Indianapolis ranks third (8.7%, with average hourly wages of $30.25)

- Columbus, Ohio, ranks seventh (7.9% and $31.39)

- Kansas City, Mo., ranks eighth (7.8% and $30.78)

Despite having a higher likelihood of working multiple jobs, Midwest metros generally have lower costs of living.

Phoenix ranks second, with 8.8% of workers holding multiple jobs. Average hourly earnings there are $32.47.

California metro has the smallest percentage of overemployment

Conversely, San Jose, Calif., has the lowest percentage of workers with multiple jobs at just 1.3%. Average hourly earnings there are $58.25 — the highest across the 50 metros, and likely a reason why residents may not be inclined to hold a second job.

Despite this, the cost of living in San Jose is high. For this reason, Schulz is surprised the figure of multiemployed workers is low.

“The truth is that high-income areas are typically high-cost-of-living areas, too, meaning that your elevated income doesn’t go nearly as far as it might elsewhere,” he says. “Despite that, this report seems to indicate that people in some of these metros are getting along fine without that second job.”

High-income areas are typically high-cost-of-living areas, too, meaning that your elevated income doesn’t go nearly as far as it might elsewhere.

However, Schulz notes that high-income individuals are likely to have greater access to credit than others. “While your income doesn’t impact your credit score, it’s a key factor in determining how big of a loan you can receive,” he says. “Higher incomes often mean higher credit limits on credit cards, for example. That creates more financial flexibility for people, possibly making it less likely that they would need to take on a second job to get by. On the flip side, however, extra credit means extra risk of overspending, so it’s important to proceed with caution and discipline.”

Raleigh, N.C., and Riverside, Calif., tie for second-lowest, with just 2.0% of workers holding multiple jobs. The average hourly earnings in Raleigh are $32.70, while that figure is $30.90 in Riverside.

Full rankings: Metros where workers are most/least likely to hold multiple jobs

| Rank | Metro | % of workers with multiple jobs |

|---|---|---|

| 1 | Milwaukee, WI | 9.1% |

| 2 | Phoenix, AZ | 8.8% |

| 3 | Indianapolis, IN | 8.7% |

| 4 | Tulsa, OK | 8.1% |

| 4 | Seattle, WA | 8.1% |

| 6 | Providence, RI | 8.0% |

| 7 | Columbus, OH | 7.9% |

| 8 | Kansas City, MO | 7.8% |

| 9 | Atlanta, GA | 7.7% |

| 10 | Denver, CO | 7.3% |

| 10 | Washington DC | 7.3% |

| 10 | Las Vegas, NV | 7.3% |

| 13 | Portland, OR | 7.0% |

| 14 | Minneapolis, MN | 6.8% |

| 15 | Cleveland, OH | 6.7% |

| 16 | Salt Lake City, UT | 6.5% |

| 16 | Pittsburgh, PA | 6.5% |

| 18 | Oklahoma City, OK | 6.4% |

| 19 | Baltimore, MD | 6.3% |

| 20 | Boston, MA | 6.2% |

| 21 | Greenville, SC | 6.1% |

| 21 | Louisville, KY | 6.1% |

| 21 | Austin, TX | 6.1% |

| 24 | Chicago, IL | 5.8% |

| 25 | Dallas, TX | 5.7% |

| 26 | San Diego, CA | 5.5% |

| 26 | Charlotte, NC | 5.5% |

| 28 | St. Louis, MO | 5.3% |

| 29 | Philadelphia, PA | 5.2% |

| 30 | Sacramento, CA | 4.8% |

| 30 | Tampa, FL | 4.8% |

| 30 | Los Angeles, CA | 4.8% |

| 33 | San Antonio, TX | 4.7% |

| 34 | Cincinnati, OH | 4.5% |

| 34 | Detroit, MI | 4.5% |

| 36 | Nashville, TN | 4.3% |

| 37 | Virginia Beach, VA | 3.8% |

| 37 | New York, NY | 3.8% |

| 39 | Houston, TX | 3.6% |

| 40 | Richmond, VA | 3.3% |

| 40 | Jacksonville, FL | 3.3% |

| 40 | Orlando, FL | 3.3% |

| 43 | San Francisco, CA | 3.2% |

| 44 | Birmingham, AL | 2.8% |

| 44 | Miami, FL | 2.8% |

| 44 | Hartford, CT | 2.8% |

| 47 | Memphis, TN | 2.6% |

| 48 | Riverside, CA | 2.0% |

| 48 | Raleigh, NC | 2.0% |

| 50 | San Jose, CA | 1.3% |

Considering multiple jobs: Top expert tips

Working more than one job can open many financial doors for workers, but it’s important to know what you’re doing before you dive in. Schulz offers the following advice:

- Know your goals. “Being clear with yourself and what you’re trying to accomplish with the extra money you earn can help you answer some basic questions to aid your job search,” he says. “Do you need a part-time job with a few hours a week or do you need one where you can work as many hours as possible? Are you looking for a long-term, part-time job or a temporary or seasonal one? Do you have to work remotely? These questions and others honestly can help guide you to the best second job for you.”

- Take steps to get your debt under control. “For some, this might mean using a 0% balance transfer credit card or a low-interest personal loan to drive down your interest rates,” he says. “For others, it might mean seeking credit counseling. For others, it might mean sticking to a budget more closely. Any of these things can be a major step toward tackling your debt and potentially no longer needing that second job in the future.”

- Protect your time and energy. Burnout can creep in quickly, and no amount of extra income is worth sacrificing your physical or mental health. Working multiple jobs can take a serious toll on your health and overall well-being if you’re not careful. Take time to rest, unplug and take care of yourself, even if it’s just a quiet half hour each day.

Methodology

To estimate the number of workers holding multiple jobs, researchers analyzed U.S. Census Bureau Current Population Survey (CPS) data from May 2025 and December 2024.

We compared the total number of workers to the number of workers reporting multiple jobs. To calculate the percentage of workers with multiple jobs across the 50 metros with the largest total labor force (via the CPS), we averaged December 2024 and May 2025 data. Separately, we calculated the percentage of workers with multiple jobs across industries based solely on May 2025 data.

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles

From Being in the Military to Tending Bar, These Are the Types of Jobs and Individual Occupations With the Highest Divorce Rates

High Pay and Even Higher Home Prices: Housing Still Unaffordable for Some Who Work in High-Paying Occupations

Average Salary in US, by State, Profession, Age, Sex and More