High Pay and Even Higher Home Prices: Housing Still Unaffordable for Some Who Work in High-Paying Occupations

It’s no secret that working in a high-paying occupation can make it easier to afford big purchases like a house. This is true even in today’s real estate market, where mortgage rates are steep and home prices are at record highs in many parts of the country.

But having a high-paying job doesn’t guarantee you can easily afford a place to live. In fact, buying might still be out of reach in some places, even for high-income earners.

To look deeper at the impact of working in a high-paying occupation on a person’s ability to afford a home, LendingTree ranked the nation’s 50 largest metropolitan areas based on how affordable a mortgage would be for someone working in their metro’s highest-paying occupation group.

More specifically, we used the 28% rule to calculate an affordable monthly mortgage payment for a person who makes the median annual earnings in the occupation group with the highest median earnings in their metro. Then, we compared that figure to the mortgage payment they could expect if they purchased a median-value home in their area.

Key findings

- In 30 of the nation’s 50 largest metros, a mortgage on a median-value home is affordable to someone making the median earnings in their area’s highest-paying occupation group. While mortgages are affordable to high earners in most metros, they remain prohibitively expensive in multiple areas, including Phoenix, Seattle, Boston, Miami and Salt Lake City (to name a few).

- Those with median earnings in the highest-paying occupation groups in Cleveland, Milwaukee and Memphis, Tenn., can most easily afford a mortgage on a median-value home. In Cleveland, someone with median earnings in the area’s highest-paying occupation group (legal) could afford to spend $1,095 more each month than a mortgage on a median-value home in their area would cost them. In Milwaukee and Memphis, this mortgage payment surplus is $990 and $973, respectively.

- Three high-cost California metros — San Jose, San Francisco and San Diego — are where those with median earnings in their area’s highest-paying occupation group would have the most difficulty affording a house. In San Jose, a mortgage payment on a median-value home would cost $4,115 more each month than what someone with median earnings in the area’s highest-paying occupation group (computer and mathematical) could comfortably afford. In San Francisco and San Diego, a mortgage on a median-value home would cost $2,821 and $2,378 more than what workers in those metro’s highest-paying occupation groups could comfortably afford.

- While there’s variety among metros, certain occupation groups are more likely to be the highest-paying in a given area. Legal occupations have the highest median earnings in 19 of the nation’s 50 largest metros, while architecture and engineering occupations do in 15 metros. Further, the highest median earnings come from computer and mathematical occupations in 11 cities, followed by law enforcement occupations (three) and health diagnosing and treating practitioner occupations (two).

Metros where housing is most affordable for those in highest-paying occupation group

No. 1: Cleveland

- Occupation group with highest median earnings: Legal

- Median earnings in highest-paying occupation group: $106,253

- Median home value: $209,000

- Calculated monthly mortgage payment for median-value home: $1,384

- Affordable mortgage payment for someone with median earnings in area’s highest-paying occupation group: $2,479

- Difference between affordable monthly payment and calculated monthly mortgage payment: $1,095

No. 2: Milwaukee

- Occupation group with highest median earnings: Legal

- Median earnings in highest-paying occupation group: $120,945

- Median home value: $289,600

- Calculated monthly mortgage payment for median value home: $1,832

- Affordable mortgage payment for someone with median earnings in area’s highest-paying occupation group: $2,822

- Difference between affordable monthly payment and calculated monthly mortgage payment: $990

No. 3: Memphis, Tenn.

- Occupation group with highest median earnings: Legal

- Median earnings in highest-paying occupation group: $102,546

- Median home value: $244,100

- Calculated monthly mortgage payment for median value home: $1,420

- Affordable mortgage payment for someone with median earnings in area’s highest-paying occupation group: $2,393

- Difference between affordable monthly payment and calculated monthly mortgage payment: $973

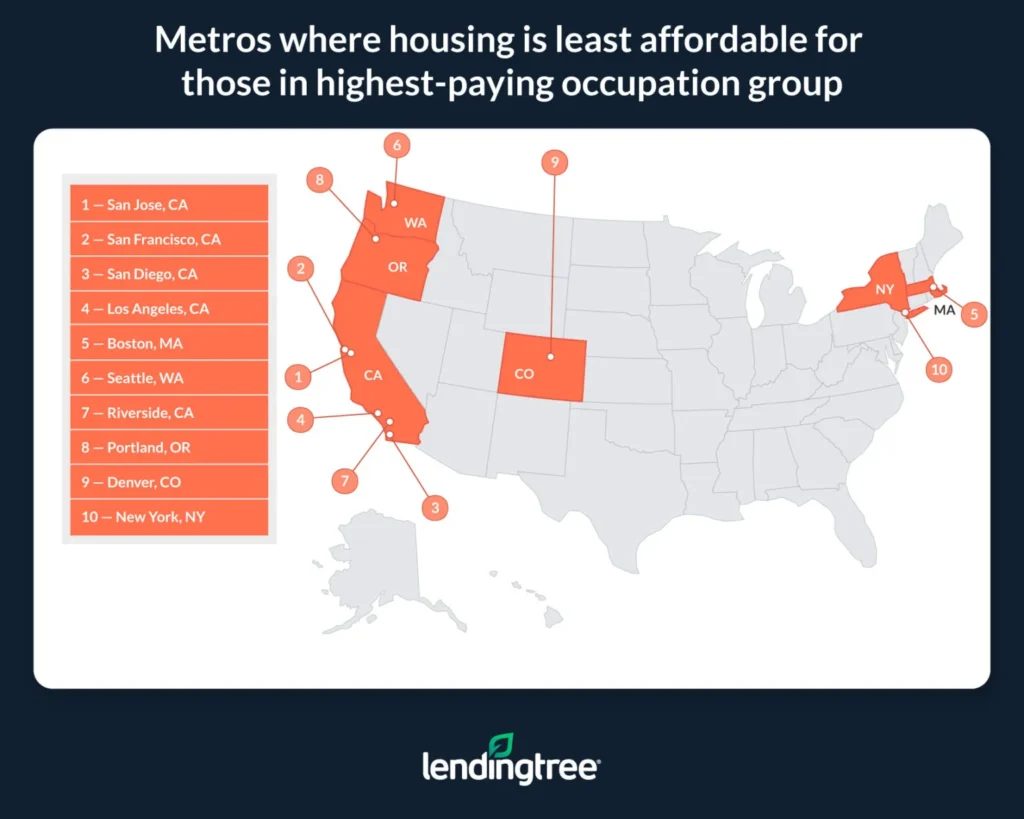

Metros where housing is least affordable for those in highest-paying occupation group

No. 1: San Jose, Calif.

- Occupation group with highest median earnings: Computer and mathematical

- Median earnings in highest-paying occupation group: $172,799

- Median home value: $1,422,600

- Calculated monthly mortgage payment for median value home: $8,147

- Affordable mortgage payment for someone with median earnings in area’s highest-paying occupation group: $4,032

- Difference between affordable monthly payment and calculated monthly mortgage payment: -$4,115

No. 2: San Francisco

- Occupation group with highest median earnings: Legal

- Median earnings in highest-paying occupation group: $162,373

- Median home value: $1,135,500

- Calculated monthly mortgage payment for median value home: $6,609

- Affordable mortgage payment for someone with median earnings in area’s highest-paying occupation group: $3,789

- Difference between affordable monthly payment and calculated monthly mortgage payment: -$2,821

No. 3: San Diego

- Occupation group with highest median earnings: Architecture and engineering

- Median earnings in highest-paying occupation group: $106,202

- Median home value: $846,600

- Calculated monthly mortgage payment for median value home: $4,856

- Affordable mortgage payment for someone with median earnings in area’s highest-paying occupation group: $2,478

- Difference between affordable monthly payment and calculated monthly mortgage payment: -$2,378

The 28% rule: How it’s useful, and why it can sometimes be bent

In this study, LendingTree calculated “affordable” mortgage payments based on the 28% rule, which suggests that borrowers should spend no more than 28% of their gross monthly income on their monthly mortgage payments.

This rule is useful because it can help homeowners keep their housing costs in check and make it easier for them to ensure they have enough money for savings and other important expenses.

That said, though it’s generally recommended, following the 28% rule isn’t the only way to successfully keep up with your mortgage payments. On the contrary: There are some instances where this rule can be bent. For example, someone who’s virtually debt-free except for their mortgage might be able to allocate more money toward housing costs, as they’ll likely have fewer other bills. Similarly, smaller households, like those without children, may be able to put more money toward their mortgages, since they’re spending less on necessities like food, clothing and health care.

Of course, just because there are circumstances where not following the 28% rule can work out for a person doesn’t mean you should cast all caution to the wind and buy a house that would eat up 90% of your earnings. (If you do, you’ll probably have a bad time.) Even if you can stretch your budget to keep up with higher mortgage costs, you shouldn’t sink all your money into your house — it could leave you financially strained and vulnerable.

At the end of the day, the rules of personal finance aren’t universal, nor are they unmalleable. As long as you’re not reckless, you may still be able to thrive financially, even if you’re spending more on a mortgage than what’s typically recommended.

Tips for reducing housing costs

Though there’s no way to completely get around today’s costly housing market, the following tips can help people save money.

- Shop around for the best possible rate. When it comes to how expensive a mortgage will be, the rate you’re offered is extremely important. By shopping around and comparing offers from different lenders, you may be able to secure a lower interest rate than what you would’ve gotten had you chosen the first lender. The lower your rate, the less money you’ll need to spend on your mortgage.

- Save for a larger down payment. Though there are some circumstances where you can get away with putting very little money toward a down payment, the more you can allocate toward one, the cheaper your mortgage will be in the long term. Higher down payments can not only help you receive a lower rate, but also help you avoid additional expenses like those associated with private mortgage insurance (PMI).

- Consider renting. Unfortunately, buying a house isn’t always the best financial choice a person can make, especially if it would require them to stretch their budget beyond its breaking point. Because it’s typically much less expensive than buying — at least in the short term — renting can help you keep your housing costs in check, while also leaving you enough money for other important expenses. Renting can also make it easier for you to save money that you can one day put toward buying a place of your own.

Methodology

Median home value and occupation group earnings data are via the U.S. Census Bureau 2022 American Community Survey with one-year estimates (the latest available). Mortgage rate data is via Freddie Mac and reflects the average rate on 30-year, fixed-rate mortgages in 2023 as of Oct. 5.

To calculate monthly mortgage payment figures, we assumed a potential buyer would put a 20% down payment toward a median home value in their area, and that they would receive a 30-year, fixed-rate mortgage with a rate of 6.66%. Included in our calculated monthly mortgage payments are property taxes — equivalent to a twelfth of a given metro’s median annual real estate taxes for homes with a mortgage as sourced from the 2022 American Community Survey.

LendingTree then calculated an “affordable” monthly mortgage payment amount based on the 28% rule. In accordance with this rule, LendingTree multiplied the median earnings for a given metro’s highest-paying occupation group by 0.28 and divided that figure by 12. In doing so, we were able to determine what an “affordable” monthly mortgage payment would be for a person whose earnings are equal to the median earnings in their metro’s highest-paying occupation group.

Occupation groups reported by the Census Bureau roughly correspond to the major groups included in the Standard Occupational Classification System, the system used by U.S. government agencies to classify job types.

Examples of specific jobs in the occupation groups referenced in our study include the following (note that the following doesn’t include every possible job within a given occupation group):

- Legal occupations: Lawyer, judicial law clerk, judge, paralegal, title examiner

- Architecture and engineer occupations: Architect, surveyor, civil engineer, mechanical engineer, chemical engineer

- Computer and mathematical occupations: Computer systems analyst, information security analyst, computer programmer, software developer, actuary, data scientist

- Law enforcement occupations: Police officer, bailiff, sheriff, correctional officer, detective, criminal investigator, commanding police officer

- Health diagnosing and treating practitioner occupations: Chiropractor, dentist, pharmacist, registered nurse, midwife, psychiatrist, dental hygienist, surgeon, acupuncturist

View mortgage loan offers from up to 5 lenders in minutes