Sharing Bank Accounts Could Lead To Fewer Fights — But Most Americans Aren’t Fully Committed

Finance is a finicky subject in relationships (particularly early on), but consumers who share bank accounts say they’re less likely to fight about money. In fact, 12% of coupled consumers who share a bank account say financial issues have caused problems in their current relationship — 25% less than the percentage among coupled consumers who don’t share an account.

LendingTree asked more than 2,000 U.S. consumers about their financial experiences with their partners — and how much they valued financial security in their relationships. Here’s what we found.

Key findings

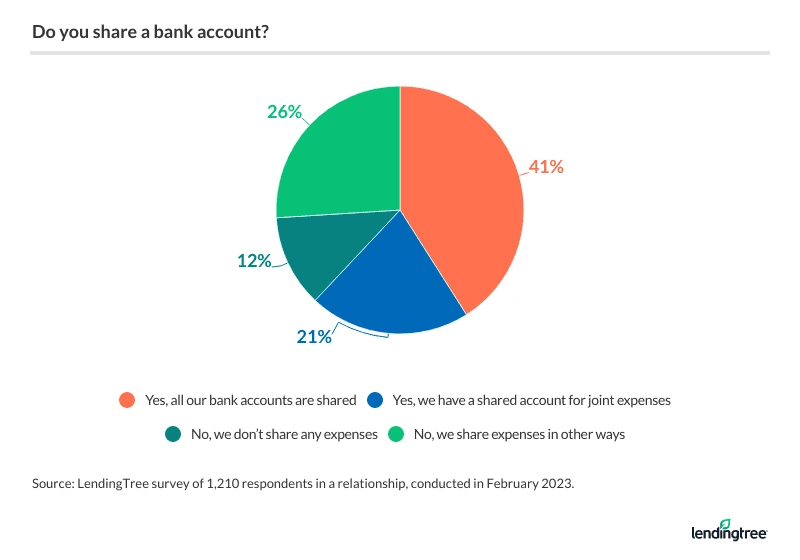

- Sharing is caring when it comes to relationships and finances. 62% of couples say they share at least one account, with 41% completely combining funds. These integrated partnerships report having fewer money issues. Of those who share at least one account, only 12% say financial issues have caused problems in their current relationship. That’s 25% less than the figure among those who don’t share accounts.

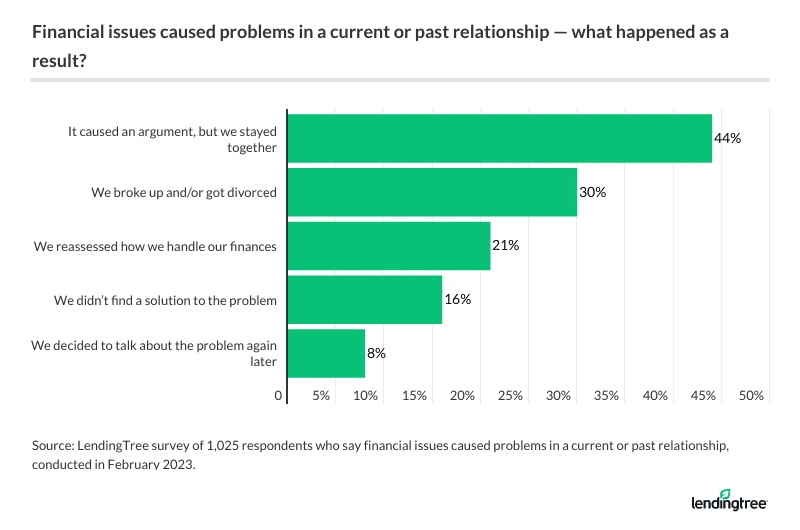

- Although arguments might be common, they’re not always a deal breaker. Of those who say financial problems have caused issues in current or past relationships, 44% say they hashed it out and stayed together. However, this isn’t the case for the 30% of people who admit to breaking up or divorcing post-money issues. These breakups are most common generationally among baby boomers, with 39% reporting financial issues spurred splits.

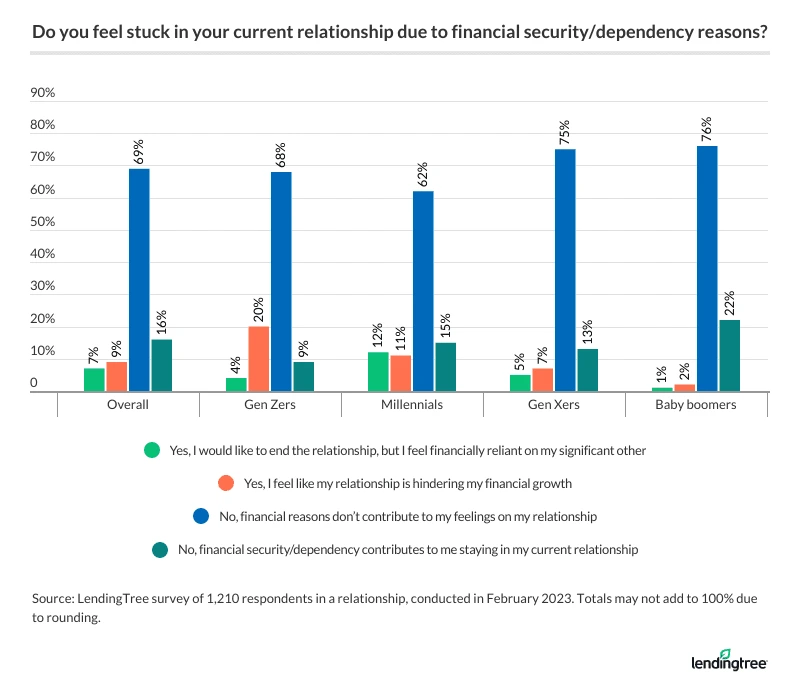

- Money doesn’t just drive people apart, as nearly a quarter of coupled Americans report staying in their current relationships due to financial dependency. 27% of millennials are staying because they’re reliant or dependent, with 12% admitting to wanting to end the relationship but feeling stuck. Baby boomers are the most likely generation to report they don’t feel stuck because of finances.

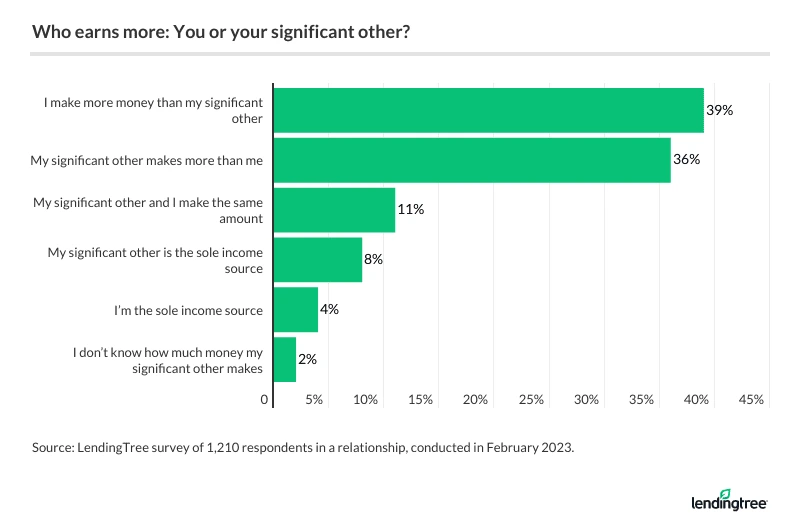

- While Americans rank trust and attraction as the most important qualities in a partner, 33% consider financial security before committing to a relationship. Although salary discussions don’t make for the best pillow talk, 98% of coupled people say they know how much their significant other makes. However, this changes by relationship type. Those in same-sex partnerships are three times more likely to report mystery surrounding incoming paychecks.

Couples who share accounts report fewer money problems

When it comes to relationships, sharing finances seems to work best — and a high number of couples do, in fact, share. Of those in relationships (whether dating or married), 62% say they share at least one bank account — with 41% completely combining funds.

By generation, older consumers are much more likely to share at least one bank account than younger consumers. Baby boomers ages 59 to 77 are the most likely to share finances, at 77%. That compares with:

- 64% of Gen Xers ages 43 to 58

- 58% of millennials ages 27 to 42

- 33% of Gen Zers ages 18 to 26

Notably, high earners are significantly more likely to split finances than low earners. While 78% of six-figure earners say they share an account with their partner, just 40% of those earning less than $35,000 annually say similarly. Same-sex partners are also less likely to share accounts than heterosexual partners, at 53% versus 63%.

Integrating finances may mean fewer financial fights. Of those who share at least one account, only 12% say financial issues have caused problems in their current relationship. That’s a quarter (25%) less than the 15% of consumers who don’t share accounts but have fought over finances in their current relationship.

According to LendingTree chief consumer finance analyst Matt Schulz, it’s understandable why sharing at least one bank account may prevent financial fights in relationships.

“Openness, honesty and transparency are crucial for a relationship’s success, and that’s certainly true when it comes to money,” he says. “By sharing an account, it gives each partner equal visibility into what’s going on in that account. That can help grow trust within the relationship.”

This comes as 51% of Americans say financial issues have caused problems in their romantic relationships. That’s particularly true for parents with children younger than 18 at 61%. That compares with 50% of parents with adult children and 43% of consumers without children.

Additionally, millennials (58%) and consumers making between $35,000 and $49,999 (56%) are also particularly likely to say finances have impacted their relationships.

Financial problems aren’t always a deal breaker

Although arguments might be common, most say it’s not enough to call it quits. Of those who say financial problems have caused issues in current or past relationships, 44% say they hashed it out and stayed together. Meanwhile, 30% broke up or divorced due to money issues and 21% say these problems made them reassess how they handle finances in their relationship.

While millennials are the most likely to fight over money, they’re also the most likely age group to tough it out. Of this generation, half (50%) of those who’ve fought over finances say they stayed together. Meanwhile, breakups and divorces are most common generationally among baby boomers, with 39% reporting financial issues caused them to split.

Certain commitments may also inspire some consumers to work out their financial problems with their partners. Married people are significantly more likely to say they stayed with their partner than those who’ve never been married — 55% versus 36%. Additionally, those with underage children (55%) are much more likely to tough it out than those with adult children (41%) or no children (35%).

Additionally, financial issues tend to strain consumers who don’t share accounts more than those who do. Of note:

- 58% of those who share at least one bank account say they stayed together after a financial argument. That compares with 47% of those who don’t share accounts but have fought about finances.

- 28% of those who share at least one bank account say they reassessed how they handle their finances, while 20% of those who don’t share accounts say similarly — meaning those who share accounts are more likely to problem solve than those who don’t share.

23% of coupled Americans are too financially dependent to leave

While money drives some couples to split, others say they’re stuck because of it. In fact, nearly a quarter (23%) of Americans in relationships say they’re staying with their current partner because they’re financially dependent on them.

According to Schulz, financial dependency can be dangerous.

“No one wants to think about their relationships ending, but the truth is that we never have any idea what life has in store for us,” he says. “Both partners, regardless of the difference in income or financial know-how, should probably at least have some involvement in managing the household’s finances. Both should also have some money of their own. You definitely shouldn’t hide that money from your partner because financial infidelity can be as devastating as any other betrayal, but you should have frank and open conversations about why you think it’s important. After all, it’s better to have an awkward conversation or two at the dinner table than to find yourself wishing you had when life throws you for a loop.”

Younger consumers are particularly likely to say they’re stuck due to finances. In fact, 27% of millennials say they’re sticking around because they’re financially dependent on their partner, with 12% admitting to wanting to end the relationship but feeling stuck. While millennials are the most likely to stay in relationships for financial reasons, Gen Zers are the most likely to say their relationship hinders their financial growth (20%).

On the other hand, baby boomers are the most likely generation to report they don’t feel stuck because of finances. More than three-quarters (76%) of this age group say finances don’t impact their feelings toward their relationship.

Beyond age groups, those with children younger than 18 (24%) are significantly more likely to feel stuck due to finances than those without children (11%) and those with children older than 18 (6%). It’s also worth noting that 13% of Americans in a same-sex relationship say their relationship is hindering their financial growth — higher than the 8% of consumers in a heterosexual relationship who say similarly.

Additionally, while sharing a bank account may contribute to fewer financial fights, consumers who split finances are more likely to feel stuck (17%) than those who don’t split finances (13%).

What, exactly, triggers a financial fight between couples? According to another LendingTree survey on financial turnoffs, couples who argue about finances tend to fight about spending decisions and savings habits. Deciding who pays for what and determining how to tackle debt are also common topics in financial fights.

33% consider financial security before committing to a relationship

While Americans rank trust and attraction as the most important qualities in a partner, 33% consider financial security before committing to a relationship and 29% say they consider financial security before marriage.

Knowing what your partner (or potential partner) brings to the table helps. The majority of coupled consumers (98%) say they know how much their significant other makes. However, those in same-sex partnerships are three times more likely to report mystery surrounding incoming paychecks — but that may boil down to a difference in priorities. Those in a heterosexual relationship are almost three times as likely as those in a same-sex relationship to say financial security is the most important quality in a partner.

With inflation on the rise, it’s worth noting that less than 5% of respondents are the sole income provider in their relationship — bucking traditional conventions.

Of all generations, Gen Zers are the most likely not to know the salary of their significant other (5%). On the other hand, baby boomers (46%) and millennials (38%) are the most likely to say they make significantly more than their partners. However, these two groups have starkly different views on financial security: Baby boomers are the most likely to say they don’t consider financial security at all when choosing a partner (41%), while just 22% of millennials say similarly.

Women are also more likely than men to consider financial security before committing to a relationship or marriage, at 60% versus 51%. The gender pay gap may play a role here: In fact, 60% of men report making significantly more money than their significant other, while just 19% of women say similarly.

With 38% of Americans ranking trust as the most important quality in a relationship, it’s worth noting that some consumers aren’t particularly transparent about money in general. Overall, 17% of respondents have hid money from a significant other and 6% have hid debt. Meanwhile, 9% say they’ve hid both from a partner.

Hiding debt may be an understandable (if questionable) impulse: According to the financial turnoffs survey, 37% of Americans say a person having a lot of debt is a financial turnoff.

Top expert tips on navigating finances in relationships

From merging finances to detangling them, navigating the financial landscape with your partner (or soon-to-be-former partner) is understandably tough. Regardless of where you are in your relationship, Schulz recommends the following tips:

- Communicate, communicate, communicate. “It’s the key to a successful relationship and it’s certainly important when it comes to money,” he says. “When you’re thinking about getting serious with someone, arrange a time to talk about money. You shouldn’t spring it on them and you shouldn’t get too nosy too quickly because they may feel ambushed, but just starting with some basic conversation about your views and experience with money can help start a dialogue that is really, really important.”

- For those reliant on a soon-to-be-former partner, a first major step toward financial independence is improving your financial literacy. “There’s so much information out there and it can be overwhelming, but learning the basics of credit and budgeting can be a great place to start,” he says. “Chances are that money is going to be really tight when you step out on your own, so understanding how to best manage your money is crucial. It all starts from there.”

Additionally, Schulz says regularly checking your credit score is important to your financial health. Even if you combine finances, he recommends having a bank account in your name to prevent financial dependency. Those opening a bank account should also consider opening a credit card in their name, though a secured card might be the needed first step for credit newbies.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,011 U.S. consumers ages 18 to 77 from Feb. 21 to 24, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes