Nearly Half of Americans Financially Support Aging Parents or Expect to — Here’s the Financial and Emotional Toll It’s Taking

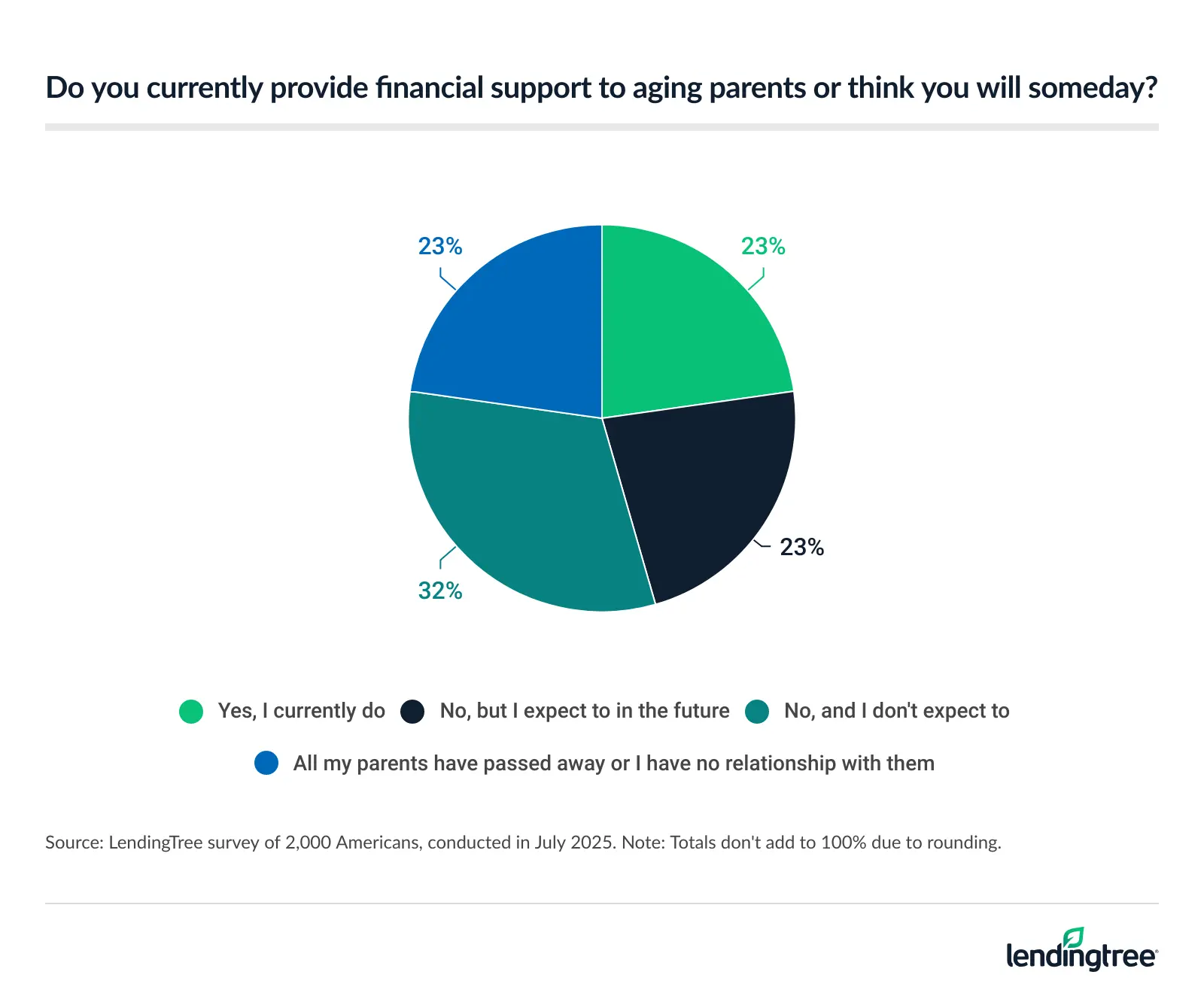

Almost 1 in 4 Americans currently provide financial support for their aging parents, their partner’s parents or both, while another 23% expect to do so in the future.

While a large majority of those who provide financial support to parents or expect to do so say it’s their responsibility, they also report that it’s taking a toll. Many say they’ve taken on debt, scaled back their work hours and made other sacrifices as a result.

Here’s what we found.

The survey’s main question was worded: “For all of the following questions, you can consider your parents, your partner’s parents or both. Do you currently provide financial support to aging parents, or do you think you’ll have to one day?”

We didn’t ask respondents to specify which parents they’re supporting or expect to support. Any references to “parents” in this report refer to any of those possible scenarios: their own parents, their partner’s parents or both.

Key findings

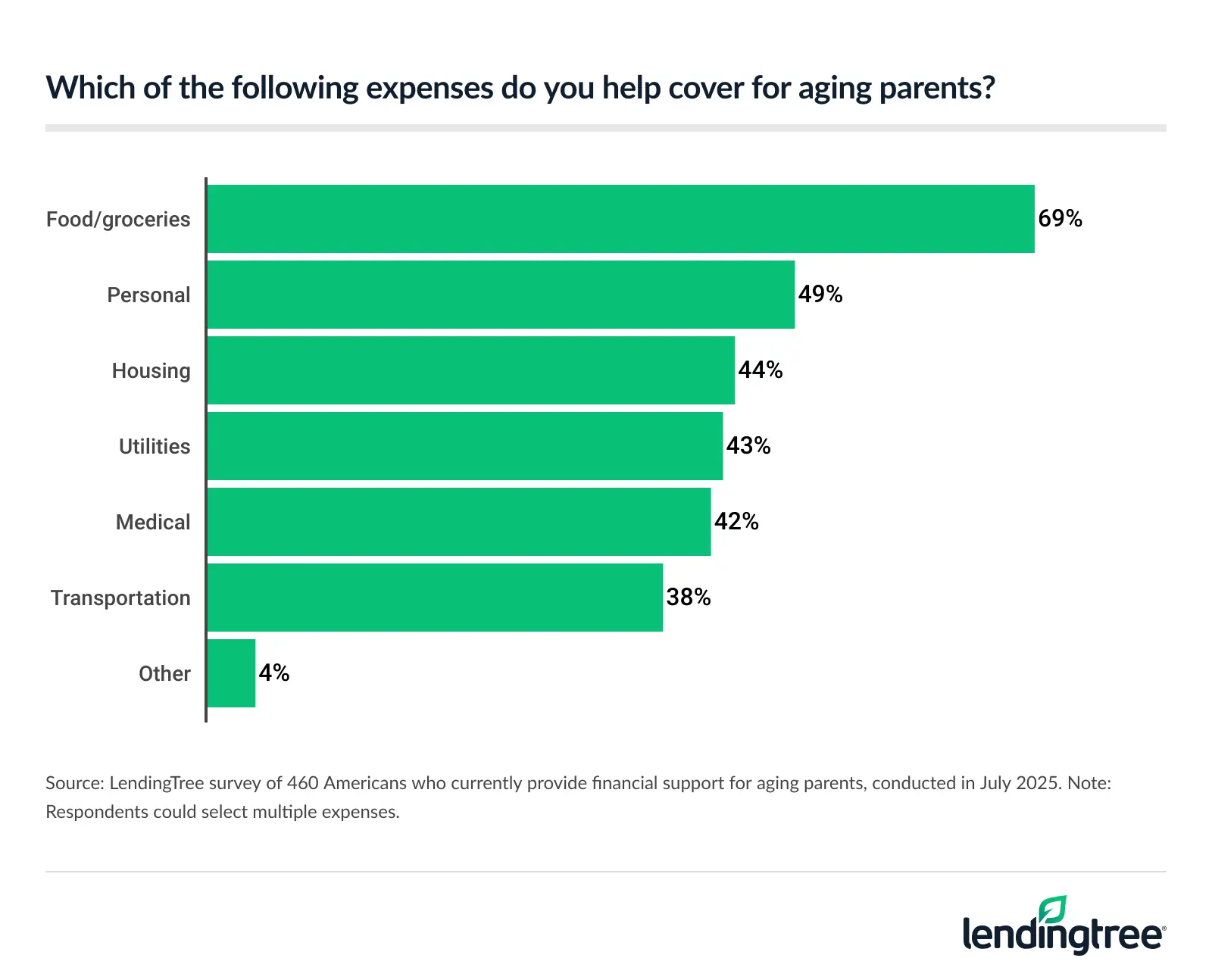

- Many Americans step up for aging parents. Nearly a quarter (23%) of Americans provide financial support to aging parents, and another 23% expect to, adding up to 46%. That includes 67% of Gen Zers and 63% of millennials. The most common expenses covered include groceries (69%), personal expenses (49%), housing (44%), utilities (43%) and medical costs (42%).

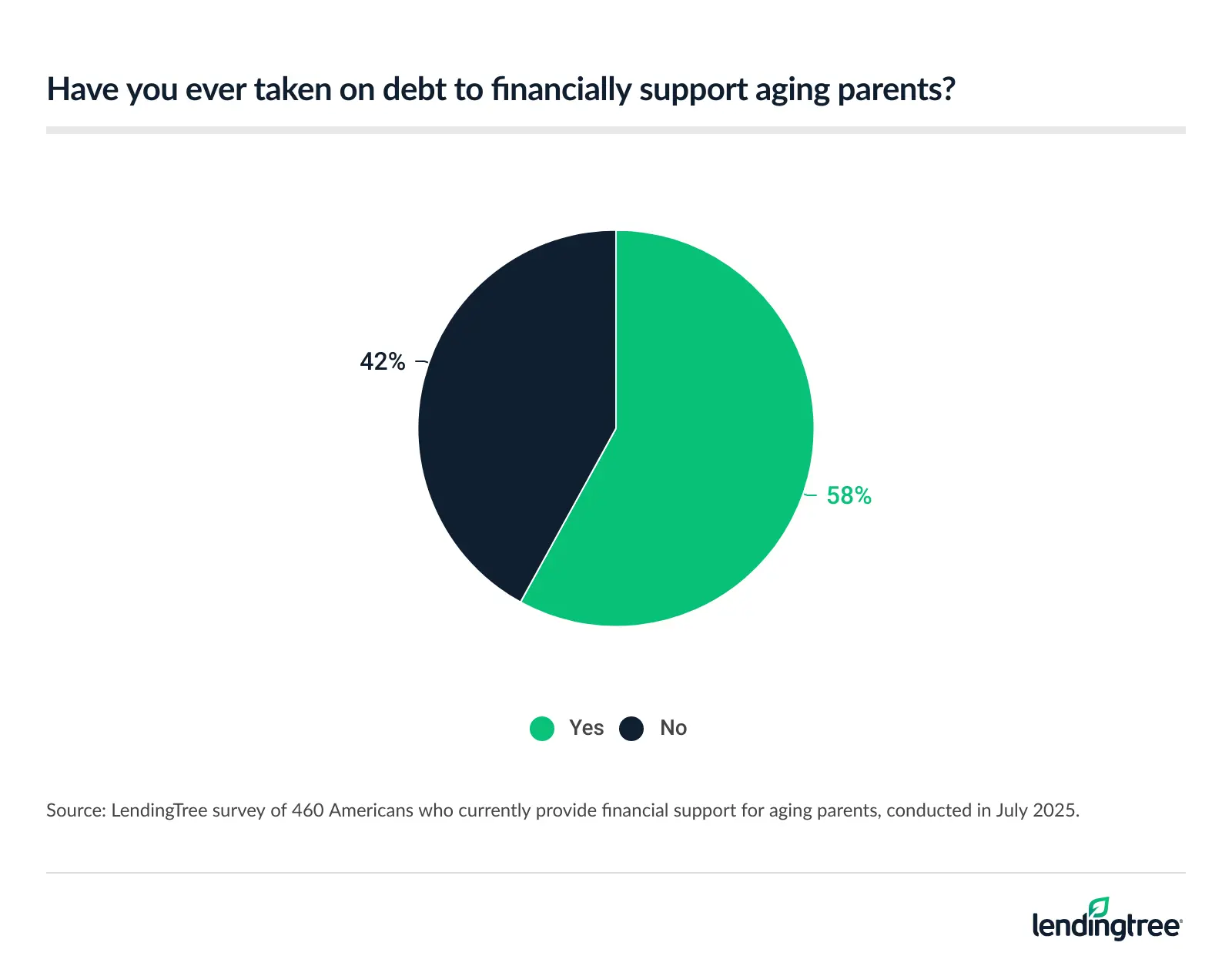

- Caring for parents comes at a financial cost — and emotional toll. Over half (58%) of Americans who financially support aging parents have incurred debt while providing help, with 53% borrowing $5,000 or more. Almost half (46%) who support admit they feel resentment toward their parents because of the financial burden.

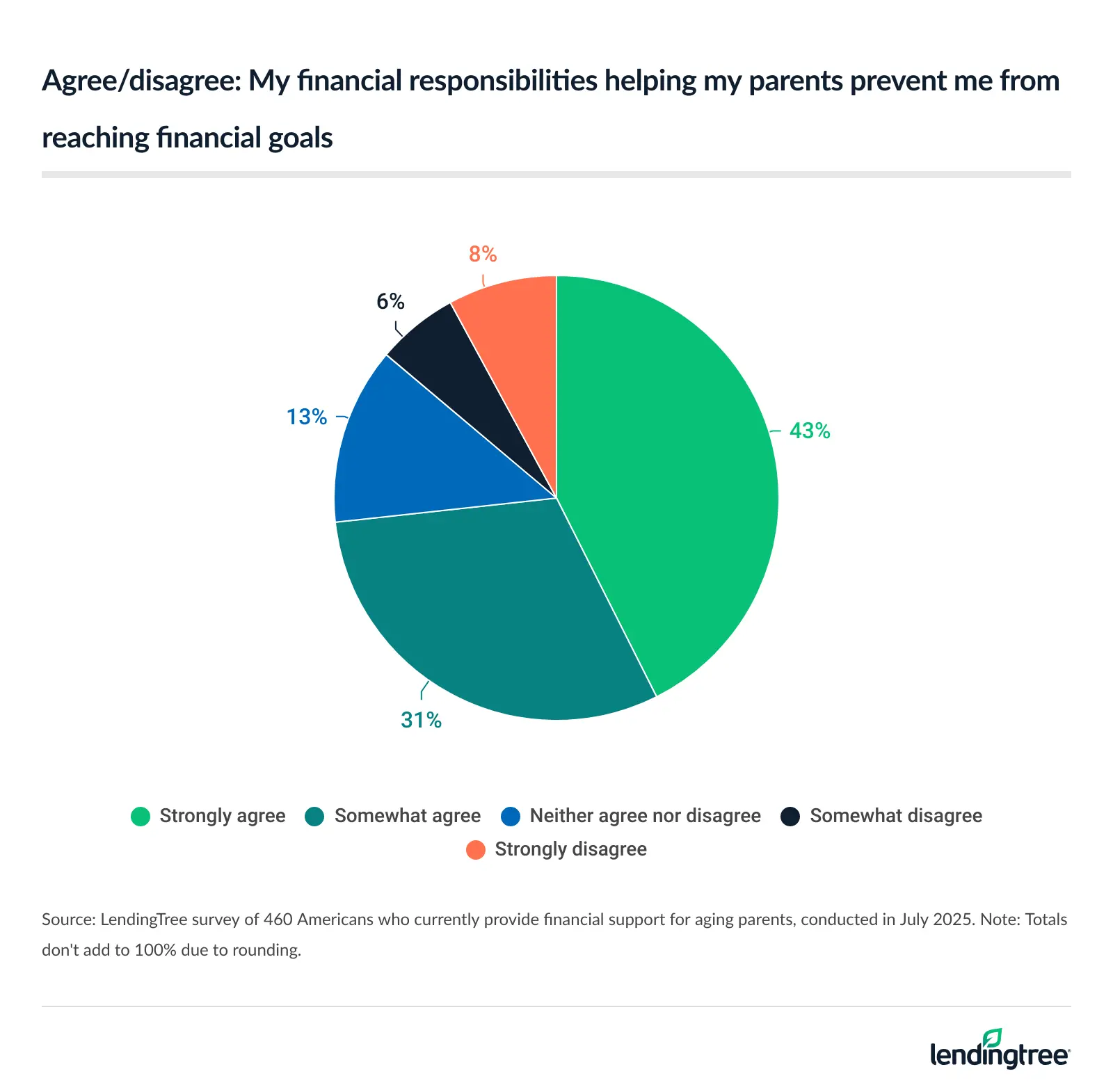

- Many caretakers aren’t reaching their goals as a result. Nearly three-quarters (74%) of those who provide support say it prevents them from achieving key financial goals, such as building an emergency fund or paying off debt. Additionally, 38% of those who provide support or expect to say they’ve reduced work hours or quit their job to take on caregiving responsibilities.

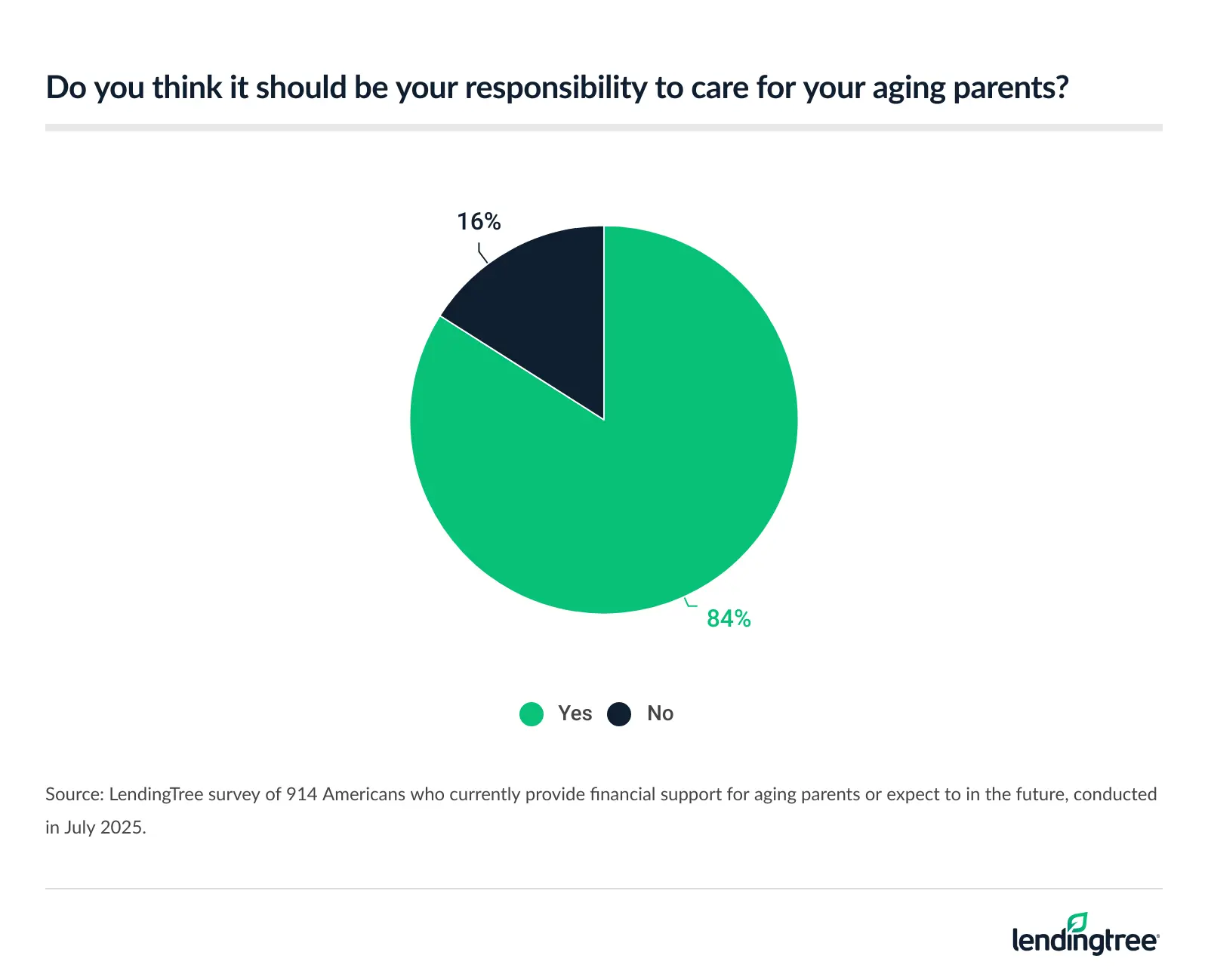

- Despite the burden, many still feel it’s their duty. A strong majority (84%) of those who financially support parents or expect to believe it’s their responsibility to do so. Gen Xers (89%) are especially likely to say so, while Gen Zers are the most hesitant, with 26% saying it’s not their responsibility.

Many Americans step up for aging parents

Nearly half of Americans provide financial support for their parents, their partner’s parents or both — or expect to in the future.

That includes a stunning 67% of Gen Zers ages 18 to 28 and 63% of millennials ages 29 to 44. Millennials are the most likely to say they’re currently providing financial support to a parent, with 35% reporting this, compared with 27% of Gen Zers and 22% of Gen Xers ages 45 to 60. Also, the higher your income, the more likely you are to say you’re currently providing financial support to a parent.

Interestingly, men are more likely than women to report that they’re currently financially supporting a parent (27% versus 19%), but women are more likely to expect to do so in the future (26% versus 19%).

Among those currently providing financial support, the most common expenses covered include:

Caring for parents comes at a financial cost — and emotional toll

It’s no secret that life is incredibly expensive in 2025. Millions of American families have very little financial wiggle room, even in the best of times. When you also have to financially support one or more parents, the situation becomes far more challenging. Given that, it may not be surprising that more than half (58%) of Americans who provide financial support for parents have gone into debt doing so.

Debt levels vary widely, but 53% have taken on $5,000 or more, including 13% who’ve taken on $25,000 or more.

For many, that financial burden is taking a toll on their relationship with those parents. Nearly half (46%) who currently support say they feel some resentment toward parents as a result. Men are significantly more likely than women to say so (52% versus 39%).

Many caretakers aren’t reaching their goals as a result

The financial burden taken on by those financially supporting aging parents goes beyond debt. About 3 in every 4 (74%) people giving financial support to parents say that doing so is keeping them from reaching some of their financial goals. Men are more likely than women to say so (77% versus 69%).

Nearly 4 in 10 people (38%) who currently financially support aging parents or expect to in the future say they or someone in their family had to quit a job or reduce their work hours because of their responsibilities to parents. Half of those making $100,000 or more a year report this, as do 48% of people with kids under 18 and 44% of men. Just 33% of women say the same.

Despite the burden, many Americans still feel it’s their duty

While the burden of supporting parents can be great, millions of Americans have taken it on for one simple reason: They believe it’s their responsibility.

The vast majority (84%) of those who financially support their parents or expect to in the future say it’s their responsibility to care for aging parents.

Among those who currently financially support parents or expect to eventually, nearly 9 in 10 Gen Xers (89%) agree, as do 86% of millennials. Gen Zers are the least likely to agree, though 74% do. The higher your income, the more likely you are to agree.

Control what you can control when it comes to your finances

To say the absolute least, supporting your aging parents can present a massive challenge — financially, physically, emotionally and in most any other way you can think of.

One of the biggest issues is that things often seem beyond your control. That lack of control can be frustrating and exhausting and can make an already difficult situation much worse.

With that in mind, one of the best things you can do to prepare yourself and your finances for the burden of financially supporting your parents is to get your own financial house in order as much as possible and as soon as possible.

Yes, I understand that’s far easier said than done. That doesn’t mean you shouldn’t try, especially if you aren’t financially supporting them yet but expect to in the future.

Here are a few things to prioritize:

- Building an emergency fund: This is always important, but rarely more so than when you’re on the cusp of a major life change, such as beginning to take on caregiver duties for a parent or stepping back from a job to look after one. Prioritizing putting some money away regularly and taking advantage of high-yield savings accounts to boost your savings can ease the burden of supporting your parents. Don’t worry if you feel like you’re not doing enough. Every little bit will matter later.

- Knocking down high-interest debt: Again, this is far easier said than done. However, it’s a crucial step in helping create as firm a financial foundation as possible so you’re as ready as you can be for whatever may lie ahead. A 0% balance transfer card can be a huge help, as can a low-interest personal loan. You can even call your card issuer and ask for a lower interest rate. It works more often than you’d think, but only if you’re willing to ask.

- Reassessing your budget: A well-made budget is a living, breathing representation of your values and priorities. As those change, your budget should, too. If your financial responsibility to your parents is growing, that money is going to have to come from somewhere. Barring a raise or a new job, that likely means tweaking your budget and making some sacrifices.

- Continuing to think long term: Your need to save for retirement and other long-term goals doesn’t disappear because you’re taking on more responsibility for your parents. It’s still especially crucial, if possible, to earmark funds for retirement. If you can’t invest at the same rate you have in recent years, make sure you’re putting enough away to take full advantage of your employer’s 401(k) match. That’s free money, after all.

It’s also crucial to understand your parents’ financial situation as deeply as possible. It may not be much fun, but having open, honest conversations with them about money is the best way to ensure you’re able to provide what they need from you. From there, it may be necessary to work with an estate planning lawyer, a certified financial planner and other professionals who are experts in dealing with issues involving older Americans and their finances.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from July 1 to 3, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get debt consolidation loan offers from up to 5 lenders in minutes