Foreign-Born Homeowners Less Likely to Live in Owner-Occupied Homes, More Likely to Be Housing Cost Burdened Than US-Born Peers

The U.S. has always been a nation of immigrants, and today tens of millions of people born outside the country reside here.

The newest LendingTree study analyzes data from the U.S. Census Bureau 2020 American Community Survey to determine which of the nation’s 50 largest metros have the highest share of homes owned and occupied by those born outside the U.S.

The Census defines “foreign-born” to include:

- Naturalized U.S. citizens

- Lawful permanent residents (immigrants)

- Temporary migrants, such as foreign students

- Humanitarian migrants, such as refugees and asylees

- Unauthorized migrants

We found that those born outside the U.S. are less likely to live in owner-occupied homes than their native-born peers and that those who are homeowners are more likely to spend an excessive amount of their monthly incomes — 30% or more — on housing costs.

Key findings

- Those born outside the U.S. make up an average of 14.25% of the population across the nation’s 50 largest metros. San Jose, Calif., Miami and Los Angeles have the largest foreign-born populations, with an average of 37.56% of residents who were born outside the U.S.

- People born outside the U.S. are less likely to live in owner-occupied homes than their native-born peers. Across the nation’s 50 largest metros, an average of 55.20% of the population born outside the U.S. live in owner-occupied housing units. For those born in the country, that figure jumps to 64.46%.

- Foreign-born homeowners are more likely to spend 30% or more of their monthly household incomes on housing costs than their native-born counterparts. An average of 26.84% of those born outside the U.S. and living in owner-occupied homes spend 30% or more of their monthly household income on housing costs, while 21.65% of those born in the U.S. do the same. It’s typically recommended that homeowners spend less than 30% of their monthly household income on housing costs to avoid becoming excessively burdened by costs.

- Despite being more likely to be cost-burdened, those born outside the U.S. own a proportional number of homes relative to their population. An average of 14.62% of owner-occupied homes across the nation’s 50 largest metros belong to those born outside the U.S. This figure is proportional to the average percentage of the foreign-born population — 14.25% — across those same metros.

- Home prices tend to be higher in areas where more homes are owned by those born outside the country. While this can impact home prices in some cases, other factors — such as how local economies function and how zoning laws are written — are more likely to have an effect.

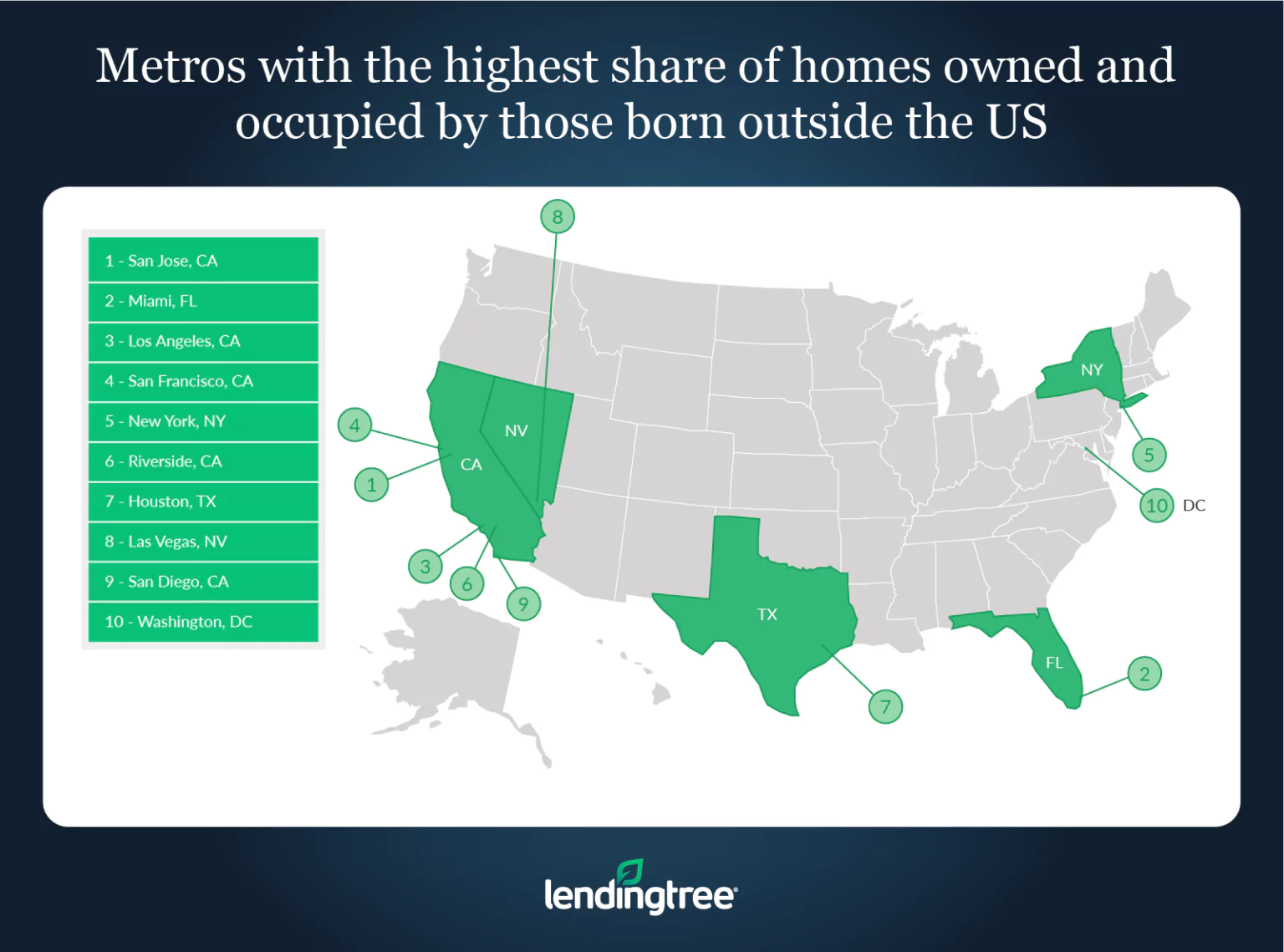

Metros with highest share of homes owned and occupied by those born outside US

No. 1: San Jose, Calif.

- % of population that’s foreign-born: 39.07%

- % of owner-occupied housing units occupied by those born outside the U.S.: 45.00%

- % of native-born population who live in owner-occupied housing units: 59.70%

- % of foreign-born population who live in owner-occupied housing units: 53.30%

- % native-born homeowners who spend 30% or more of their household income on housing costs: 28.00%

- % of foreign-born homeowners who spend 30% or more of their household income on housing costs: 28.80%

- Median home value: $1,041,800

No. 2: Miami

- % of population that’s foreign-born: 40.86%

- % of owner-occupied housing units owned by those born outside the U.S.: 43.99%

- % of native-born population who live in owner-occupied housing units: 64.50%

- % of foreign-born population who live in owner-occupied housing units: 54.80%

- % of native-born homeowners who spend 30% or more of their household income on housing costs: 29.10%

- % of foreign-born homeowners who spend 30% or more of their household income on housing costs: 37.30%

- Median home value: $298,400

No. 3: Los Angeles

- % of population that’s foreign-born: 32.74%

- % of owner-occupied housing units owned by those born outside the U.S.: 37.84%

- % of native-born population who live in owner-occupied housing units: 51.20%

- % of foreign-born population who live in owner-occupied housing units: 45.10%

- % of native-born homeowners who spend 30% or more of their household income on housing costs: 31.80%

- % of foreign-born homeowners who spend 30% or more of their household income on housing costs: 37.60%

- Median home value: $641,300

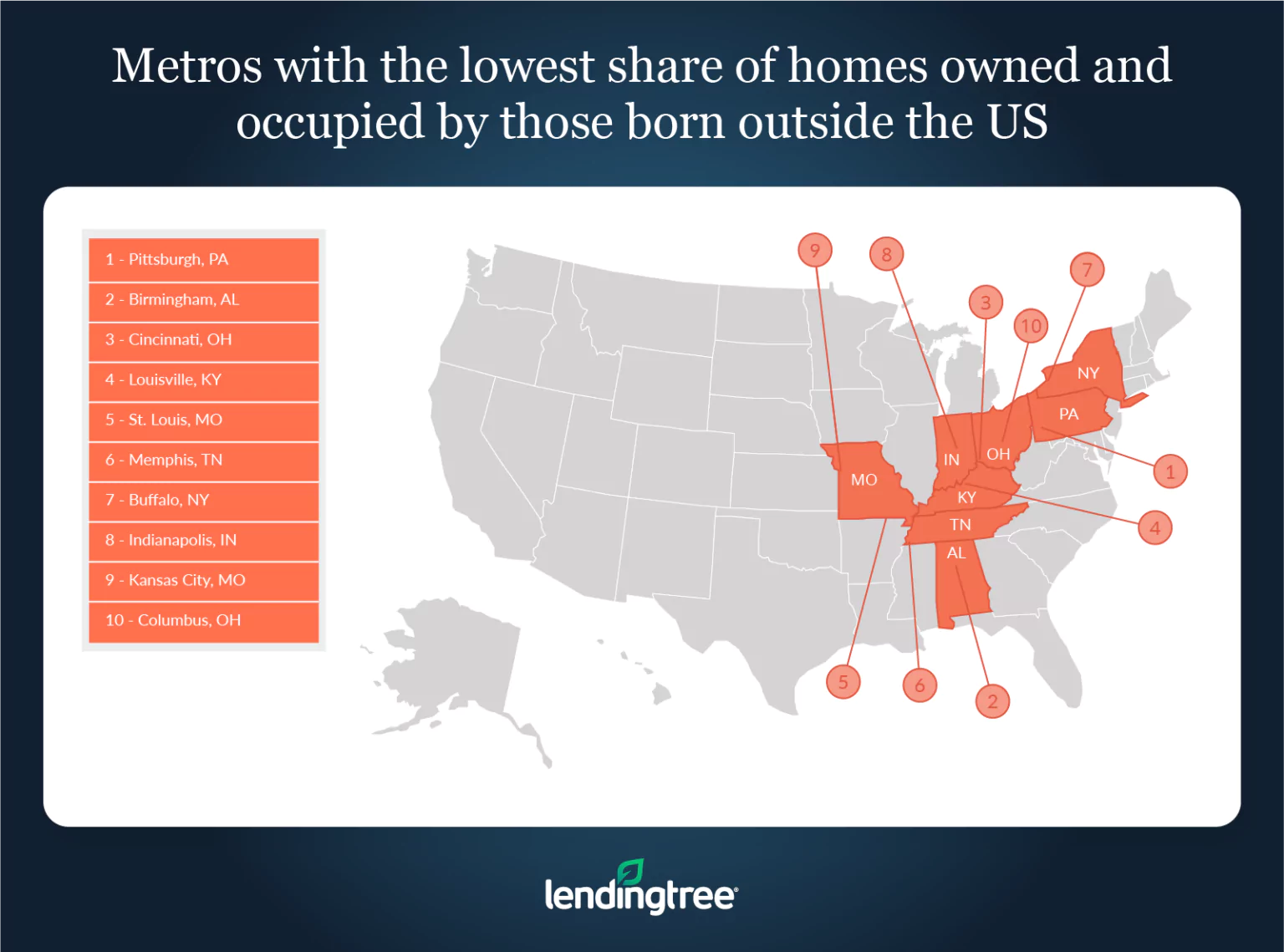

Metros with lowest share of homes owned and occupied by those born outside US

No. 1: Pittsburgh

- % of population that’s foreign-born: 4.04%

- % of owner-occupied housing units owned by those born outside the U.S.: 3.20%

- % of native-born population who live in owner-occupied housing units: 70.30%

- % of foreign-born population who live in owner-occupied housing units: 52.70%

- % of native-born homeowners who spend 30% or more of their household income on housing costs: 16.90%

- % of foreign-born homeowners who spend 30% or more of their household income on housing costs: 23.30%

- Median home value: $159,800

No. 2: Birmingham, Ala.

- % of population that’s foreign-born: 3.90%

- % of owner-occupied housing units owned by those born outside the U.S.: 3.69%

- % of native-born population who live in owner-occupied housing units: 69.60%

- % of foreign-born population who live in owner-occupied housing units: 59.80%

- % of native-born homeowners who spend 30% or more of their household income on housing costs: 18.10%

- % of foreign-born homeowners who spend 30% or more of their household income on housing costs: 21.20%

- Median home value: $171,400

No. 3: Cincinnati

- % of population that’s foreign-born: 4.96%

- % of owner-occupied housing units owned by those born outside the U.S.: 4.18%

- % of native-born population who live in owner-occupied housing units: 67.90%

- % of foreign-born population who live in owner-occupied housing units: 52.00%

- % of native-born homeowners who spend 30% or more of their household income on housing costs: 17.30%

- % of foreign-born homeowners who spend 30% or more of their household income on housing costs: 18.10%

- Median home value: $175,300

Homeownership — and stereotypes — challenging for those born outside the US

It’s not uncommon to hear someone fault foreign-born homebuyers for rising home prices. Many of those who espouse this belief argue that wealthy people from outside the country are buying large numbers of homes for investment purposes and, in doing so, drive up prices, making homes unaffordable for those born in the U.S. But as is the case with many stereotypes, this belief can diminish the struggles faced by foreign-born homebuyers and oversimplify a complicated problem.

Our findings indicate that those born outside the U.S. are more likely to be excessively burdened by housing costs and are less likely to own their homes than their native-born peers. And while there are some metros where foreign-born owners occupy a significant share of homes, the majority of owner-occupied homes in each of the nation’s largest metros are nonetheless owned by those born in the U.S. Because of this, it stands to reason that native-born homebuyers have a larger influence on an area’s housing market than those born outside the country.

Further, it’s difficult to pin down specific factors that drive up home prices, especially in highly populated, economically and socially diverse areas. While foreign investors can push prices higher in some instances, factors including the strength of an area’s economy or whether new home construction projects are being completed likely play an even larger role.

Ultimately, there’s not enough evidence to indicate that foreign-born buyers share a disproportionately large amount of responsibility for the current state of the country’s housing market. In fact, the data indicates that many of those born outside the country may have a more difficult time navigating today’s market than those born in the U.S.

Tips for foreign-born homebuyers

Buying a house can be challenging for anyone, but it can be especially daunting if you’re someone who was born outside the country and may have a more limited knowledge of how the U.S. homebuying process typically works.

With that in mind, here are three tips that can help foreign-born buyers make home purchasing less of a challenge:

- Understand what you’ll need in the U.S. Depending on how long you’ve been in the country, you may not be aware of all the things that lenders in the U.S. will typically ask to see from prospective buyers — including a credit score. By familiarizing yourself with the minimum requirements to get a mortgage and learning about other common phrases — such as debt-to-income ratios — you can better prepare yourself for the homebuying experience. If you’ve never purchased a home before, you can also look for programs designed to help first-time homebuyers more easily obtain a mortgage.

- Shop around for a mortgage. Shopping around for a mortgage before buying a home can help borrowers find a better mortgage rate and, in turn, lower their monthly payments. Because foreign-born buyers are more likely to be housing cost burdened than those born in the U.S., getting a lower rate could be especially beneficial.

- Remember that you can’t be turned down solely because you’re foreign-born. The Fair Housing Act of 1968 makes it illegal for somebody to be denied the opportunity to purchase or rent a home because of their national origin. If you’re told you can’t buy a home because you were born outside the U.S., contact your local housing authority or the U.S. Department of Housing and Urban Development (HUD) to see what legal options may be available.

Methodology

Data in this study is derived at the metropolitan statistical area (“MSA”) level from the U.S. Census Bureau 2020 American Community Survey with experimental five-year estimates — the latest available when this study was written.

This study specifically looks at foreign-based homeowners. The Census defines foreign-born as naturalized U.S. citizens, lawful permanent residents, temporary migrants, humanitarian migrants and unauthorized migrants. People born in Puerto Rico or a U.S. island area (U.S. Virgin Islands, Guam, American Samoa and the Northern Mariana Islands) or abroad to a U.S. citizen are considered native-born.

View mortgage loan offers from up to 5 lenders in minutes