Average Down Payments on Homes Across 50 Largest US Metros Top $84,000

Despite high mortgage rates and low buyer demand, home prices are still at record highs in many parts of the country. And they don’t seem like they’ll significantly drop anytime soon.

A side effect of high prices is high down payments, which can be substantial even in areas not known for expensive real estate. To examine high down payments, LendingTree analyzed data from more than 580,000 users of our platform who lived in one of the nation’s 50 largest metropolitan areas and were offered a 30-year, fixed-rate mortgage with a down payment greater than zero from Jan. 1 through Sept. 30, 2023.

We found that average down payments in the nation’s 50 largest metros top at least $47,900 but jump to more than $200,000 in some especially expensive parts of the country.

Key findings

- A down payment on a home across the nation’s 50 largest metros averages $84,499. That’s similar to an average of $84,983 over the same period in 2022. While down payments can vary significantly by location, no metro in this year’s study has an average of less than $47,900.

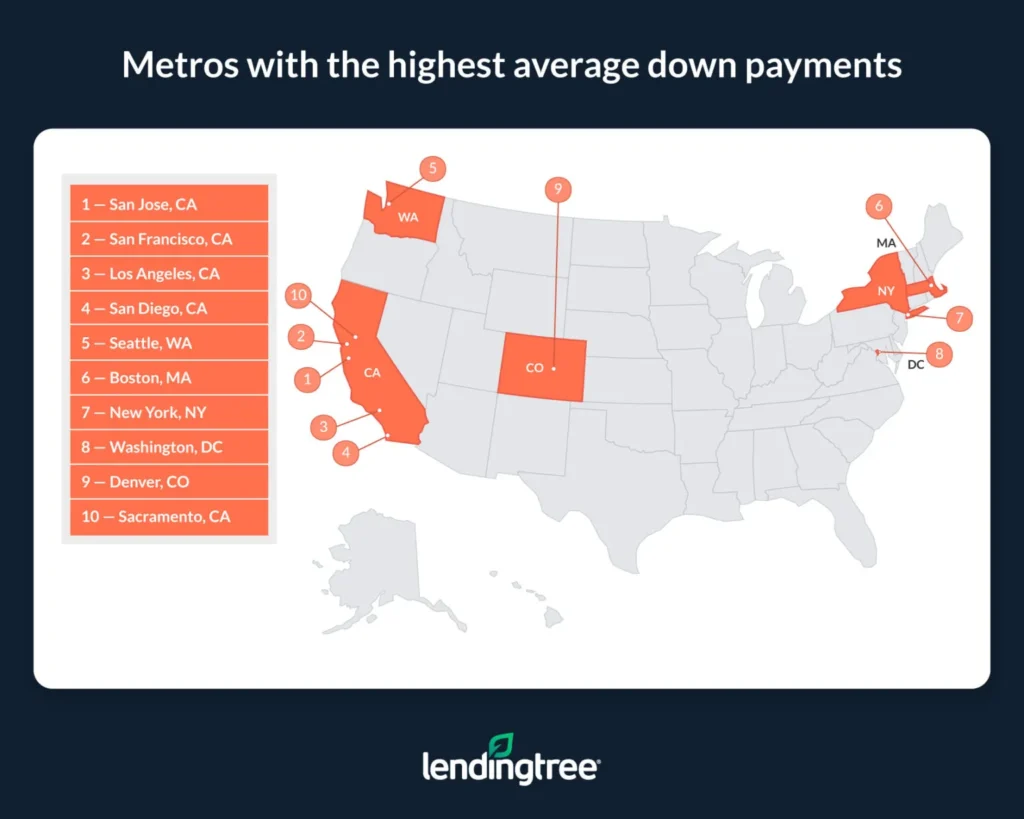

- California is home to the three metros where down payments are highest — San Jose, Calif., San Francisco and Los Angeles. The average down payments in San Jose and San Francisco are $237,600 and $228,951, respectively — making the two tech hubs the only in our study where down payments top $200,000. While not quite as steep, the average down payment in Los Angeles is still high at $157,557.

- Average down payments are higher than $100,000 in 10 metros. Apart from the previously mentioned California metros, San Diego, Seattle, Boston, New York, Washington, D.C., Denver and Sacramento, Calif., all have six-figure average down payments.

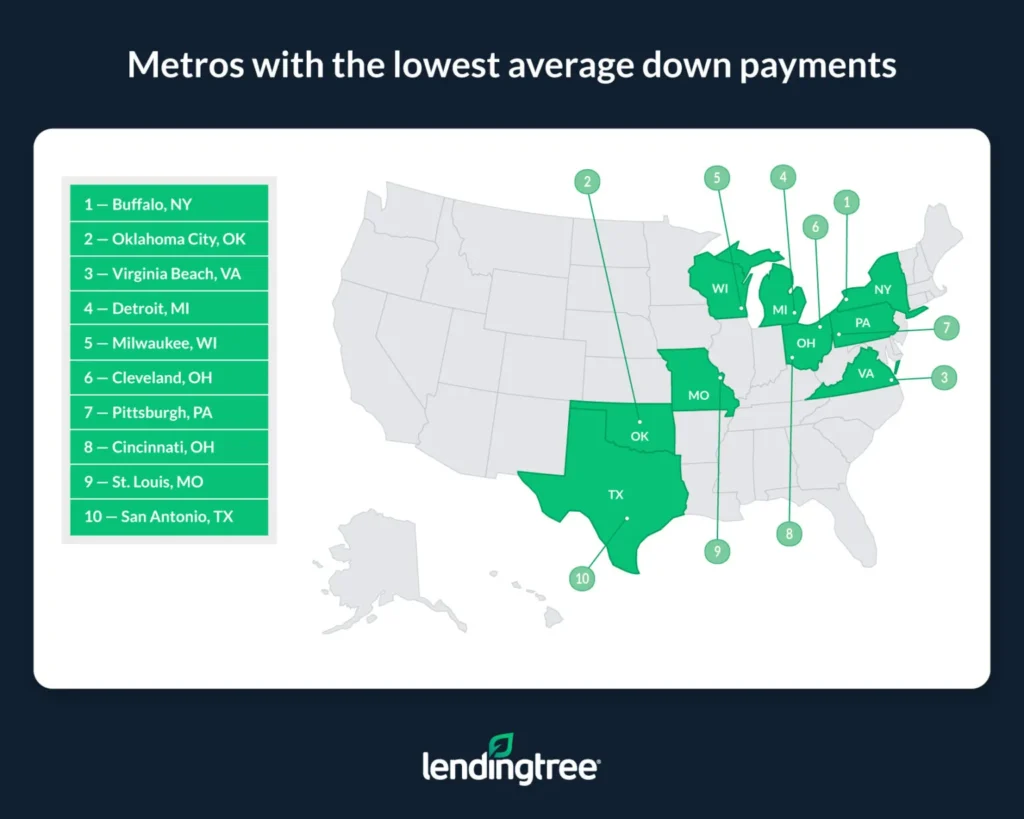

- Buffalo, N.Y., Oklahoma City and Virginia Beach, Va., have the lowest average down payments. Down payments in these metros average $47,976, $49,713 and $52,858, respectively.

- An average down payment on a home across the nation’s 50 largest metros equates to 71.48% of that area’s average annual household income. While there are likely exceptions — like instances where people rely on profits from a past home sale to pay for a down payment on a new place — this figure suggests saving for a down payment is going to be, if nothing else, a time-consuming endeavor in most areas.

- Down payments are the most affordable relative to income in Minneapolis, Buffalo and Virginia Beach. Across these metros, the average down payment is worth 50.96%, 51.97% and 53.40% — respectively — of a given area’s average annual household income.

- Down payments in Los Angeles, San Francisco, San Jose and San Diego are least affordable relative to income. Average down payments in these metros are all higher than their area’s average annual household incomes. An average down payment in these areas is worth 119% of their average annual household income.

Metros with the highest average down payments

No. 1: San Jose, Calif.

- Average down payment: $237,600

- Average annual household income: $210,290

- Average down payment as a percentage of average household income: 112.99%

No. 2: San Francisco

- Average down payment: $228,951

- Average annual household income: $184,370

- Average down payment as a percentage of average household income: 124.18%

No. 3: Los Angeles

- Average down payment: $157,557

- Average annual household income: $126,725

- Average down payment as a percentage of average household income: 124.33%

Metros with the lowest average down payments

No. 1: Buffalo, N.Y.

- Average down payment: $47,976

- Average annual household income: $92,319

- Average down payment as a percentage of average household income: 51.97%

No. 2: Oklahoma City

- Average down payment: $49,713

- Average annual household income: $91,696

- Average down payment as a percentage of average household income: 54.22%

No. 3: Virginia Beach, Va.

- Average down payment: $52,858

- Average annual household income: $98,994

- Average down payment as a percentage of average household income: 53.40%

What high down payments can mean for homebuyers

Regardless of whether a would-be buyer owns or rents, needing to come up with a lot of cash for a down payment can make the homebuying process more difficult and time-consuming.

Some homeowners might have to allocate more of the profit they made selling their house toward a down payment on a new home than they would have liked. Other homeowners may need to stay in their place longer while they save for a down payment on a new house. In that same vein, those who want to transition from renter to owner could be stuck renting for quite a while as they save the cash necessary to buy a home of their own.

Moreover, some would-be buyers whose savings aren’t cutting it may have to seek additional down payment assistance from places like family or friends.

That said, not everyone will struggle to come up with a down payment, and there are plenty of instances where putting more money down on a house can be more helpful than not. For instance, the more a person can put down on a home, the more likely they are to get approved for a mortgage and/or be offered a lower interest rate. Higher down payments can also be more attractive to sellers, especially in competitive real estate markets.

Coming up with a down payment isn’t always going to be a walk in the park, and doing so could be challenging and involve jumping through more hoops than buyers might realize. Nonetheless, down payments are important. Even if a large one isn’t always necessary or possible, the more you can put down on a house, the more benefits you’ll likely see.

Tips for coming up with a down payment

As our study makes clear, a down payment on a home can be costly — even in areas not known for high home prices. While this can challenge many homebuyers, the good news is there are ways to make coming up with enough money for a down payment a little bit easier. Here are three tips for coming up with a down payment:

- Save, save, save. Generally, the more time you give yourself to save for a down payment, the better. Of course, saving can be difficult, especially with high inflation. But doing things like eating out less often or taking fewer vacations could help you build up a significant amount of money over time.

- Consider different loan options. While a 20% down payment may be ideal, various loan options require less upfront cash. For example, Federal Housing Administration (FHA) loans require a down payment of as low as 3.5%. Keep in mind, however, that while finding a way to reduce a down payment can make it easier for someone to purchase a home, a smaller down payment will result in a higher mortgage amount and potentially even a higher interest rate. That means that a homebuyer’s monthly payments could be more expensive.

- Look into down payment assistance programs. In some instances, you may qualify for help from a down payment assistance program. These programs can provide grant money or discounts that make a down payment more affordable.

Methodology

LendingTree analyzed data from the nation’s 50 largest metropolitan statistical areas (MSAs) to determine the average down payment in each metro. This data is derived from just over 580,000 30-year, fixed-rate mortgages with down payment amounts above zero offered to LendingTree users from Jan. 1, 2023, through Sept. 30, 2023.

Average annual household income data comes from the U.S. Census Bureau 2022 American Community Survey with one-year estimates — the latest available.

View mortgage loan offers from up to 5 lenders in minutes

Read more

Can You Buy a House With No Money Down? Updated September 22, 2023 Buying a house with no money down is possible but, if you don’t qualify, you…Read more

Down Payment Assistance Programs: What They Are and How To Get Them Updated October 5, 2023 Learn how a down payment assistance program could help if you don’t have enough cash…Read more