Nearly 80% of Gen Z Homeowners Had Down Payment Help — Mostly From Family

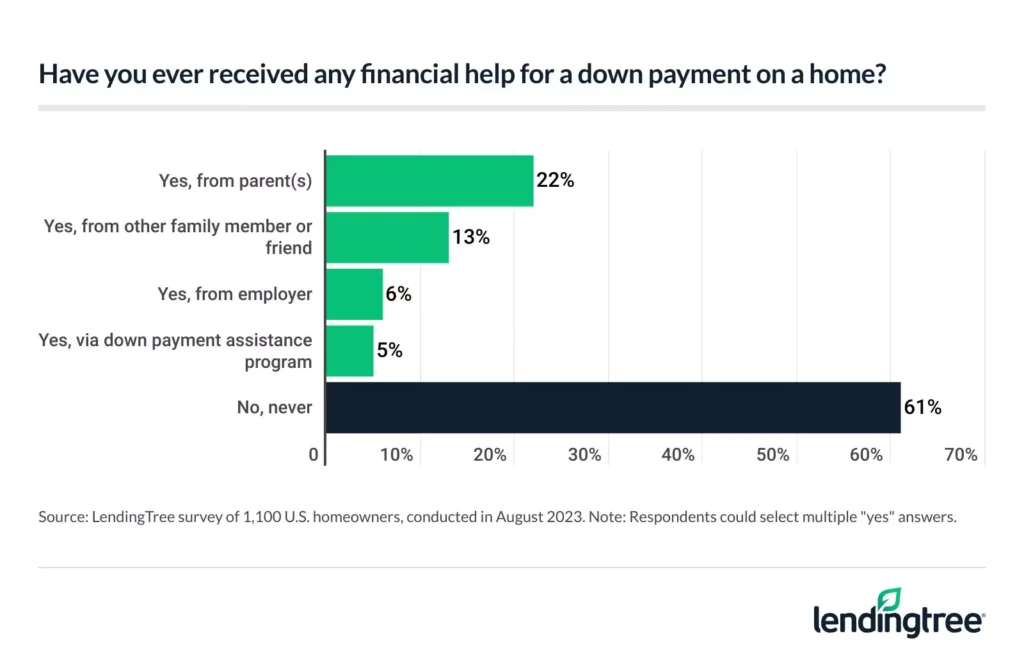

With high housing costs and homeownership feeling further out of reach, receiving help from family and friends for that crucial down payment can be a major turning point for many consumers. In fact, nearly 2 in 5 homeowners (39%) have received down payment assistance, according to the latest LendingTree survey of nearly 2,000 U.S. consumers.

Here’s what else we found.

Key findings

- Saving for a down payment can take years — but receiving help from the bank of Mom and Dad can speed up that process. 39% of homeowners have received down payment assistance, with help from parents leading the way. This is most common among younger Americans: 78% of Gen Z homeowners report some financial support for a down payment, mostly from their parents. In addition, 54% of millennials have received down payment help, followed by 33% of Gen Xers.

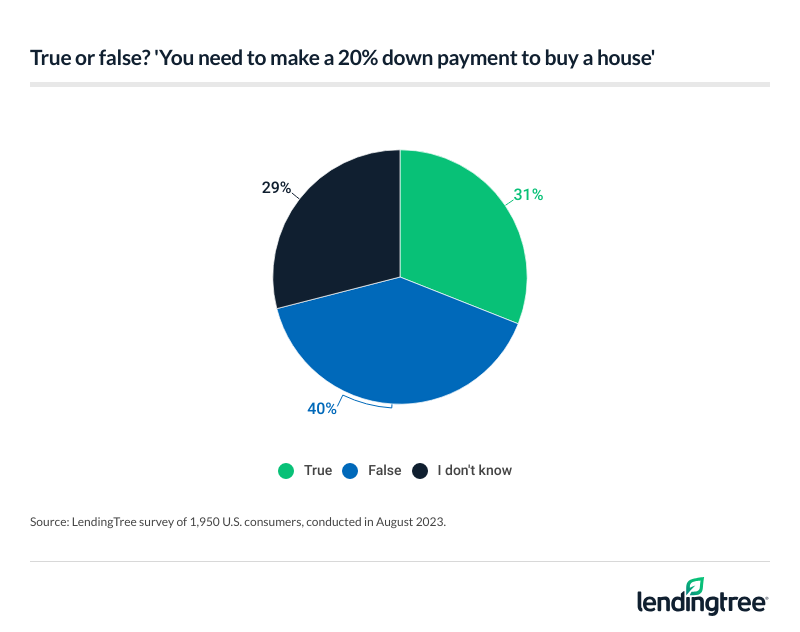

- The 20% down payment requirement is a common misconception among Americans. Almost a third (31%) of Americans think putting down 20% for a down payment is obligatory. However, 59% of current homeowners who have or have had a mortgage say their down payments were less than 20% of the home’s purchase price, and just 29% put down 20% or more. Older mortgage holders are more likely to pony up for their down payment, with 40% of these baby boomers putting down 20% or more.

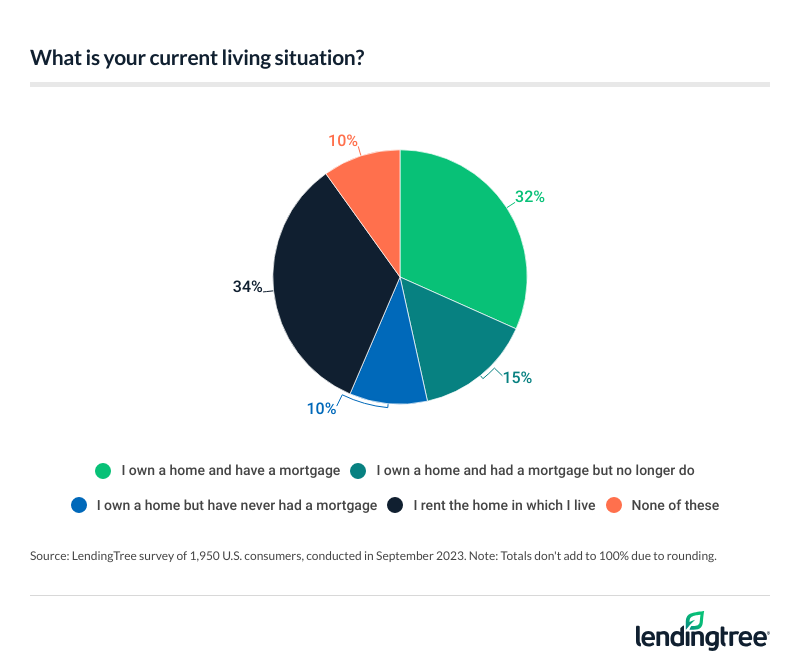

- Some consumers, primarily older generations, enjoy the mortgage-free lifestyle. One in 10 Americans never took out a mortgage, while 15% had a mortgage but have since paid it off. Baby boomers are the most likely to have paid off their mortgages, at 29%. Meanwhile, the likelihood of never having a mortgage is relatively similar across generations.

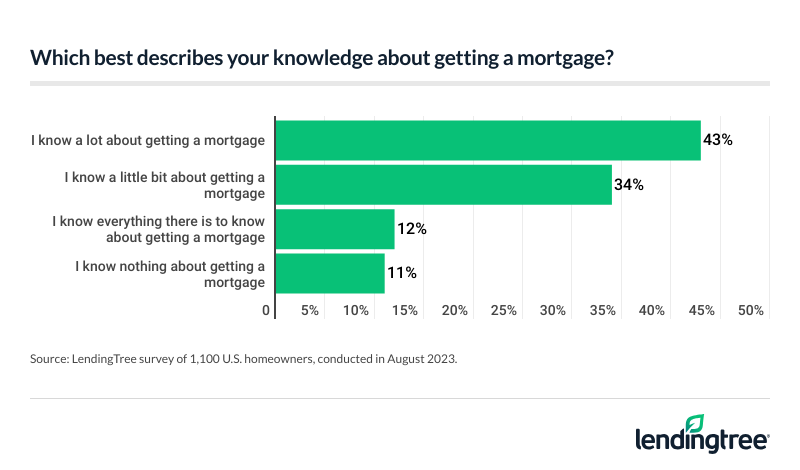

- Most homeowners say they have a solid understanding of the mortgage process, but there’s still uncertainty. 43% of homeowners say they know a lot about the process of getting a mortgage, while another 12% claim to be experts. On the other hand, 11% admit they don’t know anything about getting a mortgage, despite being homeowners. When it comes to mortgage programs, conventional loans are the most widely used, with 60% of past or present mortgage holders saying they most recently used a conventional loan. Only 12% used a Federal Housing Administration (FHA) loan, while 6% each used jumbo loans and Department of Veterans Affairs (VA) loans.

Receiving down payment help is common

A down payment can be the biggest financial hurdle in the homebuying process, but many homeowners don’t do it alone. In fact, 39% of homeowners have received down payment assistance — and of this group, 22% say their parents helped finance their homes.

Younger homeowners are the most likely to rely on others for help, at 78% among Gen Zers (ages 18 to 26). They’re also the most likely group to get help from their parents (49%). Following that (among homeowners):

- 54% of millennials (ages 27 to 42) have received help, with 27% getting it from their parents

- 33% of Gen Xers (ages 43 to 58) have received help, with 20% getting it from their parents

- 17% of baby boomers (ages 59 to 77) have received help, with 11% getting it from their parents

Meanwhile, homeowners with children younger than 18 (52%) are significantly more likely to have received help than those with no children (38%) and those with children older than 18 (23%). While parents with young children are most likely to rely on their parents for support (28%), 19% received aid from other family members or friends.

Down payment help by income group varies. Homeowners earning between $35,000 and $49,999 a year and six-figure earners tie as the most likely groups to have financial support, at 44%. In contrast, those earning less than $35,000 (28%) are the least likely.

Of course, credit scores play a large role in buying a house, particularly because having a lower one may mean larger down payment requirements. Those with FICO Scores between 580 and 669 (rated as fair) are the most likely to receive down payment help from others, at 47%. Meanwhile, those with FICO Scores between 800 and 850 (rated as exceptional) are the least likely, at 28%.

According to LendingTree senior economist Jacob Channel, receiving financial support should be seen as common, given the current market.

“In today’s housing market where — even if you can get approved for a loan — buying can still be prohibitively expensive, the more help you have with things like a down payment, the easier buying can be,” he says. “Ultimately, even though that figure is high (probably higher than many people would expect), it speaks to how expensive and tough to navigate today’s housing market can be.”

Despite misconceptions, most homeowners don’t put 20% down

Many Americans may hold on to outdated myths about down payments, and it could hold them back. Overall, 31% of Americans think it’s necessary to put down 20% for a down payment — a figure that’s particularly high among Gen Zers (39%), parents with children younger than 18 (38%) and millennials (36%).

Despite this, the majority (59%) of current homeowners who have or have had a mortgage say their down payments were less than 20% of the home’s purchase price, while just 29% put down 20% or more.

Baby boomers (40%), six-figure earners (37%) and those with children older than 18 (35%) are the most likely to put down 20% or more. In addition, men (33%) are more likely than women (25%) to put down this traditional amount.

Though aiming for a 20% down payment is often recommended, Channel says it isn’t always necessary.

“Would-be buyers who think that they need 20% for a down payment could make the mortgage process harder and more time-consuming than it needs to be, especially if they’re breaking their backs to get to the 20% number,” he says. “In that same vein, those who burn through all their savings just to make a 20% down payment could leave themselves with too little extra cash for homebuying fees like closing costs or emergencies.”

Older consumers most likely to be mortgage-free

Living mortgage-free is certainly a massive milestone, but some never had a mortgage to begin with. In fact, 10% of Americans never took out a mortgage. Meanwhile, 15% had a mortgage but have since paid it off.

Baby boomers are the most likely to have paid off their mortgages, with 29% reaching this goal. That’s followed by those with children older than 18 (23%).

According to Channel, paying off a mortgage dramatically decreases housing costs — although there are some (temporary) drawbacks to doing so.

“For the most part, the largest part of a homeowner’s housing budget is going to be allocated toward their mortgage,” he says. “If you pay off a mortgage, you could potentially free up thousands of dollars each month that you can put toward other purchases. In the long term, paying off your mortgage can also help you increase your credit score, as it’ll mean you have less debt.“In the short term, paying off your mortgage could cause your credit score to drop, though the decline should only be temporary. If you pay off your mortgage ahead of schedule, you may need to deal with some fees or penalties levied by your lender.”

For those buying a house without a mortgage, Channel notes you won’t have to deal with the hassle of getting a lender or the extra costs that come with a mortgage (like interest or fees). Plus, cash buyers may also find it easier to buy a house from a seller.

“Still, buying a house without a mortgage can be risky if you make yourself cash-poor in the process,” he says. “If buying a home (with a mortgage or otherwise) will leave you with zero savings for an emergency, it might be better to hold off. At the end of the day, however, less debt is generally preferable. This means that even if you can’t afford to pay cash for a house (which most people can’t), you should still strive to pay off your mortgage in a timely manner.”

Overall, 34% of consumers rent rather than own. Of this group, those earning between $35,000 and $49,999 (44%) and those without children (39%) are the most likely to rent the home they live in.

Some homeowners don’t know anything about the mortgage process

Overall, 43% of homeowners say they know a lot about the process of getting a mortgage, while another 12% claim to be experts. Despite being homeowners, though, 11% say they don’t know anything about mortgages.

Gen Z homeowners are the most likely to admit they know nothing about getting a mortgage, at 28% — that compares with 3% of baby boomers. Homeowners earning less than $35,000 a year (22%) are the only other group with more than 20% admitting they don’t know anything about getting a mortgage.

According to Channel, taking out a mortgage without the necessary knowledge can be harmful.

“If you don’t understand how the mortgage process works or what the terms of your specific loan are, you could get stuck with a mortgage that doesn’t fit your needs,” he says. “Similarly, you could end up with a higher rate or more fees than you could’ve gotten had you been more proactive and better understood your options. Don’t rush and be sure to ask any and all questions you have throughout the mortgage process. The more you know, the better choices you’ll be able to make.”

On the other hand, 17% of six-figure earners who are homeowners say they know everything about mortgages — the most likely group. By age group, millennial and baby boomer homeowners are the most likely to say similarly, at 13% for both. Further, men (14%) are more likely to have full confidence in their mortgage knowledge than women (10%).

As far as where homeowners are getting their mortgages, conventional loans are the most widely used: Among past or present mortgage holders, 60% say they most recently used a conventional loan. Meanwhile, 12% used Federal Housing Administration (FHA) loans and 6% each used jumbo loans and Department of Veterans Affairs (VA) loans.

Making down payments today: Top expert tips

Saving for a down payment is often the first step in achieving homeownership, but it can be difficult to know what’s appropriate. For consumers saving up, Channel recommends the following advice:

- Remember that a 20% down payment isn’t often necessary. “In fact, most people put down notably less,” he says. “And, depending on the type of loan you get, you could even qualify for a sub-5% down payment. Because of this, even if you don’t have someone who can help you with your down payment, you could still be approved for a mortgage and make your dream of buying a house a reality.”

- While a large down payment isn’t necessary, bigger down payments are often helpful. “Generally speaking, the more money you can put down, the lower the rate you’ll be offered, the higher your odds of approval will be and the cheaper your loan will be in the long run,” he says.

- Saving for a down payment is only one part of the homebuying process. Don’t focus so much on saving for a down payment that you neglect other important aspects of your finances, like paying down other debts and strengthening your credit score.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,950 U.S. consumers ages 18 to 77 from Aug. 18-22, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles

Majority of Homeowners Tackling Home Improvement Projects, With Painting, Landscaping and Bathroom Upgrades Topping To-Do Lists

Mortgage Statistics: 2025

Americans Are Sitting on Tens of Trillions of Dollars of Home Equity — Here’s Where Homeowners Are Offered the Largest and Smallest Home Equity Loans