Buying a Home Will Hurt Your Credit Score, but Data Shows It’ll Rebound Within a Year on Average

Taking out a mortgage is likely to lower your credit score, at least in the short term. How much your score drops depends on various factors, including credit history, but a new LendingTree study suggests getting a mortgage doesn’t significantly impact your credit score.

Specifically, the study shows credit scores are unlikely to fall by more than 20 points on average across the nation’s 50 largest metros in the four and a half to six months after getting a mortgage. Further, the study shows that even when credit scores fall by more than an average of 20 points, they typically rebound to pre-loan levels within a year.

Ultimately, the research suggests borrowers who get a mortgage don’t need to worry that doing so will seriously damage their ability to access their credit.

Key findings

- In the months after getting a mortgage, borrowers across the nation’s 50 largest metros saw their credit scores decline by an average of 20.4 points before hitting their low points. At the high end, scores declined by about 28 points on average in Birmingham, Ala.; on the low end, they fell by an average of 13.5 points in Sacramento, Calif.

- Before getting a mortgage, borrowers across the metros in the LendingTree study had an average credit score of 736. The highest average starting credit score was 755 in both Hartford, Conn., and San Jose, Calif., while the lowest average was tied at 713 in Memphis, Tenn., and Louisville, Ky. Because initial scores were relatively high across the board, a decline of 10 or 20 points would be unlikely to significantly impact a borrower’s ability to access credit.

- After closing a mortgage, credit scores took an average of 165 days to reach their lowest points. The average credit score fell the fastest in Richmond, Va. — taking about 137 days to hit its lowest point. The longest decline took 189 days, in San Jose, Calif.

- Once credit scores hit their low point, they took an average of another 174 days to rebound to pre-loan levels. The quickest recovery time was 148 days in Richmond, and the slowest was 206 days in Jacksonville, Fla.

- The complete credit cycle — the time it takes for scores to decline and then rebound — is 339 days, on average. This means that borrowers across the country can typically expect their credit scores to return to their starting points in a little under a year.

Metros with the smallest credit score decline after getting a mortgage

No. 1: Sacramento, Calif.

- Average initial credit score: 728

- Average decline in score: 13.47 points

- Total time until recovery: 318 days

No. 2: Memphis, Tenn.

- Average initial credit score: 713

- Average decline in score: 15.13 points

- Total time until recovery: 335 days

No. 3: Detroit

- Average initial credit score: 732

- Average decline in score: 16.47 points

- Total time until recovery: 301 days

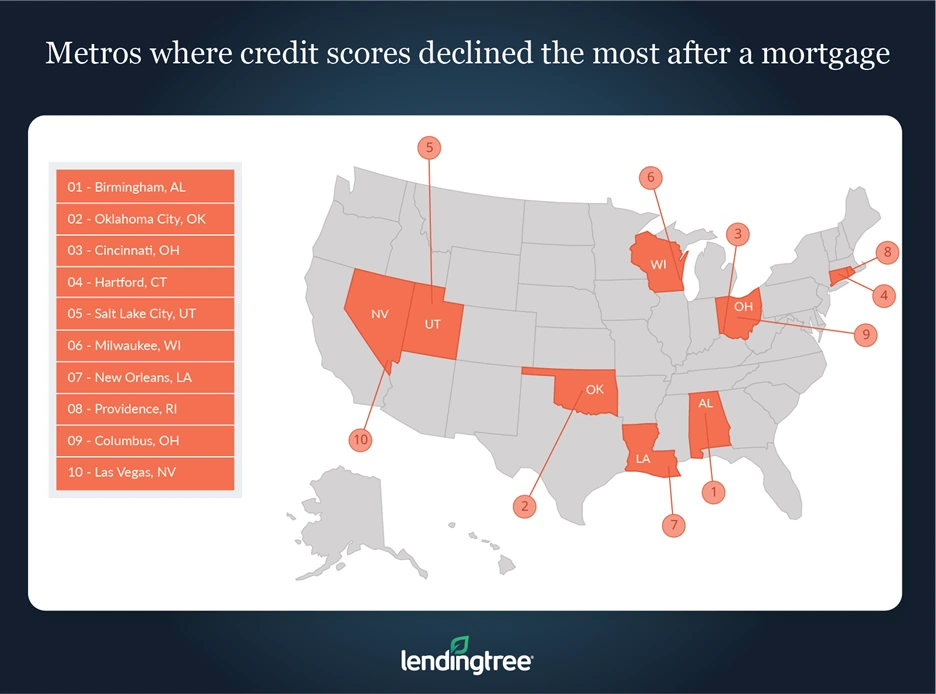

Metros with the largest credit score decline after getting a mortgage

No. 1: Birmingham, Ala.

- Average initial credit score: 736

- Average decline in score: 28.35 points

- Total time until recovery: 344 days

No. 2: Oklahoma City

- Average initial credit score: 748

- Average decline in score: 27.64 points

- Total time until recovery: 331 days

No. 3: Cincinnati

- Average initial credit score: 726

- Average decline in score: 26.33 points

- Total time until recovery: 326 days

In the long run, a mortgage can help your credit score

When a consumer takes out a mortgage, it adds a large balance to their credit report. Because credit-scoring agencies take into account the amount of money a consumer owes when formulating a person’s credit score, this will typically result in a borrower’s score falling. Fortunately, this decline is usually temporary.

In fact, showing that you can effectively manage your mortgage debt could help strengthen your overall credit rating over time.

For example, by keeping up with your mortgage payments, you’ll show that you know how to handle a significant amount of debt, and that will likely positively impact your score. Further, having a mortgage will diversify your credit profile, which could also help boost your score.

Of course, your score will suffer if you ignore your mortgage — especially if you default on your loan and your home is foreclosed. Nonetheless, by keeping up with your monthly mortgage payments, you’ll help keep your overall credit profile in top shape.

Tips for improving your credit score after getting a mortgage

By keeping the following tips in mind, you can help ensure your credit recovers after you get a mortgage.

- Try to hold off on applying for new credit until your score has recovered. If you continue to apply for new forms of credit after getting a mortgage, your credit score may fall further and take longer to rebound. As a result, the fewer new credit applications you submit, the better off your score is likely to be.

- Make sure you make your mortgage payments on time. Late payments can negatively impact your credit score, so it’s best to avoid them as much as possible. If something comes up and you think you might miss a payment, contact your lender and ask about available options to help make your debt more manageable. If you’re overwhelmed by debt, consider looking into debt consolidation or other debt relief.

- Don’t neglect your other debts. Though your mortgage is likely to be one of the, if not the, largest debts you’ve got, that doesn’t mean you should let your other ones fall by the wayside. Be sure that you’re still making your other payments, including on any credit cards or auto loans.

Methodology

To determine how getting a mortgage impacts credit scores, analysts used data from the LendingTree online marketplace to look at more than 6,000 consumers who lived in one of the nation’s 50 largest metropolitan statistical areas (MSAs) and took out a mortgage in 2020.

Analysts then tracked these consumers’ credit scores from the time their mortgage originated through August 2021 to see how many days it took until the scores returned to their pre-loan levels.

View mortgage loan offers from up to 5 lenders in minutes