Homeownership Gender Gap: Single Women Own More Homes Than Single Men

Women typically lag behind men in pay. According to the U.S. Bureau of Labor Statistics, women’s median weekly earnings are 83.6% of men’s.

While research indicates women are generally less well-off financially than men, one key area in which women are likely to fare better than men is homeownership.

A LendingTree analysis of the latest U.S. Census Bureau data finds that single women who live by themselves are more likely than single men who live by themselves to own a home in 47 of 50 states. Our study also finds that single women own about 2.72 million more homes than single men.

Key findings

- Across the nation’s 50 states, single women own 2,719,923 more homes than single men. Single women own 11.14 million homes, while single men own 8.42 million. Put another way, single women own 13.01% of owner-occupied homes, and single men own 9.83%.

- The homeownership gender gap has increased slightly since 2022. Single women owned 10.95 million homes across the U.S. in 2022, while men owned 8.24 million — a difference of 2.71 million. This means 2023’s homeownership gender gap is 14,780 housing units larger than 2022’s.

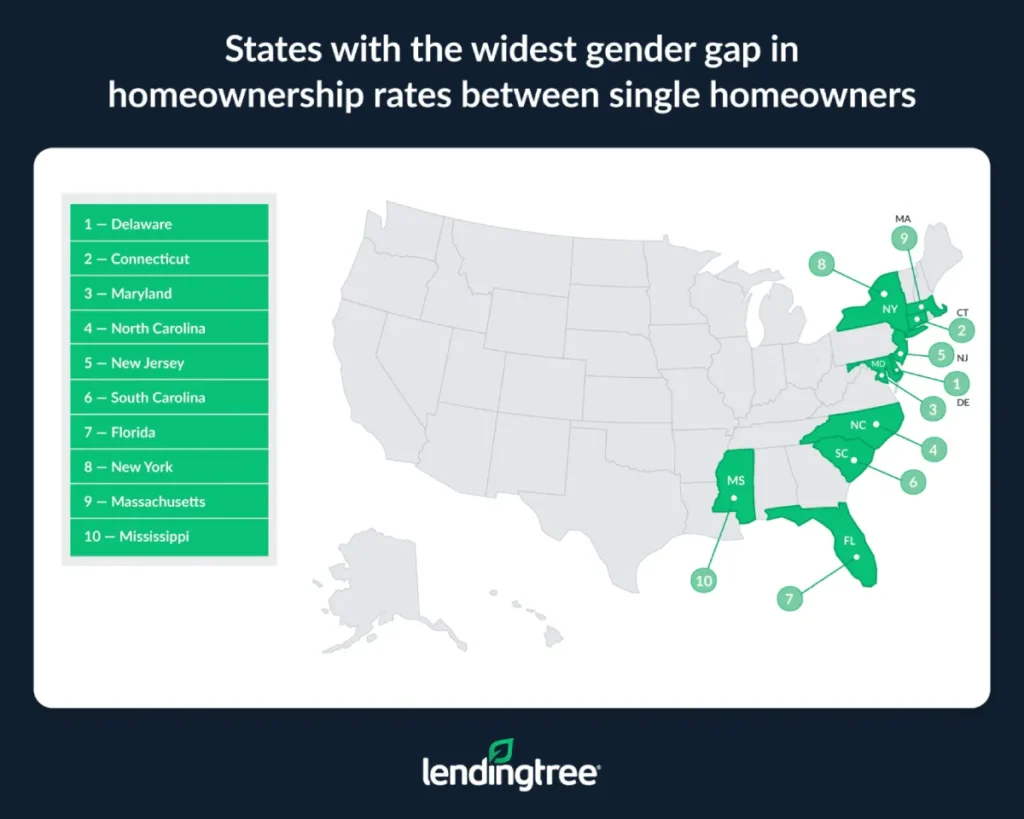

- The homeownership gender gap is largest in Delaware and Connecticut. Though neither state boasts the highest homeownership rate for single women, homeownership gender gaps of 5.23 and 5.06 percentage points, respectively, make Delaware and Connecticut the only states where the homeownership gender gap tops five percentage points.

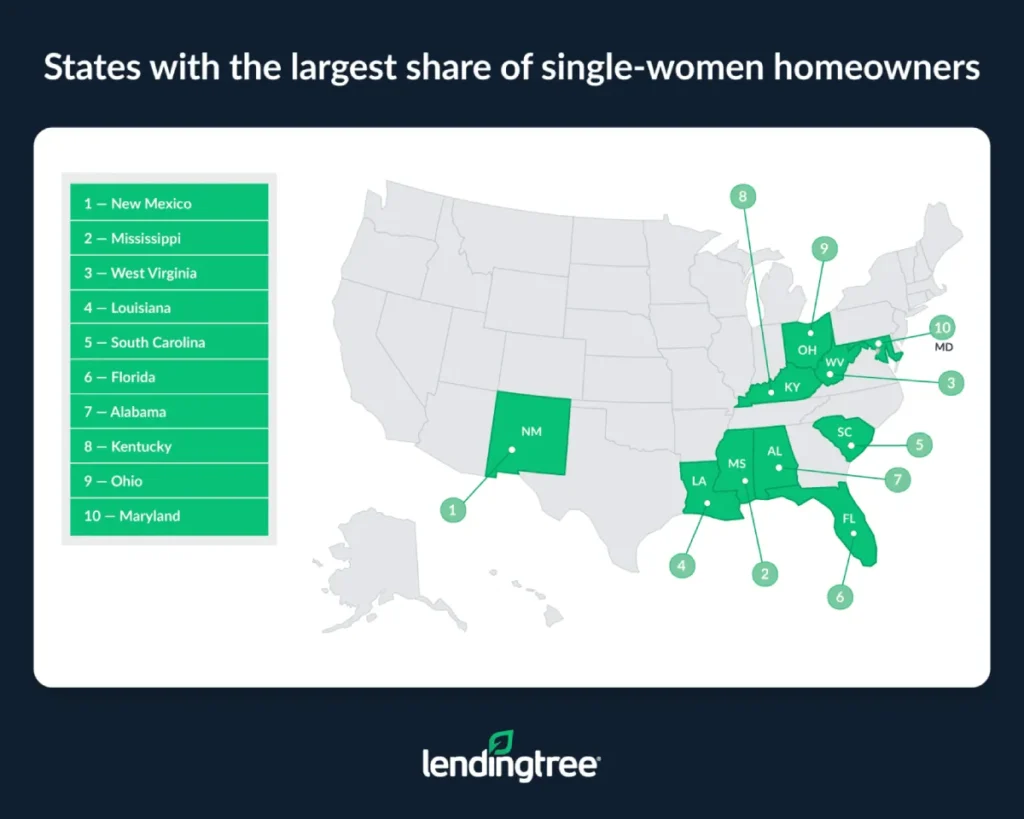

- Single women own the largest share of homes in New Mexico, Mississippi and West Virginia. In New Mexico, 15.26% of owner-occupied housing units are owned by women who live by themselves. In Mississippi and West Virginia, that figure is 15.07% and 14.73%, respectively. For comparison, single men own 12.48%, 11.04% and 12.75% of owner-occupied households in the same states.

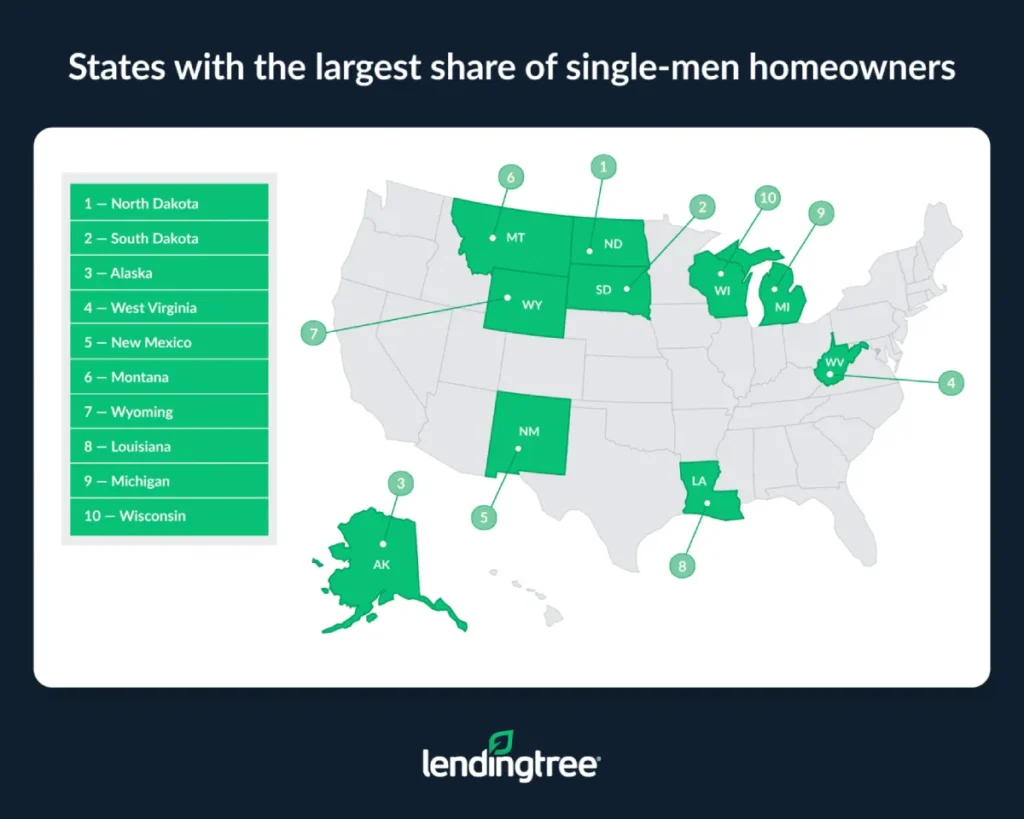

- The homeownership rate is highest among single men in North Dakota, South Dakota and Alaska. In these states, single men own 13.52%, 13.10% and 12.79% of owner-occupied housing units. In addition to being the states where homeownership rates among single men are highest, they’re the only three where single men own more homes than single women.

States with the largest share of single-women homeowners

No. 1: New Mexico

- Owner-occupied households: 594,994

- Households owned and occupied by single women: 15.26%

- Households owned and occupied by single men: 12.48%

- Gender gap between single homeowners: 2.78 percentage points

No. 2: Mississippi

- Owner-occupied households: 829,854

- Households owned and occupied by single women: 15.07%

- Households owned and occupied by single men: 11.04%

- Gender gap between single homeowners: 4.03 percentage points

No. 3: West Virginia

- Owner-occupied households: 545,554

- Households owned and occupied by single women: 14.73%

- Households owned and occupied by single men: 12.75%

- Gender gap between single homeowners: 1.98 percentage points

States with the largest share of single-men homeowners

No. 1: North Dakota

- Owner-occupied households: 216,069

- Households owned and occupied by single women: 10.75%

- Households owned and occupied by single men: 13.52%

- Gender gap between single homeowners: -2.77 percentage points

No. 2: South Dakota

- Owner-occupied households: 262,913

- Households owned and occupied by single women: 12.37%

- Households owned and occupied by single men: 13.10%

- Gender gap between single homeowners: -0.73 percentage points

No. 3: Alaska

- Owner-occupied households: 185,205

- Households owned and occupied by single women: 12.56%

- Households owned and occupied by single men: 12.79%

- Gender gap between single homeowners: -0.23 percentage points

States with the widest gender gap in homeownership rates between single homeowners

No. 1: Delaware

- Owner-occupied households: 307,275

- Households owned and occupied by single women: 14.06%

- Households owned and occupied by single men: 8.83%

- Gender gap between single homeowners: 5.23 percentage points

No. 2: Connecticut

- Owner-occupied households: 945,509

- Households owned and occupied by single women: 13.17%

- Households owned and occupied by single men: 8.11%

- Gender gap between single homeowners: 5.06 percentage points

No. 3: Maryland

- Owner-occupied households: 1,619,296

- Households owned and occupied by single women: 14.22%

- Households owned and occupied by single men: 9.28%

- Gender gap between single homeowners: 4.94 percentage points

Full rankings: Gender gaps between single homeowners

| Rank | State | % of housing units owned by single women | % of housing units owned by single men | % point difference | # of housing units | # of housing units owned by single women | # of housing units owned by single men |

|---|---|---|---|---|---|---|---|

| 1 | Delaware | 14.06% | 8.83% | 5.23 | 307,275 | 43,205 | 27,132 |

| 2 | Connecticut | 13.17% | 8.11% | 5.06 | 945,509 | 124,483 | 76,662 |

| 3 | Maryland | 14.22% | 9.28% | 4.94 | 1,619,296 | 230,227 | 150,190 |

| 4 | North Carolina | 13.87% | 9.18% | 4.69 | 2,917,585 | 404,555 | 267,968 |

| 5 | New Jersey | 12.50% | 7.92% | 4.58 | 2,256,737 | 282,096 | 178,846 |

| 6 | South Carolina | 14.55% | 10.10% | 4.45 | 1,578,590 | 229,682 | 159,513 |

| 7 | Florida | 14.52% | 10.09% | 4.43 | 6,096,092 | 885,222 | 615,057 |

| 8 | New York | 14.11% | 9.71% | 4.40 | 4,227,423 | 596,408 | 410,315 |

| 9 | Massachusetts | 13.32% | 8.94% | 4.38 | 1,745,497 | 232,554 | 155,985 |

| 10 | Mississippi | 15.07% | 11.04% | 4.03 | 829,854 | 125,070 | 91,646 |

| 11 | Kentucky | 14.41% | 10.45% | 3.96 | 1,279,053 | 184,367 | 133,674 |

| 12 | Rhode Island | 13.45% | 9.50% | 3.95 | 282,447 | 37,992 | 26,836 |

| 13 | Vermont | 14.04% | 10.11% | 3.93 | 203,277 | 28,532 | 20,550 |

| 14 | Georgia | 13.00% | 9.18% | 3.82 | 2,742,979 | 356,640 | 251,822 |

| 15 | Alabama | 14.43% | 10.75% | 3.68 | 1,442,163 | 208,171 | 155,034 |

| 16 | Illinois | 14.02% | 10.43% | 3.59 | 3,413,090 | 478,388 | 356,133 |

| 17 | Virginia | 13.22% | 9.67% | 3.55 | 2,308,812 | 305,282 | 223,265 |

| 18 | Maine | 14.01% | 10.48% | 3.53 | 456,127 | 63,895 | 47,783 |

| 19 | Oregon | 12.17% | 8.66% | 3.51 | 1,112,087 | 135,357 | 96,273 |

| 20 | Tennessee | 13.87% | 10.51% | 3.36 | 1,946,755 | 269,966 | 204,598 |

| 21 | Ohio | 14.23% | 11.07% | 3.16 | 3,307,680 | 470,609 | 366,096 |

| 22 | California | 11.32% | 8.20% | 3.12 | 7,666,209 | 867,890 | 628,418 |

| 23 | Louisiana | 14.67% | 11.57% | 3.10 | 1,253,254 | 183,829 | 145,033 |

| 24 | Arizona | 13.21% | 10.16% | 3.05 | 1,966,328 | 259,771 | 199,736 |

| 25 | Arkansas | 13.22% | 10.29% | 2.93 | 817,003 | 107,988 | 84,094 |

| 26 | Missouri | 13.46% | 10.60% | 2.86 | 1,758,371 | 236,679 | 186,426 |

| 27 | New Mexico | 15.26% | 12.48% | 2.78 | 594,994 | 90,820 | 74,242 |

| 28 | Oklahoma | 12.94% | 10.25% | 2.69 | 1,033,950 | 133,748 | 106,007 |

| 29 | Indiana | 13.11% | 10.52% | 2.59 | 1,943,666 | 254,862 | 204,384 |

| 30 | Washington | 11.70% | 9.15% | 2.55 | 1,980,173 | 231,778 | 181,281 |

| 31 | Hawaii | 11.73% | 9.29% | 2.44 | 305,108 | 35,774 | 28,335 |

| 32 | Texas | 10.83% | 8.46% | 2.37 | 7,047,911 | 763,553 | 596,170 |

| 33 | New Hampshire | 11.35% | 9.03% | 2.32 | 411,892 | 46,740 | 37,193 |

| 34 | Pennsylvania | 13.17% | 10.91% | 2.26 | 3,707,103 | 488,191 | 404,351 |

| 35 | Idaho | 11.09% | 8.87% | 2.22 | 532,332 | 59,026 | 47,192 |

| 36 | Colorado | 12.36% | 10.26% | 2.10 | 1,592,949 | 196,916 | 163,424 |

| 37 | Michigan | 13.55% | 11.48% | 2.07 | 3,037,314 | 411,598 | 348,787 |

| 38 | West Virginia | 14.73% | 12.75% | 1.98 | 545,554 | 80,336 | 69,537 |

| 39 | Kansas | 12.21% | 10.27% | 1.94 | 794,535 | 96,985 | 81,601 |

| 40 | Utah | 9.02% | 7.21% | 1.81 | 817,616 | 73,784 | 58,913 |

| 41 | Iowa | 12.60% | 10.86% | 1.74 | 960,485 | 121,041 | 104,317 |

| 42 | Wyoming | 13.69% | 12.01% | 1.68 | 177,127 | 24,252 | 21,268 |

| 43 | Nebraska | 11.41% | 9.89% | 1.52 | 541,863 | 61,846 | 53,574 |

| 44 | Nevada | 12.60% | 11.14% | 1.46 | 739,769 | 93,235 | 82,441 |

| 45 | Minnesota | 11.97% | 10.54% | 1.43 | 1,699,654 | 203,453 | 179,167 |

| 46 | Montana | 13.07% | 12.26% | 0.81 | 328,947 | 42,977 | 40,321 |

| 47 | Wisconsin | 11.97% | 11.37% | 0.60 | 1,701,801 | 203,628 | 193,552 |

| 48 | Alaska | 12.56% | 12.79% | -0.23 | 185,205 | 23,265 | 23,687 |

| 49 | South Dakota | 12.37% | 13.10% | -0.73 | 262,913 | 32,511 | 34,449 |

| 50 | North Dakota | 10.75% | 13.52% | -2.77 | 216,069 | 23,234 | 29,210 |

Various factors likely contribute to higher homeownership rates among single women

Despite the data showing that women generally earn less than men, single women have the homeownership edge. There are a few possible explanations.

Though it’s relatively sparse, there’s evidence that single women are more willing than single men to make sacrifices to become homeowners.

Further, while women generally earn less than men, that isn’t always the case — especially among younger generations. For instance, average earnings among millennial women are higher than those of millennial men in six metros, including Allentown, Pa., and Portland, Maine. And the average earnings for millennial women in major metros such as Providence, R.I., Sacramento, Calif., and Washington, D.C., are less than $2,000 lower than those of millennial men.

Comparable (or even higher) earnings — combined with a greater homeownership desire — could contribute to higher homeownership rates among younger single women.

But homeownership isn’t just a young person’s game, and factors outside of individual earnings also contribute to homeownership. Considering that women typically live longer and that there are more widowed women than widowed men, it’s likely that some women who are now single homeowners bought that home with the spouse they outlived. This helps to explain why single-women homeowners are typically older than their single-men counterparts, even though the pay gap is wider for older Americans.

With all that said, it’s important to note that single women owning more homes than single men doesn’t mean they’re better off financially. Moreover, while some may assume that higher homeownership rates are indicative that women are likely to disproportionately benefit from things like divorce, the evidence doesn’t support this conclusion. On the contrary, women are more likely to face long-term economic struggles after a divorce than men. This highlights how much work is needed to address the economic imbalances among genders.

Tips for women homebuyers

While single women may be more likely to be homeowners than single men, that doesn’t mean buying a house is easy. Here are three tips to help women make their homebuying experience a bit easier to navigate.

- Shop around for a mortgage lender before you buy. Different lenders can offer the same borrowers different rates on their loans. Because a lower rate can help you lower your monthly payment and more easily afford a house, shopping around for a mortgage lender is often an important step for cost-conscious buyers.

- Carefully plan so you’re not overwhelmed by payments. Before you rush out to buy, be sure you can afford to become a homeowner. By sitting down and calculating your monthly mortgage payment, you can better budget for your future. If you do the math and feel you’ll constantly struggle to keep up with your bills, you may want to look for something less expensive or hold off on buying for the time being.

- Know your rights. It’s illegal for a lender or seller to discriminate against you based on gender. If you think you’ve been the victim of discrimination, you can file a complaint with the U.S. Department of Housing and Urban Development (HUD) or various local housing and human rights commissions.

Methodology

LendingTree analyzed microdata from the U.S. Census Bureau 2023 American Community Survey with one-year estimates.

To determine the gender breakdown of homeowners in each state, LendingTree focused on owner-occupied housing units whose owners were living by themselves, defining these homeowners as single women or single men.

To find the share of homeowners who were either single men or women, LendingTree divided the number of homes occupied by either men or women homeowners who lived by themselves by the total number of owner-occupied homes in a state. These percentages didn’t add to 100% because of other types of homeowners, including married couples.

To find the gender gap between women and men homeowners who live alone, LendingTree subtracted the percentage of homes owned by women who live alone in a state by the percentage of homes owned by men who live alone in that same state.

View mortgage loan offers from up to 5 lenders in minutes