Small Populations and Big Costs: Towns With the Most $1 Million-Plus Homes

Home prices may seem as if they’re declining in some parts of the country, but that doesn’t change how dramatically they’ve risen over the past two and a half years. Because of this growth, homes valued at $1 million or more have become more common throughout much of the U.S.

LendingTree recently highlighted the nation’s metropolitan areas where houses valued at $1 million or more are most prevalent. Using the U.S. Census Bureau’s 2020 American Community Survey, we’re now looking to see how common $1 million-plus homes are in the nation’s 50 most expensive micropolitan areas — referred to as “towns” here — with populations between 10,000 and 50,000.

On average, million-dollar homes are more common in the nation’s most expensive towns than in its largest metros. This doesn’t mean homes worth seven figures or more are especially common across most towns, but it shows that high-value real estate isn’t reserved for the country’s population hubs.

Key findings

- Million-dollar homes aren’t common in most towns. An average of only 5.36% of the owner-occupied homes in the nation’s 50 most expensive towns are valued at $1 million or more. That said, this figure is higher than in the nation’s 50 largest metros, where an average of only 4.71% of homes are worth $1 million or more.

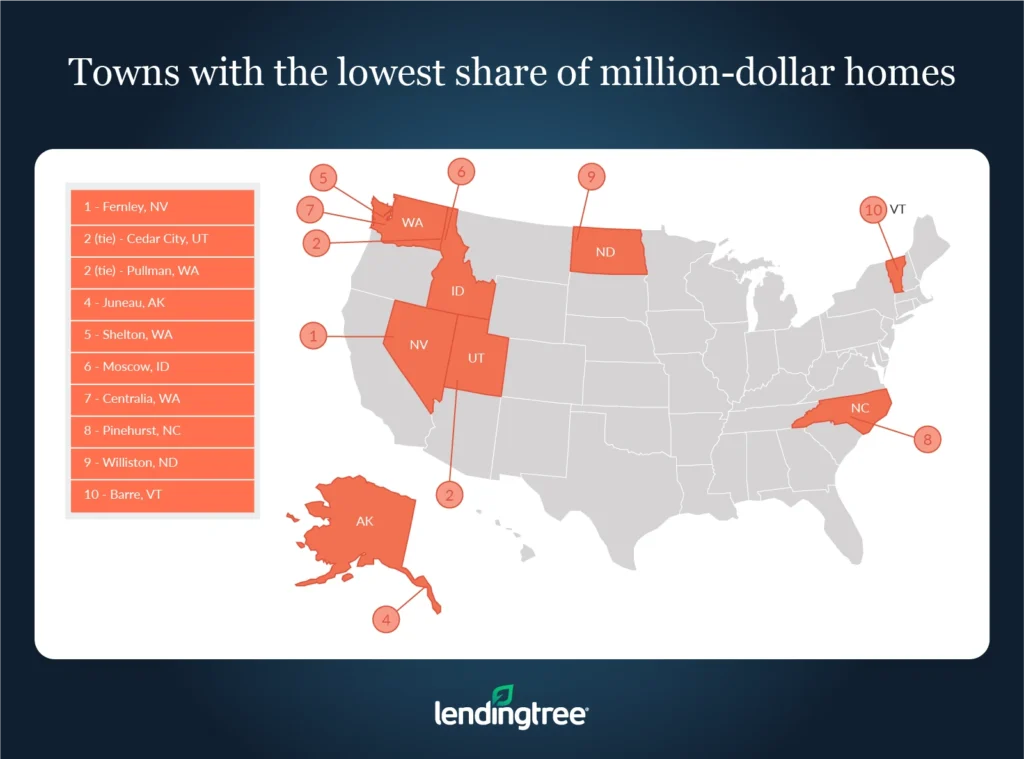

- The share of million-dollar homes can vary significantly by town. For example, 30.58% of owner-occupied homes are valued at $1 million or more in Vineyard Haven, Mass. — making it the town with the highest share of million-dollar homes. In the town with the smallest share of $1 million homes — Fernley, Nev. — that figure is 0.09%.

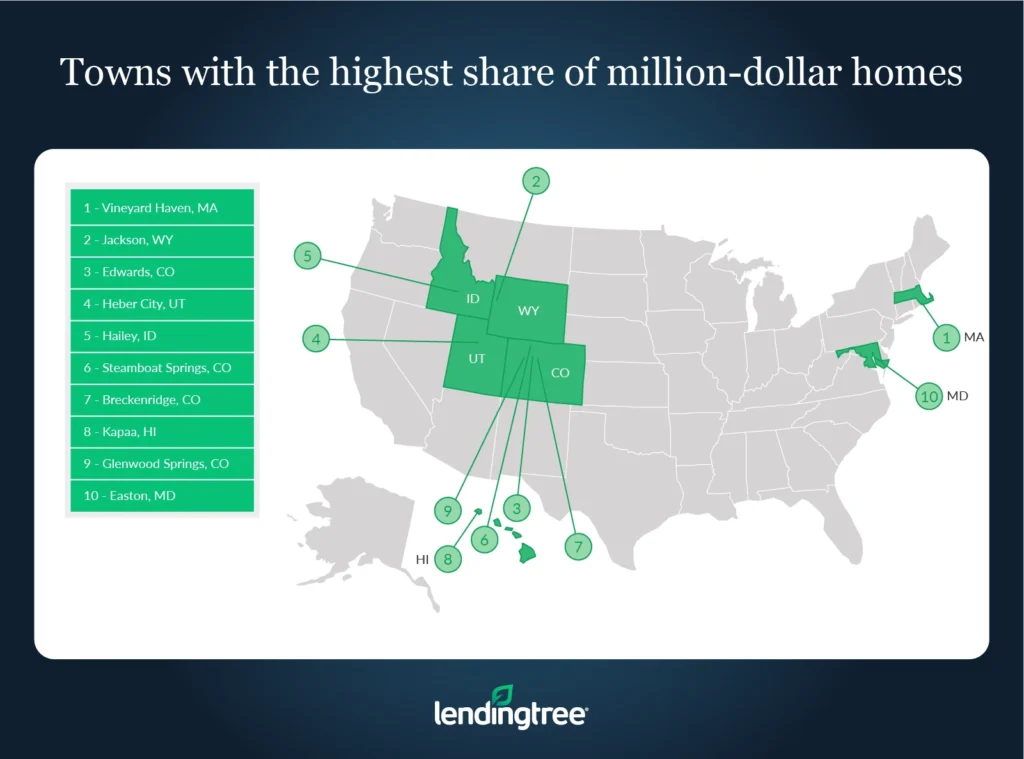

- Million-dollar homes are most common in vacation and resort towns. The three towns with the largest shares of million-dollar homes — Vineyard Haven, Mass., Jackson, Wyo., and Edwards, Colo. — are popular getaway destinations where many homeowners don’t live year-round. An average of 25.51% of homes in these three towns are worth $1 million or more.

- Four of the 10 towns with the most million-dollar houses are in Colorado. A combination of rapid statewide economic growth and an abundance of mountainous terrain suggests that the Centennial State will likely remain home to various million-dollar towns well into the future.

- Fernley, Nev., Cedar City, Utah, and Pullman, Wash., are the towns with the smallest share of homes worth $1 million or more. As mentioned, the share of homes in Fernley worth at least $1 million is a very modest 0.09%. For Cedar City and Pullman, the share of million-dollar-plus homes is slightly larger at 0.24%.

Towns with highest share of million-dollar homes

1: Vineyard Haven, Mass.

- Number of owner-occupied housing units: 4,990

- Number of owner-occupied units valued at $1 million or more: 1,526

- Percentage of owner-occupied units valued at $1 million or more: 30.58%

- Median value of owner-occupied housing units: $794,000

2: Jackson, Wyo.

- Number of owner-occupied housing units: 8,959

- Number of owner-occupied units valued at $1 million or more: 2,363

- Percentage of owner-occupied units valued at $1 million or more: 26.38%

- Median value of owner-occupied housing units: $524,800

3: Edwards, Colo.

- Number of owner-occupied housing units: 13,016

- Number of owner-occupied units valued at $1 million or more: 2,548

- Percentage of owner-occupied units valued at $1 million or more: 19.58%

- Median value of owner-occupied housing units: $617,200

Towns with lowest share of million-dollar homes

1: Fernley, Nev.

- Number of owner-occupied housing units: 15,865

- Number of owner-occupied units valued at $1 million or more: 14

- Percentage of owner-occupied units valued at $1 million or more: 0.09%

- Median value of owner-occupied housing units: $238,600

2 (tie): Cedar City, Utah

- Number of owner-occupied housing units: 11,340

- Number of owner-occupied units valued at $1 million or more: 27

- Percentage of owner-occupied units valued at $1 million or more: 0.24%

- Median value of owner-occupied housing units: $231,300

2 (tie): Pullman, Wash.

- Number of owner-occupied housing units: 8,171

- Number of owner-occupied units valued at $1 million or more: 20

- Percentage of owner-occupied units valued at $1 million or more: 0.24%

- Median value of owner-occupied housing units: $230,200

Why are $1 million-plus homes so common in some towns?

On the surface, it may seem counterintuitive to think of towns as places where million-dollar homes frequently pop up. Towns are often thought of as cheaper than their more urban counterparts.

In some instances, this holds true. Certainly, a town like Sheridan, Wyo. (15th in our study), is considerably less expensive for homebuyers than a place like New York City. That said, other towns, like Jackson, Wyo., are among the most costly places to buy a home in the U.S.

The reasons why some towns can be so expensive are complex, but expensive towns in many cases tend to be popular vacation spots for wealthy individuals who don’t necessarily earn their money locally and can afford to spend top dollar on real estate. This is why, despite their high prices, large shares of the homes in some of the nation’s most expensive towns sit vacant for most of the year.

On top of that, rural areas often see a lack of housing development because construction is seen as too costly and not profitable enough for builders. This lack of construction can put upward pressure on home prices, which means that people have to compete for a limited number of houses. This can be true even in towns that aren’t popular vacation destinations.

Tips for buying a home in a small town

Given how many homes in some of the towns featured in our study are worth $1 million or more, it may seem like many towns are completely unaffordable to all but the wealthy. This isn’t necessarily the case. There are still ways for middle-class buyers to make buying a house easier. Here are three tips:

- Shop around for a lender. Lenders can offer different rates to the same borrowers. Because of this, it’s often possible to find a lower rate by shopping around for a mortgage before you buy a home. The lower your rate, the more affordable your monthly payments will likely be.

- Boost your credit score. Generally, the higher your score is, the easier it will be for you to qualify for — and get a competitive rate on — your mortgage. If you have a strong score, you may be able to get a lower rate that makes it easier to afford a home that once seemed out of your price range.

- Consider different types of loans. Though conventional 30-year, fixed-rate mortgages are the most common type of home loan, various loan options might better fit a buyer’s needs. For example, loans backed by the U.S. Department of Agriculture (USDA) can be especially helpful for some borrowers in small towns.

Methodology

The data used in this study comes from the U.S. Census Bureau 2020 American Community Survey (with five-year estimates). LendingTree used micropolitan-level data for areas with a population between 10,000 and 50,000 to approximate town-level data.

View mortgage loan offers from up to 5 lenders in minutes