Full-Time Minimum Wage Workers Can’t Afford to Own or Rent in Any U.S. State

Though the federal minimum wage hasn’t increased since 2009, the topic has been hotly debated on the local and national level.

Proponents of a higher minimum wage argue that federal and state minimum wage laws often don’t provide workers with enough income to afford basic necessities like housing. And though there’s plenty to debate, the latest LendingTree research shows those earning minimum wage will likely struggle to find an affordable place to live.

To examine how unaffordable housing can be for minimum wage workers, LendingTree analyzed data from the U.S. Census Bureau 2021 American Community Survey and the U.S. Department of Labor. We found that median monthly housing costs for renters and homeowners with a mortgage are unaffordable for full-time minimum wage workers in each state.

Check our methodology to see how we calculated the salary of a full-time minimum wage worker and determined what an affordable housing payment would be.

Key findings

- In each state, owning a home is unaffordable for minimum wage workers. Across the nation’s 50 states, an affordable monthly housing payment for a minimum wage worker is, on average, $1,111 less than the median monthly housing cost for a homeowner with a mortgage.

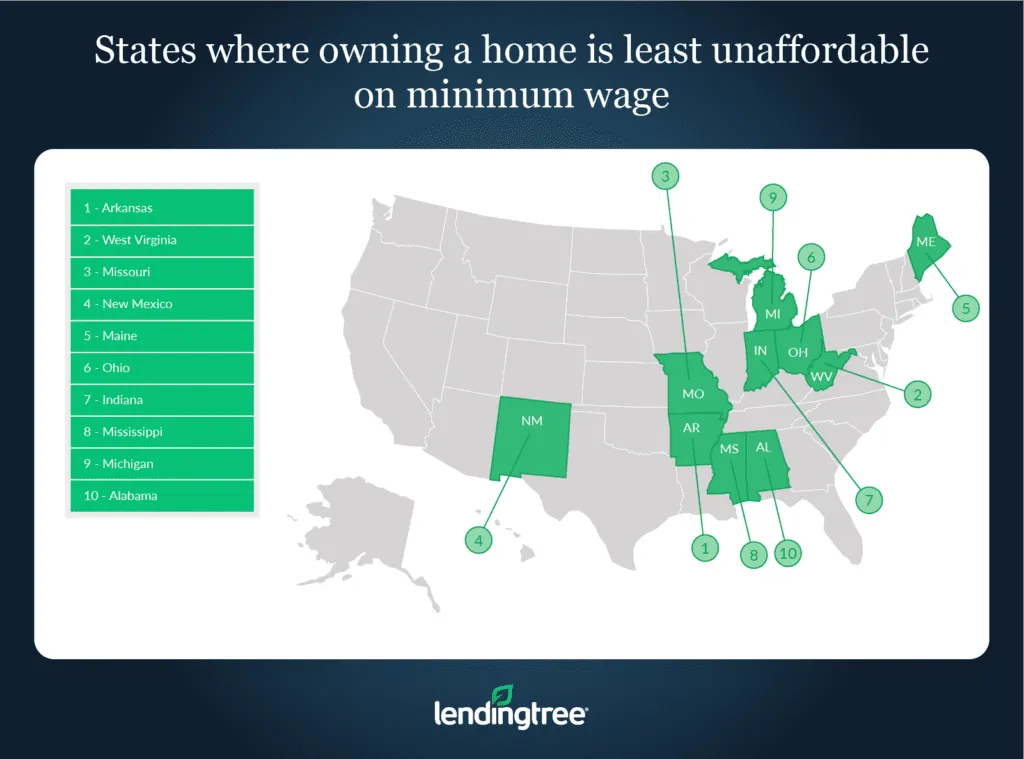

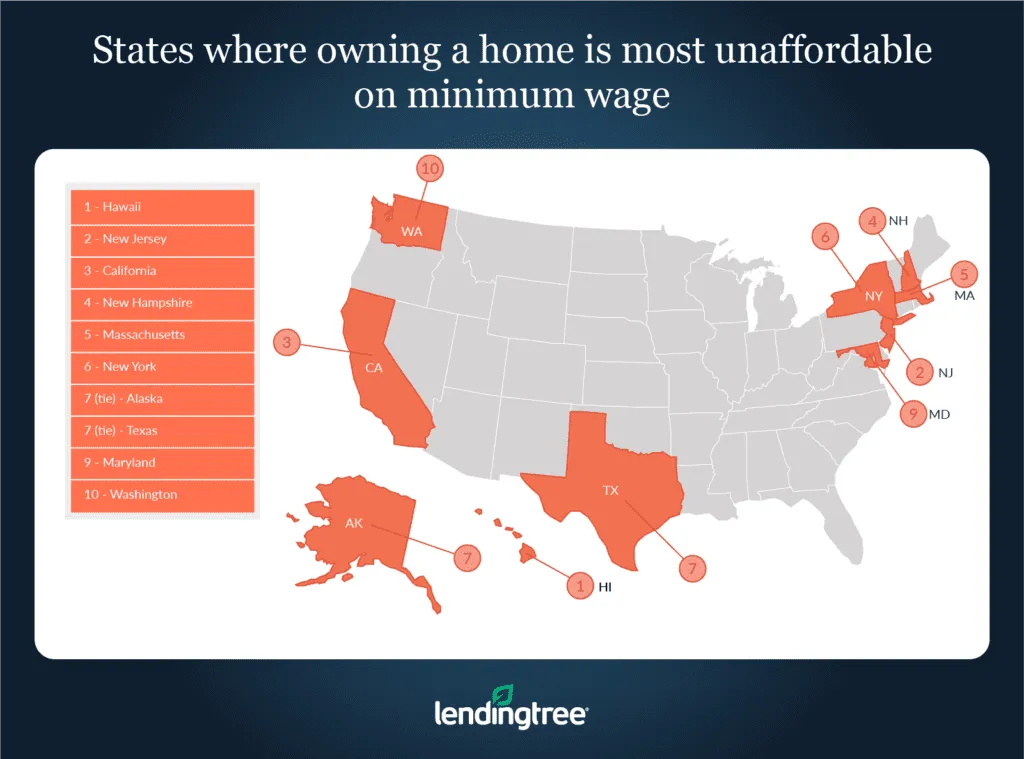

- While owning a home is unaffordable for minimum wage workers in each state, affordability challenges can vary in severity. In Arkansas, West Virginia and Missouri, for example, the average difference between an affordable housing payment for a minimum wage worker and the median monthly housing costs paid by a homeowner with a mortgage is $641 a month. That’s a significant disparity, but it pales in comparison to the average difference of $1,828 across Hawaii, New Jersey and California, where homeownership is most unaffordable for minimum wage workers.

- Though it’s cheaper than owning — at least when you’re paying off a mortgage — renting is unaffordable for minimum wage workers in every state. Across the nation, the average difference between an affordable monthly housing payment and the median monthly gross rent is $592.

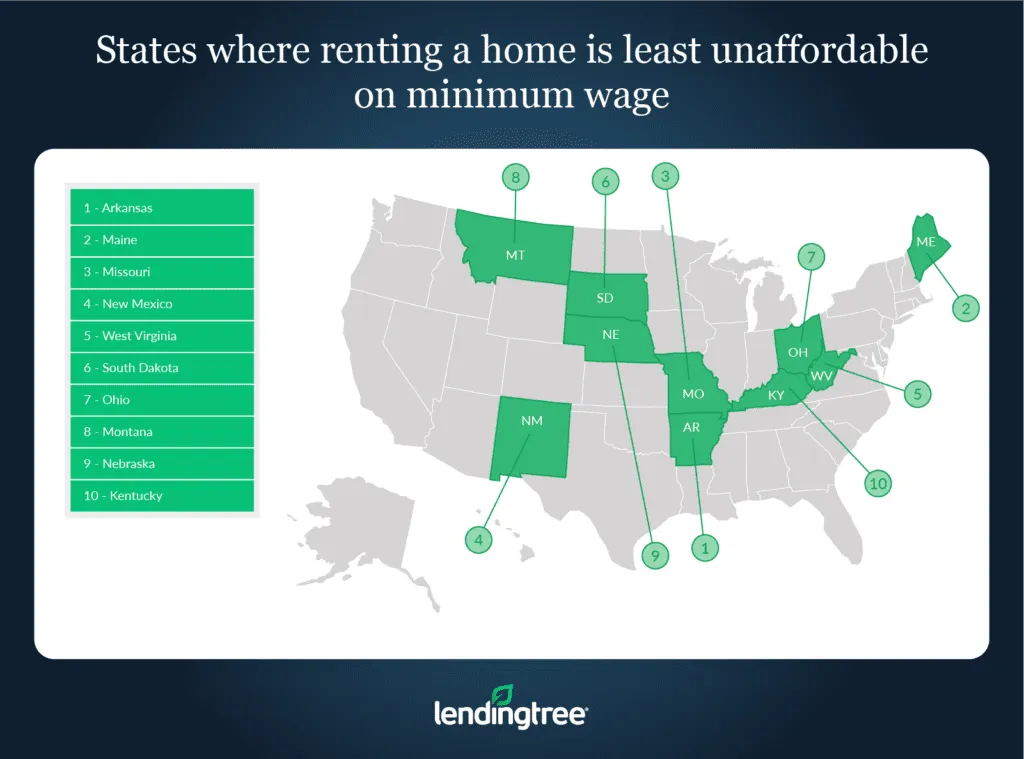

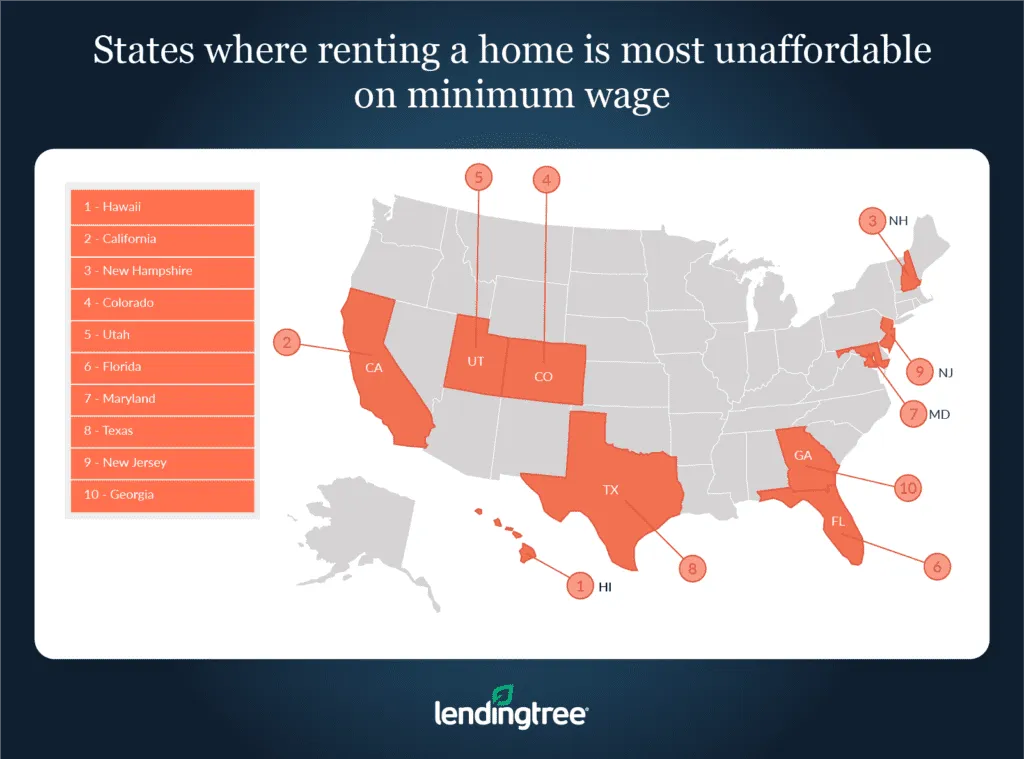

- Like with owning, the unaffordability of renting for minimum wage workers varies by state. In Arkansas, Maine and Missouri, for example, minimum wage workers earn an average of $277 less than what they would need each month to afford their state’s median gross rent. By comparison in Hawaii, California and New Hampshire, that average is $1,002 a month.

- Because the LendingTree study assumes minimum wage employees work 40 hours a week for 52 weeks a year, affording a place to live is probably more difficult for many than the findings suggest. This is especially true because a majority of those working at or below the federal minimum wage only work part time.

- A $15-an-hour minimum wage could help, but it wouldn’t be enough to make housing truly affordable in all but one state. Only in West Virginia would renting become affordable for minimum wage earners if they made $15 an hour. But, even so, homeownership would remain out of reach. In every other state, renting and owning would remain unaffordable.

States where owning is least unaffordable on minimum wage

No. 1: Arkansas

- State hourly minimum wage: $11

- Affordable monthly housing payment: $572

- Median monthly housing costs for homeowners with a mortgage: $1,147

- Difference between affordable housing payment and monthly homeowner costs: -$575

No. 2: West Virginia

- State hourly minimum wage: $8.75

- Affordable monthly housing payment: $455

- Median monthly housing costs for homeowners with a mortgage: $1,071

- Difference between affordable housing payment and monthly homeowner costs: -$616

No. 3: Missouri

- State hourly minimum wage: $11.15

- Affordable monthly housing payment: $580

- Median monthly housing costs for homeowners with a mortgage: $1,316

- Difference between affordable housing payment and monthly homeowner costs: -$736

States where owning is most unaffordable on minimum wage

No. 1: Hawaii

- State hourly minimum wage: $12

- Affordable monthly housing payment: $624

- Median monthly housing costs for homeowners with a mortgage: $2,584

- Difference between affordable housing payment and monthly homeowner costs: -$1,960

No. 2: New Jersey

- State hourly minimum wage: $13

- Affordable monthly housing payment: $676

- Median monthly housing costs for homeowners with a mortgage: $2,458

- Difference between affordable housing payment and monthly homeowner costs: -$1,782

No. 3: California

- State hourly minimum wage: $15

- Affordable monthly housing payment: $780

- Median monthly housing costs for homeowners with a mortgage: $2,523

- Difference between affordable housing payment and monthly homeowner costs: -$1,743

States where renting is least unaffordable on minimum wage

No. 1: Arkansas

- State hourly minimum wage: $11

- Affordable monthly housing payment: $572

- Median monthly gross rent: $820

- Difference between affordable housing payment and rent payment: -$248

No. 2: Maine

- State hourly minimum wage: $12.75

- Affordable monthly housing payment: $663

- Median monthly gross rent: $945

- Difference between affordable housing payment and rent payment: -$282

No. 3: Missouri

- State hourly minimum wage: $11.15

- Affordable monthly housing payment: $580

- Median monthly gross rent: $882

- Difference between affordable housing payment and rent payment: -$302

States where renting is most unaffordable on minimum wage

No. 1: Hawaii

- State hourly minimum wage: $12

- Affordable monthly housing payment: $624

- Median monthly gross rent: $1,774

- Difference between affordable housing payment and rent payment: -$1,150

No. 2: California

- State hourly minimum wage: $15

- Affordable monthly housing payment: $780

- Median monthly gross rent: $1,750

- Difference between affordable housing payment and rent payment: -$970

No. 3: New Hampshire

- State hourly minimum wage: $7.25

- Affordable monthly housing payment: $377

- Median monthly gross rent: $1,263

- Difference between affordable housing payment and rent payment: -$886

Would a $15-an-hour minimum wage make median-priced housing affordable?

To remedy part of the financial burden placed on those earning minimum wage, some — including President Joe Biden — have called for raising the federal minimum wage to $15 an hour.

If this were to happen, median-priced housing would remain unaffordable for minimum wage workers across most of the country. For example, by increasing the minimum wage to $15 an hour, a full-time worker could afford to spend $780 a month on housing. In only one state, West Virginia, would this be enough to comfortably afford the median monthly gross rent.

That being said, even though workers would need to stretch themselves thinner, housing would still be much more affordable than now should the minimum wage be raised.

As a result, while a $15-an-hour minimum wage would improve the national housing affordability situation, it would mean that minimum wage workers in most states would continue to struggle to find affordable housing. This is especially true given how much home and rent prices have risen since 2019.

Tips for making housing more affordable

Though it may be a challenge and require creative problem-solving skills, finding a place to live may still be possible even if you only make minimum wage. Here are three tips on how to do that:

- Consider living with family or roommates. By splitting housing costs with other people, owning and renting can become much more affordable. In Arkansas, for example, two full-time minimum wage workers who combined their incomes could afford to spend more than $1,100 a month on housing. That’s more than enough to afford the median gross rent in the state. Beyond making renting more affordable, having two incomes could also make affording a mortgage more achievable.

- Seek housing for people with low income. Various programs are available at the federal and state levels designed to help low-income earners find housing. For example, the U.S. Department of Housing and Urban Development (HUD) can assist eligible families who can’t find an affordable home to rent. There are also several low-income home loan programs meant to make buying a house easier.

- Pay down your debt. Even if you don’t earn a high wage, having less debt that you need to worry about paying down could free up more money to spend on housing. On top of that, having a lower debt-to-income (DTI) ratio can also make you more appealing to both prospective landlords and lenders.

Methodology

Data on median monthly housing costs for homeowners with a mortgage and median monthly gross rent costs comes from the U.S. Census Bureau 2021 American Community Survey — the latest available. Minimum wage data comes from the U.S Department of Labor and is current as of Oct. 1, 2022.

Calculated monthly full-time minimum wage earnings were calculated by assuming workers in a given state worked 40 hours a week for 52 weeks a year and were paid their state’s minimum wage, or the federal minimum wage of $7.25 per hour in states without a minimum wage or with a minimum wage below the current federal minimum wage. Note that the highest wage was chosen when a state had more than one state-level minimum wage.

Because it’s generally recommended that a person spend no more than 30% of their gross monthly income on housing costs, LendingTree calculated its affordable monthly payment metrics by multiplying a minimum wage earner’s calculated monthly earnings by 0.3.

View mortgage loan offers from up to 5 lenders in minutes