Mobile Home Prices Are Rising Faster Than Single-Family Home Prices — Here’s Where They’re the Most, Least Expensive

Though home prices aren’t as high in some areas as a few years ago, they remain steep across the U.S.

In the face of such expensive real estate, many would-be buyers may consider more affordable options like manufactured, or mobile, homes. But just because mobile homes are typically less costly than more traditional site-built, single-family housing doesn’t mean they’re cheap.

On the contrary, our newest analysis of U.S. Department of Housing and Urban Development (HUD) and U.S. Census Bureau data finds that the average sales price of new mobile homes in the U.S. easily tops six figures. In addition, our analysis finds that the sales price of new mobile homes rose faster than the sales price of new site-built, single-family homes between 2018 and 2023.

Key findings

- The average sales price of new mobile homes sold in the U.S. rose by 58.34% between 2018 and 2023. In contrast, the average sales price of new site-built, single-family homes (excluding land) rose by 37.66% over the same period.

- New mobile homes sold in the U.S. cost $124,300, on average. Though this is significant, mobile homes are considerably cheaper than their site-built, single-family counterparts. As of 2023, the average sales price of new single-family homes was $409,872 — $285,572 more than that of new mobile homes.

- Though the long-term price trend is upward, the average sales price of new mobile homes in the U.S. fell slightly from 2022 to 2023. In this period, the average sales price of new mobile homes fell 2.36% from $127,300. Mobile home prices can be volatile, so we’ll need more time before saying if this decline is the start of a new trend.

- New mobile homes sell for the most money, on average, in Washington, California and Arizona. The average sales price of new mobile homes in these states is $164,100, $154,500 and $148,800, respectively.

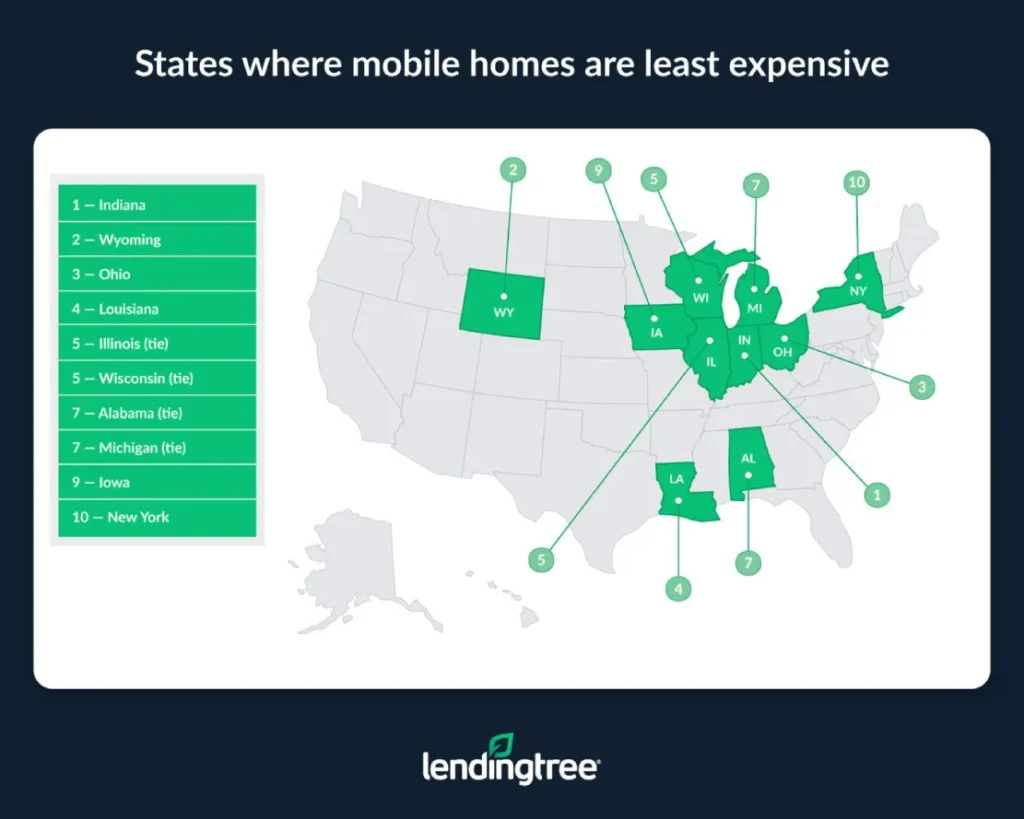

- New mobile homes sell for the least in Indiana, Wyoming and Ohio. In these states, new mobile homes sell for an average of $103,000, $106,600 and $106,900, respectively.

- Mobile home prices have seen the largest percentage growth in Kansas, Connecticut and Georgia. Though mobile homes in these states aren’t the most expensive, prices have grown dramatically in recent years. In these states, the average sales price of new mobile homes jumped by 84.93%, 83.03% and 79.05%, respectively, between 2018 and 2023.

States where mobile homes are most expensive

No. 1: Washington

- Average sales price of new mobile homes in 2023: $164,100

- Average sales price of new mobile homes in 2018: $102,600

- Change in average sales price of new mobile homes between 2018 and 2023: 59.94%

No. 2: California

- Average sales price of new mobile homes in 2023: $154,500

- Average sales price of new mobile homes in 2018: $112,500

- Change in average sales price of new mobile homes between 2018 and 2023: 37.33%

No. 3: Arizona

- Average sales price of new mobile homes in 2023: $148,800

- Average sales price of new mobile homes in 2018: $97,500

- Change in average sales price of new mobile homes between 2018 and 2023: 52.62%

States where mobile homes are least expensive

No. 1: Indiana

- Average sales price of new mobile homes in 2023: $103,000

- Average sales price of new mobile homes in 2018: $63,500

- Change in average sales price of new mobile homes between 2018 and 2023: 62.20%

No. 2: Wyoming

- Average sales price of new mobile homes in 2023: $106,600

- Average sales price of new mobile homes in 2018: $97,900

- Change in average sales price of new mobile homes between 2018 and 2023: 8.89%

No. 3: Ohio

- Average sales price of new mobile homes in 2023: $106,900

- Average sales price of new mobile homes in 2018: $66,600

- Change in average sales price of new mobile homes between 2018 and 2023: 60.51%

Full rankings: Average sales price of new mobile homes by state

| Rank | State | Avg. sales price of new mobile homes, 2023 | Avg. sales price of new mobile homes, 2018 | 2018 to 2023 mobile home price appreciation |

|---|---|---|---|---|

| 1 | Washington | $164,100 | $102,600 | 59.94% |

| 2 | California | $154,500 | $112,500 | 37.33% |

| 3 | Arizona | $148,800 | $97,500 | 52.62% |

| 4 | Massachusetts | $148,200 | $120,300 | 23.19% |

| 5 | Oregon | $146,300 | $94,300 | 55.14% |

| 6 | New Hampshire | $145,700 | $108,000 | 34.91% |

| 7 | Idaho | $144,900 | $98,100 | 47.71% |

| 8 | New Jersey | $143,400 | $82,700 | 73.40% |

| 9 | Florida | $142,100 | $82,400 | 72.45% |

| 10 | Delaware | $140,300 | $82,900 | 69.24% |

| 11 | South Dakota | $140,000 | $94,000 | 48.94% |

| 12 | North Dakota | $138,700 | $80,200 | 72.94% |

| 13 | Connecticut | $132,700 | $72,500 | 83.03% |

| 14 | Rhode Island | $132,400 | $88,000 | 50.45% |

| 15 | South Carolina | $130,900 | $78,000 | 67.82% |

| 16 | Maryland | $127,500 | $90,400 | 41.04% |

| 16 | Pennsylvania | $127,500 | $77,200 | 65.16% |

| 18 | Virginia | $125,800 | $84,900 | 48.17% |

| 19 | Tennessee | $124,800 | $78,900 | 58.17% |

| 19 | Georgia | $124,800 | $69,700 | 79.05% |

| 21 | Utah | $124,400 | $83,800 | 48.45% |

| 22 | Montana | $124,200 | $98,900 | 25.58% |

| 23 | Vermont | $124,100 | $70,500 | 76.03% |

| 24 | West Virginia | $123,800 | $74,100 | 67.07% |

| 25 | Maine | $123,700 | $82,500 | 49.94% |

| 26 | Kentucky | $122,900 | $75,500 | 62.78% |

| 27 | New Mexico | $122,800 | $84,000 | 46.19% |

| 28 | Texas | $121,400 | $75,200 | 61.44% |

| 29 | Minnesota | $121,200 | $78,500 | 54.39% |

| 30 | Nevada | $120,800 | $87,300 | 38.37% |

| 31 | North Carolina | $120,100 | $73,300 | 63.85% |

| 32 | Arkansas | $119,200 | $73,500 | 62.18% |

| 33 | Colorado | $118,000 | $82,300 | 43.38% |

| 34 | Oklahoma | $117,900 | $76,600 | 53.92% |

| 35 | Kansas | $117,800 | $63,700 | 84.93% |

| 36 | Nebraska | $117,600 | $82,600 | 42.37% |

| 37 | Missouri | $117,100 | $72,900 | 60.63% |

| 38 | Mississippi | $114,100 | $73,700 | 54.82% |

| 39 | New York | $113,300 | $72,900 | 55.42% |

| 40 | Iowa | $111,500 | $75,300 | 48.07% |

| 41 | Alabama | $110,700 | $72,700 | 52.27% |

| 41 | Michigan | $110,700 | $74,500 | 48.59% |

| 43 | Illinois | $110,600 | $73,400 | 50.68% |

| 43 | Wisconsin | $110,600 | $65,500 | 68.85% |

| 45 | Louisiana | $109,300 | $71,100 | 53.73% |

| 46 | Ohio | $106,900 | $66,600 | 60.51% |

| 47 | Wyoming | $106,600 | $97,900 | 8.89% |

| 48 | Indiana | $103,000 | $63,500 | 62.20% |

What are the drawbacks of buying a mobile home?

Though the relatively low cost of a mobile home can make one appealing, buying and owning one isn’t without drawbacks.

While the average sales price of new mobile homes has risen over time, some current owners may find that reselling existing units can be difficult, especially if they don’t own the land on which their home is placed. Further, securing a loan for a mobile home can be challenging and costly for borrowers with poor credit scores or those trying to buy one on land they don’t own.

These drawbacks — in addition to other downsides, like paying trailer park or land access fees — may be enough to discourage some buyers from considering a mobile home, even if they find the price appealing.

That said, a mobile home could be a good investment depending on who’s buying the property and their needs. Moreover, broader acceptance of mobile homes could help reduce housing affordability challenges plaguing many of the nation’s homebuyers. A mobile home can provide a good blend of affordability, convenience, safety and shelter if buyers understand what they’re getting.

Tips for finding affordable housing

There are many ways to make finding an affordable home — mobile or not — easier. Here are three tips:

- Shop around for a mortgage lender before determining what kind of home you can afford. Though mortgage rates are relatively steep now, you can potentially get a lower rate by shopping around for a mortgage lender before buying. Different lenders can offer different rates to the same borrowers. By getting a lower rate on a mortgage, you may find that a traditional single-family home is more affordable than expected.

- Think about renting instead of buying. While there are exceptions, renting a home is often much less expensive than buying one. If you’re looking for a home but don’t have the cash or the finances to get approved for a loan, renting can still be a great option.

- Separate fact from fiction. A would-be mobile home buyer might worry that manufactured housing is typically poorly made, and that living in a trailer park is unsafe. Fortunately, preconceptions like these are often untrue. In fact, mobile home communities are often relatively safe compared to other neighborhoods, and government agencies like HUD enforce strict safety standards for mobile homes. By learning more about alternative housing options (like mobile homes), you might find they’re more appealing and a better fit for you than another more expensive type of housing.

Methodology

Data in this study comes from the U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau Manufactured Housing Survey (MHS) and Survey of Construction (SOC). These surveys provide average sales prices for new manufactured homes and single-family homes sold in the U.S. For simplicity, this study refers to manufactured homes by their more commonly known name — “mobile” homes.

Alaska and Hawaii were excluded due to a lack of data.

Per the U.S. Census Bureau, a manufactured home is defined as “a movable dwelling, 8 feet or more wide and 40 feet or more long, designed to be towed on its own chassis, with transportation gear integral to the unit when it leaves the factory, and without need of a permanent foundation. These homes are built in accordance with the HUD building code.” Manufactured homes are completely constructed in a factory.

While mobile homes may be considered “single-family” homes in some circumstances, single-family housing unit data referenced in this study specifically refers to site-built, single-family housing units. Unlike manufactured homes, these houses are built almost entirely on the site on which they’ll remain, even if they may include some factory-made components.

View mortgage loan offers from up to 5 lenders in minutes

Read more

5 Steps for a Successful Mobile Home Refinance Updated February 6, 2025 Unlock savings with a mobile home refinance. Our guide covers everything you need to know…Read more

How Does a Mortgage Work? Updated March 30, 2023 How does a mortgage work? The more you understand how a mortgage works, the better…Read more