Mortgages for the Middle-Aged: Gen Xers Receive More Than 20% of Offers in the Nation’s Largest Metros

Many members of Generation X — born between 1965 and 1980 — are well into their middle age. While most Gen Xers aren’t house hunting, they make up a notable chunk of homebuyers in today’s expensive housing market.

To highlight where Gen Xers are looking to buy, LendingTree analyzed mortgage offers given to users of our online shopping platform across the nation’s 50 largest metropolitan areas from Jan. 1 through Dec. 31, 2023.

Gen Xers (ages 43 to 58 in 2023) received over 21% of the mortgages offered last year on the LendingTree platform in the nation’s 50 largest metros, though the share varies by locale.

Key findings

- Across the nation’s 50 largest metros, 21.25% of mortgage offers in 2023 on the LendingTree platform went to Gen Xers. They received more than 20% of offered mortgages in 29 of the nation’s 50 largest metros.

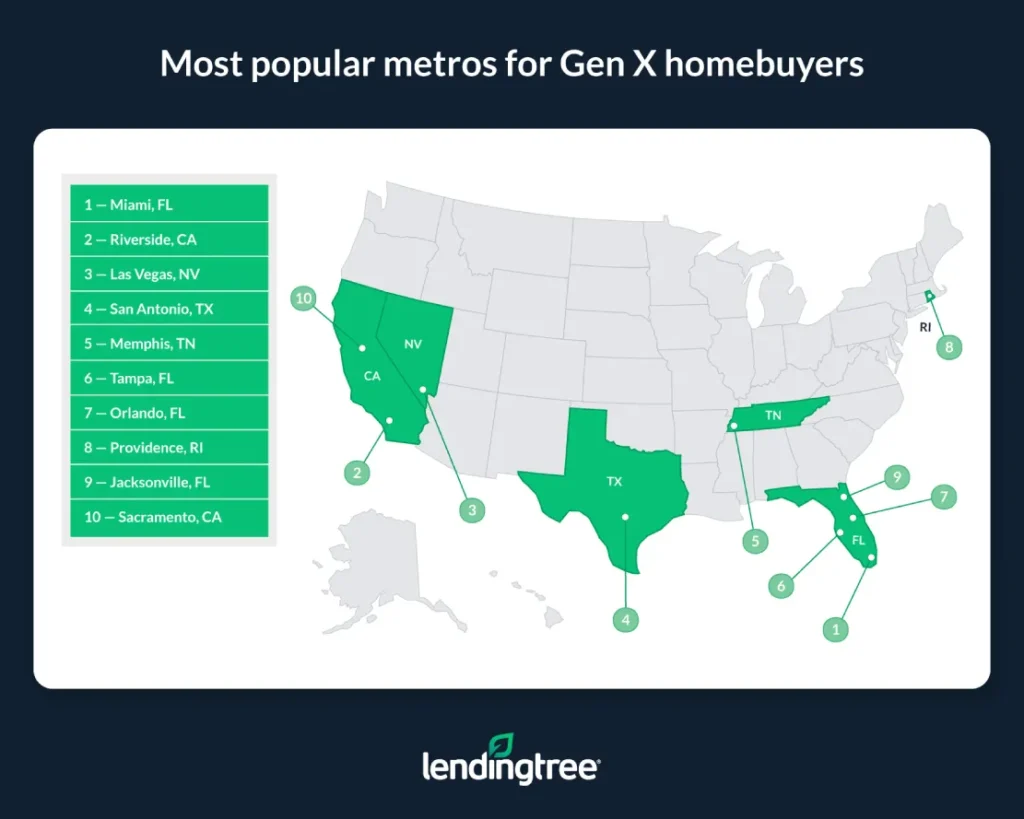

- Gen Xers made up the largest share of potential homebuyers in Miami, Riverside, Calif., and Las Vegas. In Miami, 27.43% of mortgage offers made on the LendingTree platform went to Gen Xers. The shares in Riverside and Las Vegas were 27.14% and 27.07%, respectively. These metros — which skew older — were the only ones featured in which Gen Xers received more than 27% of mortgage offers.

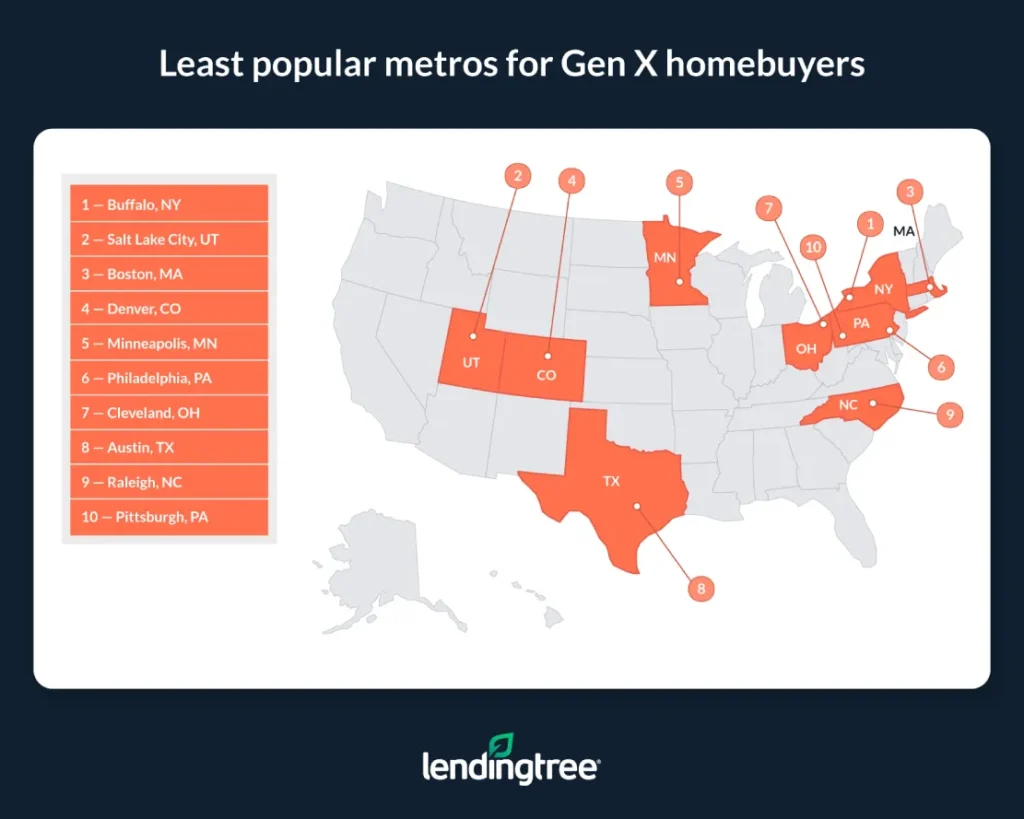

- Gen Xers made up the smallest share of potential buyers in Buffalo, N.Y., Salt Lake City and Boston. With 15.39% and 15.92% of mortgage offers going to Gen Xers in Buffalo and Salt Lake, these were the only two featured in which fewer than 16% of mortgage offers went to Gen Xers. At 16.73%, the share of offers given to Gen Xers in Boston was the third-lowest across the nation’s 50 largest metros.

- Gen Xers in expensive California metros such as San Jose, San Francisco and Los Angeles planned to put the largest down payments toward their homes. The average down payments among potential Gen X homebuyers across these metros in 2023 were $193,155, $168,762 and $129,124, respectively. Comparatively, down payments among potential buyers were smallest in Oklahoma City, Virginia Beach, Va., and Detroit, averaging $44,077, $46,127 and $46,698.

- Like down payments, offered loan amounts were largest in San Jose, San Francisco and Los Angeles. Offered loan amounts in these metros in 2023 were $679,443, $637,665 and $580,723, respectively. Conversely, at $246,300, $247,705 and $263,732, average loan amounts offered in Buffalo, Cleveland and Oklahoma City were the smallest among the nation’s 50 largest metros.

- Gen Xers often planned to put larger down payments toward their homes than millennials, but they tended to be offered smaller mortgages. As with Gen Xers, planned down payments among millennials were highest in San Jose, San Francisco and Los Angeles. But the average planned down payment amount among millennials in each metro ($170,591, $159,392 and $111,068, respectively) was lower than the average planned down payment amount among Gen Xers. That said, in part because millennials were putting less toward their down payments, the average loan amounts offered to them in these metros ($785,391, $731,062 and $627,322, respectively) were higher than the averages offered to Gen Xers.

Most popular metros for Gen X homebuyers

No. 1: Miami

- Share of mortgages offered to Gen Xers: 27.43%

- Average age among potential Gen X homebuyers: 50

- Average down payment amount among potential Gen X homebuyers: $77,933

- Average mortgage amount offered to Gen Xers: $369,862

No. 2: Riverside, Calif.

- Share of mortgages offered to Gen Xers: 27.14%

- Average age among potential Gen X homebuyers: 50

- Average down payment amount among potential Gen X homebuyers: $61,167

- Average mortgage amount offered to Gen Xers: $410,349

No. 3: Las Vegas

- Share of mortgages offered to Gen Xers: 27.07%

- Average age among potential Gen X homebuyers: 50

- Average down payment amount among potential Gen X homebuyers: $56,908

- Average mortgage amount offered to Gen Xers: $365,025

Least popular metros for Gen X homebuyers

No. 1: Buffalo, N.Y.

- Share of mortgages offered to Gen Xers: 15.39%

- Average age among potential Gen X homebuyers: 49

- Average down payment amount among potential Gen X homebuyers: $55,740

- Average mortgage amount offered to Gen Xers: $246,300

No. 2: Salt Lake City

- Share of mortgages offered to Gen Xers: 15.92%

- Average age among potential Gen X homebuyers: 49

- Average down payment amount among potential Gen X homebuyers: $57,032

- Average mortgage amount offered to Gen Xers: $401,839

No. 3: Boston

- Share of mortgages offered to Gen Xers: 16.73%

- Average age among potential Gen X homebuyers: 49

- Average down payment amount among potential Gen X homebuyers: $104,072

- Average mortgage amount offered to Gen Xers: $445,873

Why more Gen Xers aren’t buying homes

Gen Xers receive mortgage offers, but the share is notably lower than what goes to their younger millennial counterparts. It isn’t because Gen Xers have been defeated by high housing costs, while millennials haven’t. Instead, it’s because many Gen Xers already own homes they aren’t in a hurry to part with.

For example, the homeownership rate among Gen Xers is nearly 70%, significantly higher than the 51% among millennials. This higher homeownership rate means Gen Xers generally have less incentive to jump into today’s expensive housing market because they’re more likely to already own a home and would likely have to sacrifice the lower rate and more affordable mortgages they received in the past.

Put another way, with many Gen Xers already settled in their homes, the drive to move may not be as strong as it is for members of younger generations. These younger Americans could be looking to flex the newfound buying power they’ve gained as they’ve become more established in their careers. Or, they could be looking to find a new place that better suits their growing families.

Further, as Gen Xers age, staying put, building home equity and saving for retirement can become higher priorities for those gearing up to leave the workforce in the next 10 to 20 years.

At the end of the day, while the share of mortgage offers going to Gen Xers may be small, this doesn’t mean they haven’t been successful in the housing market. On the contrary, their relatively high homeownership rate indicates that many have already achieved the homeownership dream. Going forward, Gen Xers will likely remain a significant and stable segment of property owners, even if they largely shy away from buying new houses.

Tips for Gen X homebuyers

Regardless of your age, high home prices and steep mortgage rates can make buying property in today’s housing market challenging. The following tips can help make the homebuying process more manageable.

- Shop around for a mortgage before you buy. Different lenders can offer different rates to the same borrowers. Just as having a higher credit score or less debt can help you get a lower rate on your mortgage and save money, so too can shopping around for a mortgage and comparing offers from different lenders before buying.

- Consider using home equity to modify what you already own. If you’re already a homeowner but find that your house isn’t working for you as well as you’d like, it may be cheaper or preferable to make renovations instead of moving to a new home. This is especially true if you don’t want to sacrifice your current, relatively low-rate mortgage or you like the location in which you’re living. Like a first-lien mortgage, rates offered on home equity loans vary by lender and shopping around for one can help you save money.

- Plan carefully for the future. Though the vast majority aren’t on the precipice of retirement, many Gen Xers are approaching their golden years. Owing to this, they should pay attention to whether buying a new house will put them in a difficult position to save for retirement. In that same vein, they should ask themselves whether the home they’re buying will remain manageable as they age.

Methodology

LendingTree analyzed over 750,000 mortgage offers given to users of the LendingTree mortgage shopping platform in the nation’s 50 largest metropolitan areas from Jan. 1 through Dec. 31, 2023. We analyzed about 204,000 offers given to Gen Xers ages 43 to 58.

Homeownership rates were derived from U.S. Census Bureau 2022 American Community Survey microdata with one-year estimates (the latest available).

The metro rankings were generated by looking at the share of mortgages offered to Gen Xers as a percentage of the total number of mortgages offered in a given area. The larger the share of offers given to Gen Xers, the higher the ranking a metro received.

View mortgage loan offers from up to 5 lenders in minutes