Getting the Best Mortgage Refinance Rate Could Save You $54,000

If you refinance your home at the lowest rate offered, you may be able to save more than $50,000 compared to your current mortgage.

LendingTree analyzed mortgage refinance inquiries for 30-year, fixed-rate loans made on our online loan marketplace over the past two years. We looked not only at potential savings from refinancing but also at trends in the nation’s 50 biggest metros.

Here’s what we found.

Key findings

- Refinancing at the best available rate could save you $50,000 or more over your current mortgage. In September 2025, the average mortgage refinance request was $328,856, with the best rate averaging 6.51%. If you bought a house at that same price in September 2023, when the average APR offer was 7.20%, refinancing the home at today’s best rate could reduce your monthly payments by $151 and save you $54,360 over the life of a 30-year fixed mortgage.

- Mortgage refinance inquiries fell by 7.5% in the 12 months ending Sept. 30, 2025, compared to the prior 12 months. Only three of the 50 largest metros saw increases: Charlotte, N.C. (4.6%), Memphis, Tenn. (4.1%), and Las Vegas (1.5%). The largest declines were in Columbus, Ohio (25.9%), Cincinnati (23.6%) and San Jose, Calif. (21.5%).

- Average refinance request amounts decreased by 1.7% over that same period, from $299,962 to $294,982. Refinance request amounts rose in 19 of the 50 largest metros, led by Richmond, Va. (5.9%), Birmingham, Ala. (4.0%), and Cincinnati (3.0%). The largest declines were in Austin, Texas, and Grand Rapids, Mich. (both 5.3%), and Jacksonville and Tampa, Fla. (both 4.8%).

- American homeowners are sitting on $35.8 trillion in home equity as of the second quarter of 2025, providing them with significant borrowing capacity. Over the 12 months ending Sept. 30, 2025, 7 in 10 (70.4%) refinance inquiries were for cash-out refis, while 28.1% were for rate-and-term refis and 1.4% were for “other.”

- Cash-out refinancing typically increases monthly payments, even when rates fall. In September 2025, the average cash-out request was $96,805, with an average lowest offered rate of 6.49%. Though that rate is far lower than the 7.20% average rate for offers in September 2023, the far higher loan balance means that borrowers should expect higher monthly payments.

Refinancing at the best available rate could mean huge savings

Our analysis showed that the average refinance loan request was $328,856 in September 2025. That’s for refinancing one 30-year, fixed-rate mortgage into another 30-year, fixed-rate mortgage. The average APR offered on the LendingTree platform for these refinance loans was 6.83%, while the average lowest offered rate was 6.51%.

To calculate the potential refinance savings, we compared the above rates to the average rate for a 30-year, fixed-rate mortgage in September 2023, as reported by Freddie Mac — 7.20%. The savings were profound. Someone with a $328,856 mortgage and a current APR of 7.20% could save nearly $30,000 by refinancing with the average offered rate and more than $54,000 by taking the average lowest offered rate. That can add up to $151 of monthly savings.

That is a big deal.

Savings by refinancing mortgage (rate-and-term refinancing)

| Avg. loan amount | Current rate | New refinance rate | Current monthly payment | New monthly payment | Monthly savings | Lifetime savings | |

|---|---|---|---|---|---|---|---|

| Avg. offered APR | $328,856 | 7.20% | 6.83% | $2,232 | $2,150 | $82 | $29,520 |

| Avg. lowest offered APR | $328,856 | 7.20% | 6.51% | $2,232 | $2,081 | $151 | $54,360 |

When you consider that mortgage costs have continued to decline since we conducted our analysis in September, the savings today could be even more significant.

It’s important to understand that our calculations don’t include the closing costs involved with a refinance. Those closing costs can run from 2% to 6% of the loan amount — anywhere from about $6,600 to nearly $20,000 on a $328,856 loan. However, the savings are still noteworthy — even if you factor in those additional costs.

Mortgage refinance inquiries fall by 7.5%

Our analysis also compared refinance activity for the past year (Oct. 1, 2024, to Sept. 30, 2025) to the year before (Oct. 1, 2023, to Sept. 30, 2024). We found a 7.5% decrease in mortgage refinance activity between these periods, with most of the nation’s biggest metros seeing at least double-digit declines.

We did see refinance activity rise in August and September 2025, as mortgage rates fell. However, those levels were still significantly lower than what we saw in late 2024 and early 2025, leaving overall refi activity lower for the 12 months ending on Sept. 30, 2025, than it was during the previous 12 months.

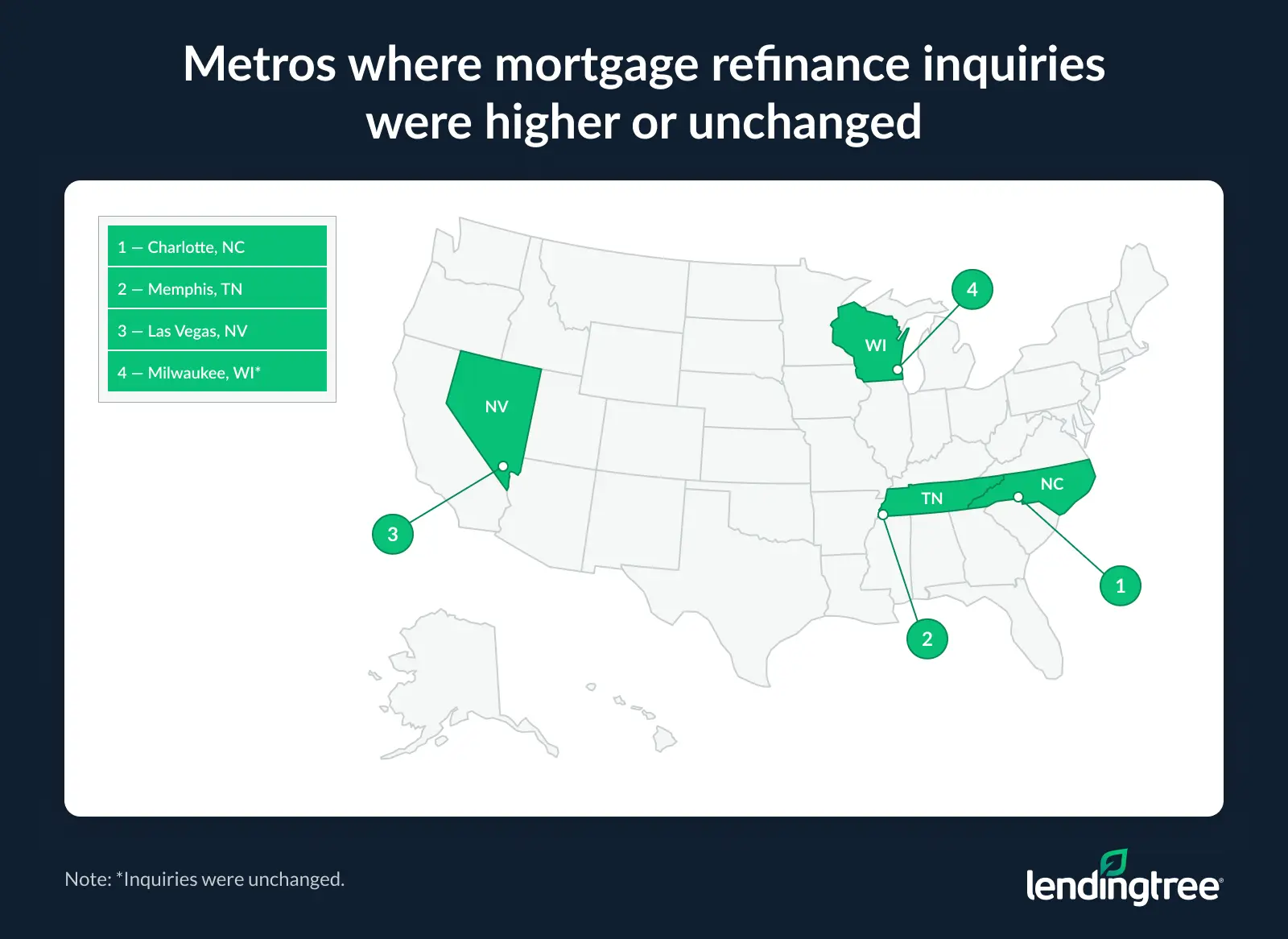

Across the analyzed period, just three of the nation’s 50 largest metros saw increases. Charlotte, N.C., saw the biggest jump (4.6%), followed by Memphis, Tenn. (4.1%), and Las Vegas (1.5%). Milwaukee was unchanged during that period.

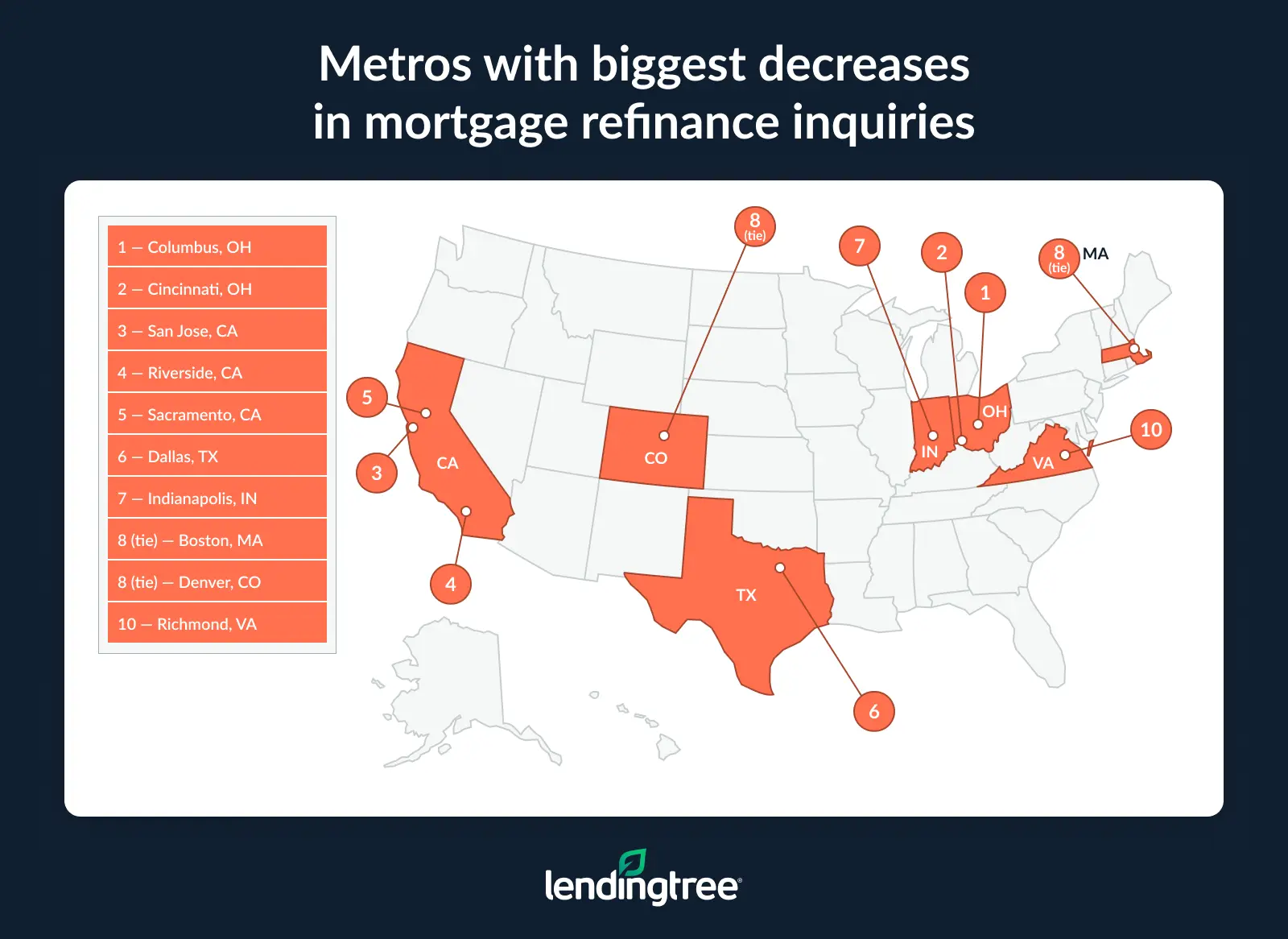

That leaves 46 of the nation’s 50 biggest metros with decreases in mortgage refinance activity during the period reviewed, including 31 with decreases of at least 10% and five with decreases of more than 20%.

The five largest decreases were in Ohio (led by Columbus at 25.9% and Cincinnati at 23.6%) and California (led by San Jose at 21.5%, Riverside at 20.8% and Sacramento at 20.5%). The rest of the metros with the biggest decreases are spread throughout the U.S., as you can see in the map below.

Changes in refinancing inquiries across 50 largest metros

| Rank | Metro | Refinance inquiries change |

|---|---|---|

| 1 | Charlotte, NC | 4.6% |

| 2 | Memphis, TN | 4.1% |

| 3 | Las Vegas, NV | 1.5% |

| 4 | Milwaukee, WI | 0.0% |

| 5 | Los Angeles, CA | -0.3% |

| 6 | Phoenix, AZ | -1.1% |

| 7 | Grand Rapids, MI | -4.1% |

| 8 | Pittsburgh, PA | -5.0% |

| 9 | Detroit, MI | -5.2% |

| 10 | Hartford, CT | -5.4% |

| 11 | Nashville, TN | -5.6% |

| 12 | Providence, RI | -6.3% |

| 13 | Baltimore, MD | -7.0% |

| 14 | Raleigh, NC | -7.1% |

| 15 | St. Louis, MO | -7.6% |

| 16 | Minneapolis, MN | -8.4% |

| 17 | Portland, OR | -8.7% |

| 18 | Kansas City, MO | -8.9% |

| 19 | Atlanta, GA | -9.2% |

| 20 | Philadelphia, PA | -10.7% |

| 21 | Oklahoma City, OK | -10.9% |

| 21 | Salt Lake City, UT | -10.9% |

| 23 | Virginia Beach, VA | -11.3% |

| 24 | San Antonio, TX | -12.1% |

| 25 | Birmingham, AL | -12.5% |

| 26 | Washington, DC | -12.7% |

| 27 | Seattle, WA | -12.8% |

| 28 | Tampa, FL | -13.2% |

| 29 | Miami, FL | -13.3% |

| 30 | San Francisco, CA | -13.8% |

| 31 | Fresno, CA | -13.9% |

| 32 | Houston, TX | -14.1% |

| 33 | Orlando, FL | -14.3% |

| 34 | New York, NY | -14.4% |

| 35 | Cleveland, OH | -15.0% |

| 36 | Chicago, IL | -15.6% |

| 37 | Jacksonville, FL | -15.7% |

| 38 | Louisville, KY | -16.5% |

| 39 | Austin, TX | -16.7% |

| 39 | San Diego, CA | -16.7% |

| 41 | Richmond, VA | -16.8% |

| 42 | Denver, CO | -17.9% |

| 42 | Boston, MA | -17.9% |

| 44 | Indianapolis, IN | -18.3% |

| 45 | Dallas, TX | -18.8% |

| 46 | Sacramento, CA | -20.5% |

| 47 | Riverside, CA | -20.8% |

| 48 | San Jose, CA | -21.5% |

| 49 | Cincinnati, OH | -23.6% |

| 50 | Columbus, OH | -25.9% |

Average refinance loan request amounts fall over same period, too

While refinance inquiries fell during the period analyzed, the average refi request amount did, too, though not as substantially. The average amount dipped by 1.7% over the past 12 months compared to the 12 months prior, from $299,962 to $294,982.

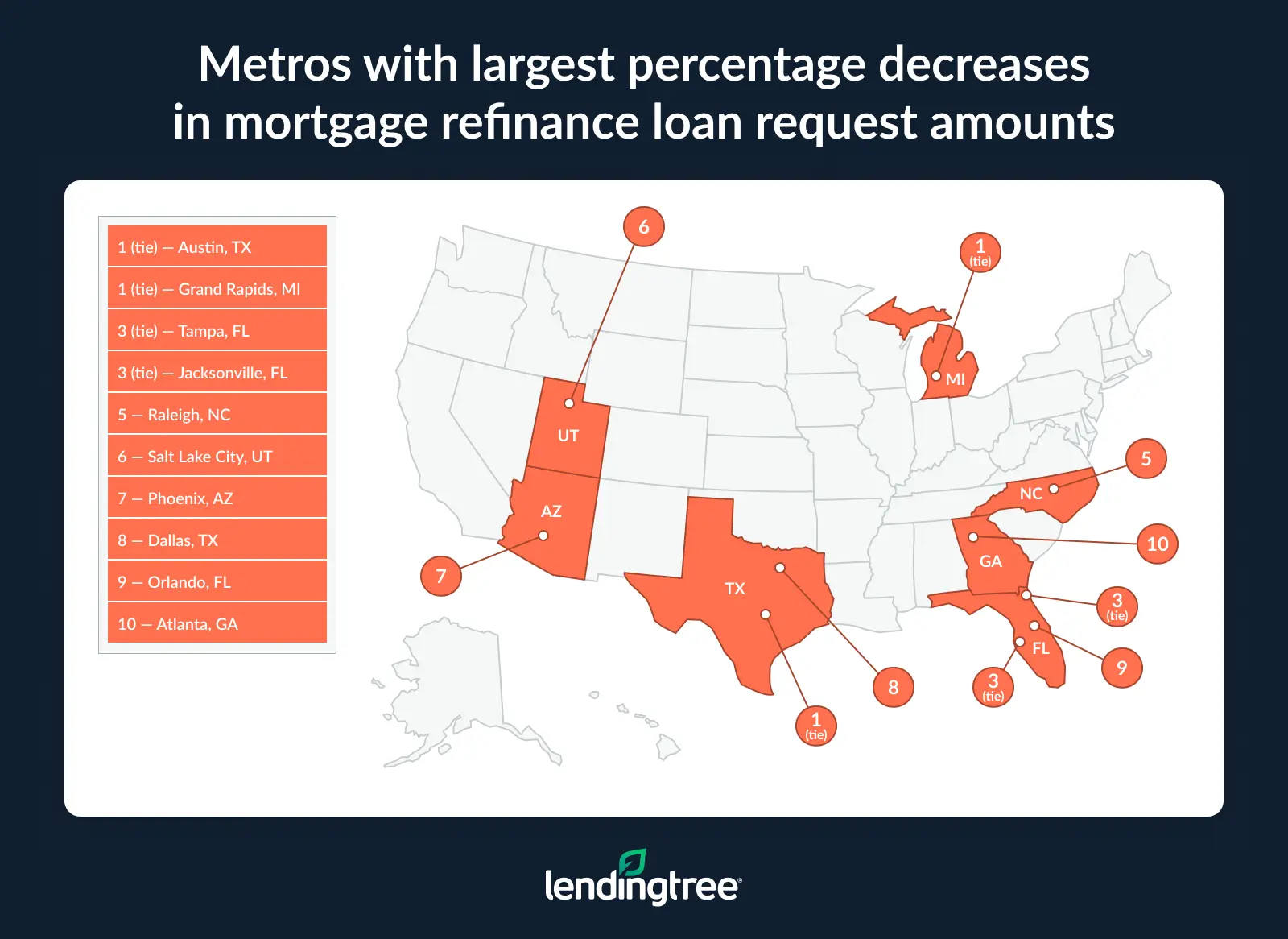

Twenty-nine of the 50 metros we reviewed saw decreases. Austin, Texas, and Grand Rapids, Mich. (both 5.3%), saw the largest decreases, followed by Jacksonville and Tampa, Fla. (both 4.8%). Most of the metros with the largest decreases were in the South.

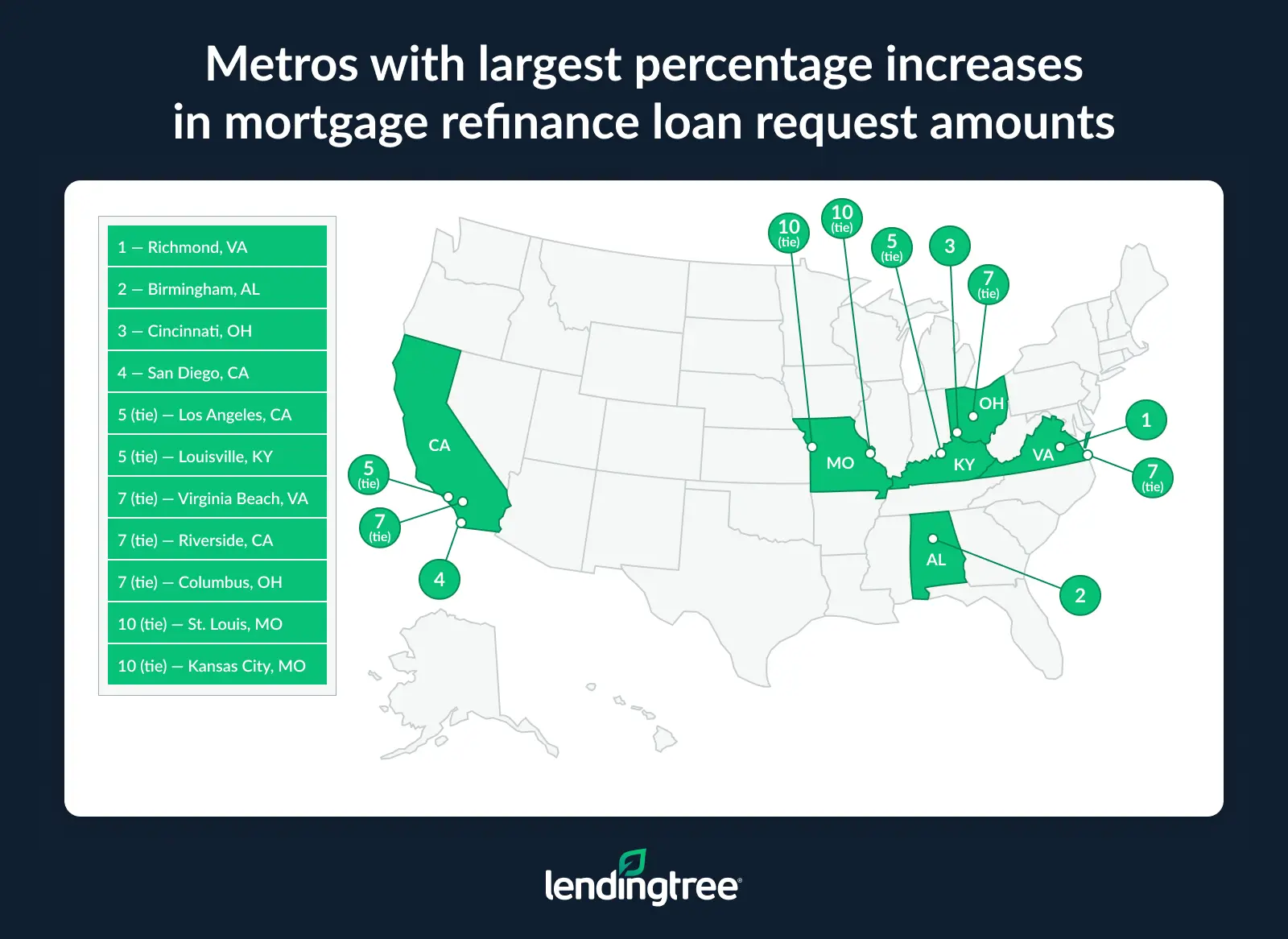

Loan request amounts rose in 19 of the 50 largest metros, with the biggest increases coming in the eastern U.S. Richmond, Va. (5.9%), saw the biggest jump, followed by Birmingham, Ala. (4.0%), and Cincinnati (3.0%).

Of the 19 increases, 10 were less than 2.0% (and five of those were less than 1.0%). Two other metros — Oklahoma City and San Jose, Calif. — saw no change.

Change in average mortgage refinance loan request amounts in 50 largest metros

| Rank | Metro | Avg., Oct. 2024-Sept. 2025 | Avg., Oct. 2023-Sept. 2024 | Change |

|---|---|---|---|---|

| 1 | Richmond, VA | $289,901 | $273,811 | 5.9% |

| 2 | Birmingham, AL | $248,204 | $238,591 | 4.0% |

| 3 | Cincinnati, OH | $239,377 | $232,313 | 3.0% |

| 4 | San Diego, CA | $516,301 | $502,359 | 2.8% |

| 5 | Los Angeles, CA | $502,330 | $490,309 | 2.5% |

| 5 | Louisville, KY | $232,188 | $226,435 | 2.5% |

| 7 | Virginia Beach, VA | $283,790 | $278,251 | 2.0% |

| 7 | Riverside, CA | $382,314 | $374,975 | 2.0% |

| 7 | Columbus, OH | $259,891 | $254,891 | 2.0% |

| 10 | St. Louis, MO | $233,293 | $229,599 | 1.6% |

| 10 | Kansas City, MO | $247,610 | $243,603 | 1.6% |

| 12 | Milwaukee, WI | $260,699 | $256,892 | 1.5% |

| 13 | Detroit, MI | $236,266 | $233,105 | 1.4% |

| 14 | New York, NY | $369,453 | $364,996 | 1.2% |

| 15 | Las Vegas, NV | $331,393 | $329,197 | 0.7% |

| 15 | Minneapolis, MN | $284,532 | $282,449 | 0.7% |

| 15 | Boston, MA | $397,805 | $395,160 | 0.7% |

| 18 | Hartford, CT | $264,079 | $263,410 | 0.3% |

| 18 | Philadelphia, PA | $281,253 | $280,551 | 0.3% |

| 20 | Oklahoma City, OK | $231,388 | $231,500 | 0.0% |

| 20 | San Jose, CA | $600,547 | $600,465 | 0.0% |

| 22 | Fresno, CA | $302,279 | $302,719 | -0.1% |

| 22 | Sacramento, CA | $381,967 | $382,366 | -0.1% |

| 24 | Pittsburgh, PA | $223,260 | $223,803 | -0.2% |

| 24 | Nashville, TN | $319,418 | $320,195 | -0.2% |

| 26 | Cleveland, OH | $217,477 | $218,134 | -0.3% |

| 26 | Indianapolis, IN | $240,039 | $240,776 | -0.3% |

| 28 | Seattle, WA | $432,052 | $433,583 | -0.4% |

| 29 | San Francisco, CA | $549,791 | $553,966 | -0.8% |

| 30 | Chicago, IL | $272,552 | $275,665 | -1.1% |

| 31 | Memphis, TN | $231,441 | $234,521 | -1.3% |

| 32 | Washington, DC | $394,677 | $401,132 | -1.6% |

| 32 | Miami, FL | $328,157 | $333,624 | -1.6% |

| 32 | Houston, TX | $273,982 | $278,427 | -1.6% |

| 35 | Denver, CO | $387,982 | $394,887 | -1.7% |

| 36 | Charlotte, NC | $290,677 | $296,341 | -1.9% |

| 36 | San Antonio, TX | $275,292 | $280,669 | -1.9% |

| 38 | Providence, RI | $309,672 | $315,863 | -2.0% |

| 39 | Baltimore, MD | $303,455 | $309,939 | -2.1% |

| 40 | Portland, OR | $365,116 | $373,248 | -2.2% |

| 41 | Atlanta, GA | $288,662 | $295,403 | -2.3% |

| 42 | Orlando, FL | $291,572 | $298,731 | -2.4% |

| 43 | Dallas, TX | $305,655 | $315,491 | -3.1% |

| 44 | Phoenix, AZ | $325,586 | $337,982 | -3.7% |

| 45 | Salt Lake City, UT | $373,209 | $387,939 | -3.8% |

| 46 | Raleigh, NC | $309,535 | $323,011 | -4.2% |

| 47 | Tampa, FL | $276,445 | $290,373 | -4.8% |

| 47 | Jacksonville, FL | $275,880 | $289,651 | -4.8% |

| 49 | Grand Rapids, MI | $239,146 | $252,619 | -5.3% |

| 49 | Austin, TX | $338,183 | $356,980 | -5.3% |

Most refinance inquiries are about cashing out

American homeowners are sitting on a mountain of home equity — an estimated $35.8 trillion, according to Federal Reserve data. That gives them enormous borrowing power, and many Americans are taking advantage of it through so-called cash-out refinancing.

With a cash-out refinance, you take out a mortgage that’s larger than your current one, use it to pay off the current one and take the rest of the funds as a lump sum. It basically allows you to convert your home equity into cash.

Seven in 10 (70.4%) refinance inquiries made in the 12 months ending Sept. 30, 2025, were for cash-out refinances. Nearly 3 in 10 (28.1%) were for so-called rate-and-term refis — loans taken out in pursuit of savings from lower interest rates or other term changes. (Another 1.4% were taken out for various other reasons.) We saw a significant drop in rate-and-term refis during the analyzed period (13.5%), while cash-out refis fell just 4.6%.

Share of cash-out vs. rate-and-term refinances

| Refinance purpose | % of inquiries | Change |

|---|---|---|

| Rate-and-term refinance | 28.1% | -13.5% |

| Cash-out refinance | 70.4% | -4.6% |

| Other purpose | 1.4% | -18.0% |

More than 8 in 10 refinance inquiries (81.3%) were submitted by people with credit scores of 660 or better, including 59.3% by those with scores of 720 or better.

Just 8.1% of refi inquiries were made by those with subprime or worse credit — those with scores of 619 or lower. We also saw bigger decreases in refinance inquiries among those at the lower end of the credit spectrum than at the top.

Cash-out refinancing typically means higher monthly payments, even with lower rates

While there can certainly be benefits to converting your home equity into cash, you should expect to pay a price.

Our analysis found that the average cash-out refinance request in September 2025 was $96,805. The average APR that applicants were offered was 6.98%, with the average lowest offered APR at 6.49%. Again, for our analysis, we compared those average numbers to the average rate for a 30-year, fixed mortgage in September 2023, as reported by Freddie Mac, which was 7.20%.

While the rates are significantly lower, the higher loan amounts mean that the average monthly payments will be higher, too.

Savings by refinancing mortgage (cash-out refinancing)

| Avg. loan amount | Avg. cash-out amount | Current rate | New refinance rate | Current monthly payment | New monthly payment | Monthly change | Lifetime change | |

|---|---|---|---|---|---|---|---|---|

| Avg. offered APR | $197,555 | $96,805 | 7.20% | 6.98% | $1,341 | $1,954 | $613 | $220,680 |

| Avg. lowest offered APR | $197,555 | $96,805 | 7.20% | 6.49% | $1,341 | $1,859 | $518 | $186,480 |

Tips to help with your refinancing decision

Whether you’re looking to save by lowering your interest rate or cash out by tapping into your home equity, refinancing is a big decision. It’s not something to enter into lightly.

Here are a few tips to help you take that next step:

- Improve your financial picture. Easier said than done, certainly, but it matters a lot. Raising your credit score and shrinking your loan-to-value and debt-to-income ratios can go a long way to helping you lock in the best possible rate on your refinance. If you’ve done these things, you should be proud of yourself. Make sure your lenders know.

- Shop around. There can be significant differences in loan terms among different lenders, and even a small fraction of a percentage point can mean tens of thousands of dollars in savings over the life of a mortgage. If you don’t shop around, you’re doing yourself a disservice. Simple as that.

- Consider how long you’ll be in the home. Refinancing isn’t free, and if you’re planning to sell your home soon, you may never realize any savings from the transaction. Our mortgage refinance calculator can help you determine when you’ll hit that break-even point and start saving money.

- Check about prepayment penalties. Some lenders will charge you a substantial fee if you pay off your mortgage early. Be sure you know if you will be subject to one. Otherwise, your break-even point calculations won’t be accurate.

- Consider other loan alternatives. If you’re looking to tap into home equity, a cash-out refinance isn’t your only choice. A home equity loan or home equity line of credit (HELOC) may be a better fit. It’s likely worth the time to explore those possibilities before you act, just so you’re making the most informed choice possible.

- Know your own risk tolerance. Whenever you use your home as collateral, it’s a big deal. Make sure that you’re going to be able to sleep at night once you’ve taken out that loan.

Methodology

LendingTree analysts analyzed data from the LendingTree online loan marketplace, focusing on mortgage refinancing inquiries for 30-year, fixed-rate loans from Oct. 1, 2024, to Sept. 30, 2025. They compared inquiry volume and average requested loan amounts over this 12-month period with the previous 12-month period (from Oct. 1, 2023, to Sept. 30, 2024) across the 50 largest metros.

The analysis calculated the share of refinancing by loan purpose and the change in refinancing between these periods. To estimate potential borrower savings, monthly and lifetime payment differences were calculated by comparing:

- The 30-year, fixed-rate mortgage average in the U.S. for September 2023 (Freddie Mac)

- The average APR offered to consumers in September 2025

- The lowest (best) APR offered per consumer in September 2025

A separate calculation was performed for cash-out refinancing, incorporating the average cash-out amount to show how payments change when borrowers access home equity.

Payments and savings are calculated on principal and interest only, excluding taxes, insurance and closing costs.

View mortgage loan offers from up to 5 lenders in minutes