When and How To Refinance a Personal Loan

Compare your rate to see if you can save by refinancing

Best personal loan refinance lenders with the lowest rates

Best for: Refinancing more than one personal loan – Best Egg

- APR

- 6.99% – 35.99%

- Can pay up to 10 creditors automatically

- Online dashboard helps you track and manage your payments to creditors

- Have the option of offering collateral to get a bigger loan or a better rate

- Will deduct 0.99% – 9.99% from your loan funds as an origination fee

- Can take up to 15 days for Best Egg to pay off your old loans

- Can’t add a co-borrower to your loan for better approval odds

If you’re consolidating debt by refinancing multiple personal loans at once, consider Best Egg. You can set up automatic payments and have your loan funds sent to up to 10 creditors. That way, you don’t have to pay them off one by one. Best Egg’s online dashboard also makes it easy to ensure your Best Egg funds made it to the right accounts.

It can take up to 15 days for your refinance loan to reach your current lender(s). If you are refinancing credit cards, the process is much quicker at one to three business days.

You’re responsible for making payments until your new loan pays off your old balances in full. Keep a close eye on your current due dates while your debt is being consolidated to avoid missing a payment and hurting your credit.

Best Egg uses built‑in home fixtures as collateral but doesn’t require an appraisal of them. It reviews your credit history and home equity instead.

You must also meet the requirements below to qualify for a Best Egg loan:

- Citizenship: Be a U.S. citizen or permanent resident living in the U.S.

- Administrative: Have a personal checking account, email address and physical address

- Residency: Not live in the District of Columbia, Iowa, Vermont, West Virginia or U.S. territories

- Credit score: 620+

Best for: Those refinancing a lot of personal loan debt – BHG Financial

- APR

- 8.72% – 28.89%

Not all solutions, loan amounts, rates or terms are available in all states. Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant’s credit profile. For example, if you request a $60,000 unsecured loan with an 84-month term and a 17.06% APR (which includes a 15.99% yearly interest rate and a 3% one-time origination fee), you would receive $58,200 and would have a required monthly payment of $1,191.38. Rates and terms are for illustrative purposes only and may vary based on creditworthiness and other factors. The APR includes the origination fee. Not all applicants will qualify for the lowest rate. Loan terms and availability are subject to change without notice. Loan amount may vary based upon request amount and cash to you. This is not a guaranteed offer of credit and is subject to credit approval. There is no impact on your credit for applying. For personal loans, a complete credit history, which will appear as an inquiry on your credit report, will be performed upon acceptance and funding of the loan and may impact your credit. Advertised rates are subject to change without notice

The APR and other loan terms presented are estimates only and not guaranteed.

Google Play and the Google Play logo are trademarks of Google LLC.

Apple Store and the App Store logo are registered trademarks of Apple Inc.

Consumer loans funded by Pinnacle Bank, a Tennessee bank, or County Bank. Equal Housing Lenders. (EHL Logo).

For California Residents: BHG Financial consumer loans made or arranged pursuant to a California Financing Law license – Number 603G493.

- Can refinance up to $250,000

- Extra-long loan terms can help you fit a bigger loan into your budget

- U.S.-based customer service

- Might not work if you don’t have a lot of debt to refinance

- May find a lower rate elsewhere if you have excellent credit

- May charge an origination fee

When you need to refinance a big personal loan, BHG Financial may be a good fit.

Many people refinance personal loans to stretch out their loan term. This usually results in a lower monthly payment (but more total interest). With BHG Financial, you could have up to 120 months to pay off your refinance loan.

Although you need a credit score of at least 640 to qualify in general, you likely won’t get approved for BHG’s biggest, longest-term loans unless you have excellent credit. BHG’s average borrower has a 740 FICO Score and an annual income of $213,000.

To get a loan from BHG Financial, you’ll need to meet the following requirements:

- Administrative: Have a Social Security number and email address

- Credit score: 640+

BHG Financial’s average borrower has a score of 740 and an annual income of $213,000. Not all of BHG Financial’s loans, loan amounts, rates or terms are available in all states.

Best for: Support during financial hardship – Discover

- APR

- 7.99% – 24.99%

- May be willing to work with you if you’re having trouble paying

- Will quickly send loan proceeds to your old creditors

- No fees

- With a maximum loan amount of $40,000, it might not be a good fit if you have a lot of debt to refinance

- Borrowers won’t qualify with bad credit

- No joint loans

If you want a financial safety net for unexpected events like a job loss, Discover is worth considering. It offers a program designed to help borrowers if they’re having a hard time keeping up with their payments. Your account must have been active for the previous six months to qualify.

If you’re looking for a personal loan with no origination fee, Discover also fits that bill. It doesn’t charge any fees at all.

A Discover personal loan isn’t easy to qualify for, however. It requires very good credit and a moderate income. Discover also doesn’t offer joint applications, so you’ll have to qualify based on your credit alone.

You’ll need to meet these eligibility criteria to get a Discover personal loan:

- Age: Be at least 18 years old

- Citizenship: Have a Social Security number

- Administrative: Have a physical address, email address and internet access

- Income: Minimum income of $40,000 (individually or as a household)

- Credit score: 720+

Best for: Beating competitors’ rates – LightStream

- APR (with autopay)

- 7.24% – 23.89%

Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% points higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $25,000 loan at 6.49% APR with a term of 3 years would result in 36 monthly payments of $766.11. © 2024 Truist Financial Corporation. Truist, LightStream and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank.

- May beat a competitor’s rate through the Rate Beat program

- Can get your funds the same day you apply

- No fees

- Won’t pay off your personal loans directly

- Must have at least $5,000 to refinance

- Can’t check rates without a hard credit pull, which can ding your credit

- Doesn’t refinance its own loans

LightStream is an online lender with a unique rate-matching program called Rate Beat. If another lender offers you a similar loan with a lower rate, LightStream may beat it by 0.10 percentage points. Loan shopping and refinancing go hand in hand, so keep Rate Beat in mind while comparing loan options.

You can’t prequalify for a loan with LightStream. That means it requires a hard credit check if you want to see if you’re eligible. It also won’t pay off your existing loans for you. Instead, you’ll have to send the funds to your old personal loan company (or companies) yourself.

LightStream doesn’t specify its exact credit score requirements, but you must have good to excellent credit to qualify. Most of the applicants that LightStream approves have the following in common:

- At least five years of on-time payment history on a variety of accounts (credit cards, auto loans, mortgages and other types of debt)

- Stable income and the ability to afford current debt obligations

- Savings, whether in a bank account, investment account or retirement account

Best for: Free financial planning – SoFi

- APR (with discounts)

- 8.74% – 35.49%

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. To qualify, a borrower must be a U.S. citizen or other eligible status, be residing in the U.S., and meet SoFi’s underwriting requirements. Not all borrowers receive the lowest rate. Lowest rates reserved for the most creditworthy borrowers. If approved, your actual rate will be within the range of rates at the time of application and will depend on a variety of factors, including term of loan, evaluation of your creditworthiness, income, and other factors. If SoFi is unable to offer you a loan but matches you for a loan with a participating bank, then your rate may be outside the range of rates listed above. Rates and Terms are subject to change at any time without notice. SoFi Personal Loans can be used for any lawful personal, family, or household purposes and may not be used for post-secondary education expenses. Minimum loan amount is $5,000. The average of SoFi Personal Loans funded in 2024 was around $33K. Information current as of 02/23/26. SoFi Personal Loans originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org). See SoFi.com/legal for state-specific license details. See SoFi.com/eligibility for details and state restrictions. Fixed rates from 8.74% APR to 35.49% APR. APR reflect the 0.25% autopay interest rate discount and a 0.25% SoFi Plus interest rate discount. SoFi Platform personal loans are made either by SoFi Bank, N.A. or , Cross River Bank, a New Jersey State Chartered Commercial Bank, operating from its Delaware branch, Member FDIC, Equal Housing Lender. SoFi may receive compensation if you take out a loan originated by Cross River Bank. These rate ranges are current as of 02/23/26 and are subject to change without notice. Not all rates and amounts available in all states. See SoFi Personal Loan eligibility details at https://www.sofi.com/eligibility-criteria/#eligibility-personal. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including evaluation of your credit worthiness, income, and other factors. Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 9.99% of your loan amount for Cross River Bank originated loans which will be deducted from any loan proceeds you receive and for SoFi Bank originated loans have an origination fee of 0%-7%, will be deducted from any loan proceeds you receive. Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi. SoFi Plus Discount: SoFi Plus members are eligible for an interest rate reduction of 0.25% on a Personal Loan. To be eligible for the discount, you must meet the SoFi Plus eligibility criteria within 31 days of the funding of your loan. For complete SoFi Plus eligibility, please see the SoFi Plus terms. When you enroll in SoFi Plus, the discount will lower the interest rate that applies to your loan only during periods in which you are enrolled in SoFi Plus. The discount will be removed during periods in which SoFi determines you are not enrolled in SoFi Plus. Each time your loan is re-amortized, your monthly payment amount will change based upon the interest rate that was in place. SoFi reserves the right to change or terminate this offer for unenrolled participants at any time. You are not required to enroll in SoFi Plus to be eligible for Loan approval.

- Free 30-minute session with a financial planner

- SoFi will pay off your previous creditor on your behalf, if you prefer

- Can refinance up to $100,000

- Must have at least $5,000 to refinance

- Charges origination fee if you want the lowest rate

- Doesn’t work with bad-credit borrowers

Every SoFi personal loan comes with a free, 30-minute financial advising session with a financial planner. If you want unlimited access to free financial planning, you can opt for a SoFi Plus membership for $10 a month.

However, SoFi will only make sense if you have a larger loan to refinance — you can’t borrow less than $5,000. Also, SoFi’s lowest rates require an origination fee. Compare loan offers with and without fees to see which option is the best choice for you.

You must meet the requirements below to get a loan from SoFi:

- Age: Be the age of majority in your state (typically 18)

- Citizenship: Be a U.S. citizen, an eligible permanent resident or a non-permanent resident (a DACA recipient or asylum-seeker, for instance)

- Employment: Have a job or job offer with a start date within 90 days, or have regular income from another source

- Credit score: 600+

Best for: Bad credit personal loan refinancing – Upstart

- APR

- 6.20% – 35.99%

- Can qualify with bad credit

- Might not get denied with thin or no credit

- Uses an algorithm to determine your creditworthiness, not just your credit score

- Can’t add a co-borrower to your loan to help you get approved

- Could pay an origination fee

- App is only available for iPhone, not Android users

It can be easy to fall into the payday loan trap when you have bad credit. If you have at least $1,000 to refinance, Upstart could be the way out of a triple-digit interest rate.

Upstart is a lending platform, and some of its partner lenders don’t have a specific minimum credit score requirement.

Upstart does charge an origination fee. Generally, the lower your credit score, the more likely it is that this fee will apply — and the higher the fee will be.

Upstart has transparent eligibility requirements, including:

- Age: Be 18 or older

- Administrative: Have a U.S. address, personal banking account, email address and Social Security number

- Income: Have a valid source of income, including a job, job offer or another regular income source

- Credit-related factors: No bankruptcies within the last three years, minimal recent inquiries on your credit report and no current delinquencies

- Credit score: None

Read more about how we made our picks for the best loans for personal loan refinancing.

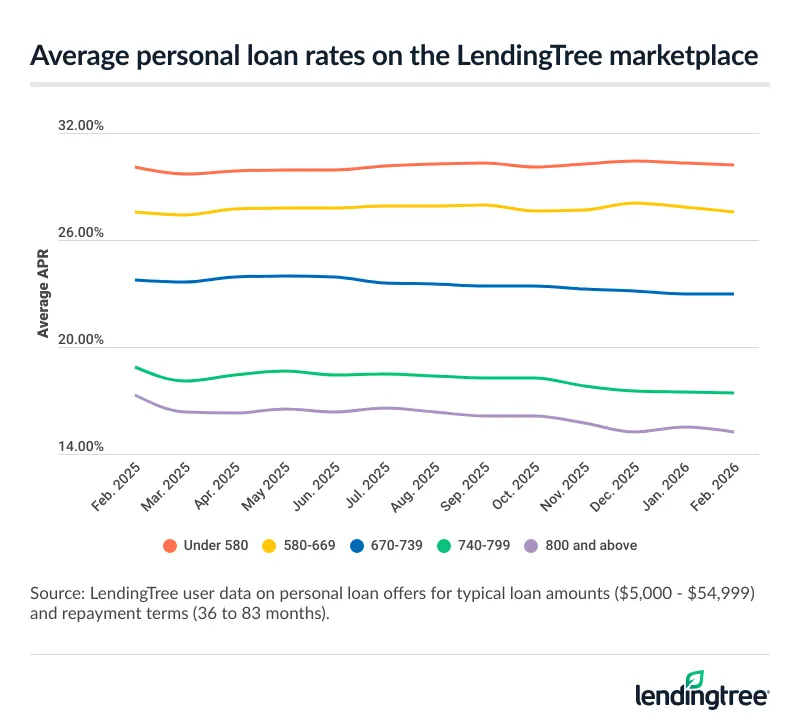

Personal loan refinance rates

Below are quarterly average personal loan rates found on the LendingTree marketplace. Find your credit tier and get an idea of what offer you might get.

| Credit tier | Average APR |

|---|---|

| Excellent (800 and above) | 15.75% |

| Very good (740-799) | 17.89% |

| Good (670-739) | 23.27% |

| Fair (580-669) | 27.79% |

| Poor (under 580) | 30.25% |

Track personal loan rates with LendingTree

Personal loan annual percentage rates (APRs) haven’t changed significantly over the last year, although they do seem to be ticking up. Rather than trying to time the market, take steps to improve your credit score or pay down current debt. These factors are inside your control and could help you save money on a personal loan refinance.

See how your refinance loan rate compares to your current loan

Why do millions of Americans trust LendingTree?

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

When banks compete, you win

You could save an average of $1,659 on your personal loan, simply by using LendingTree to compare offers and choosing the one with the lowest rate.

Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

Shop your offers

LendingTree users who get at least one offer receive 20 offers on average. Compare your offers side by side to get the best deal.

Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

What is personal loan refinancing?

Refinancing a personal loan is the act of replacing your current personal loan with a new one. Personal loan refinancing can make your debt more affordable by:

- Reducing your total interest if you qualify for a better rate

- Lowering your monthly payment by refinancing to a longer term

- Helping you pay off debt faster by refinancing to a shorter term

How to refinance a personal loan

Personal loan refinancing sounds complicated, but it doesn’t have to be. Here’s how to get started.

-

Calculate how much personal loan debt you have

You can refinance one loan or several at once (called debt consolidation). Add up your balances so you know how much money to apply for. -

Prequalify for refinancing

Check rates on the LendingTree marketplace without hurting your credit. See if you can save with a new interest rate or a lower monthly payment with a longer loan term. -

Choose a lender and close the loan

Some lenders pay off your old loan directly. Others give you the money, which you’ll use to pay off your previous personal loan. -

Start repayment

Your first refinance payment is usually due within 30 to 45 days. From then on, you’ll only make payments on the new loan.

How personal loan refinancing can save you money

Refinancing a personal loan to one with a lower rate can reduce your total interest and lower your monthly payment. Even if the rate drop seems small, you could save thousands of dollars over the life of your loan.

| Scenario | Original loan | Refinanced loan | Difference |

|---|---|---|---|

| Loan balance or amount | $20,000 | $20,000 | – |

| Loan terms | 60 months | 60 months | – |

| APR | 23.00% | 14.00% | 9.00% |

| Monthly payment | $564 | $465 | -$99 |

| Total interest paid | $13,829 | $7,922 | -$5,907 |

Step-by-step math

Here’s how we did the math in this example. When you’re comparing loan offers, use LendingTree’s personal loan calculator to see potential monthly charges and interest payments.

1. Original loan: Borrowing $20,000 at 23% APR over 60 months leads to a monthly payment of $508 and $13,289 in total interest paid.

2. Refinanced loan: Borrowing $20,000 at 14% APR over 60 months leads to a monthly payment of $465 and $7,922 in total interest paid.

3. Savings: $13,829 – $7,922 = $5,907 less interest paid over the life of the loan, and a monthly payment of about $99 less.

Borrowers with good credit (credit score of 670-739) qualify for an average APR of about 23% on the LendingTree marketplace. Borrowers in the “very good” category (credit score of 740-799) received an average APR of about 14%.

In this example, moving up just one credit tier saved the borrower close to $6,000 over the loan term. Download LendingTree Spring to get your free credit score along with personalized tips on how to improve your credit.

Other ways that refinancing can help

Refinancing isn’t always about saving on interest. You might be able to reduce your monthly payments by choosing a longer loan term, even if you don’t qualify for a better rate.

By choosing a longer loan term, you’ll break up your balance into more payments. This results in a lower payment each month, but you’ll pay more in interest overall.

Refinancing can also help you get out of debt faster if you pick a shorter loan term. This will condense your debt into a smaller window, increasing your monthly payments but reducing the total interest paid.

When it’s a good idea to refinance a personal loan

Here are three signs that it could be a good time to refinance your personal loan:

- Your credit score has improved — If your credit score has improved substantially since you got your original loan, you might get a lower interest rate by refinancing. A lower interest rate can save you money over the life of the loan.

- Interest rates have gone down — Personal loan rates reached their highest levels since 2007 in early 2024. If this is around the time you took out your original loan, you might qualify for a better rate based on market conditions.

- You need lower payments — When you need to lower your monthly payments, think about refinancing into a longer-term loan. This should lower your payment, but it will also increase the total amount of interest you’ll pay over time.

- You want to pay the loan off faster — If you want to pay off your loan faster, consider refinancing into a shorter loan term. Your monthly payment will go up if you go this route, but you’ll save on interest costs.

When you should wait to refinance a personal loan

Here are three signs you should wait to refinance:

- You can’t get a lower interest rate — Whether interest rates have risen or your credit score has dropped, it may not make sense to refinance if you don’t qualify for a lower interest rate.

- You’re facing a lot of fees — Some personal loans come with an origination fee, which the lender usually deducts from your loan amount. Your current lender could also charge a prepayment penalty (although this is rare). If the fees aren’t worth the possible benefits, refinancing may not be a good idea.

- You can’t afford your debt, even after refinancing — Refinancing won’t change how much you owe. If you have more debt than you can pay, it might be time to consider bankruptcy or debt relief.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best loans for personal loan refinancing

We reviewed more than 40 lenders and loan marketplaces to determine the overall best lenders for personal loan refinancing.

From there, we assessed each lender across four categories: eligibility and access; cost to borrow; loan terms and options; repayment support and tools.

According to our systematic rating and review process, the best personal loans come from Best Egg, BHG Financial, Discover, LightStream, SoFi and Upstart.

Our categories

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Why trust LendingTree’s methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

Frequently asked questions

Once you refinance a loan, you can’t reverse the process. It’s important to know the downsides before making a final decision. Some drawbacks of personal loan refinancing include:

- Higher interest charges if you choose a longer loan term

- Possible origination fees with your new lender

- Possible prepayment penalties with your old lender

- A small dip in your credit due to a hard credit pull (usually five points or fewer)

- Could switch to a lender with poor customer service (LendingTree user reviews can help prevent this)

While every lender has its own eligibility criteria, generally, a good credit score (670+) is required to qualify for personal loan refinancing. Lenders typically start offering their best rates once you hit 740+.

Some lenders, like Upstart and Best Egg, accept fair and bad credit scores. Rates may not be lower than what you’re currently paying, but you can still refinance to get a lower monthly payment with a longer loan term.

Lenders also look at other factors, like your debt-to-income ratio (DTI). This is how much you currently owe per month compared to your income. Most lenders prefer a DTI of 35% or less, but the lower, the better.

Because every lender has its own eligibility requirements, the best way to see if you qualify for personal loan refinancing is by prequalifying. It won’t hurt your credit score and will show you what rates to expect from each lender.

Some lenders will refinance their own loans, but not all. LightStream, for instance, won’t refinance its own loans. Although it might feel more comfortable refinancing with your current lender, you should still shop around.

On the LendingTree marketplace, you can check refinance rates with the nation’s largest network of lenders with just one form. It’s possible you might get the best deal from your current lender, but you won’t know unless you compare multiple offers.