BHG Financial Personal Loan Review

- APR

- 8.72% – 29.92%

Not all solutions, loan amounts, rates or terms are available in all states. Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant’s credit profile. For example, if you request a $60,000 unsecured loan with an 84-month term and a 17.06% APR (which includes a 15.99% yearly interest rate and a 3% one-time origination fee), you would receive $58,200 and would have a required monthly payment of $1,191.38. Rates and terms are for illustrative purposes only and may vary based on creditworthiness and other factors. The APR includes the origination fee. Not all applicants will qualify for the lowest rate. Loan terms and availability are subject to change without notice. Loan amount may vary based upon request amount and cash to you. This is not a guaranteed offer of credit and is subject to credit approval. There is no impact on your credit for applying. For personal loans, a complete credit history, which will appear as an inquiry on your credit report, will be performed upon acceptance and funding of the loan and may impact your credit. Advertised rates are subject to change without notice

The APR and other loan terms presented are estimates only and not guaranteed.

Google Play and the Google Play logo are trademarks of Google LLC.

Apple Store and the App Store logo are registered trademarks of Apple Inc.

Consumer loans funded by Pinnacle Bank, a Tennessee bank, or County Bank. Equal Housing Lenders. (EHL Logo).

For California Residents: BHG Financial consumer loans made or arranged pursuant to a California Financing Law license – Number 603G493.

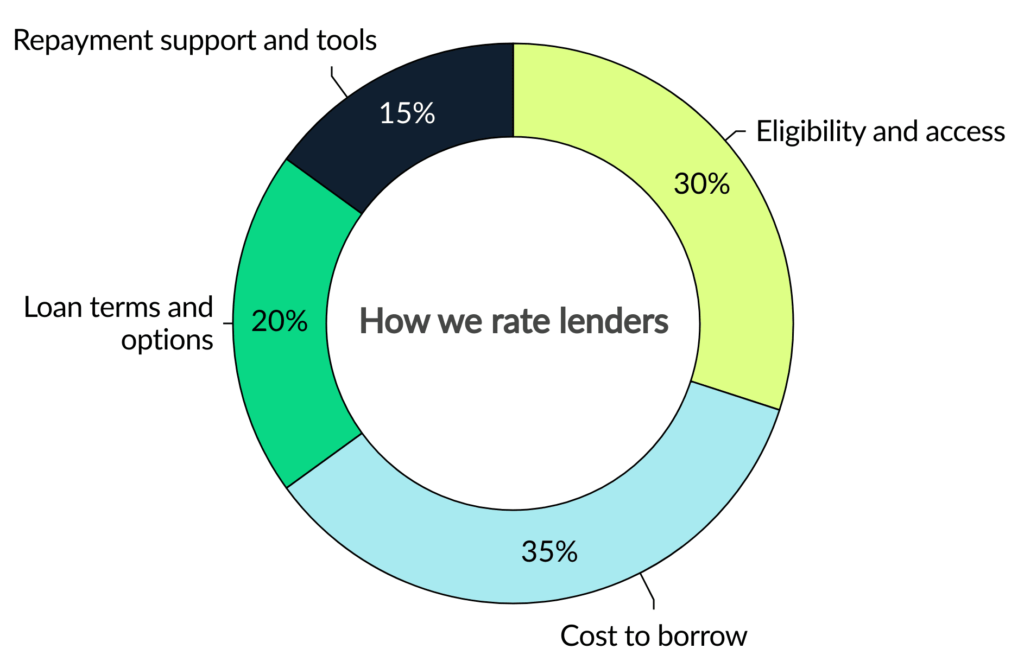

- Eligibility and access: 4/5

- Cost to borrow: 3.2/5

- Loan terms and options: 4.2/5

- Repayment support and tools: 2/5

BHG Financial, formerly BHG Money, offers personal loans with longer repayment terms and higher loan amounts than many competitors. Before applying, here’s what borrowers should know about this lender’s rates, fees and funding timeline.

- Long loan terms: While many lenders only offer repayment terms of up to 60 or 72 months, BHG Financial’s loan terms range from 36 to 120 months. A longer loan term usually means lower monthly payments but more overall interest.

- Accepts fair credit: You could qualify for a BHG Financial loan with a credit score as low as 640. However, don’t expect to be approved for a $250,000 loan. The average BHG Financial borrower has a credit score of 740.

- Higher interest rates: Thanks to a higher minimum annual percentage rate (APR), you can probably find a cheaper loan somewhere else if you have excellent credit.

- Long wait times: Many online lenders offer same- or next-day loans. With BHG Financial, it can take up to five days before you receive your money.

- Charges an origination fee: If you get a loan through BHG Financial, you may have to pay an origination fee. This is an amount of money that BHG will deduct from your loan before sending it to you.

- Best for major purchases: This lender may be a good fit for consumers looking for longer loan terms — up to 120 months — and higher loan amounts. However, other lenders may offer lower rates and faster funding.

BHG Financial pros and cons

BHG Financial personal loans offer plenty of benefits to borrowers looking for larger loans, but BHG Financial is not a one-size-fits-all financial solution. Here’s what to keep in mind about the benefits and downsides of a personal loan with BHG Financial.

Pros

- Can borrow up to $250,000

- Offers longer repayment terms

- Won’t automatically deny you for having fair credit

Cons

- May take up to five days to receive funds

- Not as competitive if you have excellent credit

- Charges an origination fee

- Must fill out a web form to contact customer service

At $250,000, BHG Financial offers one of the biggest personal loans on the market. It also offers repayment terms from 36 to 120 months. A longer repayment term can be especially helpful on a big loan. The longer you stretch out your payments, the lower your monthly bill will be. But keep in mind that the longer your loan is active, the more overall interest you’ll pay.

BHG Financial’s APRs start at 8.72%, much higher than the most competitive personal loan lenders. It also charges an origination fee on every loan. Many other lenders waive this fee if you have excellent credit (if it charges one at all).

BHG Financial requirements

Aside from a minimum credit score requirement of 640, BHG Financial doesn’t provide many details about its personal loan requirements. It does state that its average borrower has a 740 FICO Score, no past bankruptcies or collections and makes $213,000 a year.

It also doesn’t offer joint loans, so you can’t add a second person to your application. That means you’ll have to qualify under your own merit.

If you meet the basic requirements listed above, you may need to disclose how you plan to use your personal loan. Here’s how you can use a loan from BHG Financial:

- Debt consolidation

- Home improvement projects

- Major life events

- Large purchases and expenses

- Refinancing a BHG personal loan

If BHG Financial’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that can help you reach your financial goals and offer you the best-fitting rates, terms and amounts.

How to get a personal loan with BHG Financial

You can apply for a BHG Financial loan online, on its website. Here’s what to expect when filling out an application:

- First, you’ll need to specify how much money you’d like to borrow and the reason for your personal loan. Then, you’ll need to provide your basic information, such as your name and contact information.

- Next, you’ll need to supply information about your income level, your source(s) of income and your occupation.

- Once you’ve submitted your application, you’ll work with the lender to verify your information. For instance, you’ll need to provide pay stubs to verify your income and government-issued identification to prove your identity.

- After your information has been finalized and your loan application is officially approved, you’ll need to sign a loan agreement. You can expect to receive funds in as few as five days of approval.

How BHG Financial compares to other personal loan companies

Even if you believe BHG Financial aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare lenders. Here’s how BHG Financial stacks up against similar personal loan lenders.

| BHG Financial | LightStream | Wells Fargo Bank | |

|---|---|---|---|

| LendingTree’s rating | 3.4/5 | 4.4/5 | 4.4/5 |

| Minimum credit score | 640 | Not specified | Not specified |

| APRs | 8.72% – 29.92% | 6.49% – 24.89% (with autopay) | 6.74% – 25.99% |

| Loan amount | Up to $250,000 | $5,000 – $100,000 | $3,000 – $100,000 |

| Repayment term | 36 to 120 months | 24 to 84 months | 12 to 84 months |

| Origination fee | Varies | None | None |

| Funding timeline | May receive funds up to five days after approval | May receive funds as soon as the same day as approval | Receive funds within one to three business days |

| Bottom line | BHG Financial could be a good fit if you need a lot of money and have time to wait for it. It offers loans as large as $250,000, but it could take up to five days to get your funds. | With zero fees and low interest rates, LightStream also offers large loans. But unlike BHG Financial, LightStream requires good to excellent credit. | Wells Fargo has cheaper rates and a faster turnaround time than BHG, but you have to be a client for at least a year to be eligible. |

How we rated BHG Financial

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

BHG is not especially hard to get approved for since it requires a credit score of at least 640, which is fairly standard. However, its average borrower has a 740 FICO Score, no bankruptcies or delinquencies and makes $213,000 a year. So, while you might be approved with a lower score, BHG probably won’t offer its largest loan amounts or longest terms.

When applying for a BHG Financial loan, you will have to verify your income. You may have to provide documentation, such as pay stubs or tax returns.

It can take up to five days before you receive your personal loan from BHG Financial. If you need money fast, consider lenders that specialize in quick loans, instead.

Get personal loan offers from up to 5 lenders in minutes