Car-Buying Basics: What is MSRP?

A car’s price tag or window sticker may show several prices, including the MSRP (manufacturer’s suggested retail price), which is what the automaker sees as a fair price.

But you probably won’t pay the MSRP to drive the car off the lot. You’ll also have mandatory fees like taxes, title and registration, and maybe some add-ons and extras. On the other hand, you could negotiate for a lower price.

- MSRP is only a starting point for negotiation.

- Dealers set the final price — you should focus on that.

- MSRP is different from the invoice price and sticker price.

What does MSRP mean for your wallet?

The keyword in MSRP is “suggested.” Dealers can set their price above or below the MSRP.

A dealer may advertise a price “below MSRP” as an incentive, or it might add a markup to the MSRP if the car is in high demand.

Few vehicles are sold for the exact MSRP, but it’s a good place to start negotiations. Know that simply getting a price below the MSRP doesn’t always mean you got the best deal.

How much you should pay may depend on your down payment, the value of any vehicle you trade in, your financing and other factors. Before you start haggling with the dealer, check out our five tips for negotiating a car’s price.

How is MSRP set?

The manufacturer sets the MSRP by considering several factors:

- Cost to make: The automaker needs to recoup the costs for parts, labor, engineering and development in order to turn a profit on the car sale.

- Market conditions: The car must be competitively priced, based on the brand, size, style and trim level. Automakers may lower the MSRP to help move slow-selling inventory off dealers’ lots.

- Accessories and packages: The luxury package with leather seats and premium audio will cost more than the mid-level version. Sporty handling capabilities or specific color schemes can also raise the price.

The goal is to offer customers an appealing price, while also allowing the automaker and dealer to profit.

Use our car affordability calculator to determine how much you can afford to spend on a car.

What does the MSRP include?

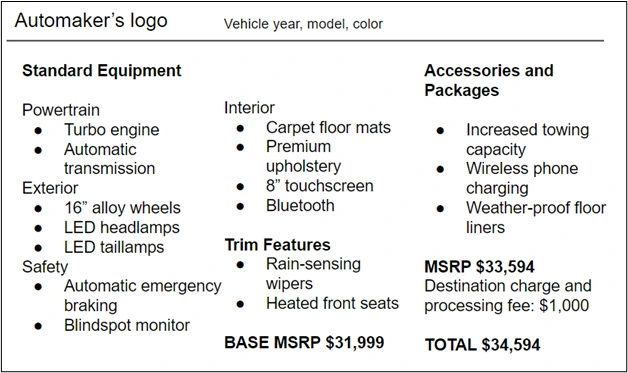

A car’s window sticker will show a base MSRP for the type of vehicle with standard equipment, along with the final MSRP, which includes accessories and options packages.

The base MSRP also includes the standard factory warranty, service coverage and destination charge.

Here’s an example of what you might see on a typical window sticker.

MSRP vs. invoice price vs. sticker price

The MSRP is the price the automaker has set for the consumer. It’s what the manufacturer thinks the car is worth.

The invoice price is the amount the automaker charges the dealer to buy the car. If you can buy a car for the invoice price, you’re basically getting it for what the dealer paid.

The sticker price is the total price for the car, including the MSRP, various dealer fees and any add-ons like window tinting or paint protection. The dealer’s sticker price will be displayed next to the factory window sticker on a document called an “addendum” or “supplemental window sticker.”

Generally, the sticker price will be the highest of the three, while the invoice price will be the lowest.

Try starting your negotiations from the dealer’s sticker price, since the dealer may have already discounted it from the MSRP.

Also, focus on the “out-the-door price” — the final total cost to drive the car away from the dealership. This will include non-negotiable required charges, such as taxes, registration and title, as well as the dealer fees.

Can you negotiate MSRP down?

While you can’t affect the MSRP, you can negotiate the final price you’ll pay.

Shop around and compare prices for a new car. If you get an acceptable out-the-door price at one dealer, you can visit other dealers and ask them to beat the offer to gain your business.

You may pay over MSRP if you really like a popular car or there aren’t many alternatives to getting the vehicle you want. It comes down to supply and demand. Dealers will add a “market adjustment” to the MSRP to increase their profit from the latest must-have model.

The price of the car is only one factor in how much you’ll pay for it. The interest rate on your auto loan will have a big impact on your monthly payment.

Consider getting preapproved for an auto loan, so that you don’t have to take whatever financing the dealer gives you. You can shop around for the best car loan rates and then, with a loan approval in your pocket, ask the dealer to beat that rate.

Get auto loan offers from up to 5 lenders in minutes

Recommended Articles