Auto Loans by Generation: Balances, Payments, Interest Rates and More

Many of us have debt related to our vehicles — between July and September 2025 alone, Americans took out nearly $184 billion in new auto loans. But auto loan burdens also vary substantially by generation.

According to a LendingTree study, millennial and Gen X auto loan holders carry the largest balances, while Gen Zers pay the highest interest rates (though they hold the smallest balances). Below are our full findings, including interest burden, term length and balance by generation.

Key findings

- Millennials and Gen Xers with auto loans have the largest balances. Millennials with auto loans owe an average of $22,627, nearly identical to Gen X borrowers at $22,514. Gen Z borrowers have the smallest balances at $20,241.

- Gen Xers with auto loans make the highest monthly payments. Gen X auto loan holders have the highest average monthly payments at $594. Gen Zers with auto loans make the lowest average monthly payments at $522.

- Gen Z borrowers face a significant interest burden. Even with a starting balance over $4,000 smaller than that of baby boomers ($26,175 versus $30,311), Gen Z borrowers pay over $1,200 more in estimated interest ($9,773 versus $8,556). They also pay nearly the same total interest as Gen X borrowers, despite Gen Xers’ much larger $32,226 starting balance.

- Longer auto loan terms are slightly more common among Gen X and millennial borrowers. 53.0% of Gen Xers have auto loans extending beyond 72 months — the highest share of any generation. In contrast, Gen Z borrowers are the least likely to have loan terms longer than 72 months, at 40.0%. Meanwhile, 8.0% of millennials have auto loans exceeding 84 months, also the highest proportion among the generations.

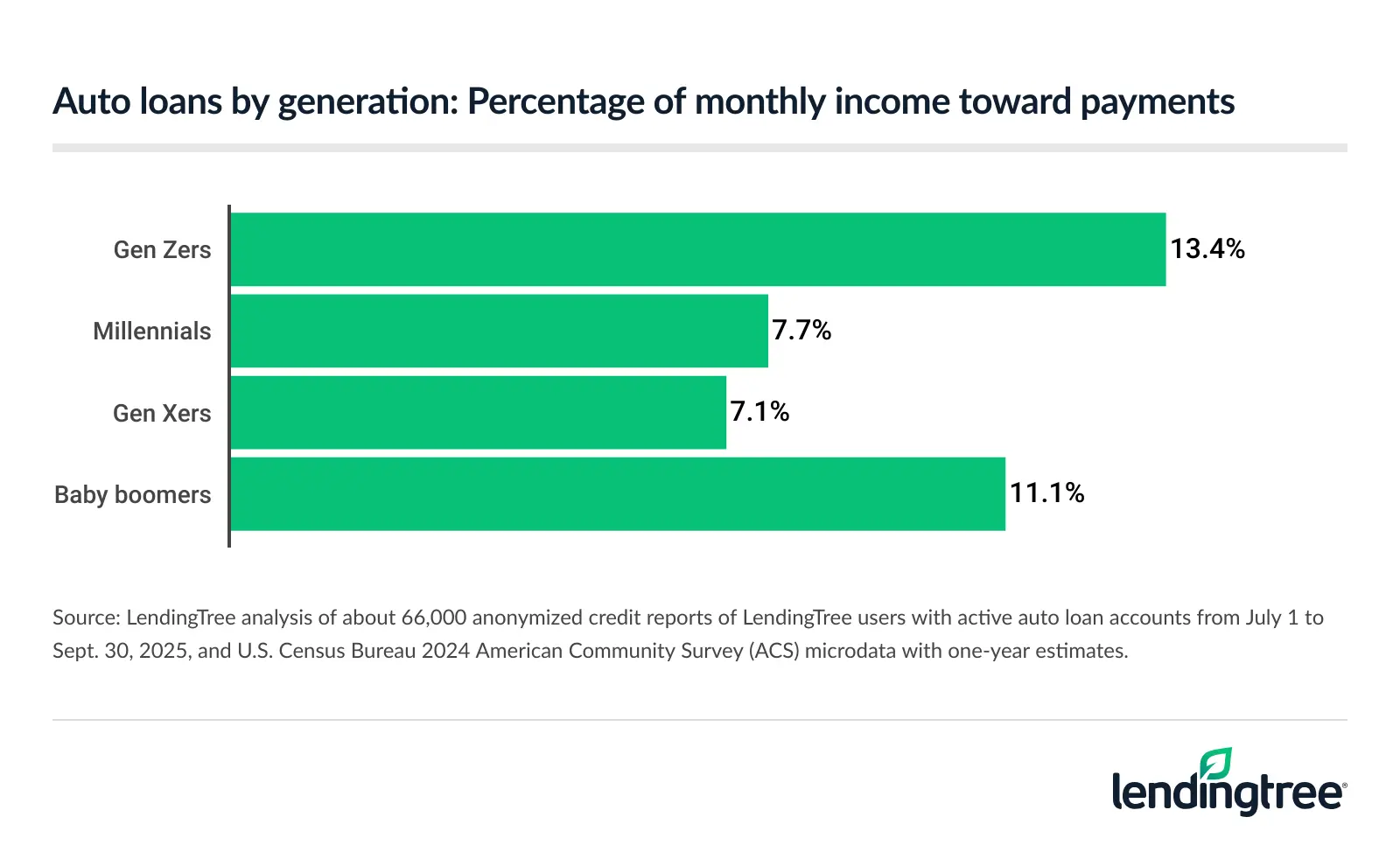

- Gen Z auto loan holders put the largest share of their income toward payments. Gen Zers with auto loans spend 13.4% of their monthly household income on payments — above baby boomer (11.1%), millennial (7.7%) and Gen X (7.1%) borrowers.

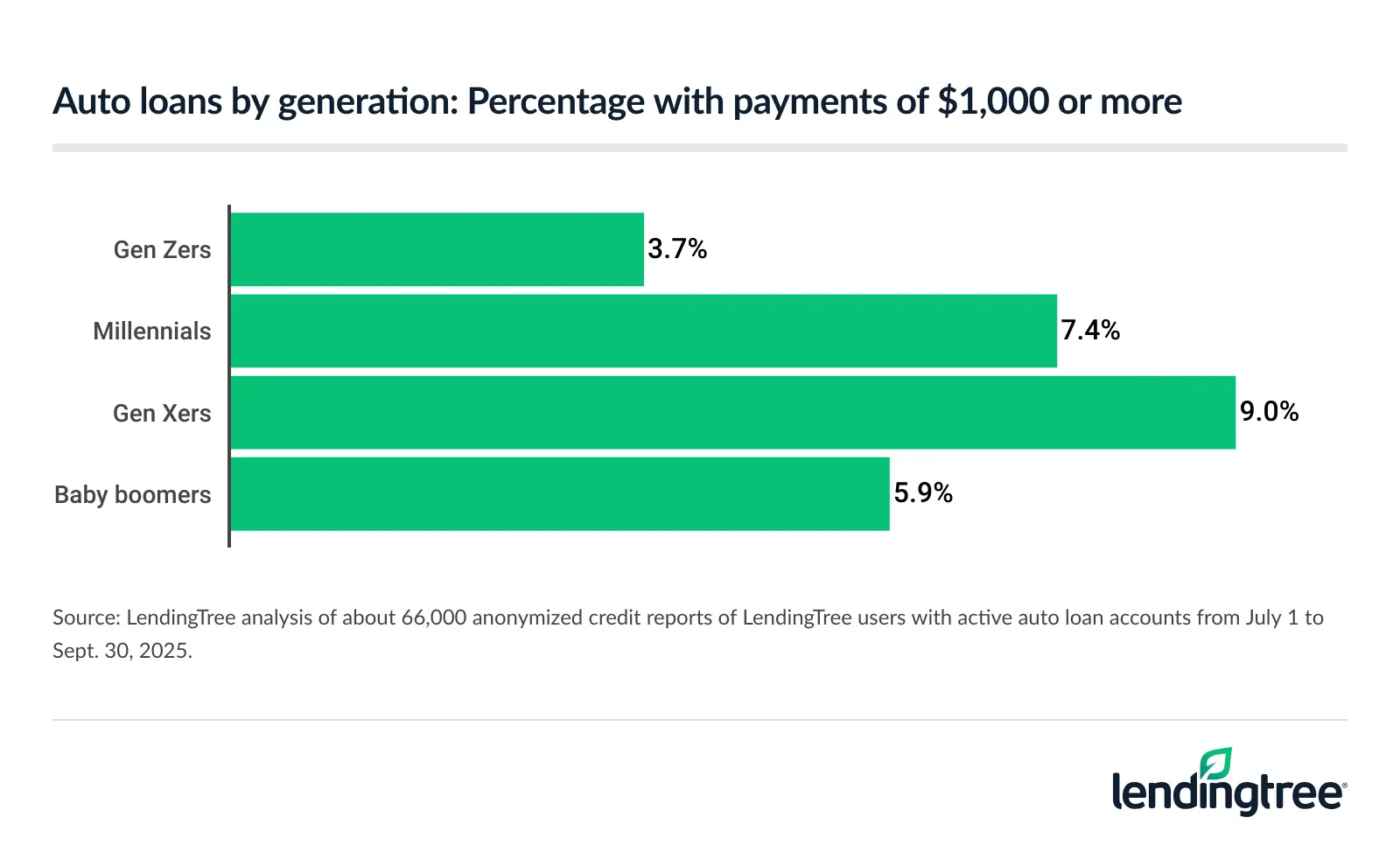

- The highest monthly payments are most common among Gen X borrowers. 9.0% of Gen X auto loan holders have at least one payment of $1,000 or more — the highest of any generation. Gen Z borrowers are least likely to have a four-figure payment, at just 3.7%.

Millennial, Gen X borrowers have largest auto loan balances, while Gen Z borrowers face significant interest burden

Of the generations studied, millennials and Gen Xers with auto loans hold the largest balances: $22,627 and $22,514, respectively. Baby boomers come in next, with an average balance of $20,632. (For our analysis, we defined Gen Z as those ages 18 to 28, millennials as those 29 to 44, Gen X as those 45 to 60 and baby boomers as those 61 to 79 in 2025.)

Gen Z borrowers have the smallest auto loan balances ($20,241) and also make the lowest monthly payment on average ($522). Gen Xers make the highest average monthly payment ($594), followed by millennials ($589).

“Millennials and Gen Xers have big auto loan debts because they need and are able to get them,” says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“They’ve got super-busy lives with growing kids, aging parents, demanding jobs and homes in need of constant care. They can get bigger loans because they’re in or approaching their peak earning years and have had plenty of time to build strong credit scores,” he explains. “Gen Z will eventually have all these things too — including more auto debt — they’re just not quite there yet.”

Auto loans by generation: Key details

| Generation | Avg. starting balance | Avg. balance | Avg. monthly payment | Avg. term (months) | Estimated interest rate | Estimated interest paid |

|---|---|---|---|---|---|---|

| Gen Zers | $26,175 | $20,241 | $522 | 68.9 | 13.00% | $9,773 |

| Millennials | $31,220 | $22,627 | $589 | 70.9 | 11.80% | $10,531 |

| Gen Xers | $32,226 | $22,514 | $594 | 70.7 | 10.70% | $9,805 |

| Baby boomers | $30,311 | $20,632 | $554 | 70.1 | 9.80% | $8,556 |

Younger auto loan holders do, unfortunately, face a substantial interest burden: Gen Zers are charged the highest estimated interest rates of the age groups we studied — a whopping 13.00%.

However, because interest rates interplay with other factors like loan term to determine the total amount of interest paid, it’s millennials who have the highest total estimated interest burden, at $10,531 over the life of their loans. Still, for younger borrowers with shorter credit histories and often lower credit scores and incomes, interest rates over 11.00% — the amount Gen Z and millennial borrowers pay on average — are concerning.

“Having a limited credit history can be super challenging. You end up paying higher interest rates, more fees and get smaller loans,” Schulz says.

“The typical Gen Zer’s financial margin for error is already tiny. The last thing they need is to pay more for borrowing, but that’s usually what happens.”

The typical Gen Zer’s financial margin for error is already tiny. The last thing they need is to pay more for borrowing, but that’s usually what happens.

Higher rate of Gen X, millennial borrowers take out longer auto loans

While auto loan repayment terms can be as short as two or three years (24 or 36 months), many borrowers are opting for loans of over 72 or even 84 months. These longer loans may lower monthly payments, but they also increase overall interest paid.

In our study, Gen X and millennial borrowers are the most likely to take out longer-term auto loans: 53.0% of Gen Xers have terms longer than 72 months (six years), and 8.0% of millennials have terms over 84 months (seven years).

Auto loans by generation: Long terms

| Generation | % with loans over 72 months | % with loans over 84 months |

|---|---|---|

| Gen Zers | 40.0% | 5.4% |

| Millennials | 50.9% | 8.0% |

| Gen Xers | 53.0% | 7.7% |

| Baby boomers | 48.0% | 7.6% |

Meanwhile, Gen Z auto loan holders are the least likely to have longer loan terms, with just 40.0% holding loans over 72 months and 5.4% holding loans more than 84 months — the lowest for both categories.

Gen Z borrowers put largest share of income toward payments

Though their loans may be smaller and the terms may be shorter, Gen Z borrowers put more of their monthly household income toward car payments than any other age group. In our analysis, Gen Z borrowers spend 13.4% of their average $3,888 earnings on car payments each month. Baby boomers — who are more likely to be retired and have the second-lowest monthly incomes, at $4,971 — are next-highest at 11.1%. Millennial borrowers (7.7% of their $7,674 monthly income goes to payments) and Gen Xers (7.1% of $8,338) follow behind.

While the average monthly payments for all age groups are in the same ballpark — the lowest is $522 for Gen Z borrowers, while Gen Xers have the highest at only $594 — the burden of those payments changes drastically depending on how much income you earn.

“The greater the share of income you put toward car payments, the greater the risk of being unable to make those payments in a financial emergency,” Schulz explains. “Because vehicles tend to be vital to our ability to work, those loans are often highly prioritized. But life happens. Whether it’s a job loss, income reduction, medical emergency or something else, we all can face financial rough patches. If your car payment is too big, it may not be feasible when times get tough.”

So how much monthly income should borrowers be directing toward their auto loans?

“A good rule of thumb is to be sure your car payment doesn’t make up more than 10% to 15% of your take-home pay each month,” Schulz says. (That puts Gen Z and baby boomer borrowers in our analysis more or less in the clear.) But “that can be easier said than done depending on your pay and the vehicle in question,” he admits. “You should consider your tolerance for debt and risk, too.”

Gen Xers have high monthly payments

While even an auto payment of $500 can be a lot for many, some borrowers face monthly payments far higher. Nearly 1 in 10 Gen X auto loan holders — 9.0% — have an auto payment of $1,000 or more, the highest percentage in our analysis. Millennial borrowers are next-highest at 7.4%, followed by baby boomers at 5.9%, and even 3.7% of Gen Z borrowers face such high payments.

An auto payment of $1,000 or more per month edges up against the amount many Americans are paying for their housing, which is traditionally the largest line item in any household budget. According to data from the U.S. Census Bureau, the median mortgage payment in the U.S. was $1,521 in 2024 (though in many cases it’s far higher, especially for those who have moved or purchased a home recently). Car payments can get this high in large part because cars have gotten more expensive over time (tariffs haven’t helped).

To follow Schulz’s 10%-15% rule described above, an auto loan borrower paying $1,000 per month should make at least between $6,667 and $10,000 in monthly income — after taxes.

Buying a new car: Top budgeting tips

If you’re buying a new — or new-to-you — car, a little bit of homework can go a long way toward keeping that purchase from ruining your budget. Here are our top expert tips for getting the keys with financial ease.

- Get preapproved. “Unless you get one of those sweetheart 0% offers, the dealership is highly unlikely to have better rates than what you’d find from other lenders,” Schulz says. “Take the time to get preapproved for a loan before you ever set foot in the showroom.” Shopping around for the right auto loan could also save you thousands in interest over the lifetime of the loan.

- Understand what you can actually afford. “Just because someone will lend you money doesn’t mean that you can afford it or should take it,” Schulz advises. “Only you know what you can really afford. The best way to do that is to make a budget of how much money is coming in and going out of your household on a regular basis.”

- Consider lower-cost options. “Will a used car do? Will a version of the vehicle with fewer bells and whistles suffice?” Schulz asks. “If you don’t at least consider a wider array of options when you buy, you’re likely doing yourself and your family a disservice.”

- Shop around when it comes to your dealer, too. With a slew of online tools, “it has never been easier to look at multiple car dealers to compare inventory, prices and more,” Schulz says. “That also makes it easier to play car sellers off of each other, potentially resulting in lower rates and prices for you. When dealers compete, you win.”

Methodology

LendingTree researchers analyzed a sample of about 66,000 anonymized credit reports from July 1 to Sept. 30, 2025 — the third quarter of 2025.

The analysis focused on users with active auto loan debts for new and used vehicles, including individual and joint accounts. We calculated (by generation):

- Average starting balances, balances, monthly payments and terms

- Estimated interest rates and estimated interest paid

- Percentage of loans that are for more than 72 or 84 months

- Share of monthly income toward payments

- Percentage of loans with payments of $1,000 or more

We estimated monthly income using U.S. Census Bureau 2024 American Community Survey (ACS) microdata with one-year estimates. Average annual household income was calculated for each age group, then converted to monthly amounts by dividing by 12.

The analysis was conducted nationally by generation. We defined age generations based on the following age groups in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get auto loan offers from up to 5 lenders in minutes