How to Upgrade a Capital One Card

- A credit card upgrade allows you to switch cards without triggering a hard credit pull.

- You can keep the same credit card number and credit limit.

- Upgrading a Capital One credit card is simple, fast and can be done in the Capital One app.

If you’re looking to close your old Capital One card for a card with better benefits and rewards, a card upgrade can be a quick route to a card that’s a better fit for you.

Upgrading from one Capital One credit card to another is a simple process. You can request an upgrade in just a few minutes through the Capital One app or by calling the 1-800 number on the back of your card. The main benefit is that you can get a better card without impacting your credit score. However, you will lose out on any sign-up bonus that the card typically offers, which could be worth hundreds of dollars in rewards.

What is a credit card upgrade?

A credit card upgrade, also known as a “product change” or a “swap,” occurs when a cardholder switches from their current credit card to a different one from the same issuer.

An upgrade may be ideal if your existing credit card no longer suits your lifestyle and spending needs. For example, if you got the Capital One Platinum Credit Card as a starter credit card and have since established your credit profile, you may want to upgrade to a Capital One card that offers a rewards program like the Capital One Savor Cash Rewards Credit Card. Or, if you got the Capital One QuicksilverOne Cash Rewards Credit Card to earn cash back and your credit score has improved, you may want to swap it for a cash back card like the Capital One Quicksilver Cash Rewards Credit Card card with a $0 annual fee.

Pros and cons of a Capital One upgrade

Pros

- No hard credit check needed

- May be easier to be approved

- Card number and credit limit stays the same

- Upgrade between types of rewards credit cards

Cons

- Generally not eligible for a sign-up bonus

- May not be eligible for an intro APR offer

- Annual fee may increase

- Cannot upgrade to a card from another issuer

How to upgrade a Capital One credit card

There are a few ways to begin the process of upgrading your credit card:

- Contact Capital One by phone to request an upgrade.

- Respond to an upgrade offer that you received by mail or email.

- Use the Capital One mobile app.

To upgrade your card in the app, follow these quick steps that show how to upgrade your Capital One card:

Step 1

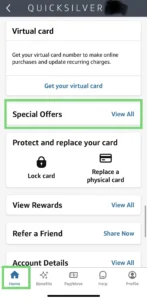

Open your Capital One app and scroll down the home page to the “Special Offers” box. Open “View All.”

Step 2

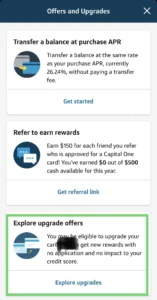

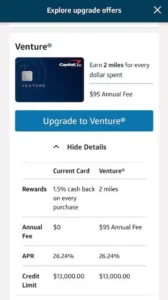

Scroll down and click “Explore upgrade offers”.

Step 3

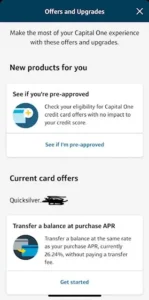

Click on “See if I’m pre-approved” to view new product offers.

Step 4

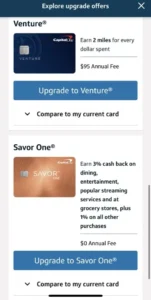

Look at the available offers and compare them to your current Capital One credit card.

Step 5

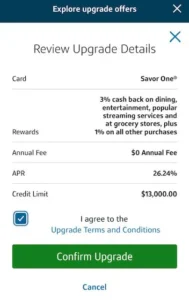

If you decide to upgrade, select the offer you want and review the details. Tap “confirm upgrade” when you’re ready to continue.

Step 6

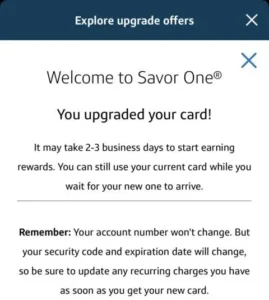

Receive a decision. In this case, it was confirmation of approval.

This process can be completed in under 60 seconds. However, do give yourself time to read about the terms, conditions and credit card fees.

LendingTree Expert Advice

“I recently upgraded my Capital One Quicksilver Cash Rewards Credit Card with flat-rate rewards to the Capital One Savor Cash Rewards Credit Card. It offers better rewards in an area where my family spends heavily: groceries and restaurants. I had researched my options ahead of time, so it took less than a minute to do it in the app.”

Charlotte Zhang

credit cards writer at LendingTree

You can contact Capital One’s credit card reconsideration line at 800-625-7866 to ask them to review your credit card application.

Possible Capital One upgrades

Not everyone upgrades, or downgrades, their card for the same reason. Here are a few card upgrade possibilities and why you might consider upgrading your card. Remember that your options are limited to what Capital One offers.

| Current card | New card | Why upgrade? |

|---|---|---|

| Capital One Platinum Credit Card | Capital One Quicksilver Cash Rewards Credit Card | Upgrade to a card with a rewards program |

| Capital One QuicksilverOne Cash Rewards Credit Card | Capital One Savor Cash Rewards Credit Card | Eliminate your annual fee |

| Capital One Quicksilver Cash Rewards Credit Card | Capital One Venture Rewards Credit Card | Elevated cash back rewards in certain categories |

| Capital One Venture Rewards Credit Card | Capital One Venture X Rewards Credit Card | More robust travel rewards and benefits |

What you should know before upgrading your Capital One credit card

Product upgrades are seldom talked about, so before you commit to swapping one card for another, be sure you really understand how they work and can impact your overall credit health.

- Consider the pros vs. cons of doing an upgrade. If you’ve recently had several credit checks but really want a different card, upgrading may be preferable to opening a new card. Remember that by upgrading you won’t get a sign-up bonus or promotional APR that usually comes with the credit card.

- Product changes aren’t considered new accounts, so they don’t require a credit check. However, issuers typically require your existing credit card account to be in good standing in order to be eligible.

- Your account number will remain the same, but the expiration date and security code will change.

- Your credit limit will also stay the same. With the upgrade, you’re simply moving your line of credit from one card to the other.

- You can also request a credit card downgrade. For example, if you find that having a card with an annual fee no longer makes sense for you, you can request a product change to a no-annual-fee card.

- Once you request a product change, you may not be able to do another on the upgraded or downgraded card for at least six months, according to cardmember reports online. Make sure the change you request is one you can live with, especially if you choose a card that charges an annual fee. You also may not be able to upgrade to a credit card with an annual fee, or higher one, due to the Credit Card Accountability Responsibility and Disclosure Act. This act forbids credit card companies from raising your annual fee in the first year of card ownership.

How to boost your approval odds for an upgrade

Before you even consider upgrading, know that if you have a pattern of late payments or high balances on your current card, the odds of being approved for another card may be slim. Therefore, it’s important to establish good credit card habits, like the following, in advance:

Always pay your bill on time

Your payment history, which shows whether you’ve made past credit card and loan payments on time, accounts for 35% of your credit score, according to FICO.

→ Discover the five factors that affect your credit score

Keep your card balance low

Amounts owed and your credit utilization ratio — how much the amount of your available credit you’re using — make up about 30% of your credit score. If your credit utilization ratio is too high, that signals to issuers that you might be struggling to pay back your debt. Try to keep your card balance below 30% of your credit limit or pay off the entire balance every month for best results.

Be patient

You should also examine how long you’ve had your existing card. If you haven’t been solicited for an upgrade offer from Capital One, know that you may have to wait a bit. In fact, it’s a good idea to hold onto your existing card for at least six months and show regular and responsible usage during that time before you request an upgrade.

→ See how the length of your credit history affects your credit score

Check your credit score

Knowing where your credit score stands can help give you some insight as to which card products you may qualify for. You can access your credit score for free and without generating a hard inquiry in a variety of ways, including through LendingTree Spring or through Capital One’s CreditWise.

→ Try these tips to raise your credit score

Check your credit score for free with LendingTree Spring

Is a Capital One upgrade right for you?

If you’ve had your Capital One card for at least six months, have used it regularly and have a good history of on-time payments, you can request an upgrade. Remember, however, you’re not guaranteed approval.

When requesting an upgrade, consider what type of rewards you’re looking for and whether or not you spend enough on your card to make any annual fee worthwhile.

That said, if you want to take advantage of a new cardmember sign-up bonus or promotional 0% intro APR on purchases or balance transfers*, you may want to apply for a new card instead. The application will generate a hard inquiry on your credit report, which may temporarily reduce your score. But opening a new card can also improve your credit utilization ratio and help boost your score over time.

To see if you prequalify for a Capital One card without initiating a hard inquiry, you can check out Capital One’s pre approval tool.