Average Credit Card Interest Rate in US Today

The average credit card interest rate in the U.S. fell to 23.79% in January, the lowest since March 2023.

LendingTree reviews about 220 of the most popular credit cards from over 50 issuers to comprehensively examine the current state of credit card interest rates. We publish our findings here.

What’s the average interest rate on new credit card offers?

The average APR offered with a new credit card is 23.79% in January, down from 23.96% in December.

| Category | Min. APR | Max. APR | Avg. | Prior month |

|---|---|---|---|---|

| Avg. APR for all new card offers | 20.18% | 27.39% | 23.79% | 23.96% |

| 0% balance transfer cards | 17.65% | 26.81% | 22.23% | 22.40% |

| No-annual-fee cards | 19.64% | 26.93% | 23.28% | 23.46% |

| Rewards cards | 19.84% | 27.54% | 23.69% | 23.86% |

| Cash back cards | 20.41% | 27.51% | 23.96% | 24.11% |

| Travel rewards cards | 19.33% | 28.01% | 23.67% | 23.88% |

| Airline credit cards | 19.43% | 28.59% | 24.01% | 24.26% |

| Hotel credit cards | 19.39% | 28.32% | 23.86% | 24.11% |

| Low-interest credit cards | 13.26% | 22.06% | 17.66% | 17.68% |

| Grocery rewards cards | 19.69% | 22.73% | 23.71% | 23.87% |

| Gas rewards cards | 20.32% | 27.52% | 23.92% | 24.06% |

| Dining rewards cards | 19.24% | 27.68% | 23.46% | 23.67% |

| Student credit cards | 17.49% | 27.09% | 22.29% | 22.64% |

| Secured credit cards | 26.10% | 26.10% | 26.10% | 26.27% |

The average new credit card APR fell for the fourth straight month, dropping to the lowest since March 2023, when it stood at 23.65%. The decrease wasn’t a surprise, though. The Federal Reserve announced rate cuts at its December meeting — after having done so in its September and October meetings as well — spurring card issuers to lower the rates on new card offers.

The downward trend is likely to continue for the next few months. Card issuers tend to roll out changes at varying speeds, with some moving within days and others taking a month or two. However, those hoping for additional Fed rate cuts in the immediate future are likely to be disappointed. I and many other observers expect the Fed to leave rates unchanged at its next meeting, which happens Jan. 27-28.

When the Fed does move, it doesn’t just impact future balances. Rates on current balances will fall for most cardholders within the next few months. That’s welcome news for those struggling with card debt.

While each individual rate cut doesn’t have much of an impact by itself, the accumulated effect of multiple rates in a short time can add up to a big deal. We’re starting to see that with the Fed’s recent spate of cuts since September 2024. Consider this scenario, with numbers generated using our credit card interest calculator:

- In September 2024, the average APR on a new card offer was a record high 24.92%. At that rate, someone with a balance of $7,000 who paid $250 a month would need 42 months and $3,594 in interest to pay it off.

- At today’s 23.79% rate, it would take 41 months and $3,314. That’s a difference of one month and $280 in interest, a significant reduction for those struggling with card debt.

While we expect the Fed to take its foot off the gas with rate cuts for the next few months, a change of heart could bring even greater savings. Lower today’s rate by another quarter-point to 23.54% and the savings fall further. It would still take 41 months but just $3,255 in interest. That’s a difference of $339 from the September 2024 rate.

Still, regardless of what the Fed does, rates are still sky-high, and no one should expect that to change anytime soon. As with the Fed rate cuts in September, October and December, any further Fed moves would likely be small, reducing rates by a quarter-point or a half-point at most. Given that, it would be wise for consumers to expect credit card interest rates to remain relatively high for the foreseeable future.

Issuers offer a range of possible rates based on whether you have good or bad credit. The better your credit, the lower the rate you can typically expect. But that’s not guaranteed, as issuers consider various factors when approving you for a new card account.

Learn more about how to increase your chances of instant approval for credit cards.

If you have really good credit now, the average APR you can expect to be offered is 20.18%. If you have really crummy credit, the average APR offered is 27.39%. That’s a big difference.

For example, say you owe $7,000 on a card and pay $250 a month. Again, using our credit card interest calculator:

- With a rate of 27.39%, you’ll pay $4,290 in interest and take 45 months to pay it off.

- Lower the rate to 20.18% and you’ll pay $2,542 in interest and take 38 months to pay it off.

- That’s a savings of $1,748 in interest and seven months in payoff time. In regular times, given that most Americans’ financial margin for error is tiny, that’s a big deal. However, these aren’t normal times, so those savings are even more critical.

The good news is that the average FICO Score of Americans in the third quarter of 2024 was 715, according to Experian — the same as Q3 2023. That means most Americans may be more likely to qualify for lower interest rates. For those who don’t, however, things get expensive in a hurry.

The type of card you shop for also affects the APR you can expect. For example, we found that cash back cards and 0% balance transfer cards tend to have lower APRs than airline-branded travel rewards cards. (That’s true even when you exclude the 0% offer.) Meanwhile, secured credit cards — which require a deposit to open and are typically held by individuals new to credit or rebuilding their credit — have the highest APRs overall.

Learn more about our picks for the best cash back credit cards and why we chose them.

What’s the average interest rate on current credit card accounts?

| Category | Avg. APR |

|---|---|

| All credit card accounts | 20.97% |

| Accounts assessed interest | 22.30% |

Each quarter, the Federal Reserve releases data on cards currently in Americans’ wallets. It examines the average interest rate for accounts assessed interest — those that weren’t paid in full at the end of the month — and across all credit card accounts.

It’s essential to distinguish between the average assessed interest and interest across all credit card accounts, as nearly half of active credit cardholders carry a balance. The average APR for all accounts in the fourth quarter of 2025 was 20.97%. That’s down from 21.39% in Q3 2025.

Meanwhile, the average for accounts accruing interest fell to 22.30% from 22.83% in Q3. That decrease is welcome news because the accounts accruing interest average is the one that matters most. After all, a credit card interest rate is a moot point if you pay your bill every month, since interest never has the chance to accrue. Unfortunately, that’s not the reality for most Americans.

While both averages remain high, they’re below record levels. Both records were set in Q3 2024, when the all-accounts average hit 21.76% and the accruing-interest average reached 23.37%.

It’s important to remember, however, that the Q4 2025 numbers date to November — before the Fed’s December rate cut. Because of that, I expect both of these averages to continue to fall in the next quarter or two.

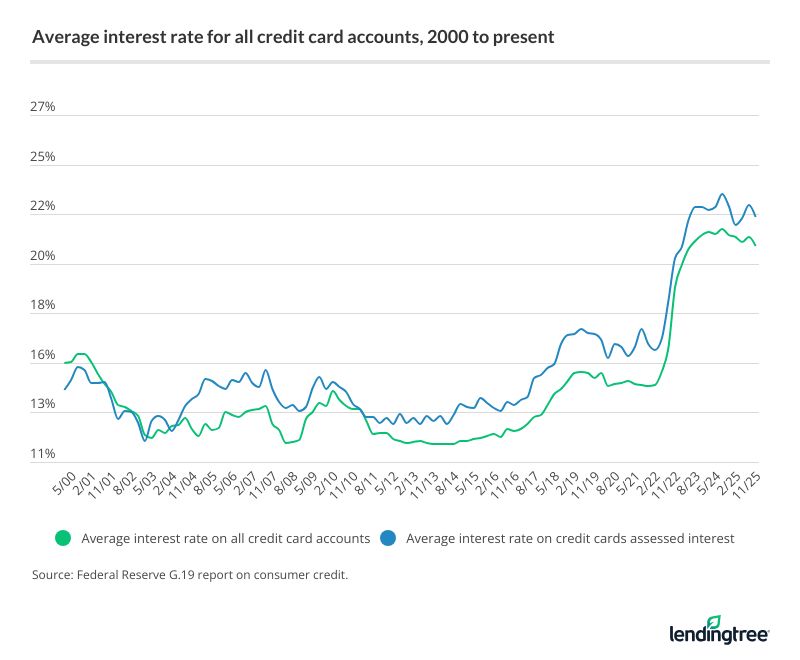

How have credit card interest rates changed over the years?

In recent years, we’ve seen significant movement in interest rates, primarily driven by the Federal Reserve. Rates rose significantly beginning in 2015 and continued to do so until 2019. The following year, the Fed dramatically lowered interest rates in response to the economic turmoil that began at the start of the pandemic. In 2022, however, the Fed reversed course, raising rates seven times. There were another four hikes in 2023. Since, there were three rate cuts in late 2024 and another three in late 2025.

Before 2015, credit card rates had been largely stable for several years, following the introduction of the Credit Card Accountability, Responsibility and Disclosure Act of 2009, better known as the Credit CARD Act. The pro-consumer law, signed by former President Barack Obama, brought significant changes to the credit card industry. It set limits on when issuers could raise cardholders’ rates, changed how payments must be applied to balances, restricted specific fees and much more. Those changes forced issuers to scramble to figure out how to recoup the revenues lost under the CARD Act. As a result, credit card rates became volatile for several years — one card even famously featured an APR of 79.90% for a short time — as banks determined what the market could bear.

Ultimately, all the changes led to overall higher credit card interest rates but relative stability, even as the nation emerged from the Great Recession. That stability lasted until the Fed began raising rates in 2015. Those hikes helped push rates to the high levels we see today.

What can I do if my interest rate is too high?

Even though more Fed rate cuts are possible, credit card interest rates remain near record highs as credit card issuers wrestle with ongoing economic uncertainty, including sky-high consumer debt and a shaky job market. That means it’s perhaps more important than ever that you start knocking down your credit card debt in a big way. That’s certainly easier said than done, though. If it’s possible, one of the best things you can do is pay down your debt to free up more cash for a rainy day fund.

You also have more power over your credit card’s APR than you realize. Two concrete steps can significantly impact your credit card’s interest rates.

Get a 0% balance transfer credit card

It may seem counterintuitive to fight credit card debt by getting another credit card, but 0% offers can be a godsend. Many cards offer 0% introductory periods of 12 to 15 months on purchases and balance transfers, with some even offering 18- to 24-month periods. If you’re knee-deep in card debt, a yearlong reprieve from interest on a transferred balance can make a huge difference. Make sure you understand all the fees, deadlines and rules associated with the card before applying. Also, you’ll likely need a good credit score — perhaps 680 or higher — to get one, as banks are more selective about whose transferred balances they’ll take on, given economic uncertainty. However, if you have good credit, you’ll likely have lots of options from which to choose.

Ask your issuer for a lower rate

A June 2025 LendingTree survey found that 83% of cardholders who asked to lower their credit card’s APR were successful. The average reduction was 6.7 percentage points. That’s a big deal! The problem is that just 25% of cardholders asked. The best way to approach it is to find credit card offers you’d qualify for at sites like LendingTree or in your snail mail and use those to frame your negotiations. Say something like, “I love my card, but it has a 27.70% APR and I’ve just been offered a card with a 21.00% APR. Will you match it?” There’s a good chance they’ll work with you. Just know you’ll have to make that call and ask for it. They likely won’t come to you.

Methodology: How we evaluated credit card APRs

For new credit card offer APRs, LendingTree examined the online terms and conditions for about 220 credit cards from more than 50 issuers, including banks and credit unions. To gather the data, we noted the standard purchase APRs listed for each card on each issuer’s or retailer’s website. (Introductory or promotional rates aren’t included in our averages.)

For current credit card account APRs, we used data from the latest Federal Reserve G.19 consumer credit report.