Best Credit Cards with No Annual Fee in 2026: Rewards Without the Extra Cost

Best credit card with no annual fee

Best credit card with no annual fee

Bilt World Elite Mastercard®

The Bilt World Elite Mastercard® is the best no-annual-fee credit card — not just for earning points* on rent (up to 100,000 points per calendar year) but for anyone looking for a great no-annual-fee rewards card. You’ll get flexible rewards with generous bonus categories, monthly Rent Day promotions and an intriguing list of airline and hotel transfer partners.

Key takeaways

- No-annual-fee credit cards let you earn valuable rewards without worrying about offsetting an annual fee.

- Many no-annual-fee cards offer rewards and perks similar to cards with higher annual fees.

- Maximize your rewards by choosing a no-annual-fee card with bonus categories that align with your regular spending.

- Winner/Best rewards credit card with no annual fee: Bilt World Elite Mastercard®

- Best credit card for airline miles with no annual fee: American Airlines AAdvantage® MileUp® Card

- Best travel credit card with no annual fee: Wells Fargo Autograph® Card

- Best cash back credit card with no annual fee: Capital One Savor Cash Rewards Credit Card

- Best credit card for gas and groceries with no annual fee: Blue Cash Everyday® Card from American Express (see rates & fees)

- Best secured credit card with no annual fee: Discover it® Secured Credit Card

- Best business credit card with no annual fee: Ink Business Unlimited® Credit Card

- Best hotel rewards credit card with no annual fee: Marriott Bonvoy Bold® Credit Card

- Best student credit card with no annual fee: Discover it® Student Cash Back

- Best metal credit card with no annual fee: Prime Visa

- Credit card with no annual fee and low interest: Amazon Secured Card

11 Best credit cards with no annual fee

| Credit Cards | Our Ratings | Rewards Rate | Welcome Offer | Regular APR | |

|---|---|---|---|---|---|

Bilt World Elite Mastercard®*

|

Rewards credit card

|

1X - 5X points

| N/A | See rates & fees | |

American Airlines AAdvantage® MileUp® Card

on Citibank's secure site Rates & Fees |

Airline miles

|

2X miles

| 15,000 miles

Earn 15,000 American Airlines AAdvantage® bonus miles after making $1,000 in purchases within the first 3 months of account opening.

| 19.49% - 29.49% (Variable) |

on Citibank's secure site Rates & Fees |

Wells Fargo Autograph® Card*

|

Travel credit card

|

1X - 3X points

| 20,000 points

Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

| 18.49%, 24.49%, or 28.49% Variable APR | |

Capital One Savor Cash Rewards Credit Card

|

Cash back credit card

|

1% - 8% cash back

| $200 Cash Back

Earn $200 Cash Back after you spend $500 on purchases within 3 months from account opening

| 18.49% - 28.49% (Variable) | |

Blue Cash Everyday® Card from American Express

|

Gas and groceries

|

1% - 3% cash back

| As High As $200 statement credit

You may be eligible for as high as $200 cash back after spending $2,000 in purchases on your new Card in the first 6 months. Welcome offers vary and you may not be eligible for an offer. Cash back is received as Reward Dollars, redeemable for statement credit or at Amazon.com checkout. Terms Apply.

| 19.49%-28.49% Variable | |

Discover it® Secured Credit Card

on Discover's secure site Rates & Fees |

Secured credit card

|

1% - 2% cash back

| Cashback Match

Discover will match all the cash back you’ve earned at the end of your first year.

| 26.49% Variable APR |

on Discover's secure site Rates & Fees |

Ink Business Unlimited® Credit Card

on Chase's secure site Rates & Fees |

Business credit card

|

1.5% cash back

Earn unlimited 1.5% cash back on every purchase made for your business

| $750 cash back

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

| 16.74% - 24.74% Variable |

on Chase's secure site Rates & Fees |

Marriott Bonvoy Bold® Credit Card*

|

Hotel credit card

|

1X - 14X points

| 30,000 points

Earn 30,000 Bonus Points after spending $1,000 on eligible purchases within the first 3 months from account opening.

| 19.99% - 28.49% Variable | |

Discover it® Student Cash Back

on Discover's secure site Rates & Fees |

Student credit card

|

1% - 5% cash back

| Cashback Match

Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $50 cash back into $100. Or turn $100 cash back into $200.

| 16.49% - 25.49% Variable APR |

on Discover's secure site Rates & Fees |

Prime Visa*

|

Metal credit card

|

1% - 5% cash back

| $150 Amazon gift card

Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

| 18.74% - 27.49% Variable | |

Amazon Secured Card*

|

Low interest

|

2% cash back

2% back at Amazon.com and Whole Foods Market with an eligible Prime membership

| N/A | 10.00% non-variable |

Methodology: How we chose the best no-annual-fee credit cards

We take a comprehensive, data-driven approach to identify the best no-annual-fee credit cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals. We use the following criteria to make our picks:

We calculate the rewards earned for the average cardholder using Bureau of Labor Statistics data and an annual spend of $20,000, minus the annual fee. This value includes sign-up bonus and annual bonuses (including annual free night certificates). We look at the average rewards earned over two years to balance out a card’s ongoing value with its first-year value.

We consider how easy the rewards are to use, looking at factors like expiration dates, minimum redemption thresholds, blackout dates and the availability of flexible redemption options like travel statement credits and cash back.

We also compare a card’s benefits — such as purchase protections, travel protections, elite status benefits and travel credits — against benefits from other cards.

Note, that our ratings are a starting point for comparing and choosing the best rewards credit card. However, your needs may be different from the average cardholder. You should consider the amount you’re likely to spend in a card’s bonus categories and which benefits you value to choose the best card for you.

Winner: Best rewards credit card with no annual fee

Bilt World Elite Mastercard®*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards: 1X - 5X points

- Earn 1X points on rent payments without the transaction fee, up to 100,000 points each calendar year

- Earn up to 5X Bilt points on Lyft rides when you link your Bilt account and pay with your Bilt card

- Earn 2X points on travel

- Earn 3X points on dining

- Earn 1X points on other purchases

- Use the card 5 times each statement period to earn points

- Earn 1X points on rent payments without the transaction fee, up to 100,000 points each calendar year

- Earn up to 5X Bilt points on Lyft rides when you link your Bilt account and pay with your Bilt card

- Earn 2X points on travel

- Earn 3X points on dining

- Earn 1X points on other purchases

- Use the card 5 times each statement period to earn points

- Earn rewards on rent (up to 100,000 points per calendar year) with no transaction fees

- Bonus points on dining and travel purchases

- Transfer points 1:1 to a wide variety of partners, including United Airlines and Hyatt

- $0 foreign transaction fee

- Solid travel protections

- No sign-up bonus

- Homeowners cannot benefit from the card’s biggest benefit: points on rent payments

- Must use the card five times each statement period to earn points

The Bilt World Elite Mastercard® is a no-brainer for renters, since it lets you earn points on rent payments (up to 100,000 points per calendar year)* with no transaction fee. However, anyone looking for a good no-annual-fee rewards card should give it a close look. It offers all-around great rewards and perks that are typically reserved for annual fee cards.

That includes the option to transfer points to a wide variety of travel loyalty programs, including United MileagePlus and World of Hyatt, to maximize your rewards. You also get double points on dining and travel purchases, making it the most potentially rewarding card on our list in terms of rewards earned per dollar spent.* It offers other great travel features, including $0 foreign transaction fees and trip cancellation and interruption protection.

How rewarding is it?

- The average cardholder can earn around $0.028 in rewards per $1 spent.**

- The average cardholder can earn around $863 in rewards in the first year.**

**This estimate is based on LendingTree’s value methodology.

- $0 Annual Fee

- Earn 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year

- Earn 3x points on dining, 2x points on travel, and 1x on other purchases

- Earn double points on the first of each month (excluding rent, up to 1,000 bonus points)

- Use the card 5 times each statement period to earn points

- Earn up to 5x Bilt points on Lyft rides when you link your Bilt account and pay with your Bilt card

- Point redemptions include airlines, hotels, future rent payments, credit card statements, toward a down payment on a home, etc.

- Other features and benefits include: Auto Rental Collision Damage Waiver, Purchase Security, Trip Cancellation and Interruption Protection, Cellular Telephone Protection, and Trip Delay Reimbursement

- Select Apply Now to learn more about the product features, terms, and conditions

Best airline miles credit card with no annual fee

American Airlines AAdvantage® MileUp® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Earn 15,000 miles

- Earn 2 AAdvantage® miles for each $1 spent at grocery stores, including grocery delivery services.

- Earn 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases.

- Earn valuable AAdvantage miles at twice the rate on grocery purchases

- Get a solid sign-up bonus

- 25% discount on in-flight purchases

- 3% foreign transaction fee

- Few airline benefits

- Limited bonus categories

- No travel protections

The American Airlines AAdvantage® MileUp® Card gives you the chance to stack up valuable (and hard to come by) AAdvantage miles on your grocery purchases. It’s the only AAdvantage card to offer a bonus on grocery purchases, which means even annual fee AAdvantage card holders might consider adding it to their arsenal.

While it doesn’t offer priority boarding or free checked bags, it does give you a 25% discount on in-flight purchases. But you may want to keep this airline credit card at home during international travel because of its 3% foreign transaction fee.

How rewarding is it?

- The average cardholder can earn around $0.015 in rewards per $1 spent.*

- The average cardholder can earn around $487 in rewards in the first year.*

- Click APPLY NOW to apply online.

- Earn 15,000 American Airlines AAdvantage® bonus miles after making $1,000 in purchases within the first 3 months of account opening.

- 0% Intro APR for 15 months from date of account opening for balance transfers only. After that the variable APR will be 19.49% - 29.49%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- Balance transfer fee of either $5 or 5% of the amount of each credit card balance transfer, whichever is greater. Balance Transfers must be completed within 4 months of account opening.

- No Annual Fee

- Earn 2 AAdvantage® miles for each $1 spent at grocery stores, including grocery delivery services

- Earn 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases

- Save 25% on inflight food and beverage purchases when you use your card on American Airlines flights

- Rates & Fees

Best travel credit card with no annual fee

Wells Fargo Autograph® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Earn 20,000 points

- Earn unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans.

- Earn 1X points on other purchases

- 3x points on common spending categories

- Flexible redemption options, including airline and hotel partners

- Intro offer on purchases

- Foreign transaction fees: None

- Intro APR offer doesn’t include balance transfers

- Only a handful of transfer partners to choose from

- Limited travel protections

With 3x points on a wide variety of travel-related purchases, a generous sign-up bonus and no foreign transaction fees, the Wells Fargo Autograph® Card offers a lot to frequent travelers. Wells Fargo recently introduced transfer partners, which significantly enhances the value of its rewards. Plus, all cardholders receive cellphone protection and rental car coverage.

New cardholders also get an intro APR offer on purchases, which can help you finance an upcoming trip.

How rewarding is it?

- The average cardholder can earn around $0.022 in rewards per $1 spent.*

- The average cardholder can earn around $696 in rewards in the first year.*

- Apply Now to take advantage of this offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 18.49%, 24.49%, or 28.49% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Best cash back credit card with no annual fee

Capital One Savor Cash Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Earn $200 Cash Back

- Earn 3% Cash Back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services

- Earn 5% Cash Back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Earn 8% Cash Back on Capital One Entertainment purchases

- Earn 1% Cash Back on all other purchases

- One of the highest earning rates on food and entertainment purchases

- Earn a large sign-up bonus

- Foreign transaction fee: None

- Long intro APR on purchases and balance transfers

- Potentially high APR

- Balance transfer fee applies on promotional rates

The Capital One Savor Cash Rewards Credit Card is one of the most rewarding cash back cards around, especially if you love to eat out and have fun. It offers unlimited 3% Cash Back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services; 5% Cash Back on hotels, vacation rentals and rental cars booked through Capital One Travel; 8% Cash Back on Capital One Entertainment purchases; 1% Cash Back on all other purchases.

The card has no foreign transaction fees, making it a good choice for travel. You’ll also get a good intro APR on balance transfers and new purchases (a balance transfer fee applies).

How rewarding is it?

- The average cardholder can earn around $0.023 in rewards per $1 spent.*

- The average cardholder can earn around $652 in rewards in the first year.*

- Earn a one-time $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

- $0 annual fee and no foreign transaction fees

- Earn unlimited 3% cash back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services, plus 1% on all other purchases

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

- 0% intro APR on purchases and balance transfers for 12 months; 18.49% - 28.49% variable APR after that; balance transfer fee applies

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best credit card for gas and groceries with no annual fee

Blue Cash Everyday® Card from American Express

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: As High As $200 statement credit

- Earn 3% cash back at U.S. supermarkets, on U.S. online retail purchases, and at U.S. gas stations, on eligible purchases for each category on up to $6,000 per year in purchases (then 1%).

- Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- High rewards rate on U.S. gas and U.S. supermarket purchases

- Solid welcome offer

- Monthly streaming subscription credit (enrollment required; subject to auto-renewal)

- Long intro APR

- Cap on higher rewards rate

- Bonus categories are limited to U.S.-based purchases

- Foreign transaction fees

If you’re looking for a dedicated card for U.S. gas and U.S. supermarket purchases, the Blue Cash Everyday® Card from American Express may be your best bet. It offers one of the highest rewards rates among no-annual-fee cards for these categories combined.

Plus, you can get up to a $7 monthly statement credit after using your enrolled Blue Cash Everyday® Card from American Express for a subscription purchase, including a bundle subscription purchase, at DisneyPlus.com, Hulu.com or Stream.ESPN.com U.S. websites. Subject to auto-renewal.

How rewarding is it?

- The average cardholder can earn around $0.019 in rewards per $1 spent.*

- The average cardholder can earn around $583 in rewards in the first year.*

- Click APPLY NOW to apply online.

- Apply and find out your welcome offer. As High As $200 cash back* after you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply, and if approved: 1. Find out your offer amount 2. Accept the Card with your offer 3. Spend $2,000 in 6 months 4. Receive the cash back. *Cash back is received in the form of Reward Dollars that can be redeemed for a statement credit or at Amazon.com checkout.

- No Annual Fee.

- Enjoy 0% intro APR on purchases and balance transfers for 15 months from the date of account opening. After that, your APR will be a variable APR of 19.49%-28.49%.

- Plan It®: Buy now, pay later with Plan It. Split purchases of $100 or more into equal monthly installments with a fixed fee so you don’t have the pressure of paying all at once. Simply select the purchase in your online account or the American Express® App to see your plan options. Plus, you’ll still earn rewards on purchases the way you usually do.

- Earn 3% cash back at U.S. supermarkets, 3% cash back on U.S. online retail purchases, 3% cash back at U.S. gas stations, on eligible purchases for each category on up to $6,000 per year in purchases (then 1%). Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- Get up to a $7 monthly statement credit after using your enrolled Blue Cash Everyday® Card for a subscription purchase, including a bundle subscription purchase, at DisneyPlus.com, Hulu.com, or Stream.ESPN.com U.S. websites. Subject to auto-renewal.

- Terms Apply.

- Rates & Fees

Best secured credit card with no annual fee

Discover it® Secured Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Cashback Match

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter.

- Earn unlimited 1% cash back on all other purchases.

- Earns rewards on every purchase

- Matches cash back in the first year for new cardholders

- Automatic reviews to graduate to an unsecured card starting at seven months

- No penalty APR

- No late fee for first missed payment

- Security deposit required

- Bonus cash back is capped

- High APR

The Discover it® Secured Credit Card is one of the most rewarding secured credit cards you can find. It earns cash back on every purchase, including bonus rewards on your first $1,000 on gas station and restaurant purchases each quarter. And Discover will match all the cash back you’ve earned at the end of your first year.

There is no credit score required to apply, and you can get started with a security deposit of just $200. Discover also offers automatic account reviews starting at seven months. By responsibly using your card, you may qualify for a higher credit limit or an upgrade to an unsecured card.

How rewarding is it?

- The average cardholder can earn around $0.013 in rewards per $1 spent.*

- The average beginner cardholder can earn around $91 in rewards in the first year.*

- Click APPLY NOW to apply online.

- No credit score required to apply. No Annual Fee.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. You'll still earn unlimited 1% cash back on all other purchases.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers—only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards.

- Get an alert if we find your Social Security number on the dark web. Activate for free.

- Terms and conditions apply.

- Rates & Fees

Best business credit card with no annual fee

Ink Business Unlimited® Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Earn $750 cash back

- Large sign-up bonus

- High flat rate of 1.5x points on all purchases

- Intro APR on purchases

- Free employee cards

- No bonus categories to earn extra points

- Cannot transfer points without an eligible Chase card

- Foreign transaction fees

The Ink Business Unlimited® Credit Card offers some of the best rewards of any no-annual-fee business credit card. You’ll get a very generous sign-up bonus, and you’ll earn unlimited 1.5% cash back on every purchase made for your business. Plus, with free employee cards, all of your employee purchases will earn rewards too.

The card includes purchase protection and extended warranty coverage to protect your business, and rental cars receive primary rental car insurance against damage or theft. New cardholders also get an intro APR offer, providing extra time to pay off purchases to even out your cash flow.

How rewarding is it?

- The average cardholder can earn around $0.015 in rewards per $1 spent.*

- The average cardholder can earn around $1,050 in rewards in the first year.*

- Click APPLY NOW to apply online.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- 0% introductory APR for 12 months on purchases

- Earn 5% total cash back on Lyft rides through 9/30/27.

- Member FDIC

- Rates & Fees

Best hotel rewards credit card with no annual fee

Marriott Bonvoy Bold® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Earn 30,000 points

- Earn up to 14X total points for every $1 spent at thousands of hotels participating in Marriott Bonvoy®

- Earn 2X points for every $1 spent at grocery stores, rideshare, select food delivery, select streaming, and internet, and cable and phone services

- Earn 1X point for every $1 you spend on all other purchases

- Earn a very generous sign-up bonus

- Earn up to 14x points at Marriott properties

- Automatic Marriott Bonvoy Silver elite status

- $0 foreign transaction fees

- Travel and purchase protections

- Limited Marriott perks

- Meager earning rate outside of Marriott purchases

- Dynamic pricing on award nights impacts the value of rewards

- No intro APR offers

The Marriott Bonvoy Bold® Credit Card comes with a very large sign-up bonus for a card with no annual fee. You’ll get other decent hotel perks like automatic Silver elite status. The card also lets you earn up to 14X total points for every $1 spent at thousands of hotels participating in Marriott Bonvoy® and 2X points for every $1 spent at grocery stores, rideshare, select food delivery, select streaming, and internet, and cable and phone services. Plus, earn 1X point for every $1 you spend on all other purchases.

If you want to achieve higher elite status with Marriott, you’ll receive a jump start with five Elite Night Credits each year. When traveling, keep the Marriott Bonvoy Bold® Credit Card handy since it has $0 foreign transaction fees and includes valuable travel protections, which cover lost or delayed baggage, trip delays and more.

How rewarding is it?

- The average cardholder can earn around $0.01 in rewards per $1 spent.*

- The average cardholder can earn around $464 in rewards in the first year.*

- Earn 30,000 Bonus Points after spending $1,000 on eligible purchases within the first 3 months from account opening.

- Pay no annual fee with the Marriott Bonvoy Bold® Credit Card from Chase®!

- Earn up to 14X total points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Bold® Card.

- 2X points for every $1 spent on purchases at grocery stores.

- 2X points for every $1 spent on rideshare and select food delivery.

- 2X points for every $1 spent on select streaming, and internet, cable and phone services.

- 1X point for every $1 spent on all other purchases.

- Receive 5 Elite Night Credits annually, plus complimentary Silver Elite Status. Restrictions apply.

- No Foreign Transaction Fees.

- Earn unlimited Marriott Bonvoy® points and get Free Night Stays faster.

Best student credit card with no annual fee

Discover it® Student Cash Back

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Earn Cashback Match

Earn Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $50 cash back into $100. Or turn $100 cash back into $200.

- Earn 5% cash back on everyday purchases at different places each quarter, up to the quarterly maximum when you activate.

- Earn 1% cash back on all other purchases – automatically

- No credit score required to apply

- Earn a high rate of cash back on rotating categories

- Unlimited cash back match the first year

- Intro purchase APR offer

- You have to activate categories each quarter to earn the bonus

- Quarterly bonus categories are capped

The Discover it® Student Cash Back is a great student card to build a credit history with. It doesn’t require a credit score to apply, and you don’t need a security deposit to open it. Plus, you’ll enjoy a rewards program that’s on par with some of the best cash back cards — as long as you don’t mind activating bonus categories each quarter. You’ll earn 5% cash back at different places each quarter up to the quarterly maximum when you activate. 1% unlimited cash back on all other purchases - automatically.

While it doesn’t have a traditional welcome offer, all of your cash back rewards are doubled after the first year, no matter how much you spend.

How rewarding is it?

- The average cardholder can earn around $0.017 in rewards per $1 spent.*

- The average beginner cardholder can earn around $120 in rewards in the first year.*

- Click APPLY NOW to apply online.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $50 cash back into $100. Or turn $100 cash back into $200.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases.

- Redeem cash back for any amount

- No credit score required to apply.

- No annual fee and build credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 16.49% - 25.49% applies.

- Terms and conditions apply.

- Rates & Fees

Best metal credit card with no annual fee

Prime Visa*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Welcome offer: Get a $150 Amazon gift card

Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members.

- Earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases with an eligible Prime membership

- Earn unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare)

- Earn unlimited 1% on all other purchases

- Earn up to 5% as an Amazon Prime member

- Earn bonus rewards on gas, dining and transit

- Get an Amazon gift card upon approval

- $0 foreign transaction fees

- Travel and purchase protections

- Must be an Amazon Prime member

- No intro APR offers for new accounts

- Must choose between rewards and interest rate promos

The Amazon Prime Visa is a fantastic card for Amazon and Whole Foods shopping, but it’s even more than that: It’s a metal card that you can use for a variety of everyday purchases. You’ll earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel℠ purchases with an eligible Prime membership, unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare), and unlimited 1% on all other purchases.

It’s also a decent option for travel, since it doesn’t charge foreign transaction fees. It even offers a few travel protections, like baggage and car rental protection.

How rewarding is it?

- The average cardholder can earn around $0.021 in rewards per $1 spent.*

- The average cardholder can earn around $564 in rewards in the first year.*

- Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

- Earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market and on Chase Travel purchases with an eligible Prime membership

- Prime Card Bonus: Earn 10% back or more on a rotating selection of items and categories on Amazon.com with an eligible Prime membership

- Earn unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare)

- Earn unlimited 1% back on all other purchases

- No annual credit card fee

- No more waiting. Redeem daily rewards at Amazon.com as soon as the next day

- Member FDIC

Credit card with no annual fee and low interest

Amazon Secured Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards: 2% back at Amazon.com and Whole Foods Market with an eligible Prime membership

- Extremely low 10.00% non-variable APR

- Cash back rewards on Amazon purchases

- Low $100 minimum deposit required

- Good credit-building features

- Requires Prime membership to earn rewards

- Can only be used to make purchases at Amazon

- Low maximum credit limit

The Amazon Secured Card combines accessibility, low cost and a low interest rate for a secured card. It’s a smart choice for anyone looking to build or rebuild credit without taking on high costs. Payments are reported to all three major credit bureaus, helping you strengthen your credit over time.

If you’re an Amazon Prime member, the card is even more rewarding. You can earn cash back on Amazon and Whole Foods purchases. Plus, the relatively low minimum security deposit makes it easier to get started.

How rewarding is it?

- The average cardholder can earn around $0.002 in rewards per $1 spent.*

- The average cardholder can earn around $6.31 in rewards in the first year.*

- No annual fee

- Minimum $100 security deposit up to $1,000

- Join Prime to get 2% back on Amazon.com

Pros and cons of credit cards with no annual fee

- Earn cash back, points or miles that you can use to pay off your balance, book a trip or redeem for products

- 0% APR intro periods that allow you to save money on balance transfers

- Build credit history for free as long as you pay your statement balance in full each month

- Keep your card open indefinitely to improve the age of your accounts without having to pay an ongoing fee

- Won’t offer premium travel benefits like cards that have annual fees

- May be less rewarding than some annual fee cards

- May offer a lower sign-up bonus

What is an annual fee on a credit card?

An annual fee is a fee that you pay once a year for the privilege of using a card and its benefits. Annual fees typically range from $35 to $500, but some premium cards — like the American Express Platinum Card® (see rates & fees) and Chase Sapphire Reserve® — go even higher. The Consumer Financial Protection Bureau found that the average annual fee was $94 from smaller issuers and $157 from larger ones.

Not all credit cards charge annual fees. Some cards may waive the annual fee in the first year so you can try out their benefits before committing to the fee. Other cards (including our top credit cards with no annual fee), don’t charge any annual fee at all.

Why do credit cards have annual fees?

Banks charge annual fees on credit cards to help cover the cost of benefits and rewards, as well as the operational costs of offering the cards. Typically, the higher the annual fee, the more benefits are included to justify the cost of owning the card.

When do you pay the annual fee on a credit card?

Annual fees typically post on the anniversary date of when you opened your account and are included in the following statement balance. You won’t earn rewards on annual fees, but they are treated like a purchase for interest charges if you don’t pay your balance in full.

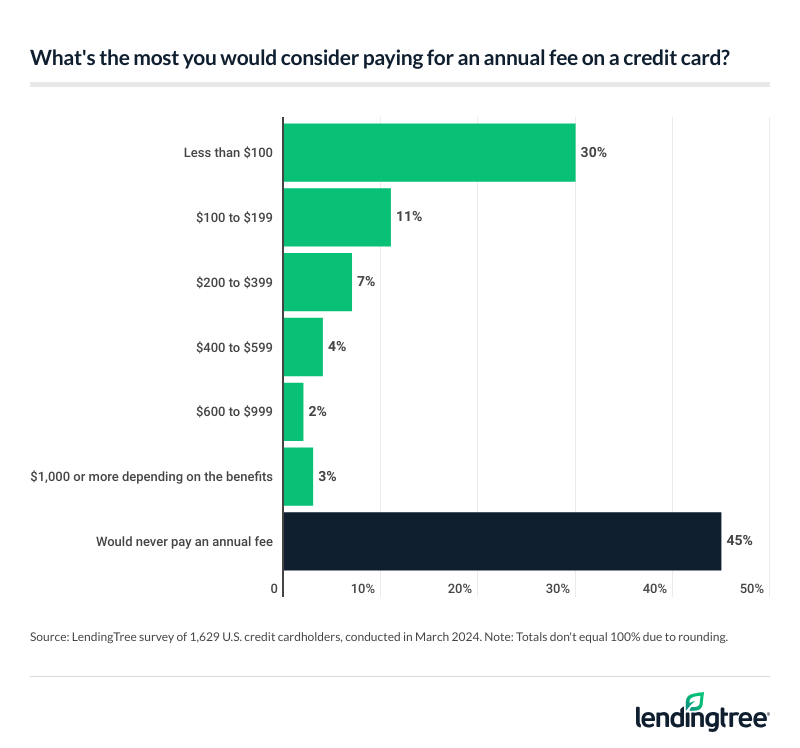

LendingTree Study: Would you pay an annual fee for a credit card?

According to a recent LendingTree survey on credit card annual fees, nearly half (45%) of the more than 1,600 respondents said they’d never pay an annual fee. The other responses varied from “less than $100” to more than $1,000, depending on benefits. 3 out of 4 respondents were unwilling to pay more than $100.

These results indicate that many consumers are willing to pay an annual fee when they see enough value in a card’s rewards and benefits.

Can you switch to a card with no annual fee?

In many cases, yes, it is possible to switch to a card with no annual fee if the issuer has a suitable no-annual-fee option. In many cases, switching from a credit card with an annual fee to a card with no annual fee is considered “downgrading.” This is because cards with no annual fees tend to have fewer benefits and rewards than annual fee cards.

Remember that issuers can impose restrictions on product changes. They may:

- Require your account to open for a certain amount of time

- Disallow changes to a particular card

- Require that changes be kept within the same card “family” (e.g., Chase Ultimate Rewards® cards or Marriott Bonvoy cards)

If downgrading isn’t an option, you can cancel a credit card. But before you cancel your credit card with an annual fee, remember that the length of your credit history factors into your credit score. You may notice a slight drop to your credit score when you close a credit card. You can raise your credit score with positive actions like making payments on time and keeping your credit utilization ratio low.

→ Learn more about product changes: How to request a product change with Capital One

How to ask about a credit card annual fee waiver

There’s no guarantee that an issuer will give you a credit card annual fee waiver, but it never hurts to ask.

- Call your credit card’s toll-free number and ask if they’ll waive your annual fee.

Highlight your positive payment history and tell them you’d like to remain a customer. - Ask the credit card issuer to match a competitor’s offer.

Many credit cards have similar benefits and features. If you find a no-annual-fee credit card that’s comparable to your card, ask your card’s customer service department if they can waive the fee in exchange for you keeping your card. - Inquire about military benefits.

For cardholders who are active duty military members, your credit card issuer may offer you benefits in addition to those given under the Servicemembers Civil Relief Act (SCRA). - Ask for a retention offer.

Banks know it is expensive to attract new customers, so they may be willing to provide a retention offer to keep you from closing your account. Retention offers may include waived or reduced annual fees, bonus points or higher rewards on purchases.

LendingTree survey: Nearly 95% of people who asked their card issuer to waive or reduce an annual fee were successful. Most had their fees waived entirely, which is proof that it really does pay to ask.

Should you get a credit card with an annual fee instead?

A credit card with an annual fee may be a better overall value if you can make use of the card’s rewards and benefits. Depending on how much you spend, you may come out ahead even after paying the annual fee. In our spending example below, the Blue Cash Preferred® Card from American Express offers $45 more in rewards value* than the Blue Cash Everyday® Card from American Express, with the annual fee factored in:

Example earnings on $20,000 yearly spend*

| Blue Cash Everyday® Card from American Express | Blue Cash Preferred® Card from American Express | |

|---|---|---|

| Annual fee | $0 (see rates & fees) | $0 intro annual fee for the first year, then $95. (see rates & fees) |

| $6,000 spent at U.S. Supermarkets | 3% ($180) | 6% ($360) |

| $2,000 spent on online retail | 3% ($60) | 1% ($20) |

| $2,000 spent at U.S. gas stations | 3% ($60) | 3% ($60) |

| $10,000 spent on other purchases | 1% ($100) | 1% ($100) |

| Total | $400 | $540 |

| Total minus annual fee | $400 | $445 |

→ See LendingTree’s top picks for the best rewards credit cards.

Frequently asked questions

While most cards that include airport lounge access carry substantial annual fees, the no-annual-fee U.S. Bank Altitude® Connect Visa Signature® Card gives you a limited four free visits per year through the Priority PassTM lounge network.

If you travel frequently, you’ll find better value with a card that has an annual fee but more unlimited lounge access and broader perks.

Yes — in fact, combining several can help you maximize rewards across different spending categories (like groceries, gas and dining) without paying any annual fees. Just be sure to manage them responsibly and avoid applying for too many at once.

Some do. Even though you won’t pay an annual fee, you might be charged 1% to 3% on purchases made abroad. If you travel internationally, look for a no-annual fee card with no foreign transaction fees.

It depends on the card. Some credit-building or student cards are available to those with poor, fair or average credit, while other rewards cards require good to excellent credit (typically 670+).

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- Blue Cash Everyday® Card from American Express

- American Express Platinum Card®

- Blue Cash Preferred® Card from American Express

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Bilt World Elite Mastercard®, Wells Fargo Autograph® Card, Marriott Bonvoy Bold® Credit Card, Prime Visa, Amazon Secured Card, Chase Sapphire Reserve® and U.S. Bank Altitude® Connect Visa Signature® Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.