CareCredit® credit card Review: A Risky Choice for Financing Medical Care

Key takeaway

Pros and cons

Pros

- Pay out-of-pocket medical expenses over time

- 0% financing options

- Accepted at over 270,000 locations

- $0 annual fee

Cons

- Promotional financing involves deferred interest

- Extremely high annual percentage rate (APR)

- Can’t use the card everywhere

- Earning rewards is based on your credit score

Is the CareCredit® credit card good?

The CareCredit® credit card can be a helpful way to manage out-of-pocket medical expenses over time without paying interest. However, proceed with caution, as the interest-free period comes with conditions that could trap you in debt if not handled carefully.

It’s a deferred interest credit card, meaning you’ll only avoid interest if you pay off the entire balance within the promotional period. You’ll have to pay an extremely high 32.99% APR for the full balance — even on what you’ve already paid off — if you don’t pay off everything in time.

If you aren’t 100% sure that you’ll be able to pay off your balance in full within the interest-free window, a 0% intro APR credit card is a much safer option.

Quick facts

Recommended credit: Credit scores ranges may vary. Your individual chance at approval may vary due to factors such as creditors using a particular variation at their discretion Good / Excellent

Rewards Rate: N/A

Welcome offer: Promotional financing available for 6 or 12 months on health, wellness and pet care purchases of $200+

Rates

- Intro purchase APR: With shorter term financing options of 6, 12, 18 or 24 months no interest is charged on purchases of $200 or more when you make the minimum monthly payments and pay the full amount due by the end of the promotional period. If you do not, interest is charged from the original purchase date.

- Regular purchase APR: 32.99%

- Intro balance transfer APR: N/A

- Regular balance transfer APR: N/A

- Regular cash advance APR: N/A

- Penalty APR: 39.99%

Fees

- Annual fee: $0

- Balance transfer fee: N/A

- Cash advance fee: N/A

- Foreign exchange fee: 3% of each transaction

- Late fee: Up to $41

Alternative cards with a 0% intro APR for financing medical expenses

| Credit Cards | Our Ratings | Intro Purchase APR | Regular APR | Welcome Offer | |

|---|---|---|---|---|---|

CareCredit® credit card*

|

N/A | With shorter term financing options of 6, 12, 18 or 24 months no interest is charged on purchases of $200 or more when you make the minimum monthly payments and pay the full amount due by the end of the promotional period. If you do not, interest is charged from the original purchase date. | 32.99% | 6 - 12 months financing

Promotional financing available for 6 or 12 months on health, wellness and pet care purchases of $200+

| |

Wells Fargo Reflect® Card*

|

0% intro APR for 21 months from account opening on purchases | 17.49%, 23.99%, or 28.24% Variable APR | N/A | ||

U.S. Bank Visa® Platinum Card*

|

0% intro APR for 21 billing cycles on Purchases | 17.74% - 28.74% (Variable) | N/A | ||

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

0% Intro APR on Purchases for 15 months | 18.24% - 27.74% Variable | $200 cash back

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

|

on Chase's secure site Rates & Fees |

→ See all of the top 0% APR credit cards.

CareCredit® credit card benefits

-

Pay out-of-pocket medical expenses over time

When an unexpected health care bill, dental procedure or emergency vet visit comes up, it can be stressful trying to figure out how to cover the expense. The CareCredit® credit card is designed to help you cover medical expenses by offering interest-free financing for purchases of $200 or more, with repayment terms ranging from six to 24 months.

But keep in mind that you’ll only get the 0% interest if you pay off your balance by the end of the promotional period, or you’ll owe a 32.99% APR on the full balance. You can also choose a reduced financing option for purchases of $1,000 or more for 24, 36, 48 or 60 months, depending on the purchase amount.

Services that are eligible include:

- Animal/pet care

- Chiropractic

- Cosmetic

- Dentistry

- Dermatology

- Funeral, cremation and burial

- Health systems and hospitals

- Health care specialists

- Hearing

- Labs and diagnostics

- Medical equipment/supplies

- Pharmacies/general wellness

- Primary care

- Sleep labs and medications

- Spa services and treatments

- Vision (including LASIK)

- Weight loss and nutrition

To get an estimate of what this could cost you per month, check out CareCredit®’s payment calculator.

While pet insurance exists, most of us don’t have our pets insured. The CareCredit® credit card can help cover unexpected vet costs. Just know that there are other ways to finance pet care. For example, a pet loan is a type of personal loan that can help with expenses such as adoption, surgery, medications or training.

CareCredit® credit card drawbacks

-

Promotional periods involve deferred interest

What’s key to know about CareCredit®’s no-interest financing periods is you’re agreeing to deferred interest. If you don’t pay the purchase in full by the end of the financing period, you’ll be charged the regular interest rate on the entire purchase amount.

Additionally, CareCredit® states that just making the minimum payment each month may not be enough to pay off your purchase within the financing period. To ensure that your purchase is paid before the end of the promotional period and avoid deferred interest, you’ll need to schedule additional or larger payments.

Deferred interest is risky and can be very costly. If you aren’t 100% sure that you can pay off your debt within the promotional window, we suggest considering a 0% APR credit card instead.

-

Extremely high APR

This card’s regular purchase APR is 32.99%. If you don’t pay off your balance within the introductory period or you make purchases that aren’t eligible for financing, you’ll be subject to expensive interest charges. For example, if you have a $10,000 balance and only make the minimum monthly payments, you could accumulate over $1,000 in interest in just six months.

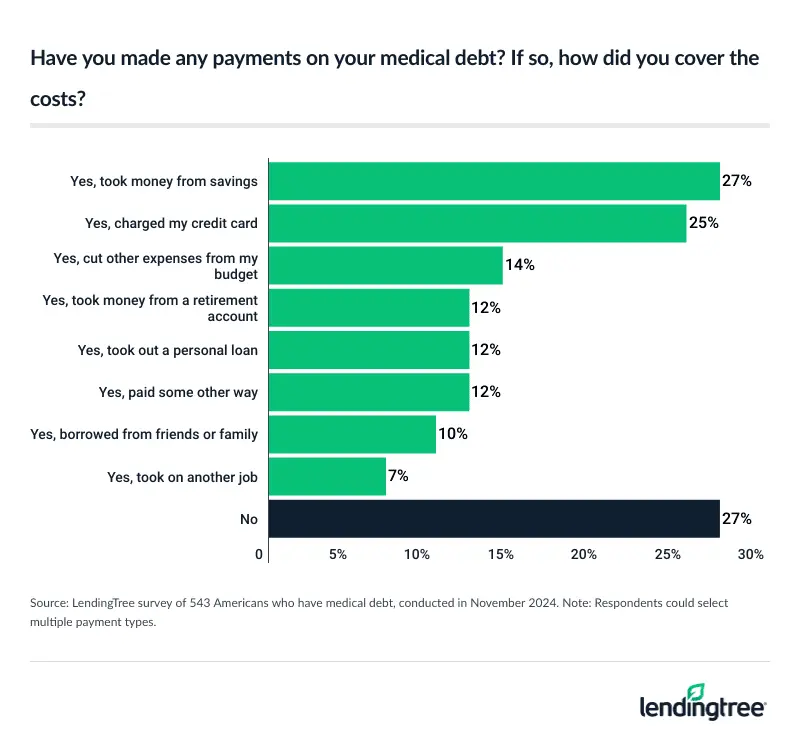

A LendingTree study shows that the average APR is currently around 24%. Choosing a card with a much lower ongoing APR, a long 0% intro APR period and no deferred interest is a far better option for paying off medical debt.

-

You can't use this card everywhere

More than 270,000 providers across the nation accept CareCredit®. However, there’s no guarantee that your provider takes the card, so you might want to verify before deciding to apply.

If you’re looking for a credit card you can use on purchases outside of medical expenses, this card isn’t the right fit. You might want to consider a card like the Chase Freedom Unlimited®, which offers a 0% Intro APR on Purchases for 15 months (followed by a 18.24% - 27.74% Variable APR), along with cash back rewards on every purchase.

-

Earning rewards is based on your credit score

When you apply for the CareCredit® credit card, you’ll be considered for either the CareCredit Rewards Mastercard® or the standard CareCredit® credit card. The CareCredit Rewards Mastercard® lets you earn 1 reward point on eligible purchases. But if you’re approved for the standard card, you won’t earn rewards.

Alternate financing options

Before paying a medical bill, first confirm that everything on your bill is accurate. By some estimates, 80% of medical bills include errors. Next, consider negotiating the bill. According to a LendingTree survey on medical debt, 59% of Americans who’ve had medical debt have negotiated a related bill, including requesting a payment plan, disputing charges and asking for a reduced balance. Of them, 93% reported at least partial success — 66% received what they requested.

Once you’ve confirmed that everything on your bill is correct and you’ve negotiated with your medical provider, here are some alternate financing options to pay your bill over time:

- Ask about a payment plan.

Your health care provider may offer shorter-term repayment plans where you pay no interest and/or longer-term plans where you pay a lower monthly amount but do incur interest charges. - Ask about medical financial assistance.

The Affordable Care Act requires hospitals to provide financial assistance to those who qualify for it. Talk with your hospital to see what it offers. - Apply for a 0% intro APR credit card.

If you know you have medical expenses coming up, applying for a 0% intro APR credit card may be your best option. With a true 0% APR card, you’ll only owe interest on any balance remaining past the intro period. Plus, many of these cards offer more reasonable APRs. - Apply for a personal loan.

A personal loan is another great option for paying off a balance over time with a low, fixed interest rate. There are also medical loans, which are personal loans designed specifically for medical expenses.

Can medical bills affect my credit?

CareCredit® credit card vs. Wells Fargo Reflect® Card

The Wells Fargo Reflect® Card offers one of the longest intro APR periods if you need time to pay off your balance. You’ll get a 0% intro APR for 21 months from account opening on purchases , then a 17.49%, 23.99%, or 28.24% Variable APR applies.

Unlike a deferred interest offer, if you have a balance remaining at the end of this card’s intro period, you’ll just accrue interest on your balance from that point onward. This makes the Wells Fargo Reflect® Card a much safer option than the CareCredit® credit card.

CareCredit® credit card vs. U.S. Bank Visa® Platinum Card

The U.S. Bank Visa® Platinum Card is another option with a lengthy intro APR, giving you plenty of time to pay off any unexpected medical bills. You’ll get a 0% intro APR for 21 billing cycles on Purchases, followed by a 17.74% - 28.74% (Variable) APR. Like the Wells Fargo Reflect® Card, this card provides a way to avoid risky deferred interest charges.

CareCredit® credit card vs. Chase Freedom Unlimited®

The Chase Freedom Unlimited® is a great card for paying off a medical bill and keeping long term, thanks to its long intro APR on purchases and balance transfers, along with a strong rewards rate on every purchase. There’s a 0% Intro APR on Purchases for 15 months. Then, a 18.24% - 27.74% Variable APR will apply.

You’ll enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases. It’s a much better value than the CareCredit® credit card, which doesn’t guarantee rewards on any purchases.

Is the CareCredit® credit card right for you?

The CareCredit® credit card can be a useful tool to spread medical payments out over time if you don’t have the cash to pay the bill up front. But it’s also a risky option due to deferred interest and a high 32.99% APR. Make sure you carefully read through the terms and conditions and have a plan in place to pay the full balance before your financing period ends.

To completely avoid the risk of deferred interest, consider financing your medical bill with a 0% intro APR credit card, personal loan or medical loan. Alternatively, reach out to your medical provider to explore available payment plans and assistance options.

How we rate credit cards

We take a comprehensive, data-driven approach to identify the best cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals. We use the following criteria to make our picks:

- Annual savings (50% of rating)

We calculate how much the average cardholder can save with the card on a yearly basis. If it’s a rewards card, we use U.S. Bureau of Labor data and $300 in monthly spend (the typical starting credit limit for an introductory card) to calculate how much the average cardholder can earn in rewards. We then subtract fees — including annual fees and maintenance fees — from this amount. - Credit building features (50% of rating)

We give points for features that help build credit, including reports to all three credit bureaus, regular account reviews for card upgrades and free credit score access. We take away points for features that can be costly to cardholders trying to build credit, such as security deposits, penalty APRs and late payment fees.

The information related to the CareCredit® credit card, Wells Fargo Reflect® Card and U.S. Bank Visa® Platinum Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.