Boo! Halloween Budgets Creep Up to Average of $192 From $172 Last Year

Witches, ghosts and ghouls may be scary, but the true terror of the looming Halloween holiday for some is the cost.

A LendingTree survey of 2,000 Americans looks at how many will celebrate this year, how much they’ll spend, whether they’ll go into debt for the festivities and more.

What we found may spook budget-conscious Americans: The 9 in 10 consumers who plan to celebrate expect to spend an average of $192 on Halloween this year, up from $172 in 2024.

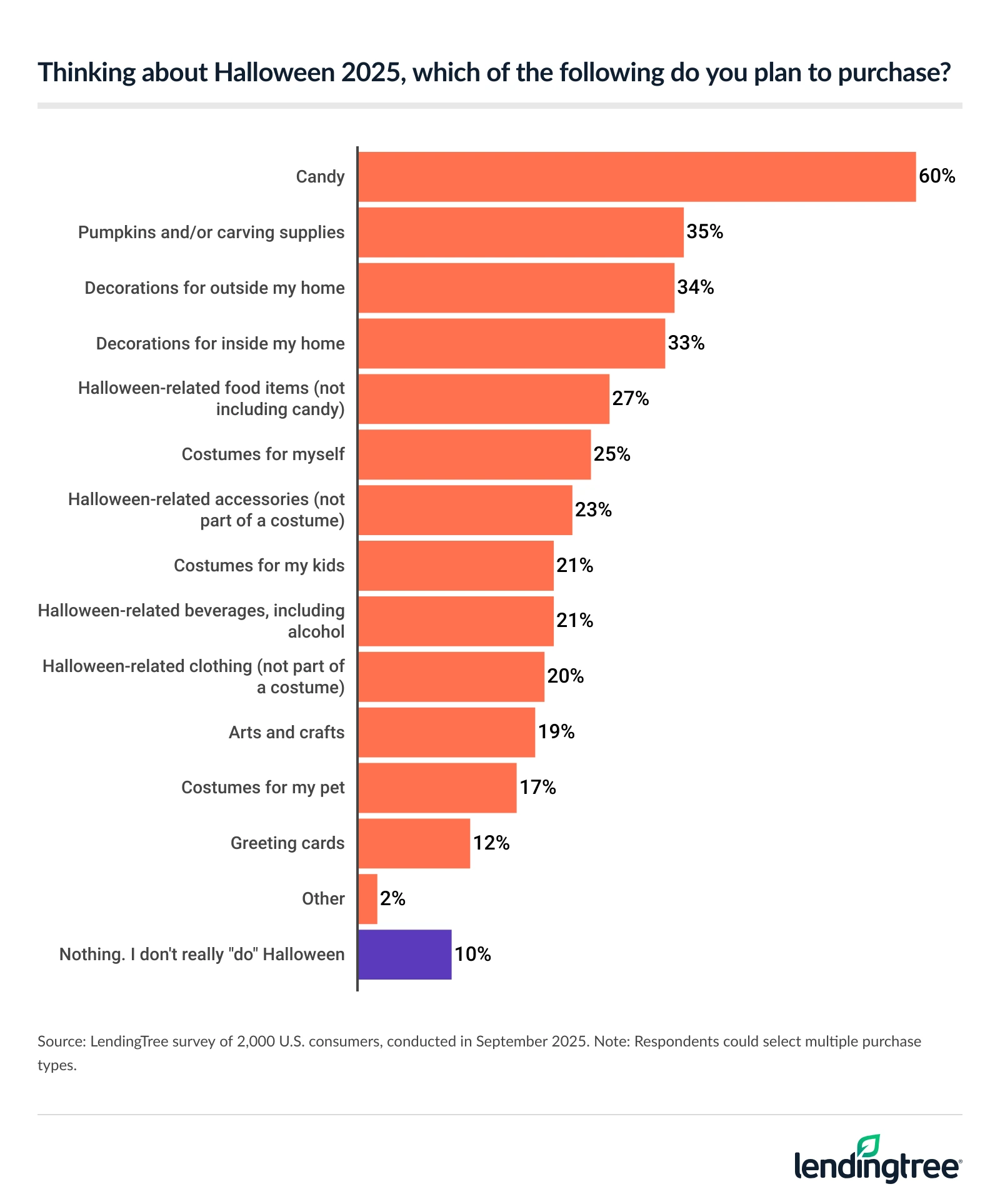

- Halloween is creeping closer, and Americans are ready to spend on scares. 9 in 10 plan to celebrate this year, spending an average of $192 — up from $172 in 2024. Candy is the top purchase at 60%, with pumpkins (35%) and outdoor decorations (34%) also high on the list of spooky shopping items.

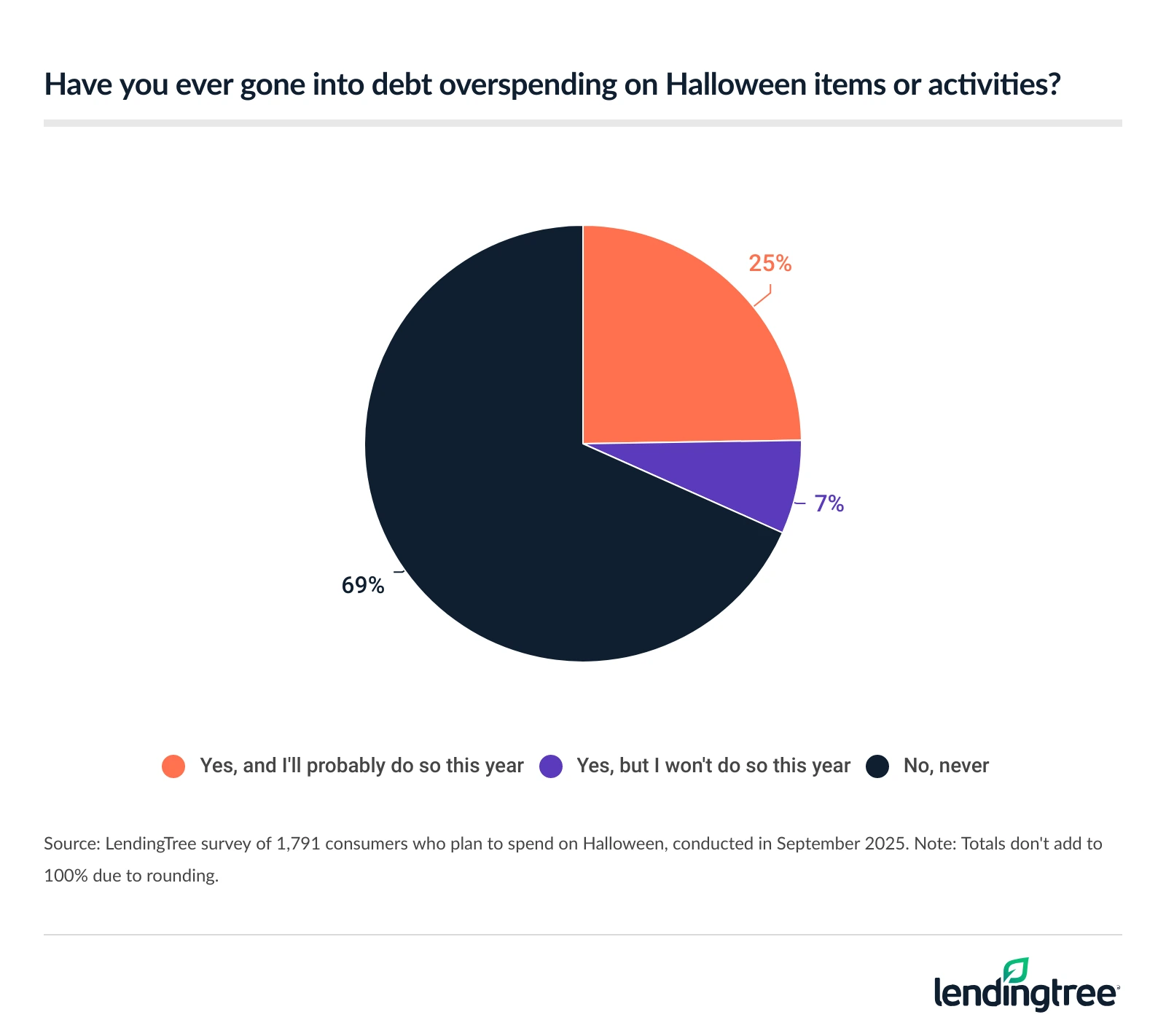

- However, the thrills can come with a chill for the wallet. 1 in 4 (25%) revelers have gone into Halloween debt before and expect to again this year, up from 17% last year. Among those who’ve overspent, 40% did so to make their kids happy and/or outdo their neighbors’ decorations. Overall, more than half (53%) of overspenders regret it.

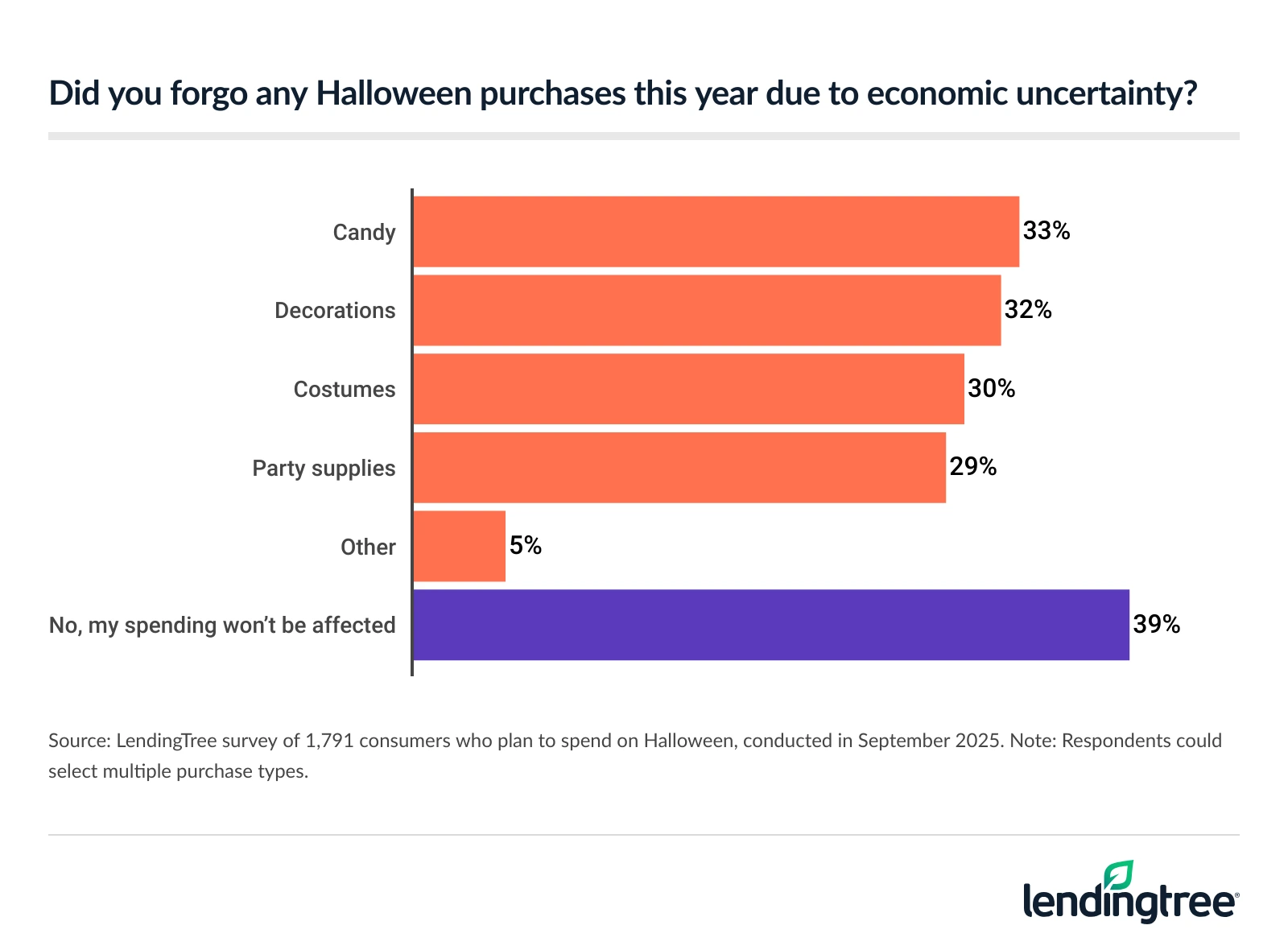

- Still, the economy is putting a spell on some spenders. More than 6 in 10 spenders say they are skipping certain Halloween purchases this year due to financial uncertainty, with candy (33%) and decorations (32%) most likely to vanish from spenders’ carts.

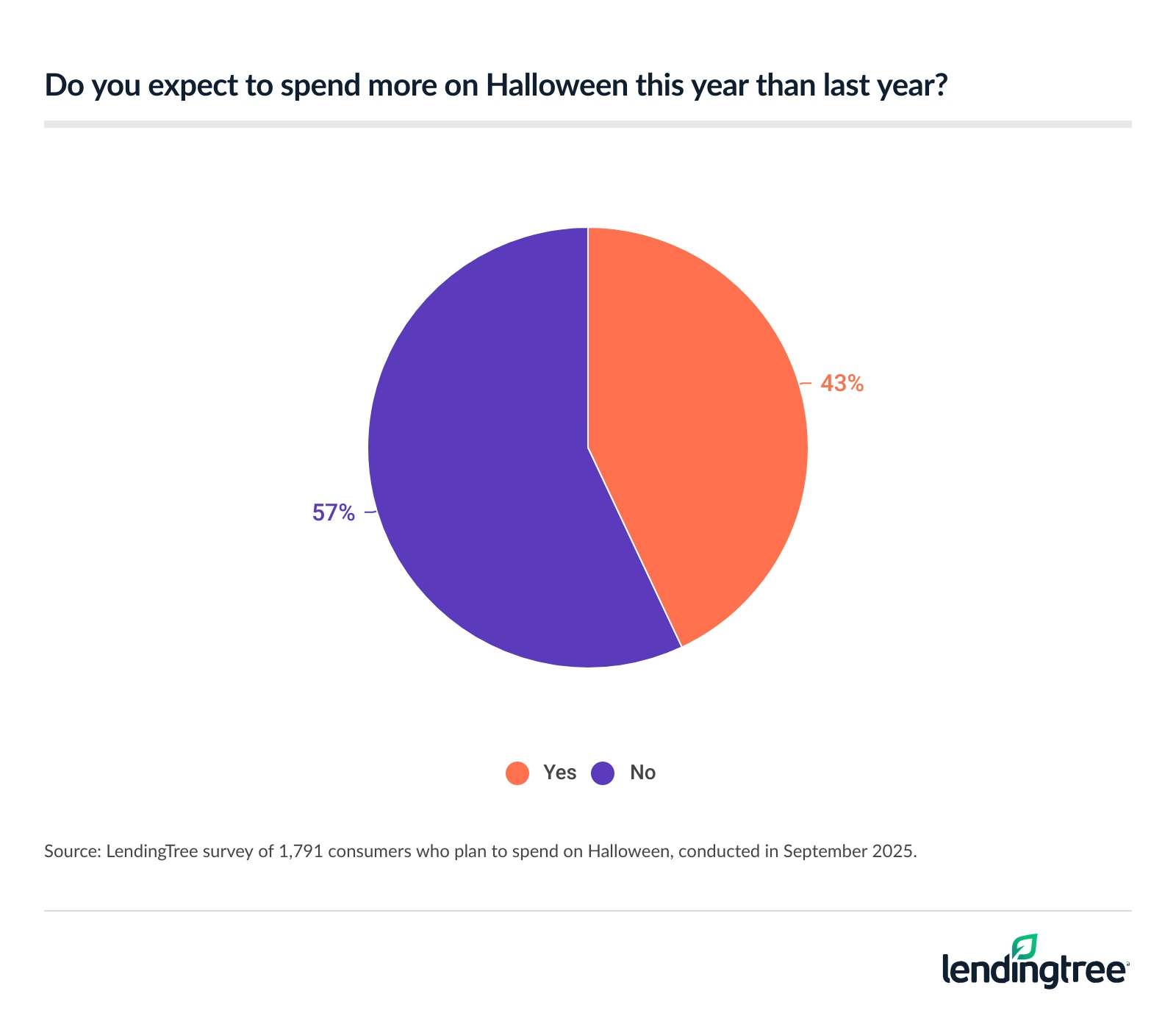

- Even as spending rises, the Halloween spirit isn’t as strong for everyone. While 43% of spenders plan to dole out more than they did last year, 21% say their interest in spending on Halloween has decreased over the past five years. Additionally, 44% think people spend too much on the holiday.

Frightfully festive: Halloween revelers plan to shell out average of $192

Spirited Halloween spending could be more nightmarish for budgets this year than last, with costs creeping higher. But that won’t stop most from celebrating.

Nine in 10 Americans plan to cough up cash for some sort of celebratory Halloween touch, with candy (60%) leading the way. The other leading items people plan to spend money on are:

- Pumpkins and/or carving supplies (35%)

- Decorations for outside their home (34%)

- Decorations for inside their home (33%)

- Halloween-related food items, not including candy (27%)

- Costumes for themselves (25%)

Halloween spenders plan to shell out an average of $192 this year, up from $172 in 2024. Men plan to spend more than double what women plan to spend — $259 versus $126. And not surprisingly, those with children younger than 18 plan to spend significantly more ($305) than those with children 18 or older ($106) or those with no children ($135).

Among generations, it’s millennials ages 29 to 44 who plan to spend the most ($265), followed by Gen Xers ages 45 to 60 ($188), Gen Zers ages 18 to 28 ($169) and baby boomers ages 61 to 79 ($91).

- 2024: Halloween Spending Report

- 2023: 48% of celebrators planning spooky splurges

- 2022: Parents of young kids expect to shell out more than $300, on average

- 2021: Parents, Gen Zers most likely to overspend

- 2020: Nearly 3 in 4 parents to spend more to help make up for lousy year

- 2019: Nearly half of millennials admit making purchases for social media posts

How are revelers planning to spend the haunting holiday? Buying holiday treats is the most frequently planned activity (44%). A close second is watching a scary movie (43%), with 63% of celebrators saying they may subscribe to a new streaming service to watch Halloween movies and shows, up from 52% last year.

Other top planned celebratory activities include:

- Decorating their home (39%)

- Baking or cooking Halloween-themed foods/treats (29%)

- Going to a Halloween-related activity like a pumpkin patch, hayride or haunted house (28%)

- Dressing up in a costume (25%)

- Going to a Halloween party (24%)

- Going trick-or-treating (23%)

- Making Halloween crafts (20%)

- Sharing Halloween content like photos or videos on social media (20%)

Of those who plan to dress up themselves, a child or a pet for Halloween, 48% will make some of those costumes to save money. That percentage is higher for parents of young kids (55%).

Part of the reason for higher holiday spending is that the prices for the Halloween items we love are growing, according to Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” If you want to have the same party you had a year or two ago, you’ll likely have to spend more.

“There are more and more options for Halloween fun, and some can be really pricey,” Schulz says. “However, some of our increased Halloween spending is simply that the holiday can be so much fun. People make so many sacrifices throughout the year because of the economy and myriad other reasons, and every so often they want to let loose, get a little wild and have fun with their friends and family. Halloween allows for that like few other occasions.”

Halloween celebrators splurge on candy for kids

Candy consumes a big portion of the Halloween tab for many, but what kind can trick-or-treaters expect to land in their bags?

Chocolate bars top the list, with 64% of Halloween spenders saying they’ll hand them out to trick-or-treaters. Coming in second is gummies/chew candies (46%), followed by lollipops (39%) and hard candies (39%).

A few (5%) plan to pass out something other than candy, while 14% of Halloween spenders risk getting tricked because they don’t plan to participate in trick-or-treating. Of the demographics analyzed, those who make less than $30,000 are most likely to say they won’t offer treats (21%), followed by baby boomers (20%).

How much are people willing to spend on these sugary treats? Those who plan to pass out candy to trick-or-treaters say they’re willing to shell out an average of $70 for it. Some are more likely to splurge than others:

- Men are willing to spend an average of $83, while women say they’d spend $55.

- Millennials are willing to spend $83, followed by Gen Xers at $69, Gen Zers at $62 and baby boomers at $50.

- Those with children younger than 18 are willing to spend $90, while those with no children say they’d spend $57. Those with children 18 or older are willing to spend $51.

- Not surprisingly, those with bigger bank accounts are willing to spend the most. Those who earn $100,000 or more are willing to spend $96, while those who earn less than $30,000 say they’d spend $47.

25% expect frightfully high bills

The threat of debt won’t stop the fun for the 31% of Halloween spenders who report going into debt by overspending on Halloween-related items or activities. This includes 25% who say they’ll probably do so again this year.

In 2024, a lower percentage said they’d gone into debt overspending for Halloween (28%).

What causes people to overspend on Halloween? For most, it’s wanting to make their kids happy (40%) and wanting their decorations to look as good as their neighbors and/or pressure from the neighborhood to decorate (40%).

Other reasons Halloween overspenders give for their excessive ways:

- Hosted a party and wanted to impress their guests (32%)

- Influenced by social media or advertisements (30%)

- Wanted to look good on social media (29%)

- Didn’t want to miss out on what their friends or family were doing (28%)

Does buyer’s remorse haunt these Halloween overspenders? Most (53%) say they regret going overboard.

Schulz says budgets are tight these days, so overspending can be a big deal and lead to this kind of regret. That doesn’t mean you can’t celebrate without digging your financial grave.

If you like to go all out on Halloween, he suggests creating a Halloween savings fund, even budgeting for it. That way, you can have a good time without taking on unnecessary debt.

“What you shouldn’t do is bury your head in the sand,” Schulz says. “If you’re passionate about Halloween, that’s awesome. Plan and budget for that spending. That’s what you should do with anything that you love and spend a significant amount of money on.”

If you’re passionate about Halloween, that’s awesome. Plan and budget for that spending. That’s what you should do with anything that you love and spend a significant amount of money on.

Economy is biggest scare for some

The current economy is striking fear in the carts of some Halloween spenders, with more than 6 in 10 spenders saying they’ve skipped certain purchases due to financial uncertainty.

Candy (33%), decorations (32%) and costumes (30%) top the list of things Halloween spenders say they would normally buy but won’t this year due to economic uncertainty.

Schulz says these slashes are a sign of the current economic times.

“Cutting back on things like candy and decorations is further proof that many Americans are struggling financially,” he says. “Tough times require sacrifice, and that means dialing back the fun of Halloween for a lot of people.”

Many revelers plan to spend more than last year

Though financial fear may be in the air, 43% of Halloween spenders say they plan to spend more money on the holiday than last year.

About two-thirds of Halloween spenders plan to make some splurges for the holiday this year, with 20% planning to overspend on Halloween decorations, 19% buying special food/treats and 18% set on buying full-size candy bars (and the adoration of every kid who comes to their door).

Is hype for the Halloween holiday waning? To some degree, as 21% say their interest in spending money on Halloween has decreased over the past five years. Still, that leaves 35% who say their interest has increased and 44% who say their interest hasn’t changed.

Overall, do people spend too much money on the holiday? Less than half (44%) of spenders think it’s excessive, but Schulz isn’t too worried about it in most cases.

“Honestly, some people need to lighten up a bit,” he says. “There’s no question that some folks go a little overboard on Halloween, but that’s their choice. If Halloween’s their thing, don’t yuck their yum. Of course, if someone is struggling and they go so far overboard on Halloween that they incur significant debt, you should consider speaking up. However, if someone takes on a little bit of debt to throw a Halloween bash to take the edge off a challenging year, who are we to say that’s wrong?”

How to avoid letting your spending come back to haunt you

Don’t want to be haunted by your Halloween spending? Here are five ways to help avoid budget nightmares:

- Shop around. It’s the most basic personal finance advice, but it’s powerful and effective. Taking the time to comparison shop for most anything Halloween-related can lead to real savings.

- A 0% credit card can be your friend. We tend to discuss 0% APR credit cards more often when it comes to balance transfers, but many cards also offer 0% deals on new purchases. You’ll likely need good credit to get one of these cards, but the savings can be significant if you can.

- Remember that not everything needs to be new. There are almost certainly plenty of things from last year’s big Halloween bash that you can use again. Whether those are costumes, decorations, leftover napkins and paper plates or anything else, using what you have at home instead of buying new can dramatically reduce the cost of the holiday.

- Consider a costume swap. Your kid’s must-have costume last year may be someone else’s perfect get-up this year. Check with friends, neighbors and local social media groups to see who might be up for trading costumes.

- Get creative. There are tons of online inspirations for DIY decorations, costumes and more. You can save a lot of money making these items yourself, especially when you’re able to use items and materials you already have lying around your house.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Sept. 2 to 4, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79