71% of Rewards Credit Cardholders Sitting on Unused Cash Back, Points or Miles

Nearly 3 in 4 credit cardholders have unused cash back, points or miles rewards, including many who are sitting on $100 or more in cash back.

It’s no secret that credit card rewards are immensely popular and can be a pathway to loads of free (or almost free) perks. However, these rewards also tend to lose value over time, which is why rewards experts tend to recommend using them sooner rather than later.

Unfortunately, our survey found that most cardholders are sitting on a pile of unused rewards, and many have had rewards expire before they could be redeemed.

Here’s more of what we found.

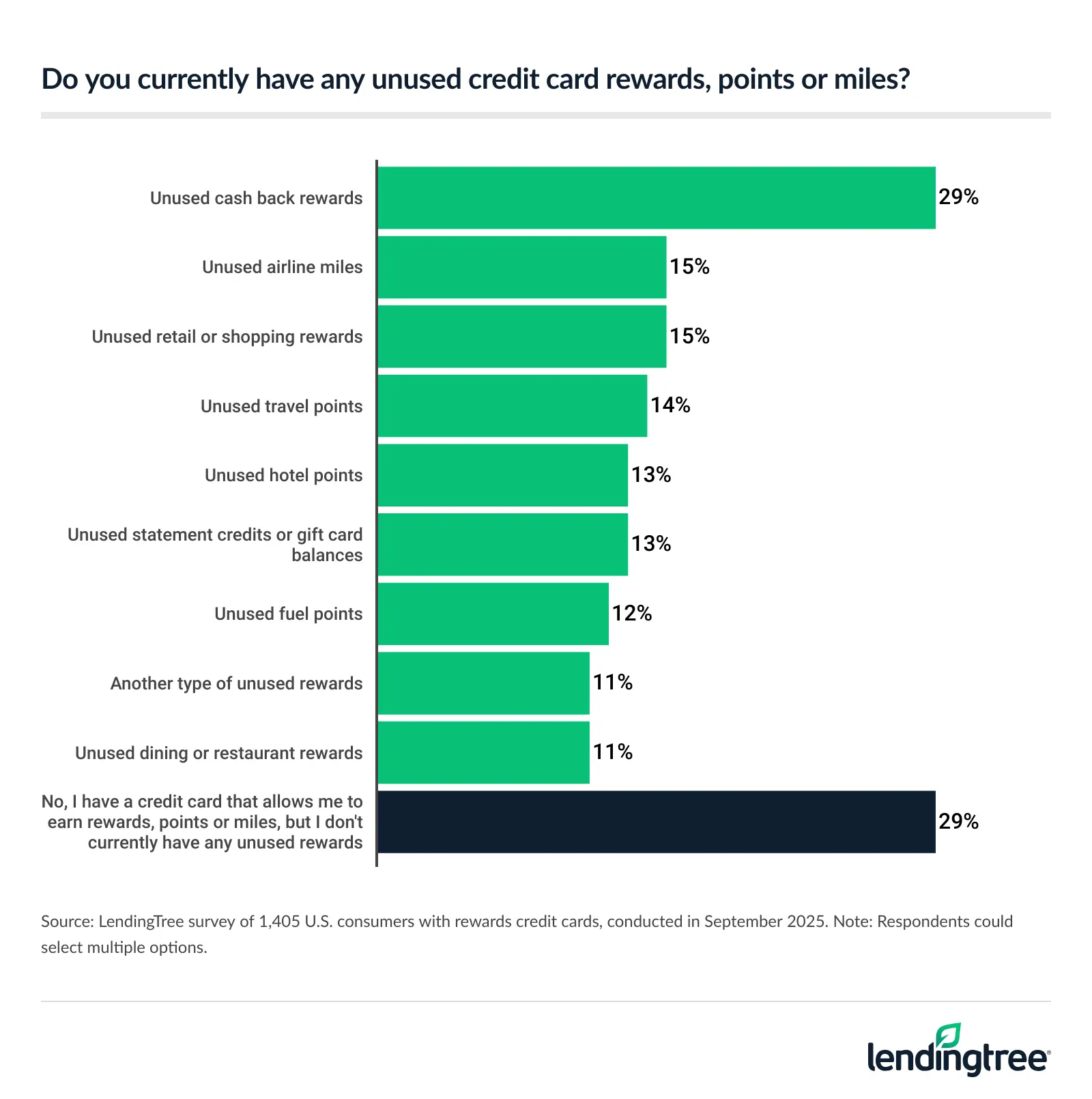

- Rewards cards can turn everyday spending into valuable perks, but the majority of cardholders aren’t cashing in. 71% of rewards cardholders are sitting on unused cash back, points or miles. Cash back is most commonly left on the table (29%), followed by airline miles (15%) and retail rewards (15%). Nearly half (49%) of those with unused cash back have stashed $100 or more.

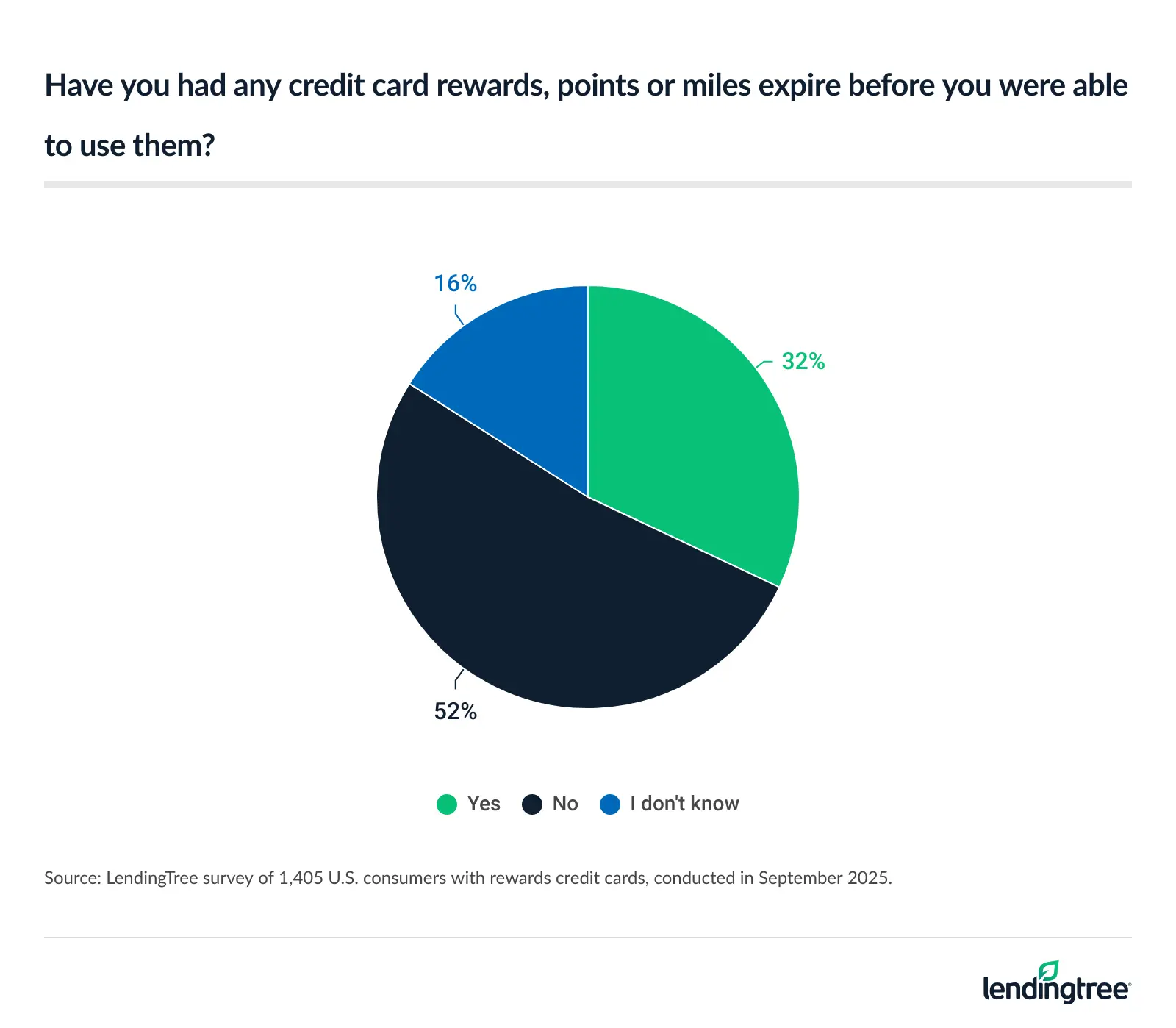

- Some have forgotten to use them before they lose them. Almost a third (32%) of rewards cardholders have had rewards, points or miles expire before they were redeemed. Among those sitting on rewards, the top reasons are saving until they reach a certain threshold (45%), waiting for a trip (21%) and uncertainty on how to use them (18%).

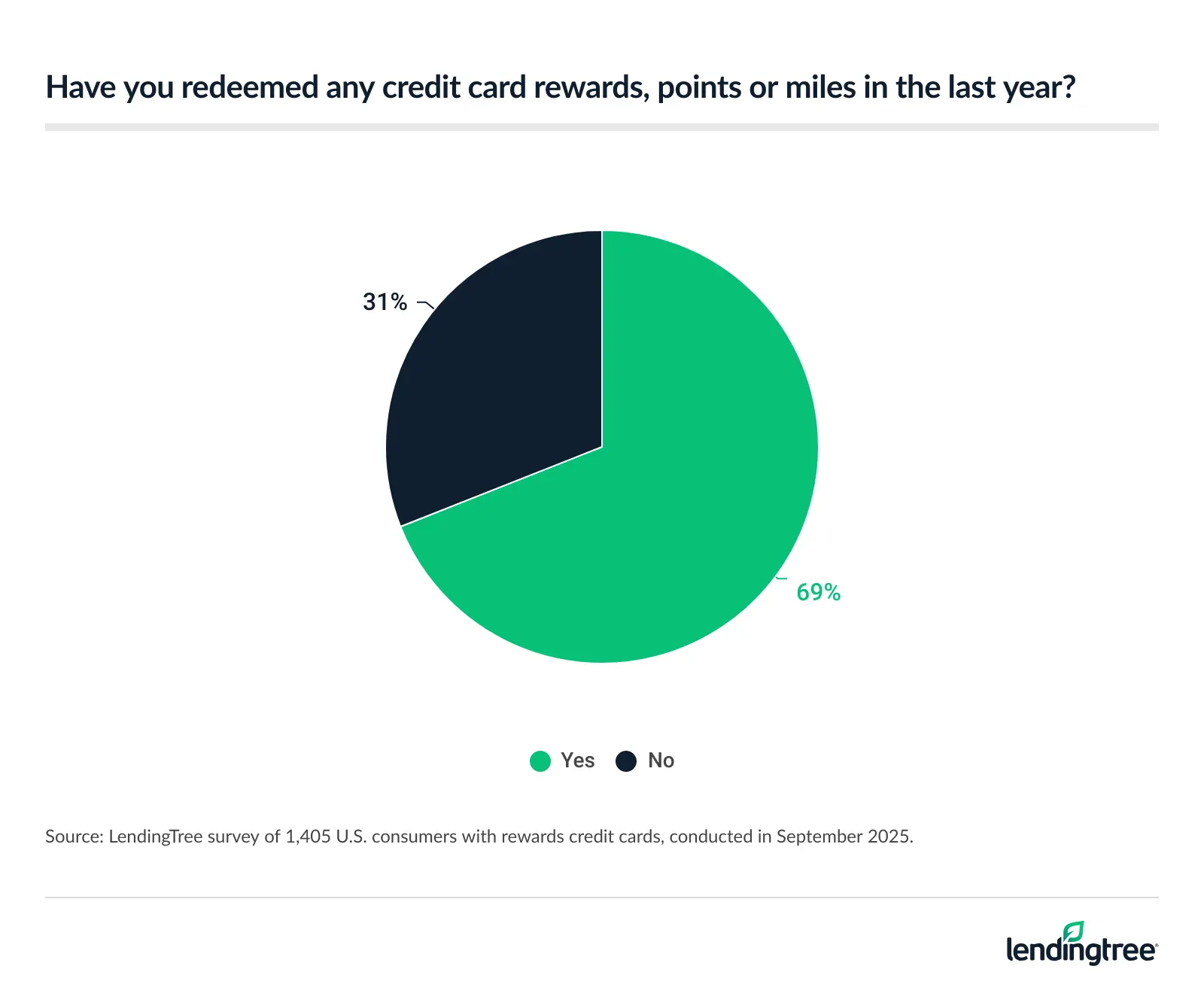

- Whether redeemed right away or saved for later, cash back remains the most popular choice. 31% haven’t redeemed any rewards in the past year, down from 40% in 2022. Among those who’ve redeemed in the past year, more than half (53%) chose cash back, while nearly a third (32%) opted for merchandise or gift cards.

- Some may have redeemers’ remorse. Nearly one-third (32%) of rewards cardholders have regretted redeeming rewards, including 44% of Gen Zers and millennials. The biggest reasons? Redeeming too soon and missing a better deal (35%) or opting for cash or gift cards when another option may have been more valuable (33%).

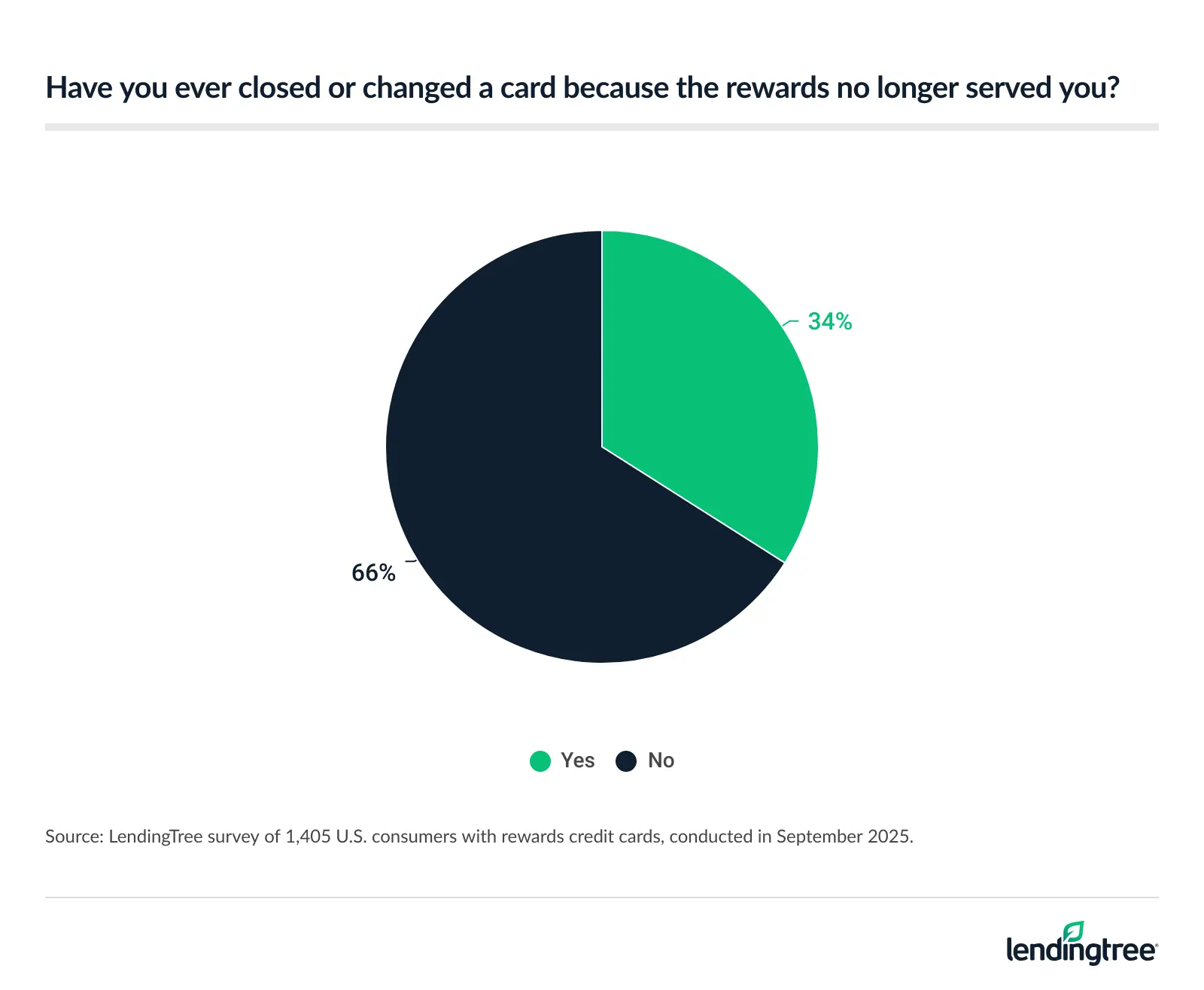

- Cardholders are happy to dump cards if the rewards no longer serve them. While 52% of rewards cardholders shopped around before applying, 48% went in with a specific card already in mind and didn’t consider others. Yet more than a third (34%) have closed or replaced a card after finding the perks no longer worthwhile.

Rewards cards can turn everyday spending into valuable perks, but majority not cashing in

More than 7 in 10 rewards cardholders (71%) have unused points, miles or cash back. Among men with rewards cards, 78% report having unused rewards, compared with 62% of women. Millennials ages 29 to 44 are the most likely age group to have unused rewards (78%), while higher-income rewards cardholders are more likely to have them than their lower-income counterparts.

Cash back is, by far, the reward most likely to go unused, at 29%. However, significant rates of rewards cardholders have unused airline miles (15%), retail rewards (15%), travel points (14%) or hotel points (13%).

Almost half (49%) of those with unused cash back have $100 or more, including 16% who have $200 or more. Men are more likely than women (55% versus 40%) to report having $100 or more in unused cash back.

Some have forgotten to use them before losing them

Rewards can be a “use it or lose it” proposition, and our survey shows that many Americans have found out the hard way.

About a third (32%) of those with rewards cards say they’ve had rewards, points or miles expire before they redeemed them.

Men are nearly twice as likely as women to say so (41% versus 21%). Millennials are the most likely age group to say so, while higher-income rewards cardholders are more likely than those with lower incomes.

Why haven’t some cardholders redeemed their rewards? The most common reason is that they’re saving them until they reach a certain amount (45%). Meanwhile, 21% didn’t have any trips planned to use them on, and 18% weren’t sure what to spend them on because there are so many options. Also, 11% haven’t redeemed rewards because it isn’t worth the hassle.

Whether redeemed right away or saved for later, cash back remains most popular choice

While unused rewards are common, a larger percentage of rewards cardholders are redeeming them. Our survey found that 69% of rewards cardholders have redeemed points, miles or other rewards in the past year, up from 60% in 2022, the last time we did this report.

Parents of young kids (78%), men (74%) and millennials (71%) are among the most likely to redeem rewards in the past year. Just 63% of women with rewards cards redeemed rewards in the last year.

More than half (53%) of those who redeemed rewards in the past year did it to get cash back, by far the most common answer. Nearly a third (32%) redeemed rewards for merchandise or gift cards, while 22% used fuel points to fill up their gas tanks.

Some may have redeemers’ remorse

Regrets? Rewards cardholders have had a few.

Almost a third (32%) of rewards cardholders who’ve redeemed rewards have regretted doing so at some point. That includes half of parents of young kids, 44% of Gen Zers ages 18 to 28 and millennials, and 40% of men.

The two biggest reasons for regret are about value. Our survey showed that 35% regretted redeeming too soon because they felt they missed a better deal or promotion, while 33% regretted redeeming for cash or gift cards when they could’ve used them for travel or something else.

Interestingly, 30% regretted redeeming their rewards because they liked having a large stockpile. A third of men said this, compared with 22% of women.

Cardholders happy to dump cards if rewards no longer serve them

The right rewards card is the one that best fits your goals and rewards you the most for your purchases. However, that changes through life.

For example, when you were younger, your biggest spending categories might have been travel, dining and entertainment, but that may no longer be the case if you’re a parent. The sooner you turn your focus to a card that better fits your needs, the more rewards you’ll bring in.

Still, we’re creatures of habit and can be quite brand loyal, so dumping a credit card can be hard. The good news is that more than a third (34%) of rewards cardholders have closed or replaced a card after realizing that its perks weren’t worth it anymore.

Millennials (43%) and Gen Zers (41%) with rewards cards are the most likely age groups to close a card that’s no longer a fit. Men are far more likely than women to do the same (40% versus 26%).

Best way to avoid unused rewards? Pick right card

“Shop around” is perhaps the most clichéd personal finance advice there is, but it’s among the best. It applies in numerous situations and can have a significant impact without requiring a substantial amount of effort.

About half of rewards cardholders didn’t do that the last time they applied for a card. Our survey found that nearly half (48%) had a specific card in mind the last time they applied for a card and didn’t look at other options.

While that can work out, if you don’t shop around when searching for a new rewards card, you may leave rewards on the table. Sure, that big sign-up bonus might be appealing, but the card may not be the best fit for you in the long run if it doesn’t match your spending habits. If you never fly anywhere, what good is a truckload of airline miles? A gas rewards card might be a better choice.

Here are a few questions to ask yourself the next time you’re considering a new rewards card:

- What do I spend my money on the most? The best rewards credit card for you is the one that best aligns with your goals and provides the most value for your everyday purchases. Take the time to review your bank and credit card statements to gain a better understanding of your spending habits. Once you know where most of your money goes, you can better choose a card to take advantage of that spending.

- What are my goals with this card? Do you want to travel? Do you want to save on gas? Do you want to extend your budget a bit? A card is only valuable to you if it helps you reach your goals, so having a handle on what you’re trying to accomplish with the card is a key step toward finding the right card for you.

- How hard do I want to work for my rewards? One of the dirty little secrets of credit cards is that maximizing your rewards can take an awful lot of work. Influencers may make it look easy and offer big promises, but there’s a lot of effort that goes into smartly managing those rewards. If you’re unwilling to put in the work, that’s fine. A “set it and forget it” cash-back card that offers you the same percentage of cash back on every purchase can be amazing, too.

- Which matters more: Flexibility or brand? This is big. If you tend to be loyal to an airline, hotel chain, gas station or other business, one of their cards can be extremely rewarding. They can give perks that other general-purpose cards never would. However, if you don’t spend with those brands often, those points and miles may go unused and be worthless to you. Compare that with a travel credit card that earns general reward points from a bank that can be used in myriad ways. Since you have more ways to redeem those points, they’re ultimately going to be more likely to get used.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Sept. 12 to 15, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79