Best Debt Consolidation Loans in February 2026

We’ve named Upgrade the best debt consolidation loan company overall — it has multiple ways to save and you only need a 580 credit score to qualify

- According to LendingTree data, borrowers with excellent credit received an average debt consolidation loan APR of 11.12% in the fourth quarter of 2025 (based on loans over $5,000 with terms 24 months or longer). This also includes loans specifically for credit card refinancing.

- Debt consolidation rolls multiple debt payments into one single monthly bill.

- With a debt consolidation loan, your interest rate is fixed. As long as you pay your payments as scheduled, your interest won’t grow over time.

- You can save money by consolidating if you qualify for a lower rate on your loan.

What is debt consolidation?

Debt consolidation lets you combine multiple debts into a single personal loan. This can simplify your budget, reduce stress and potentially save you money if you qualify for a better rate.

- After consolidating your debt, you will only have one bill to pay instead of several separate ones. This can help you stay organized and avoid missing due dates.

- If you’ve improved your credit score since taking the original debt, you might qualify for a lower rate on a consolidation loan.

- A lower debt payment could help you catch up on other things, like building an emergency fund or contributing more toward your retirement.

Debt consolidation is typically the top reason LendingTree users seek personal loans, often accounting for more than half of requests, including borrowers looking to refinance credit card debt.

Debt consolidation rates by credit score

Using real LendingTree marketplace data, we’ve compiled average debt consolidation rates. Find your credit band and see what you could qualify for.

| Credit score range | Average APR |

|---|---|

| 800-850 (excellent) | 11.12% |

| 740-799 (very good) | 13.37% |

| 670-739 (good) | 21.52% |

| 580-669 (fair) | 29.70% |

| 300-579 (poor) | 32.31% |

What kind of debt can you consolidate?

You can consolidate unsecured debt, which is debt that doesn’t require collateral.

Credit card debt

Use a debt consolidation loan to stop credit card interest in its tracks.

Typically, credit card interest compounds daily. Every day, your credit card company calculates how much interest you owe on your current balance, and then adds it to what you owe. That means you’re paying interest on your interest.

Debt consolidation loans also come with interest, but it only applies to what you borrowed (your principal). Paying off your loan early generally saves interest and, as long as you stick to your payment schedule, your interest won’t grow.

Medical bills

You can also consolidate medical bills with a debt consolidation loan. Before you do, call the phone number on your bill and see if they have any financing options. Many medical billing companies offer medical loans with low- or no-interest for a certain period of time.

Also, ask for an itemized bill and review it for duplicate charges and other mistakes. Medical billing errors are more common than you might think.

Student loans

If you want to consolidate student loans, you’ll want to look for student loan refinancing. This isn’t the same as a debt consolidation loan. Most debt consolidation loan lenders don’t let you use funds for educational purposes. On the plus side, student loan refinancing tends to come with cheaper rates than debt consolidation loans.

If you have federal student loans, it’s best to keep them federal and consolidate them with a Direct Consolidation Loan. When you refinance a federal student loan with a public refinancing company, you lose borrower benefits like income-driven repayment plans.

Business debt

You’ll need a specific business debt consolidation loan to consolidate business debt. Most personal loan lenders (the kind on this list) don’t let you use their funding for business purposes. However, you may qualify for a business debt refinancing through the Small Business Administration (SBA).

Learn more about how to get an SBA loan.

Debt consolidation pros and cons

Debt consolidation can be a great way to simplify your finances, but it’s not without its downsides. After consolidating, slow down or stop using your credit cards so you don’t end up deeper in debt. Here are a few more pros and cons to keep in mind.

PROS

- You can save money on interest when you qualify for lower rates

- Combining several payments into one can make budgeting a lot less stressful

- Can help you get out of debt sooner and know exactly when you’ll be debt-free

- Might boost your credit score

CONS

- Usually need good or excellent credit to get a lower rate

- Lender may keep part of your loan as an origination fee

- Won’t fix bad habits that led to the debt

- Does not forgive debt, it reshuffles it

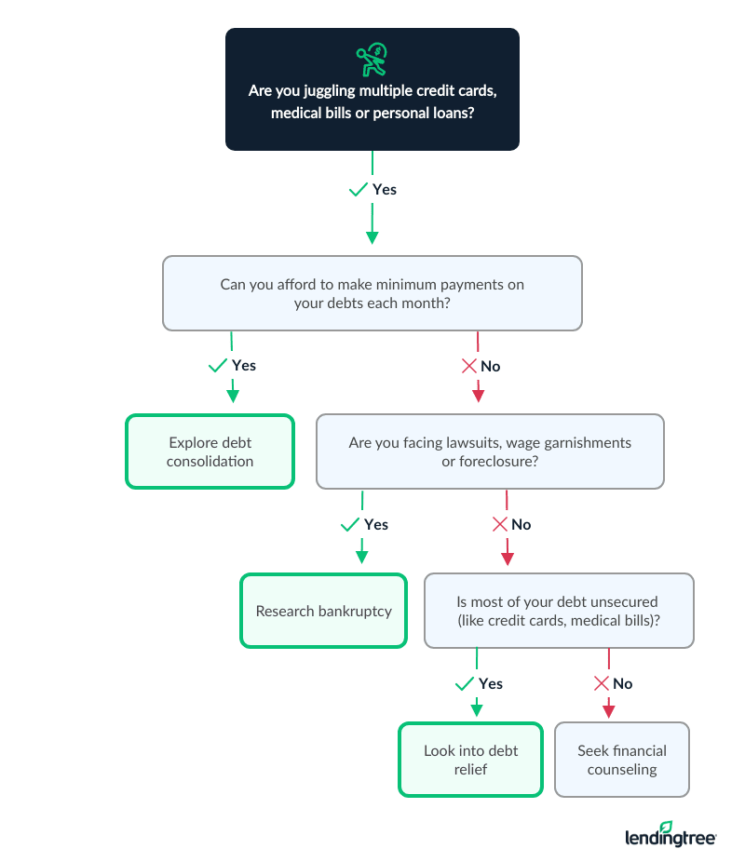

Should I get a debt consolidation loan?

It can be hard to figure out whether debt consolidation, debt relief or bankruptcy is the best solution for your unique circumstances. Using this chart can help you find the right path.

Best loan consolidation companies

Best for: Borrowers with bad credit – Upstart

- APR

- 6.50% – 35.99%

- Don’t always need credit to qualify

- 15-day grace period for late payments

- Most applicants don’t need to send in paperwork to get an instant approval decision

- Doesn’t let you apply with another person

- Only two repayment terms to choose from

- Origination fee possible

It can be hard to get a debt consolidation loan when you have bad credit. Online lending platform Upstart partners with lenders that may accept bad credit or no credit.

Upstart uses an AI algorithm to review your application. This helps it consider factors outside of credit score (like education and employment) to approve borrowers other lenders may deny.

Still, between possible fees and a high maximum APR, getting a bad credit debt consolidation loan won’t come cheap. You also can’t get a lower rate by adding a second person to your loan (also called a joint loan).

Upstart has transparent eligibility requirements, including:

- Age: Be 18 or older

- Administrative: Have a U.S. address, personal banking account, email address and Social Security number

- Income: Have a valid source of income, including a job, job offer or another regular income source

- Credit-related factors: No bankruptcies within the last three years, reasonable number of recent inquiries on your credit report and no current delinquencies

- Credit score: None

Best for: Borrowers with excellent credit – Best Egg

- APR

- 6.99% – 35.99%

- Loans available in as little as 24 hours

- Can change your due date

- Can set up your loan payments to be deducted bi-weekly

- All loans have an origination fee

- Must have a high income and excellent credit to get best rates

You don’t have to have stellar credit to get a Best Egg loan. Still, you’ll only qualify for its best rates if you make at least $100,000 a year and have a credit score of at least 700. If you tick those boxes, you could get a debt consolidation loan with an APR as low as 6.99%.

Unlike some lenders, Best Egg charges an origination fee on all of its borrowers, not just those with troubled credit.

You must meet the requirements below to qualify for a Best Egg loan:

- Citizenship: Be a U.S. citizen or permanent resident living in the U.S.

- Administrative: Have a personal checking account, email address and physical address

- Residency: Not live in the District of Columbia, Iowa, Vermont, West Virginia or U.S. territories

- Credit score: 580+

Best for: Beating competitors’ rates – LightStream

- APR (with autopay)

- 7.24% – 24.89%

Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% points higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $25,000 loan at 6.49% APR with a term of 3 years would result in 36 monthly payments of $766.11. © 2024 Truist Financial Corporation. Truist, LightStream and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank.

- No fees

- Could beat competitors’ rates through its Rate Beat Program, but many stipulations apply

- If you sign your documents by 2:30 p.m. EST on a business day, you might get your loan the same day that you apply

- Won’t know if you qualify unless you take a hard credit hit

- Must borrow at least $5,000

- Must have good-to-excellent credit

A debt consolidation loan might save you money on interest, but fees can add up. Luckily, LightStream is a zero-fee company. Also, if another lender offers you a lower APR, LightStream might beat it by .10 percentage points through its Rate Beat Program.

On the downside, LightStream doesn’t disclose its minimum credit score requirements and it doesn’t offer prequalification. You have to take a hard credit hit to check rates and eligibility, which could drop your score by a few points.

LightStream doesn’t specify its exact credit score requirements, but you must have good to excellent credit to qualify. Most of the applicants that LightStream approves have the following in common:

- At least five years of on-time payments under a variety of accounts (credit cards, auto loans, etc.)

- Stable income and can handle paying their current debt obligations

Best for: Credit card consolidation – Happy Money

- APR

- 7.95% – 29.99%

- Clear eligibility requirements

- Works with credit unions, which typically have lower APRs

- All loans have an origination fee

- Can’t apply with another person

Happy Money loans can only be used for credit card consolidation. This lending platform works with credit unions to fund some of its loans. The upside to this is that, by law, the highest APR a federal credit union can charge is 18.00%. You’ll see that reflected in Happy Money’s low maximum APR of 29.99%.

Happy Money provides clear eligibility requirements as to how you can qualify for a loan:

- Age: Must be 18 years or older

- Administrative: Must have a valid Social Security number and checking account

- Residency: Not live in Iowa, Massachusetts or Nevada

- Credit score: 640+

- Payment history: Zero current delinquencies on your credit profile

Best for: Debt consolidation loans overall – Upgrade

- APR (with discounts)

- 7.74% – 35.99%

- Can use your car as collateral to get a better rate or bigger loan

- Can get a rate discount if you also open up an Upgrade-branded checking account

- Accepts credit scores as low as 580

- APR discount for using loan to pay off debt

- All loans have an origination fee

- Might find lower rates with another lender if you have excellent credit

- Won’t qualify if you have bad credit

Upgrade stands out as our pick for best debt consolidation loans for a few reasons. For one, it accepts credit scores as low as 580, so you don’t need perfect credit to qualify. Plus, you will get a rate discount if you use your Upgrade loan to pay off debt.

You also have the option of getting a secured loan by offering your car as collateral. Offering collateral can help you get a lower rate or a bigger loan. It can be risky, though, since Upgrade can repossess your car if you fall too far behind.

Upgrade’s long loan terms can be especially handy on a debt consolidation loan. Choosing a loan with a longer term can lower your monthly payments. In trade, you will pay more interest over time. Still, the extra interest might be worth it if it makes your debt easier to manage.

Consolidating debt can also be a great time to revamp your finances as a whole. If you’re looking for a new bank, Upgrade can help with that, too.

It offers FDIC- and NCUA-insured checking accounts through Cross River Bank and other participating institutions. As long as you get at least $1,000 in direct deposits a month, you could earn benefits like rate discounts on loans and up to 2% cash back when you use your debit card.

To qualify for a loan through Upgrade, you must meet the requirements below:

- Age: Be at least 18 years old (19 in some states)

- Citizenship: Be a U.S. citizen, permanent resident or live in the U.S. with a valid visa

- Administrative: Have a valid bank account and email address

- Credit score: 580+

Best for: Easy borrowing experience – Discover

- APR

- 7.99% – 24.99%

- Can manage your loan with Discover’s mobile app

- Discover will pay your creditors directly

- Customer service available seven days a week

- Won’t qualify if you have bad credit

- Doesn’t let you apply with another person

Instead of using your debt consolidation loan to pay your creditors one by one, Discover can pay them for you. You can also forget about application fees, origination fees, late fees or prepayment penalties with this lender.

In addition to having a mobile app to manage your loan, Discover accepts loan payments online, over the phone, by mail, via wire transfer or through electronic bill pay. If you run into trouble, loan specialists are available by phone every day of the week.

You’ll need to meet these eligibility criteria to get a Discover loan:

- Age: Be at least 18

- Citizenship: Have a Social Security number

- Administrative: Have a physical address, email address and internet access

- Income: Minimum income of $40,000 (individually or as a household)

- Credit score: 720+

Best for: Less interest with a short repayment term – PenFed Credit Union

- APR (with autopay)

- 6.74% – 17.99%

- Can save on overall interest with a 12-month repayment term

- Will get access to member discounts on things like car insurance, home insurance and tax software

- Rates are capped at 17.99%

- Must join credit union to borrow

- No customer service on Sundays

If you’re ready to knock out your debt in as little time as possible, check out PenFed. It offers a 12-month repayment term, which is much shorter than most lenders. The quicker you pay off your loan, the less time interest has to accrue. And in general, debt consolidation loans with shorter terms tend to have lower rates.

Since it’s a credit union, you’ll have to become a PenFed member to borrow. However, PenFed makes this easy. You can apply for your loan and for membership in one fell swoop.

Membership is open to everyone. You can also check your eligibility before joining, with no impact to your credit score.

To qualify for a PenFed loan, you must meet the following requirements:

- Membership requirements: PenFed membership (anyone can join)

- Administrative: Open up PenFed savings account with $5 deposit; may need to submit documents to verify your identity and income

Best for: Interest rate discounts – Achieve

- APR

- 8.99% – 29.99%

- Three ways to earn APR discounts

- Assigned a dedicated loan consultant for assistance

- Will send your loan directly to your creditors

- Loans are not offered in all 50 states

- All loans have an origination fee

- Need to have at least $5,000 of debt to consolidate

Achieve offers three interest rate discounts, including one designed specifically for debt consolidation loans. If you let Achieve use at least 85% of your loan to pay your creditors directly, you could get a discount. You can also get a discount if you take out a joint loan and by having a sufficiently-funded retirement account.

However, if you only have a small amount of debt to consolidate, Achieve might not work — its loans start at $5,000.

Other than a credit score of at least 640, Achieve will typically ask you to provide the following documents and information:

- Proof of income

- Social Security number

- Government-issued ID

- Employment status

Best for: Free financial planning – SoFi

- APR (with discounts)

- 7.74% – 35.49%

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. To qualify, a borrower must be a U.S. citizen or other eligible status, be residing in the U.S., and meet SoFi’s underwriting requirements. Not all borrowers receive the lowest rate. Lowest rates reserved for the most creditworthy borrowers. If approved, your actual rate will be within the range of rates at the time of application and will depend on a variety of factors, including term of loan, evaluation of your creditworthiness, income, and other factors. If SoFi is unable to offer you a loan but matches you for a loan with a participating bank, then your rate may be outside the range of rates listed above. Rates and Terms are subject to change at any time without notice. SoFi Personal Loans can be used for any lawful personal, family, or household purposes and may not be used for post-secondary education expenses. Minimum loan amount is $5,000. The average of SoFi Personal Loans funded in 2024 was around $33K. Information current as of 02/04/26. SoFi Personal Loans originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org). See SoFi.com/legal for state-specific license details. See SoFi.com/eligibility for details and state restrictions. Fixed rates from 7.74% APR to 35.49% APR. APR reflect the 0.25% autopay interest rate discount and a 0.25% SoFi Plus interest rate discount. SoFi Platform personal loans are made either by SoFi Bank, N.A. or, Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender. SoFi may receive compensation if you take out a loan originated by Cross River Bank. These rate ranges are current as of 02/04/26 and are subject to change without notice. Not all rates and amounts available in all states. See SoFi Personal Loan eligibility details at https://www.sofi.com/eligibility-criteria/#eligibility- personal. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including evaluation of your credit worthiness, income, and other factors. Loan amounts range from $5,000 $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 9.99% of your loan amount for Cross River Bank originated loans which will be deducted from any loan proceeds you receive and for SoFi Bank originated loans have an origination fee of 0%-7%, will be deducted from any loan proceeds you receive. Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi. SoFi Plus Discount: SoFi Plus members are eligible for an interest rate reduction of 0.25% on a Personal Loan. To be eligible for the discount, you must meet the SoFi Plus eligibility criteria within 31 days of the funding of your loan. For complete SoFi Plus eligibility, please see the SoFi Plus terms. When you enroll in SoFi Plus, the discount will lower the interest rate that applies to your loan only during periods in which you are enrolled in SoFi Plus. The discount will be removed during periods in which Sofi determines you are not enrolled in SoFi Plus. Each time your loan is re-amortized, your monthly payment amount will change based upon the interest rate that was in place. SoFi reserves the right to change or terminate this offer for unenrolled participants at any time. You are not required to enroll in SoFi Plus to be eligible for Loan approval.

- Free consultation with a professional financial planner

- No late payment fees

- Can apply with another person

- 0.25% APR discount if SoFi pays your debt directly

- Must borrow at least $5,000

- Lowest rates require an optional origination fee

Debt consolidation can make it easier to pay off what you owe, but it shouldn’t be the only tool in your kit. SoFi offers no-cost financial planning to its borrowers. Here, a professional can help you with your budget, debt strategies, investments and more. Best of all — no upselling, just advice.

SoFi is also unique in that its origination fee is optional. If you pay it, you could qualify for a lower rate. Be sure to ask for offers that include and don’t include this fee to see which option makes the most sense for you.

You must meet the requirements below in order to get a loan from SoFi:

- Age: Be the age of majority in your state (typically 18)

- Citizenship: Be a U.S. citizen, an eligible permanent resident or a non-permanent resident (a DACA recipient or asylum-seeker, for instance)

- Employment: Have a job or job offer with a start date within 90 days, or have regular income from another source

- Credit score: 600+

Best for: Borrowers with fair credit – Prosper

- APR

- 8.99% – 35.99%

- Don’t need perfect credit to qualify

- Free monthly FICO credit score

- Can add a second person to your loan to boost your approval odds

- Can take up to 14 days to get your loan (although one to three days is average)

- All loans have an origination fee

- Does not pay your creditors directly

Prosper, a peer-to-peer lender, connects borrowers with investors. Peer-to-peer is often easier to qualify for compared to banks and some online loans.

Prosper’s free FICO scores could also motivate you to improve your credit.

According to a LendingTree study, improving your credit from fair to very good could save you almost $2,000 in interest.

However, it can take up to 14 days for an investor to pick up your loan. It’s also possible that all available investors pass on your application, even if Prosper has approved you. In that case, Prosper will cancel your loan request.

To get a loan with Prosper, you must meet the following requirements:

- Age: Be 18 or older

- Administrative: Have a U.S. bank account and Social Security number

- Residency: Must live in an eligible U.S. state (Prosper operates in most states, with only a small number of states excluded)

- Credit score: 560+

Why use LendingTree?

$2.8B in funding

In 2024 alone, LendingTree helped find over $2.8 billion in funding for people seeking personal loans.

$1,659 in savings

LendingTree users save $1,659 on average just by shopping and comparing rates.

308,000 loans

In 2024, LendingTree helped find funding for over 308,000 personal loans.

Estimate how much you can save with your debt consolidation loan rate

Expert insights on debt consolidation loans in 2026

What’s one thing you wish more people knew before applying for a debt consolidation loan?

I wish people knew how profound the savings can be when debt consolidation is done right. Depending on how big your balance is, consolidation can save hundreds or even thousands of dollars over the life of that loan. That’s a big deal.

Schulz goes on to say that debt consolidation loans can be one of the most powerful weapons in the battle of debt, but that it’s still important to read the fine print and check for fees.

Is now a good time to consolidate debt?

If you have pretty good credit and multiple high-interest debts, it may be a good time to consolidate. Credit cards have variable rates that fluctuate with the market.

A consolidation loan locks you into an APR that won’t change.

Push also emphasizes the importance of shopping around and comparing loans. Otherwise, she says you could be leaving money on the table.

Alternatives to debt consolidation loans

A debt consolidation loan might not be the right fit for you, and that’s OK. You do have other options.

Balance transfer credit card with 0% APR

How it works: A 0% APR balance transfer credit card consolidates credit card debt with an introductory no-interest period.

PROS

- No interest as long as you pay off your balance transfer card during the introductory period (which could last as long as 24 months)

- Non-introductory APR may still be lower than your current cards

CONS

- Variable APR that goes up and down based on the economy

- Only works for credit card debt

- Usually requires good-to-excellent credit

- May pay a 3% to 5% balance transfer fee to move the debt from your existing cards to the balance transfer card

Home equity loan

How it works: Tap into your home’s equity to pay off debt by using your home as collateral.

PROS

- Fixed interest rates, in most cases

- Payments are the same each month

- Typically lower rates than a loan that doesn’t require collateral

- May be able to consolidate a lot of debt, depending on your equity, credit score and property value

CONS

- Must be a homeowner with equity

- Can lose your home if you don’t pay

- May go underwater, which means you owe more on your home than it’s worth

- May require closing costs (2% to 5% of your loan amount)

401(k) loan

How it works: A 401(k) loan involves borrowing money from your retirement savings plan.

PROS

- No credit check

- You pay the interest back to yourself instead of losing it to a lender

- Won’t hurt your credit if you can’t pay back your 401(k) loan

CONS

- No investment growth on what you borrow until you pay it back

- May need to repay in a lump sum if you leave your job

- Taxable as income if you can’t repay

- 10% penalty if you don’t repay (unless you’re 59.5 years old or older)

Debt management plan

How it works: With the help of a certified credit counselor, create a debt management plan to repay your debt within five years.

PROS

- Free or low cost

- Credit counselor may be able to negotiate to bring down fees and interest rates

- Can consolidate many types of debt

- Promotes healthy financial habits

CONS

- Can only be used for debts that don’t require collateral

- Will probably have to stop using or close your credit cards

- Can’t open up new credit while working through the plan (which can take five years)

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best debt consolidation loans

We reviewed more than 40 lenders and loan marketplaces that offer personal loans to determine the overall best nine debt consolidation loans. To make our list, lenders must offer debt consolidation loans with competitive APRs.

From there, we assessed each lender or marketplace across four categories: eligibility and access; cost to borrow; loan terms and options; repayment support and tools.

According to our standardized rating system, the best debt consolidation loans come from Upstart, Best Egg, LightStream, Happy Money, Upgrade, Discover, PenFed Credit Union, Achieve, SoFi and Prosper.

Our categories

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Why trust our methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

Frequently asked questions

According to LendingTree data, borrowers with excellent credit received an average debt consolidation loan APR of 11.12% in the fourth quarter of 2025 (based on loans over $5,000 with terms 24 months or longer). Rates can climb as high as 35.99% (or higher) if you have bad credit.

A debt consolidation loan is a type of personal loan that combines multiple debts into one single monthly payment. You can consolidate credit card debt, medical bills, personal loans and some private student loans.

Consolidating debt can make your payments easier to manage. You could also save money on interest if you qualify for a lower rate than what you’re paying now.

You can get a debt consolidation loan with bad credit. Upstart accepts scores as low as , and eligible college students/grads might not need a credit score at all.

You might not qualify for a better rate by consolidating if you have bad credit, but consolidating can still lower your monthly payment if you stretch out your debt with a longer repayment term. The extra interest this will generate might be worth it depending on your situation.

Some debt consolidation loans have fees, the most common being an origination fee. Origination fees are usually a percentage of the loan amount you’ve been approved for.

When a lender charges an origination fee, it usually takes it out of the loan itself before sending you the money. You might have to borrow more than you thought to make up for this fee.

For instance, if you borrowed $50,000 with a 2% origination fee, you’d actually get $49,000 (2% of $50,000 is $1,000).

When comparing debt consolidation lenders, consider:

- Eligibility requirements: Check if you meet the lender’s minimum credit score and other requirements. Many will let you see if you’re eligible without hurting your credit score. This is called prequalification.

- Annual percentage rates (APRs): An APR shows you how much your loan will cost, including interest and fees. The higher the APR, the more expensive the loan.

- Fees: Origination fees can be common, especially among online lenders. Also know that the minimum APRs that lenders advertise don’t typically include their origination fee. If it does, it assumes the lowest fee possible.

- Loan amounts: Debt consolidation loans come as a lump sum. If you don’t request enough money, the only way to get more is to apply for another loan. Make sure the amount you apply for will cover the debt you want to consolidate.

- Funding speed: If you need your loan right away, look for same- or next-day loan lenders. Otherwise, it could take from a few business days to a couple of weeks to get your money.

- Other perks: Some lenders offer extra benefits, like SoFi’s free financial planning.

- Customer service and reputation: Check the Consumer Financial Protection Bureau’s complaint database to see what other people are saying about the lender.

You could get your debt consolidation loan the same day that you apply. LightStream and SoFi offer same-day loans, for example.

It can take longer if you have your new lender pay your creditors for you. Make sure you know how long this will take and pay all of your current debts until consolidation is complete.