Raising a ‘Fair’ Credit Score to ‘Very Good’ Could Save Borrowers Over $39,000

Money talks, and so does your credit score. According to the latest LendingTree study, raising your credit score from fair (580 to 669) to very good (740 to 799) could help you save significantly on debt payments — to the tune of over $39,000.

Researchers analyzed anonymized LendingTree user data and loan offers to measure the difference in savings between these two credit bands for credit cards, personal loans, auto loans and mortgages.

Key findings

- Raising your credit score from fair to very good could save you over $39,000. Borrowers with four common debt types — credit cards, personal loans, auto loans and mortgages — could save $39,292 over the lifetime of the balances by improving their credit from fair (580 to 669) to very good (740 to 799).

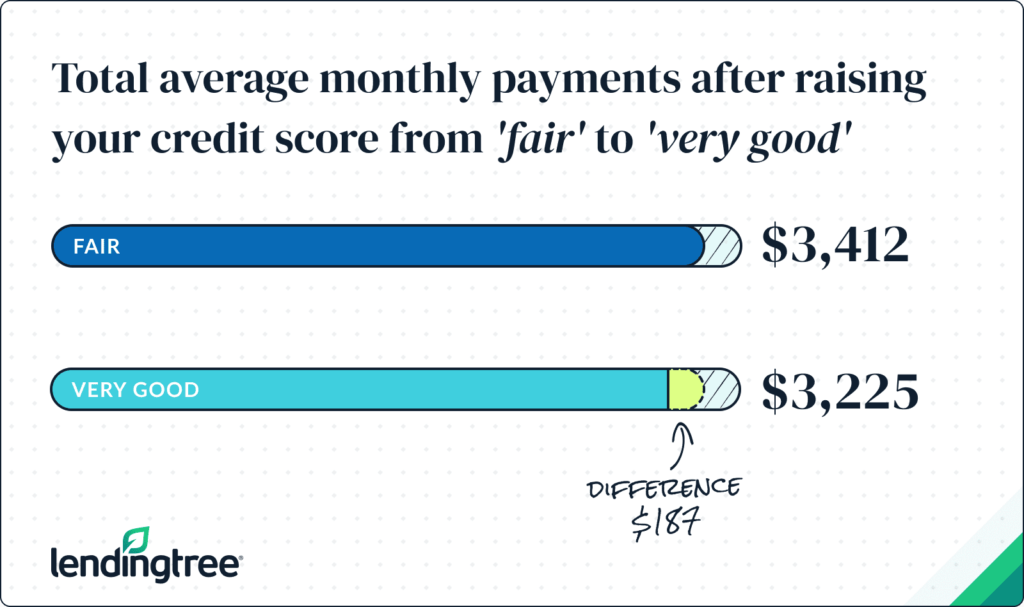

- Improving your credit score between these ranges could lower monthly debt payments by 5.5%. Total average monthly payments would be $3,412 with fair credit and $3,225 with very good credit — a difference of $187.

- Bettering your credit score has the largest impact on mortgage costs. Boosting your credit score from fair to very good could result in $31,140 in mortgage savings, accounting for 79% of the total savings.

- Finding your best offer is significant since the gap between the lowest and highest APRs offered to the same consumers can be large. If you have a very good credit score and the best offers available, you could save $40,870 compared to those with a fair credit score and the best offers. In fact, the monthly payment difference between fair and very good credit scores could be $223.

- The potential savings of $39,292 is a substantial 76.5% increase from $22,263 when we last published this study in 2024. All categories saw an increase in savings. Mortgage savings rose the most, by $14,463. That’s due to the difference in the average APR rates offered to consumers with fair and very good credit scores. The difference in average mortgage APRs was 0.22 percentage points in our 2024 report, compared with 0.40 percentage points in this report.

Raising credit score could save tens of thousands

Borrowers with four common debt types — credit cards, personal loans, auto loans and mortgages — could save $39,292 over the lifetime of their balances by improving their credit score from fair (580 to 669) to very good (740 to 799).

Breaking that down, those with fair credit would pay $3,412 a month and those with very good credit would pay $3,225. That’s a difference of $187 a month, or 5.5%.

According to LendingTree chief consumer finance analyst Matt Schulz, these savings can majorly impact people’s finances.

“That’s a significant difference,” he says. “That’s money that can go toward other debts, emergency funds, mortgage down payments, retirement savings, college funds and other big goals. Most people don’t have much of a financial cushion, but that sort of savings can change that.”

Why does boosting your credit score help? It serves as a gauge for lenders, demonstrating your likelihood of repaying borrowed money. A higher credit score increases your chances of being offered more favorable loan terms, but we’ll break down differences in APRs later.

Mortgage payment savings highest

By loan or credit type, improving your credit score makes the biggest difference in mortgage costs. Borrowers could save $31,140 in mortgage costs by increasing their score from fair to very good, accounting for 79% of the total savings.

Following that, here’s the cost difference between the two credit score bands by loan or credit type:

- Credit card: $4,032, or 10% of the total savings

- Auto loan: $2,316, or 6% of the total savings

- Personal loan: $1,804, or 5% of the total savings

Further, total debt payments could be 4.5% lower when moving from a fair credit score ($872,170) to a very good credit score ($832,878).

Money saved by raising your credit score from fair to very good

Fair credit (580 to 669)

Very good credit (740 to 799)

| Debt type | Avg. amount | Term | APR | Monthly payment | Total payments |

|---|---|---|---|---|---|

| Credit card | $7,236 | Variable | 20.79% | $71 | $18,735 |

| Personal loan | $10,529 | 3 years | 21.44% | $399 | $14,366 |

| Auto loan | $29,552 | 5 years | 10.87% | $641 | $38,437 |

| Mortgage | $320,459 | 30 years | 6.92% | $2,115 | $761,340 |

| Total | $367,776 | – | – | $3,225 | $832,878 |

Why are mortgages highest? According to Schulz, it largely boils down to interest paid.

“A home is the biggest purchase most people will ever make,” he says. “We’re talking hundreds of thousands of dollars of principal financed over decades, meaning a tremendous amount of interest. Even a fraction of a percentage point off a mortgage rate can lead to significant savings over the lifetime of that loan, but you can make an even bigger impact by improving your credit score. There’s little in life that’s more expensive than having crummy credit, and that’s certainly the case when it comes to a mortgage.”

Borrowers with fair credit scores can expect to pay 7.1% more in interest on their mortgages than those with very good credit scores. Meanwhile, borrowers with fair credit scores can expect to pay 47.0% more in interest on personal loans, 35.1% more in interest on credit card debt and 26.1% more in interest on auto loans.

Though the percentage difference is far smaller for mortgage borrowers, the dollar value difference is far larger. That’s because they’re taking out an average of $320,459 on a 30-year mortgage — more than 10 times the average balances for auto loans, personal loans and credit cards.

Difference in APRs offered can be crucial

One of the biggest reasons raising your credit score can help you save is because it unlocks better APRs — and finding your best offer is significant.

For example, those with very good credit scores could save $40,870 with the best offers available across all balances compared to those with fair credit scores and the best offers. That translates to a difference of $223 a month.

The biggest savings can again be found in mortgages, with a cost difference of $30,544. That’s 75% of the total cost difference. Following that, here’s the total cost difference by credit or loan type:

- Auto loan: $4,253, or 10% of the total savings

- Credit card: $4,032, or 10% of the total savings

- Personal loan: $2,041, or 5% of the total savings

Money saved by raising your credit score from fair to very good (with best offers)

Fair credit (580 to 669)

Very good credit (740 to 799)

| Debt type | Avg. amount | Term | APR | Monthly payment | Total payments |

|---|---|---|---|---|---|

| Credit card | $7,236 | Variable | 20.79% | $71 | $18,735 |

| Personal loan | $10,529 | 3 years | 16.14% | $371 | $13,352 |

| Auto loan | $29,552 | 5 years | 8.28% | $603 | $36,191 |

| Mortgage | $320,459 | 30 years | 6.45% | $2,015 | $725,397 |

| Total | $367,776 | – | – | $3,060 | $793,676 |

How can you find the best deals?

“Sites like LendingTree can be incredibly helpful, allowing you to easily compare offers from multiple lenders,” Schulz says. “You can also go to individual lenders’ websites, including credit unions, to see what they have to offer. There can be very real differences among lenders, so you could pay too much if you don’t shop around. It’s as simple as that.”

Potential savings up significantly from 2024 report

Going back to our main look, potentially saving $39,292 is a big deal. It looks even better considering that those savings are up 76.5% from $22,263 when we last published this study in 2024.

Savings rose across all loan and credit types, including a significant jump in auto loans. In our last report in 2024, an increased credit score saved $553. In our 2025 report, that number more than quadrupled to $2,316. Given the stubbornly high price of cars today, that’s a big deal.

Still, by dollar value, mortgage savings increased the most by far. In our 2024 report, borrowers could save $16,677 by increasing their credit score, but that rose to $31,140 in our 2025 report — a difference of $14,463.

Difference in savings by raising your credit score, 2024 report vs. 2025 report

| Debt type | Term | Amount saved, 24 report | Amount saved, 25 report | Difference ($) |

|---|---|---|---|---|

| Credit card | Variable | $3,548 | $4,032 | $484 |

| Personal loan | 3 years | $1,485 | $1,804 | $319 |

| Auto loan | 5 years | $553 | $2,316 | $1,763 |

| Mortgage | 30 years | $16,677 | $31,140 | $14,463 |

| Total savings | – | $22,263 | $39,292 | $17,029 |

A large chunk of this difference boils down to the difference in the average APRs offered to consumers with fair and very good credit scores. In our 2024 report, the difference in average mortgage APRs was just 0.22 percentage points (with fair credit borrowers offered an average APR of 7.98% and very good credit borrowers offered an average APR of 7.76%). That compares with a difference of 0.40 percentage points this time. Again, that may not sound like much, but when applied to a $300,000 mortgage, that small difference adds up.

Other types of debt also saw the gap widen in APRs offered to those with fair credit and very good credit. With auto loans, the gap was 2.58 percentage points in the 2025 report, compared with just 0.66 points the year before. With personal loans, the gap was 8.94 points this year, up from 7.88 points last time. For credit cards, the gap was largely unchanged, dipping slightly from 6.96 points last year to 6.94 this year.

Difference in APRs by debt type, 2024 report vs. 2025 report

| Debt type | Loan term | Difference in APRs, 24 report | Difference in APRs, 25 report |

|---|---|---|---|

| Credit cards | Variable | 6.96 | 6.94 |

| Personal loan | 3 years | 7.88 | 8.94 |

| Auto loan | 5 years | 0.66 | 2.58 |

| Mortgage | 30 years | 0.22 | 0.40 |

These changes reflect banks’ continued nervousness about lending to riskier borrowers. As inflation ravaged the country, banks generally made it harder for people with imperfect credit to get loans. Those on the lower end of the credit spectrum who’ve managed to get credit have often had to settle for higher interest rates and smaller loan amounts.

This isn’t anything new. Banks tend to pull back lending during times of great economic uncertainty or volatility, preferring to wait until a more predictable climate emerges. While that may make sense for banks, it makes things a lot tougher for many Americans who may need credit to help them through difficult times.

Struggling to raise your credit score? Top expert tips

Raising your credit score can seem daunting, but small steps can translate to great progress. For those looking for a credit score boost, Schulz recommends the following:

- Make sure your credit report is accurate. “One of the quickest ways to improve your credit score is to remove inaccurate information from your credit report,” he says. “Whether from fraud, simple human error or something else, more reports have inaccuracies than you’d imagine, and they can hurt your credit score. Good credit is hard enough without someone else’s mistakes holding down your score. Review your credit report and report it to the credit bureau to get it fixed if you find something that doesn’t look right.”

- Consolidate your debt. Debt consolidation can be a great tool for many reasons. “First, it can help you pay down your debt faster by lowering the amount of interest you pay,” Schulz says. “It can also help your credit in other ways, too, however. Moving your credit card debt to a personal loan, for example, can boost your credit by diversifying your credit mix and reducing your credit utilization.”

- Automate. “There’s nothing more important to your credit score than making on-time payments,” he says. “Set up automatic payments and let technology assist you in paying your bills more consistently. This won’t be a quick fix for your score, but it can lay the groundwork for steady growth over time.”

Methodology

LendingTree researchers calculated average balances and APRs for personal loans, auto loans and mortgages from offers on the LendingTree platform in the third quarter of 2024, aggregated by credit score band with a focus on fair (580 to 669) and very good (740 to 799). Researchers assumed 30-year mortgages, 60-month auto loans and 36-month personal loan terms.

The average credit card debt data was obtained by analyzing more than 410,000 anonymized LendingTree users’ data in the third quarter of 2024. Credit card payments are calculated as 1% of the balance plus interest, with a minimum payment of $25. Credit card APRs were based on a January 2025 analysis of about 220 credit cards from more than 50 issuers. For both scenarios, we used our minimum and maximum average APRs for all new credit card offers.

Get personal loan offers from up to 5 lenders in minutes