LendingTree Study: New Home Equity Loans Don’t Have a Notable Impact on Credit Scores

For the past several years, and especially since the start of the coronavirus pandemic, home prices have been steadily climbing. As a result, homeowners are now sitting on a record-high $22.7 trillion in equity — the highest amount since the data was first recorded in 1945.

Many homeowners aren’t rushing to tap their equity, however. In fact, certain types of home equity borrowing in 2020 hit their lowest level in more than 16 years.

While there are multiple reasons for this (including stricter lending guidelines and a fear of overleveraging), borrowers need not be afraid that tapping their home equity could hurt their credit scores, at least not in the long term.

That’s because — according to a new LendingTree study of more than 1,500 home equity loan requests in 40 of the nation’s largest metros — although most borrowers do see a decline in their credit score after taking out a home equity loan, the decline tends to be relatively small and their credit score usually recovers in less than a year’s time.

Key findings

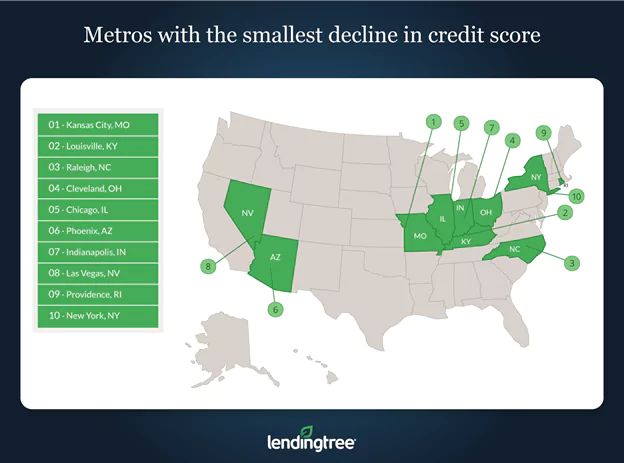

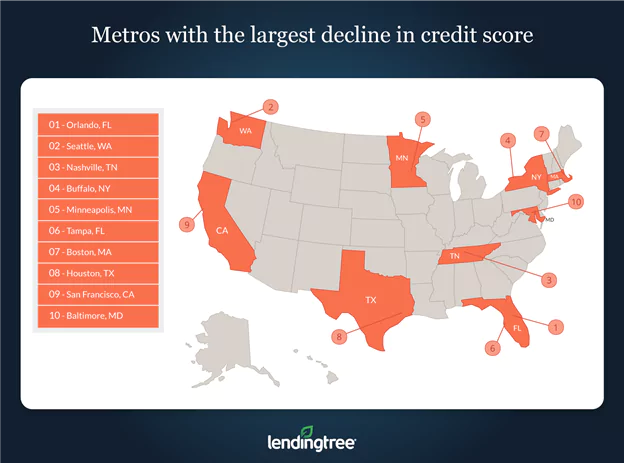

- Borrowers across all 40 of the metros analyzed in LendingTree’s study saw an average decline of 17.5 points in their credit score in the months following a home equity loan. At the high end, scores declined by about 26 points in Orlando, Fla., and on the low end they declined by just under 9 points in Kansas City, Mo.

- Across the 40 metros featured in LendingTree’s study, borrowers had an average 727 credit score before taking out a home equity loan. The highest average starting credit score was 755 in San Diego, while the lowest was 693 in Milwaukee. In general, average credit scores were high enough that a drop of 10 to 20 points wasn’t likely to have a major impact on cost or accessibility to credit.

- Credit scores took an average 104 days, or about three and a half months after closing on a home equity loan, to reach their lowest point. Kansas City homeowners saw their credit scores reach their lowest points the fastest with an average time of 63.5 days. The longest time in decline was for homeowners in Portland, Ore., at 154.5 days.

- Scores took an average of about 96 days to recover from their lowest point to their pre-loan levels. The quickest time to recover was 70.5 days in Austin, Texas. Borrowers in Memphis, Tenn., had the longest recovery time at 127.9 days.

- On average, scores tended to fully recover to their pre-loan average in under a year. The complete cycle to return the credit score to its former position before the home equity loan takes an average of about 201 days. The shortest cycle was in Kansas City at 138.6 days, and the longest in Portland — at 282.3 days.

Metros with smallest credit score decline after getting home equity loan

No. 1: Kansas City, Mo.

- Average initial credit score: 728

- Average decline in score: 8.71 points

- Total time until recovery: 138.6 days

No. 2: Louisville, Ky.

- Average initial credit score: 729

- Average decline in score: 9.90 points

- Total time until recovery: 139.8 days

No. 3: Raleigh, N.C.

- Average initial credit score: 736

- Average decline in score: 12.24 points

- Total time until recovery: 215 days

Metros with largest credit score decline after getting home equity loan

No. 1: Orlando, Fla.

- Average initial credit score: 710

- Average decline in score: 25.74 points

- Total time until recovery: 195.7 days

No. 2: Seattle

- Average initial credit score: 728

- Average decline in score: 23.39 points

- Total time until recovery: 257.7 days

No. 3: Nashville, Tenn.

- Average initial credit score: 720

- Average decline in score: 23.28 points

- Total time until recovery: 179.2 days

Why home equity loans affect credit scores

When a consumer takes out a home equity loan, that adds a large balance or credit line to their credit report. Credit scoring agencies consider the total amount of money a consumer owes, and a large increase in outstanding debt drives scores lower. The presence of a new credit line item also weighs on the score, though to a lesser extent.

As time passes, making on-time payments helps borrowers improve their credit score as they show they’re managing their new home equity loan account well. If it’s a home equity line of credit (HELOC) and the borrower doesn’t use the full credit line, their credit utilization ratio falls, which may boost their credit score. Having a home equity loan also increases the diversity of accounts in your credit file, which could also boost your score. Eventually, the score returns to its pre-loan level and, in some cases, surpasses it.

Tips for improving your credit score after borrowing from your home equity

Taking out a home equity loan will almost certainly have a negative impact on your credit score, at least in the short term. Fortunately, there are a few things you can do to help your credit rebound.

Here are a few tips for improving your credit score after you take out a home equity loan:

- Hold off on applying for new credit until your score has recovered. If you continue to apply for new forms of credit right after taking out a home equity loan, then your credit score may not only fall further, but also take longer to rebound. As a result, the fewer new credit applications you submit, the better off your score is likely to be.

- Use as little of your available credit as possible. The closer you get to maxing out your credit cards or your HELOC, the more your credit score will drop. By keeping your credit utilization low, you can generally expect your score to improve more quickly.

- Make on-time payments for all your debts (including your home equity loan). Late payments can negatively impact your credit score, so it’s best to avoid them as much as possible to help improve your score. If something comes up and you think you might miss a payment, contact your lender and ask about available options to help make your debt more manageable. If you’re overwhelmed by debt, consider looking into debt consolidation or other debt relief programs.

Methodology

To determine how taking out a home equity loan affects credit score, LendingTree analysts used data from the LendingTree online shopping platform to look at more than 1,500 consumers who lived in one of the nation’s 40 largest metropolitan statistical areas (MSAs) and took out home equity loans in 2020.

We then tracked the credit scores of these consumers through May 2021 to see how many days it took until the scores returned to their pre-loan level.

Note that in this study, we’re broadly referring to both home equity loans and home equity lines of credit (HELOCs) as home equity loans.

Senior research analyst Jacob Channel contributed to this report.

Compare Home Equity Offers