Down Payments Are Rising Faster Than Incomes — Here’s How Much Cash Buyers Need in Every State

The median planned down payment has risen sharply since 2021, according to an analysis of more than 1 million mortgage purchase inquiries on the LendingTree platform.

And it’s not just dollar amounts increasing — planned down payments now account for larger shares of both loan amounts and borrowers’ incomes.

Affordability also varies drastically by state. In fact, one of the most striking findings is that it could take potential buyers more than a decade to save enough to match the median down payment. Here’s what else our analysis reveals.

Here at LendingTree, we’re all about helping borrowers find their best rates on all types of loans, but mortgages are our bread and butter. Each year, millions of forms — which we call mortgage purchase inquiries — are filled out on our site by potential buyers looking to connect with lenders and compare rates.

These inquiries aren’t formal loan applications. Instead, they’re informational forms in which we ask key questions, including how much the borrower is seeking, when they plan to buy, how the property will be used and where it’ll be located. We also ask how much money they intend to put down. That self-reported amount forms the basis of this analysis.

One important note: The down payment figure a person provides isn’t a guarantee of what they’ll ultimately put down — it simply reflects their intent at the time of the inquiry.

Key findings

- Down payments are rising faster than incomes. The median down payment people intend to make on a mortgage purchase reached $45,000 in 2024 — up from an inflation-adjusted $37,624 in 2021. That $45,000 equals more than six months of income for the median household, almost a full month more than was needed three years prior.

- Down payments are rising not just in dollars but as a share of the loan amount. The median down payment jumped from 10% to 15% of the loan amount from 2021 to 2024. In dollars, the median down payment rose 19.6% in just three years.

- If you’re saving up for a median down payment, it could take more than a decade. With a typical household savings rate of 5% from income, the average American homebuyer would need 10.7 years to save for a median down payment in 2024, compared with 9.3 years in 2021.

- California is the least affordable state for down payments. Golden State buyers need 10.3 months of income, on average, to cover a median down payment in 2024 — the highest in the nation. Massachusetts and Washington follow at 9.7 months and 9.1 months, respectively.

- West Virginia is the most affordable. Homebuyers need 4.4 months of income, on average, to afford the median down payment — less than half the burden faced by buyers in California. Iowa follows at 4.5 months, and Missouri at 4.8 months.

Down payments rising faster than incomes

A down payment on a mortgage is a big deal for many reasons. For example, it can dramatically reduce the amount of interest you pay over the life of the loan. It can also shrink your monthly payment by ensuring that you don’t have to pay private mortgage insurance (PMI). Simply put, it matters a lot.

However, it’s a heavy lift for most Americans. That’s one of many reasons why so many feel homeownership is just a pipe dream.

Our analysis found that the median down payment on a mortgage purchase inquiry on the LendingTree platform — in other words, how much people seeking a mortgage say they intend to put down as a down payment — was $45,000 in 2024. That’s the equivalent of more than six months of income for the median American household.

In 2021, that number was $32,500, or $37,624 after adjusting for inflation. That amount equated to nearly a full month less of income for the median household.

How many months of income are needed for a down payment? (2021-24)

| Year | Median down payment (nominal) | Median down payment (2024 dollars) | Median household income (2024 dollars) | Down payment as % of income | Months of income needed |

|---|---|---|---|---|---|

| 2024 | $45,000 | $45,000 | $83,730 | 53.7% | 6.4 |

| 2023 | $42,500 | $43,754 | $82,690 | 52.9% | 6.3 |

| 2022 | $37,500 | $40,195 | $79,500 | 50.6% | 6.1 |

| 2021 | $32,500 | $37,624 | $81,270 | 46.3% | 5.6 |

Down payments rising not just in dollars but as share of loan amount

That growth from an inflation-adjusted $37,624 in 2021 to $45,000 in 2024 equates to a 19.6% jump in just three years. It’s a substantial increase in a relatively short period.

The good news is that these numbers mean that Americans intend to put a larger share of their mortgage toward the down payment. Our analysis showed that the median down payment jumped from 10% to 15% of the mortgage amount between 2021 and 2024.

Percentage of mortgage loan amount paid as a down payment (2021-24)

| Year | Median down payment | Median loan amount | Down payment (%) |

|---|---|---|---|

| 2024 | $45,000 | $292,500 | 15% |

| 2023 | $42,500 | $276,250 | 10% |

| 2022 | $37,500 | $261,250 | 10% |

| 2021 | $32,500 | $247,500 | 10% |

While that percentage growth is positive, it also underscores that most Americans still fall well short of the standard 20% down payment required to avoid PMI. For example, a 20% down payment on 2024’s median loan amount would equal $58,500 — more than $13,000 above the median down payment that year.

Saving up for median down payment may take more than decade

For all but the wealthiest Americans, $45,000 is an enormous amount of money. The idea of being able to save that much — on top of paying down credit card debt, building an emergency fund and setting aside money for long-term goals like college and retirement — is incredibly daunting. For many, it’s downright laughable.

LendingTree’s analysis underscores just how heavy a lift it can be. Consider this:

- Though the exact figure fluctuates from year to year, American households typically save about 5% of their income.

- The median household income in 2024 was $83,730.

- At a 5% savings rate, a family earning $83,730 would need more than 10 years (10.7, to be exact) to save an amount equal to today’s median down payment.

- In 2021, it would have taken 9.3 years to save the median down payment for that year — still an incredibly long time, but about a year less than in 2024.

How long it would take to save the median down payment at a 5% savings rate

| Year | Median down payment (nominal) | Median down payment (2024 dollars) | Median household income (2024 dollars) | Years needed at 5% savings rate |

|---|---|---|---|---|

| 2024 | $45,000 | $45,000 | $83,730 | 10.7 |

| 2023 | $42,500 | $43,754 | $82,690 | 10.6 |

| 2022 | $37,500 | $40,195 | $79,500 | 10.1 |

| 2021 | $32,500 | $37,624 | $81,270 | 9.3 |

Again, that decade-long savings wouldn’t even get you close to hitting that magic 20% down payment number. That would mean saving $58,500. To do that, it would take 14 years for someone making the median household income and saving 5% a year.

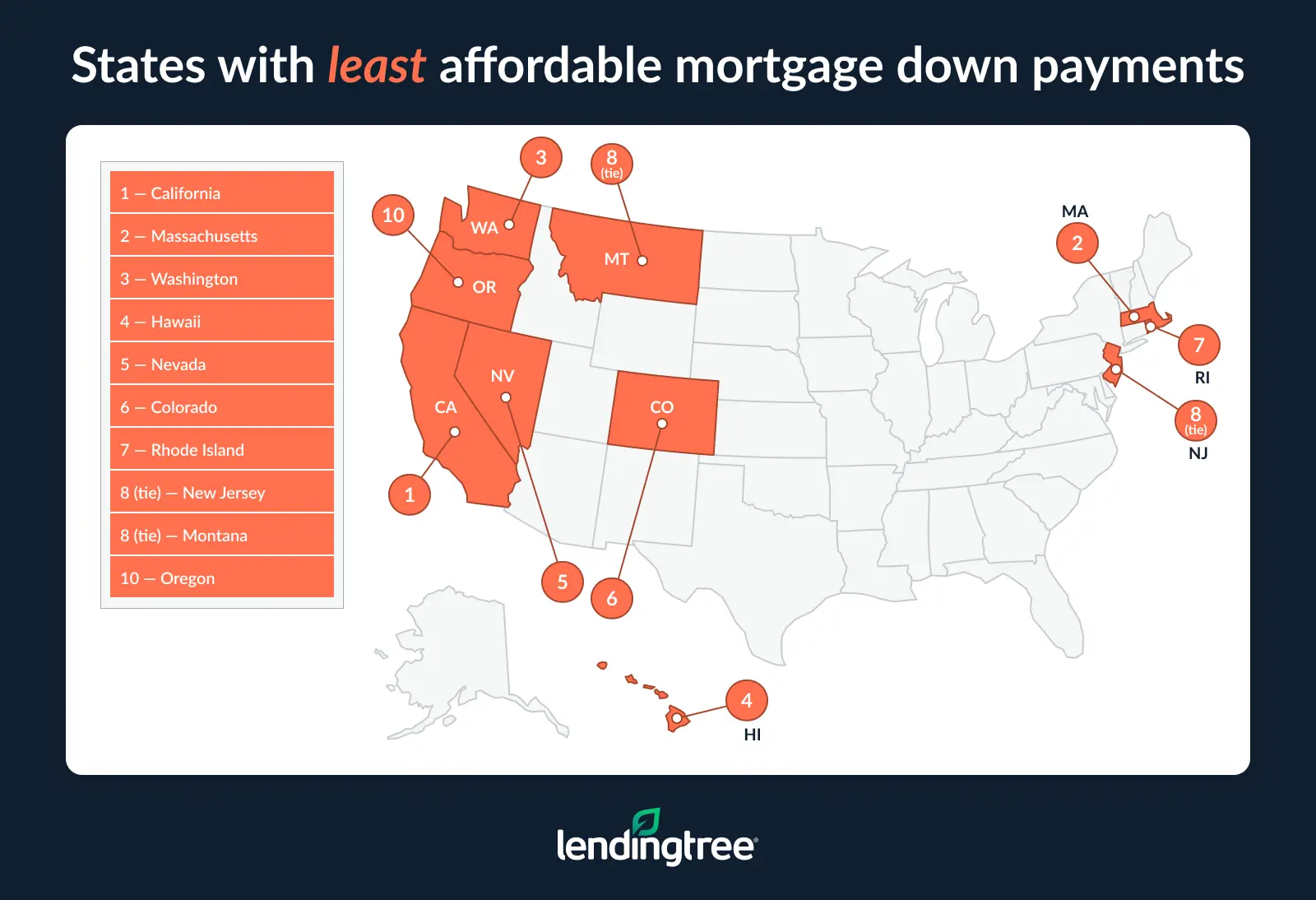

California is least affordable state for down payments

While $45,000 is certainly a lot of money for most Americans, it doesn’t come close to covering the median down payment in several states.

For example, the median down payment with mortgage inquiries from Californians was $86,250, with Massachusetts not far behind at $85,000. It shouldn’t be surprising that these two states top the list, given that they’re among the most expensive — and highest-income — in the U.S. However, despite those higher incomes, our analysis still found them to be the least affordable states for down payments.

Buyers in California would need to use 10.3 months of income to make a median down payment, while those in Massachusetts would require 9.7 months. Washington follows at 9.1 months.

Perhaps unsurprisingly, the states with the least affordable down payments are mostly coastal, with only a few inland exceptions — Nevada, Colorado and Montana.

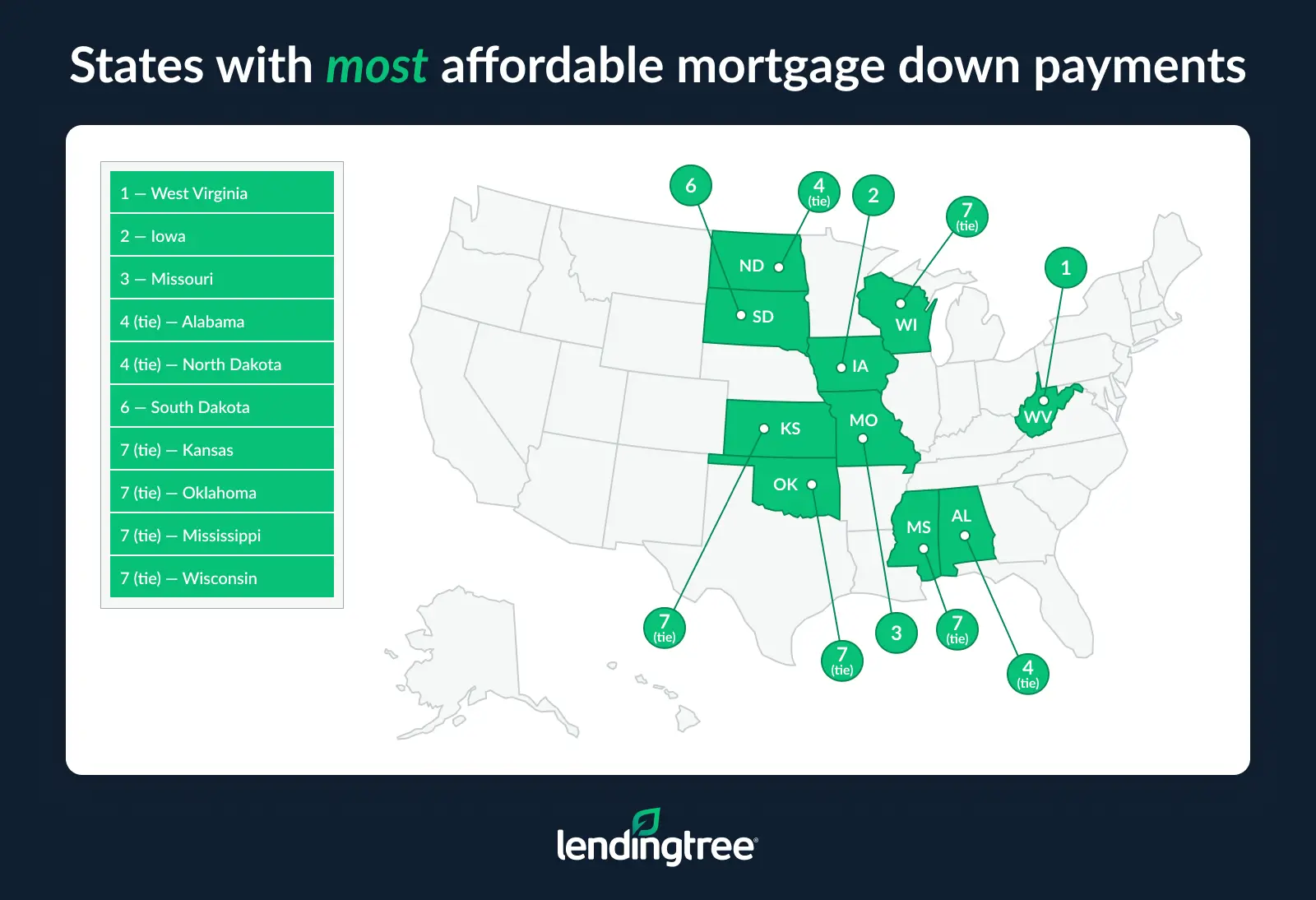

West Virginia is most affordable

On the other end of the affordability spectrum is West Virginia. Homebuyers in the Mountain State would have to use 4.4 months of income to make the median down payment — less than half the time required by buyers in California. Iowa isn’t far behind at 4.5 months, nor is Missouri at 4.8 months.

When looking at dollar values, the differences at the top and bottom of the list are perhaps even more stark. California, Massachusetts, Washington and Hawaii all have median down payments of more than $70,000. Meanwhile, median down payments in eight states — West Virginia, Iowa, Missouri, Alabama, Oklahoma, Mississippi, Kentucky and Louisiana — fall below $30,000.

Down payment affordability by state (2024)

| Rank | State | Median down payment | Median household income | Down payment as % of income | Months of income needed |

|---|---|---|---|---|---|

| 1 | California | $86,250 | $100,149 | 86.1% | 10.3 |

| 2 | Massachusetts | $85,000 | $104,828 | 81.1% | 9.7 |

| 3 | Washington | $75,000 | $99,389 | 75.5% | 9.1 |

| 4 | Hawaii | $72,500 | $100,745 | 72.0% | 8.6 |

| 5 | Nevada | $55,000 | $81,134 | 67.8% | 8.1 |

| 6 | Colorado | $65,000 | $97,113 | 66.9% | 8.0 |

| 7 | Rhode Island | $55,000 | $83,504 | 65.9% | 7.9 |

| 8 | New Jersey | $67,500 | $104,294 | 64.7% | 7.8 |

| 8 | Montana | $48,750 | $75,340 | 64.7% | 7.8 |

| 10 | Oregon | $55,000 | $85,220 | 64.5% | 7.7 |

| 11 | North Carolina | $45,000 | $73,958 | 60.8% | 7.3 |

| 11 | New Mexico | $41,250 | $67,816 | 60.8% | 7.3 |

| 13 | Arizona | $48,750 | $81,486 | 59.8% | 7.2 |

| 14 | Utah | $57,500 | $96,658 | 59.5% | 7.1 |

| 14 | Maine | $45,000 | $76,442 | 58.9% | 7.1 |

| 16 | Connecticut | $56,250 | $96,049 | 58.6% | 7.0 |

| 16 | Idaho | $47,500 | $81,166 | 58.5% | 7.0 |

| 18 | Florida | $45,000 | $77,735 | 57.9% | 6.9 |

| 19 | New York | $47,500 | $85,820 | 55.3% | 6.6 |

| 19 | New Hampshire | $55,000 | $99,782 | 55.1% | 6.6 |

| 21 | Vermont | $45,000 | $82,730 | 54.4% | 6.5 |

| 21 | Illinois | $45,000 | $83,211 | 54.1% | 6.5 |

| 23 | Pennsylvania | $41,250 | $77,545 | 53.2% | 6.4 |

| 24 | Tennessee | $37,500 | $71,997 | 52.1% | 6.3 |

| 25 | South Carolina | $37,500 | $72,350 | 51.8% | 6.2 |

| 25 | Texas | $41,250 | $79,721 | 51.7% | 6.2 |

| 25 | Georgia | $41,250 | $79,991 | 51.6% | 6.2 |

| 25 | Delaware | $45,000 | $87,534 | 51.4% | 6.2 |

| 29 | Wyoming | $37,500 | $75,532 | 49.6% | 6.0 |

| 30 | Virginia | $45,000 | $92,090 | 48.9% | 5.9 |

| 30 | Minnesota | $42,500 | $87,117 | 48.8% | 5.9 |

| 32 | Arkansas | $30,000 | $62,106 | 48.3% | 5.8 |

| 33 | Maryland | $48,750 | $102,905 | 47.4% | 5.7 |

| 34 | Alaska | $45,000 | $95,665 | 47.0% | 5.6 |

| 34 | Michigan | $33,750 | $72,389 | 46.6% | 5.6 |

| 36 | Indiana | $32,500 | $71,959 | 45.2% | 5.4 |

| 36 | Louisiana | $27,500 | $60,986 | 45.1% | 5.4 |

| 36 | Ohio | $32,500 | $72,212 | 45.0% | 5.4 |

| 39 | Nebraska | $33,750 | $76,376 | 44.2% | 5.3 |

| 39 | Kentucky | $28,500 | $64,526 | 44.2% | 5.3 |

| 41 | Wisconsin | $33,750 | $77,488 | 43.6% | 5.2 |

| 41 | Mississippi | $25,500 | $59,127 | 43.1% | 5.2 |

| 41 | Oklahoma | $28,500 | $66,148 | 43.1% | 5.2 |

| 41 | Kansas | $32,500 | $75,514 | 43.0% | 5.2 |

| 45 | South Dakota | $32,500 | $76,881 | 42.3% | 5.1 |

| 46 | North Dakota | $32,500 | $77,871 | 41.7% | 5.0 |

| 46 | Alabama | $27,500 | $66,659 | 41.3% | 5.0 |

| 48 | Missouri | $28,500 | $71,589 | 39.8% | 4.8 |

| 49 | Iowa | $28,500 | $75,501 | 37.7% | 4.5 |

| 50 | West Virginia | $22,500 | $60,798 | 37.0% | 4.4 |

Tips for managing down payments

These are some big, scary numbers, without question. It’s completely understandable why people who are wrestling with high prices at the grocery store and high interest rates might write off the idea of homeownership.

Still, owning a home can be an amazing, worthwhile goal for many reasons. If it’s something you want to pursue, here are some tips to help you tackle the challenge of working toward a down payment.

- Run the numbers to know what you can really afford. This is incredibly important. Don’t rely solely on a mortgage lender to tell you what you can afford — do the math yourself. Tools like LendingTree’s mortgage affordability calculator allow you to input interest rates, loan amounts, durations and other key factors to help you understand the real costs involved with that mortgage, including monthly payments. You can even test different down payment amounts to see how they change your costs.

- Remember, you don’t have to put 20% down. Saving up enough to put 20% down on a home seems like such an outlandish goal to some people that it stops them from even trying. That’s the wrong way to think about it. Yes, 20% would be amazing and would save you real money in the end, but it isn’t required. Some loans allow down payments as small as 3% to 3.5%. Not saving simply because you can’t hit 20% is like refusing to jog because you’ll never run a marathon. Just start and see where it takes you.

- Automate savings and maximize your return. The less effort involved in saving, the better. Automating transfers makes the money feel like it never existed, reducing temptation to spend it. Then, make sure it’s kept in the right place. A high-yield savings account is far better than a traditional megabank savings account. If you have a lump sum to set aside, a longer-term CD may also be worth considering.

- Pay off higher-interest debt to free up cash. Of course, this is easier said than done, but reducing credit card debt frees up money you can redirect toward your down payment. A 0% balance transfer card or a debt consolidation loan can help, and you can even call your credit card issuer to ask for a lower rate, which works more often than you’d expect.

- Reevaluate your budget. Budgeting is all about prioritizing. Some expenses can’t be changed, but many can be adjusted based on your goals. If saving for a down payment has become a top priority, a close look at your budget can reveal opportunities to redirect more money toward that goal.

- Be flexible. We don’t always get a blank slate when choosing where to buy, but flexibility can offer major advantages. This report shows that where you live has a huge impact on your housing costs and, therefore, the down payment you’ll need. You don’t have to switch states, though. Even different neighborhoods in the same city can vary dramatically in cost, especially if you’re willing to live a bit farther out. Home type, size and other features also matter.

Methodology

LendingTree researchers analyzed more than 1 million mortgage purchase inquiries submitted on the LendingTree platform between Aug. 31, 2021 (the earliest data available), and Dec. 31, 2024, for owner-occupied loans, including conventional, Federal Housing Administration (FHA) and Department of Veterans Affairs (VA) programs.

For each year and state, analysts calculated the median down payment. All down payment figures were then adjusted to 2024 dollars using the consumer price index for all urban consumers (CPI-U) to ensure consistent, inflation-adjusted comparisons over time.

Median household income comes from the U.S. Census Bureau, which reports income in real 2024 dollars. State-level median household income figures are sourced from the U.S. Census Bureau 2024 American Community Survey (ACS) with one-year estimates. These values were used to calculate:

- Down payment as a percentage of annual household income

- The number of months of income needed to cover a median down payment

View mortgage loan offers from up to 5 lenders in minutes