58% of Renters Have Disliked a Landlord, and One-Third Say They’ve Experienced Rent Discrimination

Renting has its pluses and minuses. While it’s nice not to have serious financial skin in the game if, say, your house’s foundation starts crumbling, it can be challenging to call someone else’s property “home.”

Case in point: Nearly 3 in 5 renters have disliked a landlord at some point, according to the latest LendingTree survey of more than 2,000 respondents.

Common causes of friction between landlords and renters include maintenance issues, poor communication and a lack of professionalism, and a not-insignificant portion of renters — 33% — say they’ve been discriminated against based on factors like race and age.

Below is an exploration of these tensions — and tips for renters trying to keep the peace.

Key findings

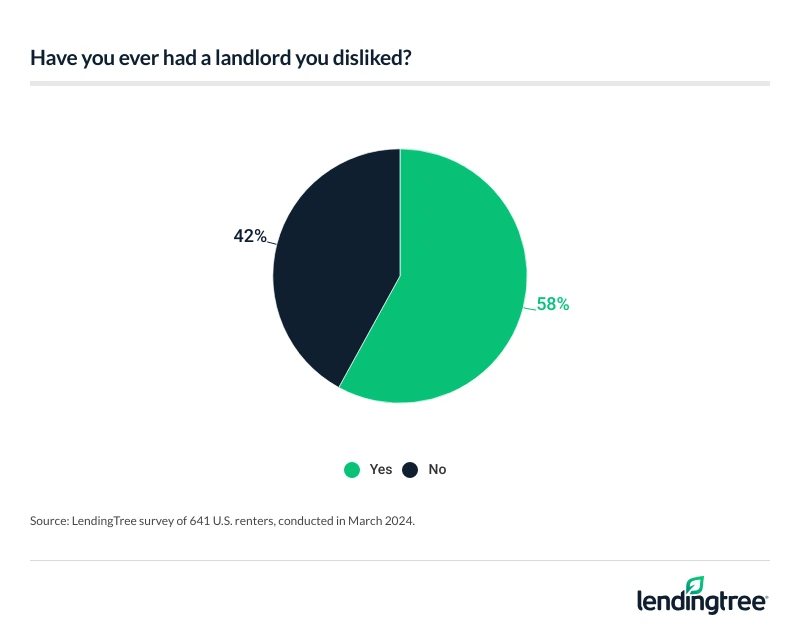

- The majority of renters have had a landlord they disliked. 58% of renters say they’ve had at least one landlord they didn’t like, with 1 in 4 (25%) disliking their current one. Among those who disliked a landlord, the bad blood was mainly due to maintenance (68%) and communication issues (53%) or a lack of respect or professionalism (42%). In fact, 31% of renters say a landlord has entered their home without permission, while 21% have had a legal dispute with theirs.

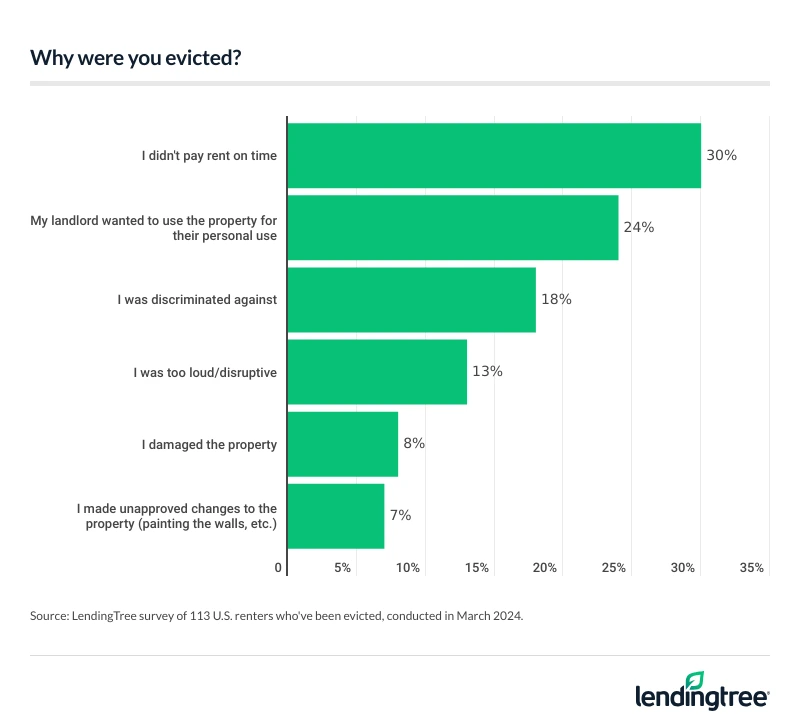

- Many renters who’ve been evicted think it was done unfairly. Of the 18% of renters evicted, 68% believe it was done unfairly. As far as why they were kicked out, 30% say it was for not paying rent on time, 24% say their landlord wanted to reclaim the property for personal use and 18% say it was due to discrimination.

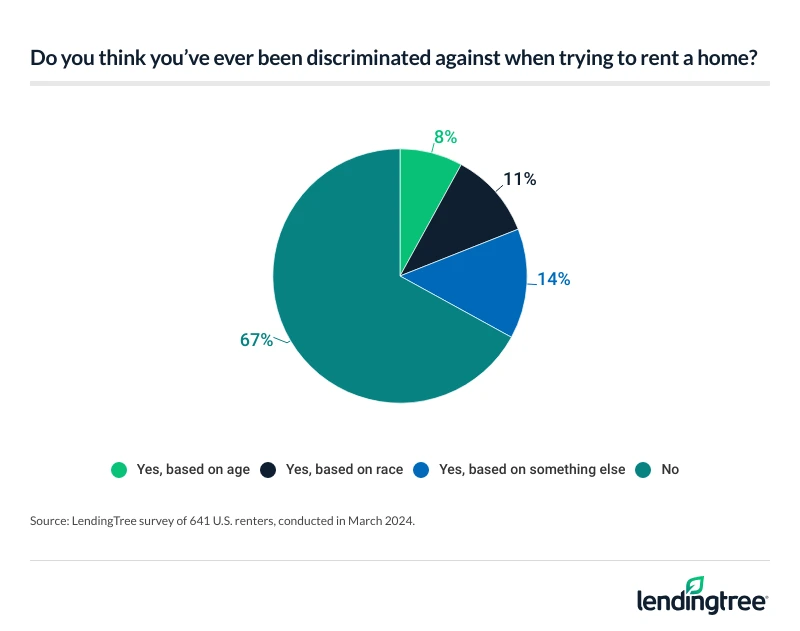

- Some have faced discrimination when applying to rent a property. A third (33%) of renters believe they’ve been discriminated against, with 11% saying it was based on race and 8% saying it was based on age. Men are more likely than women to believe they’ve been discriminated against (36% versus 30%).

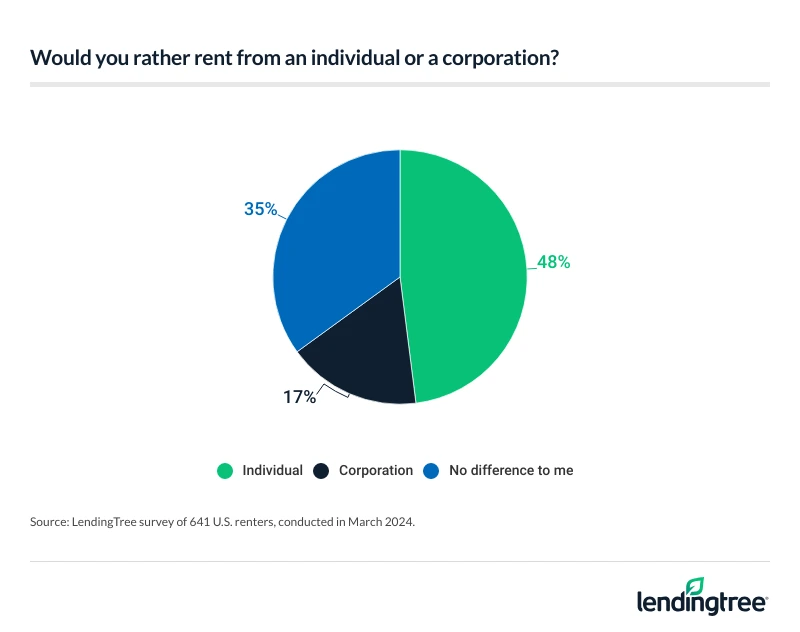

- Renters would rather work with an individual landlord than a corporation. Almost half (48%) would rather rent from an individual than a corporation, with 49% of renters believing it’s cheaper. Additionally, 57% of renters think the government should limit how many homes an individual or corporation can own.

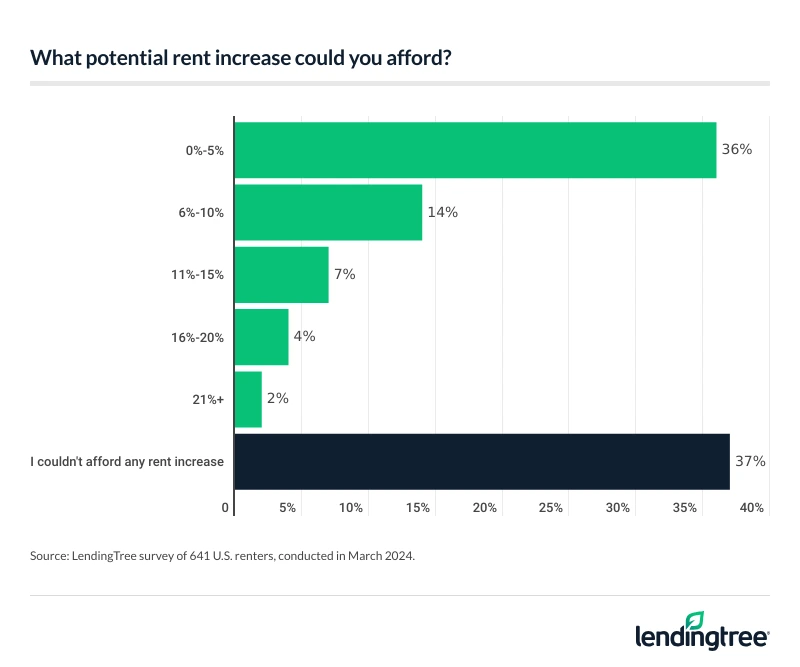

- While rent is a cost burden for many, most have never negotiated the terms of a lease. 37% of renters don’t believe they’re paying a fair market value for their rental, yet 60% have never negotiated lease terms. Additionally, 37% say they couldn’t afford any increase in rent and 36% would only be able to afford an increase of 5% or less.

58% of renters have had a landlord they didn’t like

Nearly 3 in 5 (58%) survey respondents renting today say they’ve had a landlord they didn’t like at some point in their journey.

Gen X renters ages 44 to 59 are the most likely generation to say so, at 61%, while Gen Z renters ages 18 to 27 seem to be the most copacetic with their landlords, with only 51% having one they didn’t like. (Of course, they may simply have had less time to encounter such tension.)

Fortunately, 75% of renters say they like their current landlord, though that still leaves a quarter in an uncomfortable situation.

For those who agree they’ve had a landlord they disliked at some point, the top reasons are maintenance issues (68%), poor communication (53%) and a lack of respect or professionalism (42%), along with issues like rent increases (38%) and privacy violations (22%).

LendingTree senior economist Jacob Channel says documentation is one of renters’ most important tools when dealing with unresponsive or unprofessional landlords.

“Renters should make sure they document all their interactions with their landlord,” he says. “And they should be firm and assertive (but not overly aggressive) when asking a landlord to address a problem.”

Don’t forget to make a written record of phone or in-person interactions, too. “Immediately follow up on a call or visit with an email summarizing your conversation and confirming that everyone is on the same page regarding fixes or other solutions,” Channel says.

He also reminds renters that taking photos and videos of problem areas needing repairs can provide proof of maintenance needs — or negligence, should the issue ever escalate.

With legal issues and unexpected visits, 30% don’t trust their landlords

Unsurprisingly, given the tension-causing issues that renters note, almost a third of renters — 30% — say they don’t trust their current landlord.

Households earning $50,000 to $99,999 a year are more likely to have faith in their property’s owners than those in the lowest economic tier (those earning less than $30,000 a year). More than 3 in 4 (76%) of the former demographic say they trust their current landlord, while only 67% of the latter demographic do.

One reason for the lack of confidence is unwanted visits. Of surveyed renters, 31% report they’ve experienced a landlord entering their dwelling without permission.

What’s more, at least 1 in 5 renters — 21% — have had a legal dispute with a landlord. Among renters, 8% say they won the dispute, while 6% lost. Another 5% of renters report the dispute was dropped, while the matter is still ongoing for an unlucky 2%.

68% of those who’ve been evicted think it was done unfairly

While the vast majority of renters — 82% — say they’ve never been evicted, 18% have. And of those who’ve been evicted, more than two-thirds, or 68%, say they were evicted unfairly.

The most common cause of eviction among our survey respondents was not paying rent on time (30%), though almost a quarter of renters (24%) say they were evicted because the landlord wanted to reclaim the property for their own use. Disturbingly, 18% believe they were evicted due to discrimination — a troubling trend we’ll come back to in a moment.

“Generally speaking,” Channel says, “if you follow the terms of your lease, you probably won’t need to worry too much about being evicted.” He also encourages renters to review the laws in their area governing how the eviction process works.

But if your landlord wants to reclaim their property, there’s usually not much you can do about it, he says. “Even so, this doesn’t mean your landlord can kick you out without notice. Depending on where you live and what your lease says, they typically have to give you a few weeks or months to pack your bags before forcing you to leave.”

Renters’ rights and protections against evictions vary significantly by location, Channel warns, and laws can always change. “Reaching out to a local housing authority, tenant advocacy group or lawyer can help you better learn about your rights and otherwise navigate your way through an eviction,” he recommends.

Renters have faced age, racial discrimination when applying

While 67% of renters say they don’t think they’ve ever been discriminated against during the home rental application process, a shocking 33% — a third — do. Male respondents (36%) are more likely than female respondents (30%) to believe a landlord has potentially discriminated against them, and Gen Z respondents (42%) are far more likely to believe this than baby boomers ages 60 to 78 (18%).

Housing discrimination is no joke — and renters are protected against it by law. “If you’re being discriminated against because of your race,” Channel says, “immediately reach out to a local tenant advocacy group, local housing authority or the Department of Housing and Urban Development and ask for help.”

Along with keeping this from happening again, filing a complaint could put money in your pocket, Channel says. “If a landlord is guilty of discrimination based on something like race, they may be required to pay for the costs you incurred while finding another place to live.”

While it’s not exactly discrimination, renters with pets also sometimes face trouble finding a place to live that accepts their entire family, four-legged members and all. More than 6 in 10 renters — 61% — think all landlords should accept pets, including 28% who say pet acceptance by landlords should be legally mandated. Gen Zers (69%), women (64%), parents with children younger than 18 (64%) and those who earn less than $30,000 a year (64%) are the most likely demographics to say landlords should accept pets (regardless of whether laws are drafted to enforce this).

Renters prefer individual landlords over corporations

Given the choice between renting from a person and a corporation, almost half of renters, or 48%, say they’d rather rent from an individual. Less than 1 in 5 (17%) would prefer to rent from a corporation, while the remaining 35% say it makes no difference to them.

One of the main reasons for the preference toward individual people? Many renters — 49% — say it’s cheaper. (Still, 41% say the cost is no better than renting from a corporate entity.)

But a larger question remains: Should people or corporations be allowed to buy multiple homes when so many find it difficult to achieve homeownership?

More than half of renters, or 57%, believe there should be some form of government restriction on individuals and companies buying multiple houses. A quarter (25%) say it should be illegal to own more than 10 single-family homes, while 20% believe it should be illegal to own more than one and 12% would allow moguls to buy up to 100. (The other 43% of respondents say there should be no such government restrictions.)

Meanwhile, renters most commonly — 35% — think the average landlord or rental company owns between two and five single-family homes. Another 27% estimate they own six to 10, while 20% believe they own 16 or more.

60% have never negotiated the terms of their lease

Almost two-thirds of surveyed renters (63%) believe they’re paying fair market value for their rental. Still, 37% believe they aren’t — and most renters couldn’t afford much of a hike. Among renters, 37% say they can’t afford any increase in their rental cost whatsoever, while another 36% say they can only tolerate an increase between 0% and 5%. (According to an analysis of the latest U.S. Census Bureau data, median gross rent rose 9% between 2021 — $1,191 — and 2022 — $1,300.)

But despite how tight things are for renters, most of them — 60% — have never negotiated the terms of their lease. Those who have negotiated lease terms have asked for accommodations like price changes (22%), lease length changes (14%) or upfront discounts (7%). Women are far less likely to negotiate their lease than men — and many renters may simply be unaware that it’s possible to negotiate a lease at all.

“Negotiating a lease can be a good idea,” Channel says, “and it’s often worth trying. Depending on factors like how long a unit has been on the market or how many people are applying to rent it, a landlord might be willing to offer a lower rent to fill a vacancy.”

Even if the owner is unwilling to budge on the monthly rental cost, there could be other factors that landlords may be more flexible about. “You may be able to get your landlord to pay for certain perks,” Channel says, “like moving fees or utility costs.”

The worst thing they can say is no, so there’s no harm in trying, Channel says — and “if you’re successful, doing so can quite literally pay off.”

Of course, to be in the best possible position to negotiate a lease, the first step is to read it. And, according to our survey, a large portion of renters don’t pore over their contracts. While 52% say they read every word of a lease, 38% merely skim it and 10% don’t read it at all.

The majority want to use renting to improve their credit

Renters are somewhat split on whether they want their landlords to report their payments to the credit bureaus: A slight majority, or 53%, say yes, but 47% would rather they didn’t. Still, this finding suggests that more than half of renters wish their housing payments could be used to improve their credit.

The largest group of renters — 23% — make their monthly rent payments through a check, while 21% pay cash and 20% pay via bank account transfer or autodraft. But these days, plastic can also be used for housing payments, as 19% of respondents use their debit card to pay rent each month, while 5% pull out a credit card. (Gen Z is, perhaps unsurprisingly, the most likely demographic to turn to a payment application like Venmo or Cash App for the transaction — but only 9% of Gen Z renters do so.)

Dealing with a difficult rental situation? 4 expert tips

Even in the face of these challenges, renting doesn’t have to be scary. Here are four expert tips to help make your renting experience easier — or catapult you into homeownership.

- Again, document everything. We said it earlier, but it’s important enough to bear repeating: Save every text, email or letter you get from your landlord, Channel says. It might seem like extra work, but “the more documentation a renter has that proves a problem exists or that their landlord isn’t living up to their end of a rental agreement, the harder it is for a landlord to ignore them,” he explains. “This is especially true if a problem violates the terms of a tenant’s lease or is against the law.”

- If you’re negotiating, do your research. Some types of landlord difficulties can be squelched ahead of time — but successful negotiation, Channel cautions, takes research. “Look at things like how much similar units in your area cost and how long units tend to sit on the market before they’re rented,” he suggests. “The longer it takes for a landlord to fill an empty unit, the more they may be willing to negotiate.” And don’t forget to be polite!

- Seek legal reparations — or leave, if you can. “If a property owner refuses to address serious issues,” Channel says, “a tenant may be able to end their lease early. In some cases, the tenant may be able to take their landlord to court.” While not every whim will qualify, when it comes to major complaints that affect safety and livability, landlords are usually bound by local, state and federal law to help solve the problem. They’re also forbidden from discriminating based on protected traits like race, religion or gender.

- Consider whether homeownership makes sense. One surefire way to never deal with a difficult landlord again is to buy your own home. While buying can feel intimidatingly expensive at the start — especially saving up for a down payment — depending on where you live and how long you plan to stay, it could save you a substantial amount of money over time. Fortunately, the rate of homeownership has risen over the last decade, even with housing prices on the rise. And with down payment assistance programs, owning your own home could be closer than you think.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from March 15 to 18, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles