Rising Mortgage Rates Could Cost Homebuyers Average of Nearly $44,000 Over Lifetime of Loans

Mortgage rates rose dramatically in 2022, with the average rate on a 30-year, fixed mortgage doubling between January and December. Rates haven’t grown nearly as much this year, hovering between 6% and 7% — that said, they’re still considerably higher than at this time last year.

While it’s common knowledge that higher mortgage rates make monthly payments more expensive, it can be difficult to picture how much a higher rate can impact payments on a loan. With that in mind, LendingTree used data collected from users of our online mortgage marketplace to put a dollar amount on how rising rates could affect the cost of a mortgage.

Specifically, we calculated the difference between average monthly mortgage payments on 30-year, fixed-rate loans in each state based on what those payments would be with the average APRs in April 2022 and April 2023.

We found that rising APRs could potentially cost new borrowers across the U.S. in excess of $100 a month and tens of thousands of dollars over the lifetime of their loans.

Key findings

- 30-year, fixed-rate mortgage APRs increased by an average of 1.85 percentage points across all 50 states between April 2022 and April 2023. In April 2023, the average APR across the 50 states was 7.18%, up from 5.33% in April 2022.

- Nationwide, rising APRs caused calculated mortgage payments to increase by an average of $121.09 a month. To put that figure into perspective, that monthly increase amounts to an average of $1,453.10 in extra costs each year and an average of $43,593.12 in additional costs over the lifetime of a 30-year loan. While these extra costs are substantial, keep in mind that those with fixed-rate loans won’t see the amount they spend on their mortgage rise. Instead, higher APRs will typically impact new mortgage borrowers and those with variable-rate loans.

- Calculated mortgage payments increased the least in North Dakota, Iowa and Wisconsin. Owing to relatively low loan amounts, monthly payments increased by $64.93, $77.06 and $79.24, respectively. Though these increases are less than the national average, they average $26,547.60 in extra costs over the 30-year lifetime of a mortgage.

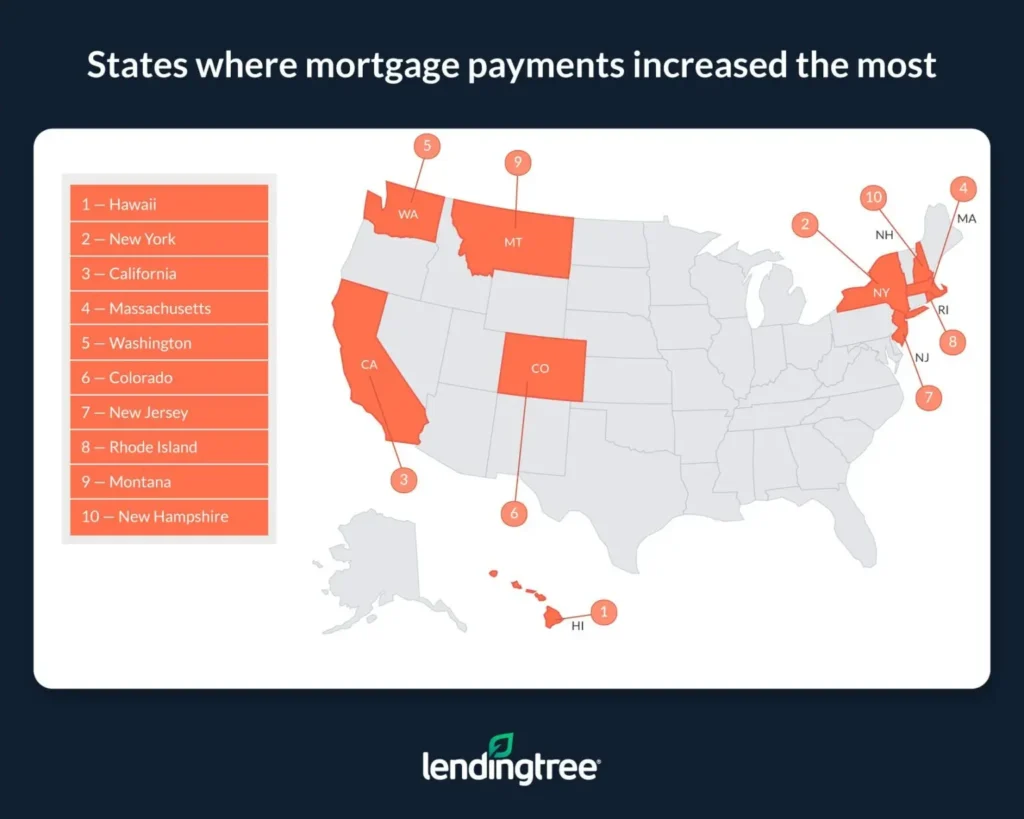

- Hawaii, New York and California saw mortgage payments increase the most. These high-cost states saw monthly increases of $256.47, $194.02, and $185.79, respectively. Over 30 years, these extra monthly costs average $76,353.60.

States where mortgage payments increased the least

No. 1: North Dakota

- Average mortgage amount (April 2023): $249,545

- Average APR (April 2022): 5.40%

- Average APR (April 2023): 6.66%

- Monthly payment with April 2022 average APR: $942.29

- Monthly payment with April 2023 average APR: $1,007.22

- Difference between payments with April 2022 and April 2023 average APRs: $64.93

No. 2: Iowa

- Average mortgage amount (April 2023): $232,460

- Average APR (April 2022): 5.45%

- Average APR (April 2023): 7.04%

- Monthly payment with April 2022 average APR: $880.21

- Monthly payment with April 2023 average APR: $957.27

- Difference between payments with April 2022 and April 2023 average APRs: $77.06

No. 3: Wisconsin

- Average mortgage amount (April 2023): $243,555

- Average APR (April 2022): 5.48%

- Average APR (April 2023): 7.04%

- Monthly payment with April 2022 average APR: $923.67

- Monthly payment with April 2023 average APR: $1,002.91

- Difference between payments with April 2022 and April 2023 average APRs: $79.24

States where mortgage payments increased the most

No. 1: Hawaii

- Average mortgage amount (April 2023): $473,549

- Average APR (April 2022): 4.84%

- Average APR (April 2023): 7.46%

- Monthly payment with April 2022 average APR: $1,735.44

- Monthly payment with April 2023 average APR: $1,991.91

- Difference between payments with April 2022 and April 2023 average APRs: $256.47

No. 2: New York

- Average mortgage amount (April 2023): $391,748

- Average APR (April 2022): 5.31%

- Average APR (April 2023): 7.68%

- Monthly payment with April 2022 average APR: $1,472.76

- Monthly payment with April 2023 average APR: $1,666.78

- Difference between payments with April 2022 and April 2023 average APRs: $194.02

No. 3: California

- Average mortgage amount (April 2023): $509,516

- Average APR (April 2022): 5.18%

- Average APR (April 2023): 6.94%

- Monthly payment with April 2022 average APR: $1,901.31

- Monthly payment with April 2023 average APR: $2,087.10

- Difference between payments with April 2022 and April 2023 average APRs: $185.79

Mortgage rate growth is cooling, but that doesn’t mean rates are significantly declining

With the Federal Reserve potentially poised to stop hiking its target federal funds rate and inflation showing signs of coming back under control, there’s much less reason for mortgage rates to start rapidly climbing like in 2022. This is somewhat good news for buyers, as it means they may not need to deal with constantly rising rates that threaten to price them out of the market if they don’t buy immediately.

However, this doesn’t mean that mortgage rates will start showing sustained declines anytime soon. On the contrary, though it’s been volatile on a week-to-week basis, the average rate on a 30-year, fixed mortgage has consistently stayed between 6% and 7% this year — a trend that appears likely to continue until the broader economy starts experiencing a more serious slowdown. Unfortunately, buyers will still need to navigate an expensive housing market that’s typically anything but friendly to those without strong credit scores and low debt-to-income ratios. And while rates likely will eventually come down again, there’s no telling when that’ll happen.

Regardless of the future, it’s clear that today’s rates have and likely will continue to make buying a home more expensive. Even so, that doesn’t mean homebuying is an impossible feat, and with proper planning, purchasing a house could still be a great option for many people.

3 tips for getting a lower mortgage APR

Though rates remain relatively steep, there are still a few ways for borrowers to potentially get a lower APR on their mortgage. Here are three tips on how to do just that:

- Shop around for a mortgage before buying. Because different lenders often offer different rates to the same borrowers, homebuyers can potentially secure a lower rate by shopping around for a mortgage before buying a house. In some instances, a borrower may receive a rate dozens of basis points lower than what the first lender offered them. This lower rate could result in tens of thousands of dollars in savings over the lifetime of a loan.

- Work on your credit. Because it’s used to gauge how likely a person is to repay their debt, a credit score is an important factor that lenders consider when determining what rate to offer a prospective homebuyer. Owing to this, borrowers should work on making their credit score as strong as possible before they apply for a mortgage. Not only can a higher score help a homebuyer get a lower rate, but it can also help them get approved for a loan in the first place.

- Consider a mortgage with a shorter term. Shorter-term loans often come with lower rates than their long-term counterparts. For example, borrowers with excellent credit can typically expect to receive a rate on a 15-year, fixed-rate mortgage that’s more than 50 basis points lower than what they can expect to receive on a 30-year, fixed mortgage. Though a shorter loan term will typically result in higher monthly payments, it’ll nonetheless result in less interest paid over the lifetime of a loan. This can be worth it for those who have extra cash and don’t mind a steeper housing payment.

Methodology

Data in this study was generated from more than 30,000 users who received an offer for a 30-year, fixed-rate mortgage on the LendingTree platform in April 2022 or April 2023.

To calculate monthly mortgage payments, LendingTree used the average mortgage amounts offered to users in each state in April 2023 and the average APRs offered to users in each state in April 2022 and April 2023 (through April 22).

Monthly payment differences were found by subtracting a calculated monthly payment with an average APR for April 2022 from a calculated monthly payment with an average APR for April 2023. To determine how much this difference would add up to yearly, the monthly difference was multiplied by 12. This yearly difference was multiplied by 30 to determine how much more expensive a mortgage would be over its lifetime.

View mortgage loan offers from up to 5 lenders in minutes

Read more

High Pay and Even Higher Home Prices: Housing Still Unaffordable for Some Who Work in High-Paying Occupations Updated October 16, 2023 In 30 of the 50 largest metros, a mortgage on a median-value home is affordable…Read more

Shopping Around for Mortgage Could Save Borrowers $80,000+ Over Lifetime of Loan Updated June 14, 2022 According to our analysis, borrowers could save a staggering $80,024 on average by shopping around…Read more