LendingTree Ranks Housing Markets with Most Competitive Homebuyers

With a lack of affordable homes on the market, competition among homebuyers in many parts of the country is fierce.

To find out where buyers are the most competitive, LendingTree ranked the 50 largest metropolitan areas (metros) in the United States, based on the following categories:

- Average down payment percentage among homebuyers

- Share of homebuyers who have credit scores above 720

- Share of homebuyers who shop around for a mortgage before looking for a house

These criteria were chosen because they each play an important role in a person’s ability to secure a home loan. Since 63% of homeowners have a mortgage, those who are strong in these categories will likely be very competitive among other homebuyers.

Key findings

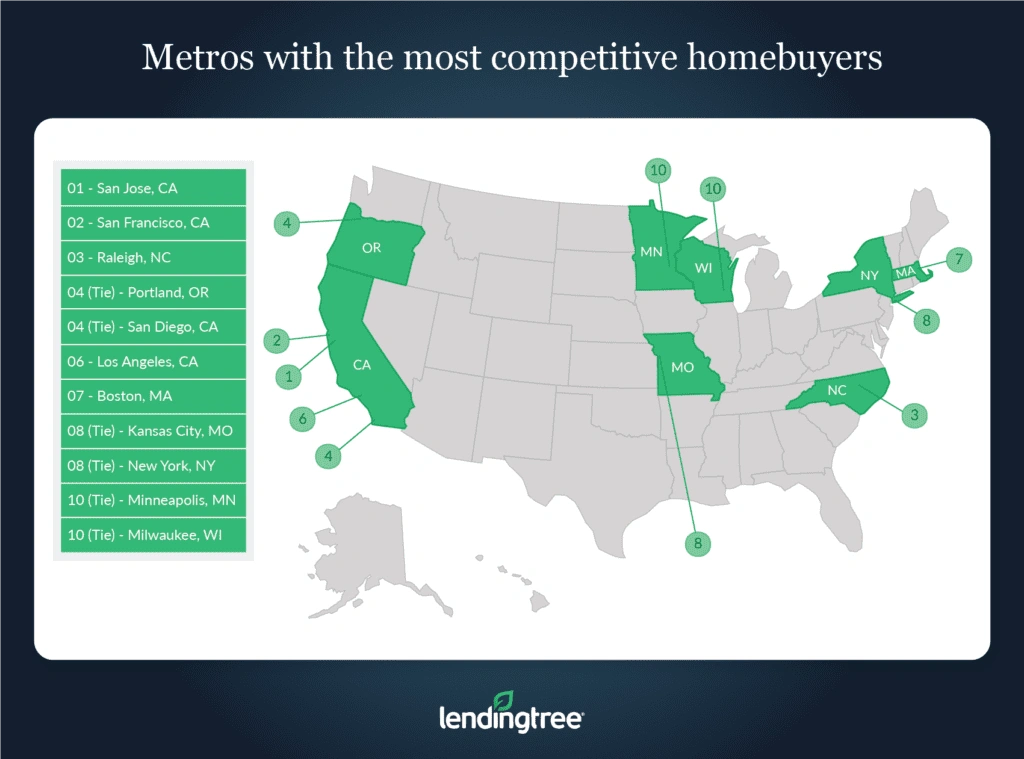

- San Jose, Calif., San Francisco and Raleigh, N.C., are the three metros with the most competitive homebuyers. Despite only ranking 17th in the “shopping around” category, San Jose ranks first in both the “credit score” and “down payment” categories, allowing it to rank first overall. While neither San Francisco or Raleigh rank first in any individual category, their relatively strong showings across the board are enough to secure them the second and third spots.

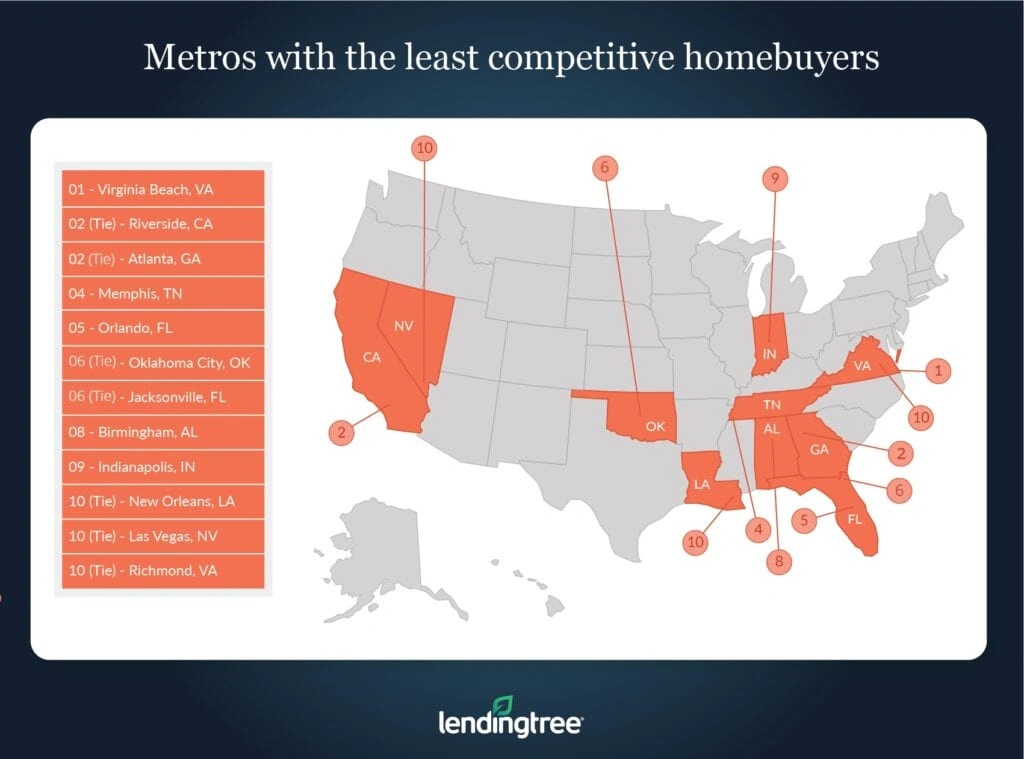

- Virginia Beach, Va., has the least competitive homebuyers in the country, followed by Riverside, Calif., and Atlanta, who are tied for the metro with the second least competitive buyers. Buyers in these metros tend to have lower credit scores, smaller down payments and are less likely to shop around for a mortgage before choosing a home.

- The average down payment percentage in the top 11 most competitive metros is 21%. For the least competitive 12 metros, that number is 19%. Typically, larger down payments make buyers more appealing to sellers. As a result, more competitive buyers will generally be able to put down more on a home.

- About 73% of buyers in the top 11 most competitive metros have credit scores of at least 720. Across the 50 largest metros in the country, that number is 64%. For the 12 least competitive buyer metros, it’s 57%.

- In the 11 most competitive metros, 62% of buyers shopped around for a mortgage before looking for a house. Comparatively, only 54% of potential buyers in the 12 least competitive metros can say the same.

Metros with the most competitive homebuyers

No. 1: San Jose, Calif.

- Average down payment percentage: 23.67%

- Share of buyers with a credit score of 720 or higher: 84.15%

- Share of buyers who shopped around for a mortgage before looking for a house: 61.08%

No. 2: San Francisco

- Average down payment percentage: 21.43%

- Share of buyers with a credit score of 720 or higher: 81.96%

- Share of buyers who shopped around for a mortgage before looking for a house: 62.32%

No. 3: Raleigh, N.C.

- Average down payment percentage: 20.39%

- Share of buyers with a credit score of 720 or higher: 70.48%

- Share of buyers who shopped around for a mortgage before looking for a house: 61.5%

Metros with the least competitive homebuyers

No. 1: Virginia Beach, Va.

- Average down payment percentage: 17.17%

- Share of buyers with a credit score of 720 or higher: 57.71%

- Share of buyers who shopped around for a mortgage before looking for a house: 51.91%

No. 2 (tie): Riverside, Calif.

- Average down payment percentage: 17.25%

- Share of buyers with a credit score of 720 or higher: 57.69%

- Share of buyers who shopped around for a mortgage before looking for a house: 55.64%

No. 2 (tie): Atlanta

- Average down payment percentage: 18.86%

- Share of buyers with a credit score of 720 or higher: 58.26%

- Share of buyers who shopped around for a mortgage before looking for a house: 53.29%

How to be a competitive homebuyer

Because both lenders and sellers have different criteria for who they want to work with, there are many factors that can contribute to a homebuyer’s perceived strength.

That being said, buyers who do the following will generally be seen as more competitive than those who don’t.

- Shop around for a mortgage. Buyers who shop around for a mortgage usually have a better idea of what kind of loans that they might qualify for and which lenders are more likely to offer a mortgage preapproval. Potential buyers who are preapproved are often seen as more appealing to sellers because they have shown they are likely financially stable, and probably won’t need to go through a potentially lengthy loan approval process after deciding to buy a house.

- Make a larger down payment. Larger down payments show sellers that potential buyers have the financial stability and means to purchase a home. As a result, sellers may have more confidence in offers from buyers who make larger down payments.

- Have a high credit score. Buyers with higher credit scores have an advantage because it’s one of the main factors mortgage lenders consider when offering a loan. This means borrowers with higher scores are more likely to be approved for a loan than those with credit scores below 720.

Methodology

For this study, LendingTree reviewed more than 750,000 mortgage loan requests that came through LendingTree’s marketplace from March 1, 2020, through March 24, 2021.

Using data pulled from those requests, LendingTree ranked the top 50 largest metropolitan statistical areas (MSAs) — also referred to as “metros” in this study — in the United States in three separate categories (as listed above) before averaging those rankings to get the overall ranking used in the study.

LendingTree senior research analyst Jacob Channel contributed to this study.

View mortgage loan offers from up to 5 lenders in minutes