Housing Market Movers: Millennial Homebuyers Received More Than 50% of Mortgage Offers in the Majority of the Nation’s Largest Metros

Though it may sometimes seem as if millennials are destined to rent or live in their parents’ basements forever, members of the generation are among the most influential in the housing market.

To highlight where millennials are looking to buy, LendingTree analyzed mortgage offers given to users of our online shopping platform across the nation’s 50 largest metropolitan areas from Jan. 1 through Dec. 31, 2023.

Millennials (born between 1981 and 1996, or ages 27 to 42 in 2023) received at least 50% of mortgage offers made in most of the country’s largest metros, including pricey areas like San Jose, Calif., San Francisco and Boston.

Key findings

- Across the nation’s 50 largest metros, 53.85% of mortgage offers in 2023 went to millennials. Millennials received more than 50% of all offered mortgages in 35 of the nation’s 50 largest metros.

- Millennials made up the largest share of potential homebuyers in San Jose, Calif., San Francisco and Boston. In San Jose, 64.75% of mortgages in 2023 were offered to millennials. That’s up slightly from 63.57% in 2022. In San Francisco and Boston, the 2023 figures were 62.77% and 61.46%, respectively. These figures increased from 59.18% and 60.59% in 2022.

- Millennials in Las Vegas, Phoenix and Tampa, Fla., made up the smallest share of potential buyers — though still substantial. In Las Vegas, 40.76% of mortgage offers in 2023 went to millennials. In Phoenix and Tampa, those figures were 44.31% and 45.16%, respectively. These figures were lower than in 2022, when they were 41.92%, 46.11% and 48.71%.

- Millennials in expensive California metros San Jose, San Francisco and Los Angeles planned to put the largest down payments toward their homes. The average down payments among potential millennial homebuyers across these three metros in 2023 were $170,591, $159,392 and $111,068, respectively. For comparison, down payments among potential buyers were smallest in Virginia Beach, Va., San Antonio and Oklahoma City, averaging $36,123, $38,413 and $38,481.

- Like down payments, offered loan amounts were largest in San Jose, San Francisco and Los Angeles. Loan amounts in these three metros in 2023 were $785,391, $731,062 and $627,322, respectively. Conversely, at $242,220, $268,484 and $268,900, average loan amounts offered in Buffalo, N.Y., Cleveland and Louisville, Ky., were the smallest among the nation’s 50 largest metros.

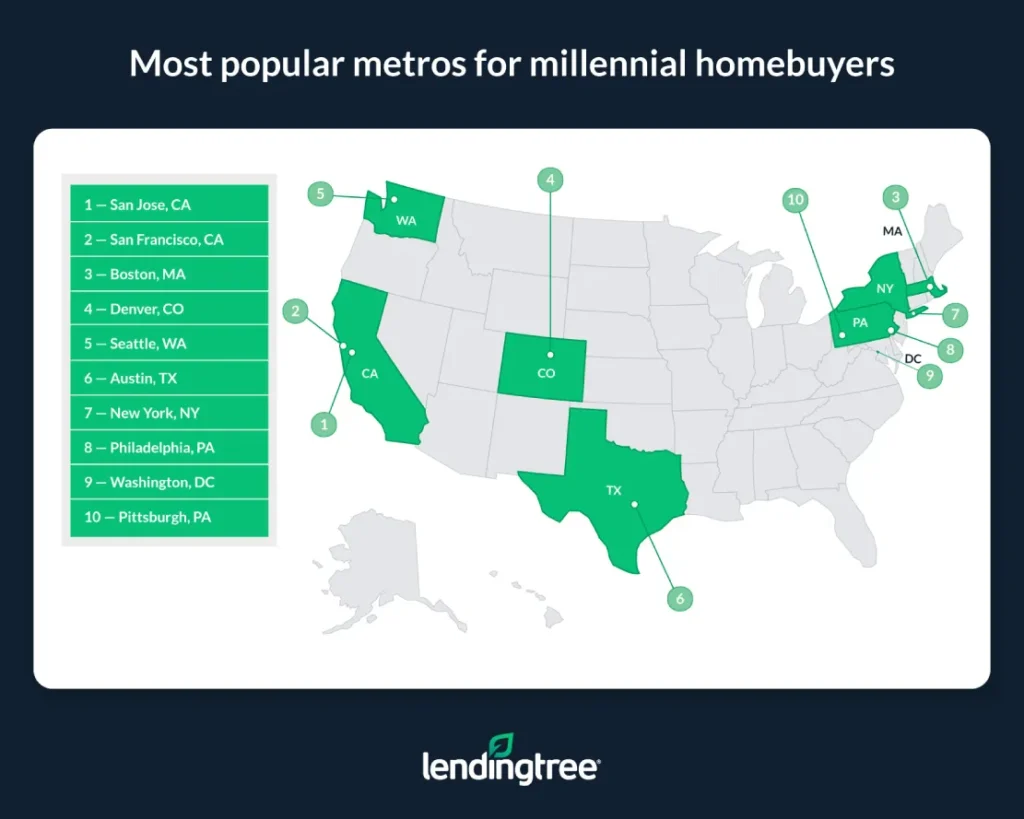

Most popular metros for millennial homebuyers

No. 1: San Jose, Calif.

- Share of mortgages offered to millennials: 64.75%

- Average age among potential millennial homebuyers: 33

- Average down payment amount among potential millennial homebuyers: $170,591

- Average mortgage amount offered to millennials: $785,391

No. 2: San Francisco

- Share of mortgages offered to millennials: 62.77%

- Average age among potential millennial homebuyers: 34

- Average down payment amount among potential millennial homebuyers: $159,392

- Average mortgage amount offered to millennials: $731,062

No. 3: Boston

- Share of mortgages offered to millennials: 61.46%

- Average age among potential millennial homebuyers: 33

- Average down payment amount among potential millennial homebuyers: $94,903

- Average mortgage amount offered to millennials: $500,126

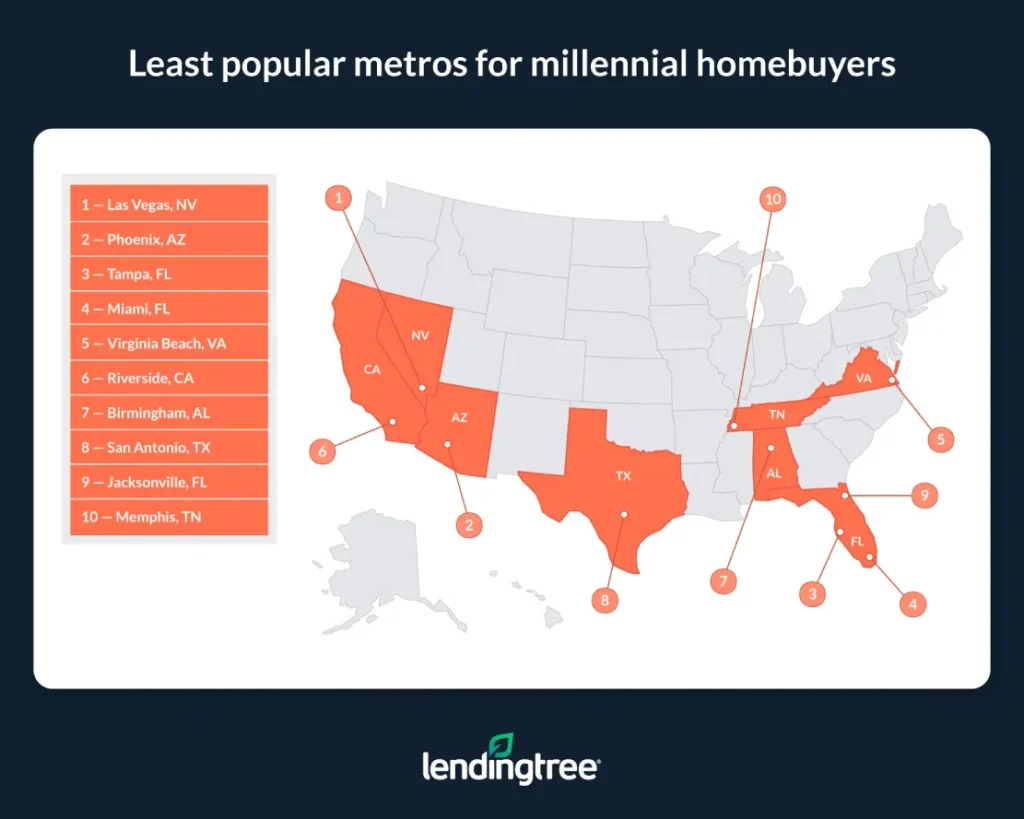

Least popular metros for millennial homebuyers

No. 1: Las Vegas

- Share of mortgages offered to millennials: 40.76%

- Average age among potential millennial homebuyers: 33

- Average down payment amount among potential millennial homebuyers: $44,980

- Average mortgage amount offered to millennials: $362,280

No. 2: Phoenix

- Share of mortgages offered to millennials: 44.31%

- Average age among potential millennial homebuyers: 33

- Average down payment amount among potential millennial homebuyers: $53,903

- Average mortgage amount offered to millennials: $381,696

No. 3: Tampa, Fla.

- Share of mortgages offered to millennials: 45.16%

- Average age among potential millennial homebuyers: 33

- Average down payment amount among potential millennial homebuyers: $49,573

- Average mortgage amount offered to millennials: $342,700

Why millennials play such a large role in the housing market

Given how often we hear about the financial woes facing millennials, it might be surprising to learn that a majority (53.85%) of mortgage offers across the nation’s largest metros were given to members of the generation. That said, the trend makes sense for various reasons.

For example, many millennials are at an age when they’re starting families and earning more money. This means they have a greater financial ability to become homeowners and are incentivized by reasons like needing to provide for their loved ones in a way they may not have been when more of them were in their 20s.

In that same vein, while getting a mortgage and buying a home might make more sense when you’re younger and starting a family or becoming established in your career, it often starts to make less sense as you age. After all, it’s one thing to take out a six-figure mortgage in your 30s when you’ll likely have plenty of time to work and pay it off, but it’s another thing to take out a mortgage when your retirement is fast approaching.

Of course, this doesn’t mean members of older generations aren’t buying. They are. This is especially true in today’s high-rate, low-demand lending environment where a relatively large share of buyers pay for their homes entirely in cash. Despite this, millennials remain an active force in the housing market and their influence will likely continue to grow as rates fall and all-cash purchases become less common.

Simply, though millennials are certainly not as wealthy as older generations, they’re at a place where buying often makes the most sense. And as millennials age, younger generations will almost certainly supplant them as the largest share of homebuyers on the market — even if those younger generations might also have to deal with increased financial hardships related to buying.

Tips for millennial homebuyers

With home prices and rates still high, navigating today’s housing market can be challenging. This can be especially true for millennials, many of whom may not have as much cash or experience buying a home as older generations. There are a few tips buyers of any age can consider to make the homebuying process more manageable.

- Save, save, save. Though it’s usually much easier said than done, it’s hard to overstate how important saving money is for someone looking to buy a home. The more cash you have, the more you can put toward things like a down payment. While a large down payment isn’t always necessary, the more you can put toward one, the more likely you may get approved for a mortgage or be offered more generous loan terms. Further, extra cash can help you cover additional costs like paying for movers.

- Pay down your monthly debts. A key factor that lenders look at is your debt-to-income (DTI) ratio, or the percentage of your gross monthly income that goes toward recurring debts. Maximum DTI ratios vary by loan program, but it’s a good idea to keep your total DTI ratio (which includes your monthly mortgage and all debt payments) at 35% or less.

- Know your loan options. It can be a challenge to build credit quickly or come up with a significant down payment. But don’t stress, as many mortgage programs are designed to make homeownership easier and/or more affordable. For example, borrowers with a credit score as low as 580 and a down payment of only 3.5% may qualify for a Federal Housing Administration (FHA) loan.

Methodology

To conduct this study, LendingTree analyzed over 517,000 mortgage offers given to borrowers ages 27 to 42 across the nation’s 50 largest metropolitan areas from Jan. 1 through Dec. 31, 2023, along with offers given to the total population of mortgage seekers.

The metro rankings were generated by looking at the share of mortgages offered to millennials as a percentage of the total number of mortgages offered in a given area. The larger the share of offers given to millennials, the higher the ranking a metro received.

View mortgage loan offers from up to 5 lenders in minutes

Read more

Nearly 80% of Gen Z Homeowners Had Down Payment Help — Mostly From Family Updated October 9, 2023 Across all homeowners, 39% have received down payment assistance, with help from parents leading the way.Read more

Most Popular Metros for Gen Z Homebuyers Updated May 12, 2025 Grand Rapids, Mich. (31.45%), has the largest share of mortgage requests from Gen Zers. Salt…Read more