Best Loans for Bad Credit in February 2026

LendingTree users with credit scores under 580 who receive an offer, average 13 loan offers

Read more about how we made our picks for the best bad credit loans.

Best bad credit loan lenders with the lowest rates

Best for: Boosting approval odds with collateral – Best Egg

- APR

- 5.99% – 29.99%

- Better approval odds with collateral

- Best Egg secured loans only put your home fixtures at risk, not your home itself

- Accepts collateral but doesn’t require it

- Takes between 1.49% – 8.99% from your loan as an origination fee

- Could lose home fixtures if you stop making payments

- Must own your home for secured loans

- Loan must be paid in full before you can sell your home

I shopped for personal loans with Best Egg using my real information. Here’s what I found:

- Application experience: Best Egg asks more questions than the average lender, but its application is clear and easy to complete. Once you have offers, you can quickly click through to a loan agreement that outlines next steps and how much you’ll pay.

- Unusual questions to prepare for: Annual income for other people in your household, other types of accounts held (e.g., savings, retirement and investments), car payment, number of cash advances taken in past six months.

You can boost your odds of approval using Best Egg’s unique secured personal loans. Instead of putting up your entire home as collateral, you’ll use your home’s permanent fixtures like cabinets. You can also get an unsecured loan from Best Egg with APRs from 6.99% to 35.99%.

But you have to own your home in order to qualify, and you can’t sell your home without paying off the loan in full. This can make moving or even refinancing your home more complicated.

Quick stats:

- 98% of LendingTree users who borrowed from Best Egg recommend them

- Best Egg funded nearly 24,000 personal loans to LendingTree users in 2024

Best Egg lets you boost your approval odds with:

- Collateral

- Smaller loans, if unsecured

Best Egg uses your home’s permanent fixtures as collateral, but no appraisal is needed. Instead, Best Egg will review your credit history and home equity to see if you qualify.

You must also meet the requirements below to qualify for a Best Egg loan:

- Citizenship: Be a U.S. citizen or permanent resident living in the U.S.

- Administrative: Have a personal checking account, email address and physical address

- Residency: Not live in the District of Columbia, Iowa, Vermont, West Virginia or U.S. territories

- Credit score: 580+

Best for: Overall bad credit loans – Upstart

- APR

- 6.50% – 35.99%

- Partners with lenders that may accept bad or no credit

- Get money as soon as one business day

- Considers factors beyond your credit score

- May be able to use your paid-off car as collateral for better odds

- Can’t boost your approval odds with a co-borrower

- Could keep some of your loan for itself as an origination fee

- No current delinquencies or recent bankruptcies

I shopped for personal loans with Upstart using my real personal information to better understand the application process. Here’s what I found:

- Application experience: Upstart’s application is straightforward and clear. It has more questions than the average loan application, but these questions are tied to its AI algorithm designed to improve users’ chances of approval.

- Unusual questions to prepare for: Amounts in checking, savings and investment accounts; car payment; miles on car

Upstart uses an AI algorithm that evaluates factors outside of credit history (such as education and employment) to approve more people, including those with bad or no credit.

Loans through Upstart’s network come with only two repayment terms — 36 to 60 months. Origination fees vary by lender.

Quick stats:

- 99% of LendingTree users who borrowed from Upstart’s platform recommend them

- Upstart funded 20,000+ personal loans to LendingTree users in 2024

Upstart lets you boost your approval odds with:

- Collateral

- Smaller loans

- Factors like your education and employment history

Upstart has transparent eligibility requirements, including:

- Age: Be 18 or older

- Administrative: Have a U.S. address, personal banking account, email address and Social Security number

- Income: Have a valid source of income, including a job, job offer or another regular income source

- Credit-related factors: No bankruptcies within the last three years, reasonable number of recent inquiries on your credit report and no current delinquencies

- Credit score: None

Best for: Spreading out payments – Upgrade

- APR

- 7.74% – 35.99%

- Get lower monthly payments with an extended 24- to 84-month loan term

- Discounts for autopay and paying your creditors directly

- May accept your car or home fixtures as collateral (not all lenders will)

- Takes between 1.85% – 9.99% from all loans as an origination fee

I shopped for personal loans with Upgrade using my real information. Here’s what I found:

- Application experience: Upgrade’s application is very quick with few questions, and it’s easy to apply with a co-borrower — you can add their information on the first page.

- Unusual step to prepare for: Must create an account to see your rates

Upgrade lets you spread out payments across an extra-long loan term, which can help you get affordable monthly payments. Plus, you can get discounts for letting Upgrade pay your creditors directly and for signing up for autopay. Keep in mind that longer loan terms mean that you’ll pay more in interest overall.

But you’ll have to watch out for fees. Upgrade keeps between 1.85% – 9.99%) of every loan and the worse your credit, the higher this fee typically is.

Quick stats:

- 97% of LendingTree users who borrowed from Upgrade’s platform recommend them

- Upgrade funded 5,000+ personal loans to LendingTree users in 2024

Upgrade lets you boost your approval odds with:

- Collateral

- Smaller loans

- Cosigners/co-borrowers

To qualify for a loan through Upgrade’s network, you must meet the requirements below:

- Age: Be at least 18 years old (19 in some states)

- Citizenship: Be a U.S. citizen, permanent resident or live in the U.S. with a valid visa

- Administrative: Have a valid bank account and email address

- Credit score: 580+

Best for: Live support seven days a week – Avant

- APR

- 9.95% – 35.99%

- Offers live application support seven days a week

- Accepts bad credit — minimum credit score is on the low end for personal loan lenders

- Get money as soon as the next business day

- Up to 9.99% of your loan taken as an upfront origination fee

- Can’t boost your odds with a secured loan or a co-borrower

I shopped for personal loans with Avant using my real personal information to better understand the application process. Here’s what I found:

- Application experience: Avant’s application is straightforward and fast — easily one of the best application experiences I tested.

If you need someone to walk you through your loan application, you can contact Avant application support by phone 13 to 15 hours a day, seven days a week. Other lenders offer more limited hours, and some are closed on weekends altogether.

Unlike other lenders on this list, Avant doesn’t allow you to put up collateral or apply with a co-borrower to improve your odds of getting a loan.

Quick stats:

- 95% of LendingTree users who borrowed from Avant recommend them

- Avant funded 6000+ personal loans to LendingTree users in 2024

Avant lets you boost your approval odds with:

- Smaller loans

To get a loan with Avant, you’ll need to meet the following minimum requirements:

- Residency: Not available to residents of Hawaii, Iowa, Maine, Massachusetts, New York, Vermont, Washington and West Virginia.

- Administrative: Must have a bank account. May need to submit bank statements, pay stubs or tax documents to prove your income. Avant may also call your employer to verify your employment.

- Credit score: 580+

Best for: Same-day loans for bad credit – OneMain Financial

- APR

- 18.00% – 35.99%

California residents must borrow at least $3,000

- Can get your loan within an hour as long as you have a debit card

- Can use your car as collateral for a bigger loan or easier approval

- Accepts bad credit — credit score requirement is on the low end compared to other lenders

- Charges an upfront origination fee on every loan

- You may get lower rates elsewhere if you have close to fair credit

- Paying off your loan faster might not save you money

I shopped for personal loans with OneMain using my real information. Here’s what I found:

- Application experience: OneMain’s application is fast and easy to navigate, especially if you’ve prepared for additional questions about your income and employment (see below).

- Unusual questions to prepare for: Monthly take-home pay (most lenders ask for annual income), employer phone number, car payment

OneMain has some of the quickest loans on the market — you could get your money in just an hour. All you have to do is use your debit card number to get your money directly deposited into your bank account.

But OneMain loans aren’t cheap — they come with high rates and fees. OneMain also calculates interest in a way that stops you from saving much (or any) interest if you pay your loan off early.

Quick stats:

- 94% of LendingTree users who borrowed from OneMain recommend them

- OneMain funded 51,000+ personal loans to LendingTree users in 2024

OneMain lets you boost your approval odds with:

- Collateral

- Smaller loans

- Cosigners/co-borrowers

OneMain Financial isn’t very transparent about its personal loan eligibility requirements, but it’s possible to qualify even with a credit score as low as 500. Before closing on a loan, you may need to provide:

- Government-issued identification (such as a driver’s license or passport)

- Proof of residence (such as a rental agreement or utility bill)

- Proof of income (such as pay stubs or tax returns)

OneMain loans are not available in Alaska, Arkansas, Connecticut, District of Columbia, Massachusetts, Rhode Island, Vermont or in U.S. territories.

How LendingTree works

You’d shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and get lenders from the country’s largest network to compete for your business.

Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

Shop your offers

LendingTree users with a credit score of 580 or lower who get at least one offer receive about 13 offers on average.

Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

Estimate how much you’ll pay — even with bad credit

What to know about bad credit loans

- Bad credit is a FICO Score below 580.

- You can still get approved for a loan with bad credit, but your loan will likely be expensive.

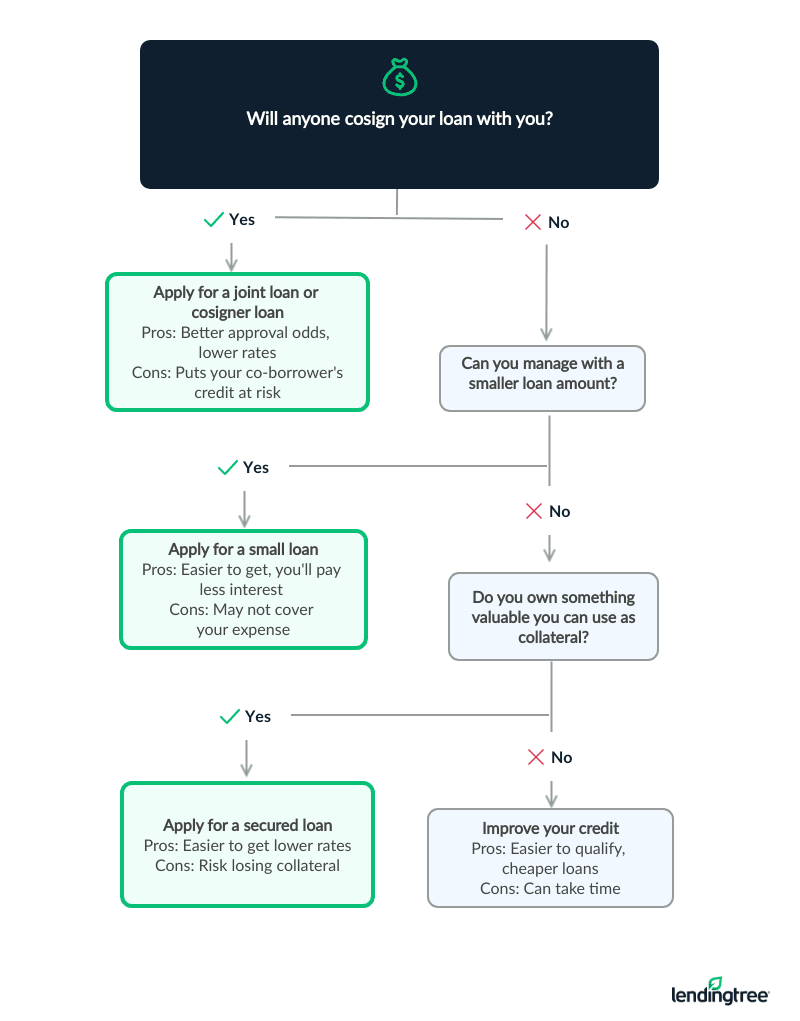

- Strategies like adding a co-borrower or applying for a smaller loan can help you get approved with lower rates.

You might be worried about whether you’ll qualify for a personal loan, given your credit history. The good news? There are a lot of ways to borrow money with bad credit, and LendingTree users with a credit score under 580 received up to $43,553 for a personal loan in the first half of 2025.

Here’s the hard part: It costs more to borrow money when you have bad credit, and there are a lot of unaffordable options. Personal loans can be a solid solution when they come from lenders with reasonable interest rates. But you should steer clear of offers with rates above 36%.

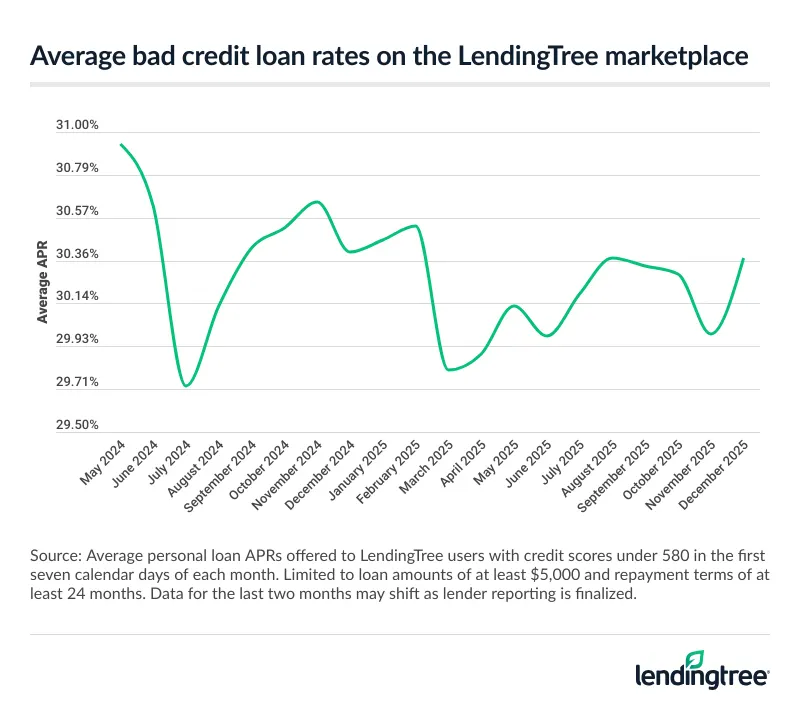

Bad credit loan rates over time

Bad credit loan rates don’t move in a straight line. They rise and fall based on factors like interest rate changes, lender risk tolerance and demand for credit. Although rates have seen periods of decline in the past, recent data shows bad credit personal loan rates trending upward.

Types of loans for bad credit

This article focuses on unsecured personal loans for bad credit, but there are other options that may be a better fit for you.

| Loans for bad credit | Best if… | What are they? | Pros and cons |

|---|---|---|---|

| Secured loans | You have collateral you can lose | Loans backed by collateral like a car, home or savings account | Pros: Easier to get, lower rates Cons: Risk losing your collateral if you can’t make payments |

| No-credit-check loans | You need a smaller loan that you can pay off fast | Personal loans with no credit check and/or apps that allow you to borrow money | Pros: No credit check, can get online Cons: High rates/fees, apps can lead to overborrowing |

| Joint personal loans | You have a supportive family member/friend willing to back your loan | Loans you get with another person who is equally responsible for repayment | Pros: Easier to get, lower rates Cons: Missing or late payments will hurt both of your credit scores |

| Cash advances | You have a financial emergency and need fast cash | Small, short-term loans that you can get by withdrawing cash directly from your credit card | Pros: No credit checks, fast cash Cons: Potential fees and high rates |

| Payday loans | You can afford high fees and can pay it off fast | Small, expensive loans that you pay back in two to four weeks | Pros: No credit checks, fast cash Cons: APRs up to 400% could trap you in a cycle of debt |

| Pawnshop loans | You have something of value to offer the pawnshop that you can lose | Small, short-term loans offered by pawnshops and backed by collateral | Pros: No credit checks, fast cash Cons: Chance to lose collateral, high fees |

| Car title loans | You understand the risk of using your car as collateral and have no other options | Short-term loans that are backed by your car | Pros: No credit check, fast cash Cons: Rates are high, could lose your car |

How to choose a loan when you have bad credit

| Situation | Strategy | Next steps |

|---|---|---|

| You have several offers from different lenders | Choose the loan with the lowest total interest that has monthly payments you can afford. | Use a personal loan calculator to compare both monthly payments and total interest. |

| You only have a couple of options, and they’re expensive | See if you can manage the payments, and if not, choose an alternative. | See if the monthly payments fit in your budget. If you can’t afford them, use the expert strategies below to get better rates. |

| You don’t qualify | Choose a strategy to improve your odds when you apply again. | Evaluate strategies and consider alternatives like family loans and payday alternative loans. |

Find a bad credit loan with LendingTree

Tell us what you need

Fill out one quick form so we can find your best offers. It takes just a few minutes, and checking rates won’t hurt your credit score.

Compare free offers

LendingTree has America’s largest lender network. Compare offers from up to five lenders and watch banks compete for your business.

Apply and win

Once you find an offer you like, it’s time to formally apply. After you get your bad credit loan, use it to pay off your credit cards, medical bills or most any other debt that you’re juggling.

How to improve your chances of getting approved

Getting a loan if you have bad credit can be hard, but certainly not impossible. Finding a friend or family member willing to be a cosigner or co-borrower can significantly boost your approval chances, especially if that other person has a longer and better credit history than you.

But you’re more than a credit score, and that isn’t the only thing lenders consider. Your income, employment history and even education level can be green flags, too. Finding stable employment and boosting your income could give you an ‘in’ with some lenders.

How to spot scams for bad credit loans

Some bad credit loans really are too good to be true. To avoid being scammed by a shady lender, be on the lookout for the signs below:

-

High APRs and expensive fees

Expensive loans aren’t technically scams, but they can do a number on your budget. Take control by shopping around for lower rates and skip offers with APRs above 36%. Also, check your offer for upfront fees — you shouldn’t have to pay any fees out of pocket until you start repayment. -

Negative lender reviews

Before you sign, read online personal loan reviews for your potential lender. Pay attention to recurring complaints from current customers. This can help you avoid similar frustrations or decide to pass on the lender altogether. -

Pressure to act

If a lender is pressuring you to make a decision within a small window of time, that’s a red flag. A reputable lender won’t corner you and will give you time to think about your options. -

No physical address

A reputable lender will have the company’s physical address listed on its website (not a post office box), and you’ll be able to confirm it with Google Maps or a similar app. -

They contact you

If a lender contacts you but you haven’t applied or completed a form with them before, don’t respond. It could be a scam to steal your financial information. Legitimate lenders won’t cold call and ask for your personal information. -

No credit check

A reputable lender won’t guarantee loan approval before checking your credit score and report.

Contact law enforcement and file a police report. There may not be much the police can do, but it’s important to document the crime. You should also report the scam to the FTC Internet Crime Complaint Center to potentially prevent others from being scammed in the future.

Why use LendingTree?

$149M in funding

In 2024 alone, LendingTree helped find funding for over $149 million in personal loans for people with credit scores of 580 or lower.

$1,659 in savings

LendingTree users save $1,659 on average just by shopping and comparing personal loan rates.

308,000 loans

In 2024, LendingTree helped find funding for over 308,000 personal loans.

Why trust LendingTree’s methodology?

LendingTree’s writers and editors diligently vet dozens of lenders to narrow down which ones offer the most affordable rates and a customer-centered experience. We have ongoing conversations with loan companies to ensure accuracy and collect first-person feedback to understand the holistic process of getting and repaying a loan.

Using my financial health counseling certification, I’m here to walk you through the important — and sometimes stressful — process of understanding your personal finances and credit.

Amanda’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best personal loans for bad credit

LendingTree’s team of expert writers and editors reviewed more than 40 lenders and loan marketplaces — and shopped directly with 15 of them — to find the best personal loans for bad credit. To make our list, lenders must advertise a minimum credit score of 580 or lower and cap their annual percentage rates (APRs) at 36%.

From there, we assessed each lender across four categories: eligibility and access; cost to borrow; loan terms and options; repayment support and tools.

According to our systematic rating and review process, the best personal loans for bad credit come from Best Egg, Upstart, Upgrade, Avant and OneMain Financial. LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Our categories

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Upstart is our top expert pick for the best loan for bad credit. Its credit score minimum is one of the lowest on the market, and it caps its rates at 35.99%, which is reasonable for a bad credit loan.

Yes, it’s possible to get a personal loan with a 500 credit score — two lenders on our list (Upstart and OneMain Financial) offer loans to borrowers with that score.

Check out our expert tips on how to improve your chances of approval. The short version? Apply with a co-borrower, take out less money, use collateral or take the time to improve your credit.

Yes, your credit score will drop when the lender pulls your credit. As long as you make payments on time, any drop will likely be temporary and small.